How to Grow Your Savings

What Are Savings?

Savings, in the world of personal finance, refers to the portion of your income that you don't spend on immediate expenses and set aside for future use. It's like putting away seeds today to enjoy a bountiful harvest tomorrow.

Think of it this way: your income is like rain falling onto your financial field. Savings is the portion you store in a rain barrel instead of letting it flow away unused. This stored water then comes in handy during dry spells, like unexpected expenses, future goals, or retirement.

Savings can take many forms:

- Cash: Tucked away in a piggy bank or a jar under your mattress (not the most secure, but still counts!)

- Savings account: A safer and more accessible option at a bank, usually offering some interest.

- Investments: Putting your money into stocks, bonds, or other assets that potentially grow over time.

- Retirement accounts: Dedicated platforms like IRAs or 401(k)s with tax benefits specifically for your golden years.

The main goal of saving is to preserve and grow your wealth over time. It's a crucial safety net for life's unpredictable moments and a stepping stone towards your financial dreams.

So, why should you save? Here are just a few reasons:

- Emergency cushion: Unexpected expenses like car repairs or medical bills won't leave you scrambling if you have savings.

- Financial independence: Building a substantial savings pot gives you freedom and flexibility to pursue your goals, like starting a business or taking a career break.

- Retirement security: Regular saving throughout your working years ensures a comfortable life after you stop earning a regular income.

- Peace of mind: Knowing you have money set aside reduces financial stress and allows you to sleep soundly at night.

Saving doesn't have to be intimidating or a chore. Even small amounts saved consistently can grow significantly over time thanks to the power of compounding. Start with creating a budget, setting achievable goals, and finding saving methods that work for you. And remember, every penny saved counts!

Why Are Savings Important?

Saving is more than just putting away some cash for a rainy day; it's an essential building block for financial security and freedom. Here are some key reasons why savings are so important:

1. Emergency cushion: Life throws curveballs, and having savings acts as a safety net when unexpected expenses arise. Medical bills, car repairs, unemployment - these can significantly disrupt your budget. A strong savings fund empowers you to handle these challenges without resorting to high-interest loans or depleting other resources.

2. Financial independence: Savings give you the power to make life choices on your own terms. Buying a car without a loan, taking a career break with financial security, or even quitting a job you dislike become achievable when you have a solid savings cushion. It grants you freedom from financial constraints and the ability to pursue your personal goals.

3. Goal achievement: Whether it's a dream vacation, a down payment on a house, or starting your own business, savings fuel your aspirations. Setting specific goals and consistently dedicating a portion of your income towards them makes them attainable. The progress you see motivates you and fosters financial discipline.

4. Retirement security: Regular income ceases during retirement, so accumulating sufficient savings becomes crucial for maintaining a comfortable lifestyle. The earlier you start saving, the more time your money has to grow through investments and compound interest, providing you with a stable income post-retirement.

5. Peace of mind: Knowing you have financial resources set aside for future needs reduces stress and anxiety. You can face life's uncertainties with confidence and avoid the constant worry of unexpected expenses. This mental security positively impacts your overall well-being and allows you to enjoy life to the fullest.

Saving isn't just about accumulating money; it's about investing in your future. It provides a sense of control, empowers you to pursue your dreams, and grants you peace of mind knowing you're prepared for whatever life throws your way. Remember, even small amounts saved consistently can make a significant difference over time. Start incorporating saving into your budget and experience the many benefits it has to offer!

Effective Strategies for Growing Your Savings

Building a healthy savings routine is an essential step towards financial security and achieving your goals. But where do you start? Here are some effective strategies to grow your savings:

1. Create a Budget:

- Track your income and expenses for a few months to understand where your money goes.

- Categorize your spending as "needs" (rent, utilities, groceries) and "wants" (entertainment, dining out).

- Use the 50/30/20 rule as a guideline: allocate 50% to needs, 30% to wants, and 20% to savings. Adjust the ratios based on your circumstances.

2. Set SMART Goals:

- Make your saving goals Specific, Measurable, Achievable, Relevant, and Time-bound. For example, aim to save $500 for a vacation within 6 months.

- Divide your goals into short-term, mid-term, and long-term categories to prioritize and track progress.

3. Build an Emergency Fund:

- Prioritize creating a safety net of 3-6 months of living expenses to cover unexpected costs.

- Keep this fund in a secure and easily accessible account, like a high-yield savings account.

4. Automate Savings:

- Set up automatic transfers from your paycheck to your savings account to eliminate the temptation to spend.

- Many apps even round up your purchases to the nearest dollar and automatically deposit the difference into your savings.

5. Reduce Expenses:

- Identify areas where you can cut back on unnecessary spending, like eating out less or switching to cheaper subscriptions.

- Consider selling unused items or finding ways to earn extra income through side hustles.

6. Invest Your Savings:

- Once you've built an emergency fund, consider investing your savings for long-term growth. Research low-risk options like index funds or explore high-potential assets like cryptocurrencies with caution and thorough understanding of the risks involved.

7. Pay Yourself First:

- Treat your savings like a bill and prioritize it as an essential expense.

- Think of it as investing in your future self and the financial freedom it brings.

Bonus Tips:

- Find a saving method that works for you, like using cash envelopes or saving apps.

- Set up reminders and track your progress to stay motivated.

- Celebrate your milestones and adjust your strategies as needed.

Remember, growing your savings is a journey, not a sprint. Be patient, consistent, and adaptable, and you'll gradually build a secure financial future for yourself.

How Does Inflation Impact Your Savings?

Inflation, the seemingly harmless rise in the cost of living, can be a sneaky thief when it comes to your savings. It silently nibbles away at the purchasing power of your hard-earned cash, potentially turning your future dreams into faded souvenirs. Here's how inflation can impact your savings: Picture: https://chetwood.co/news/how-inflation-impacts-your-savings/

Picture: https://chetwood.co/news/how-inflation-impacts-your-savings/

1. Erodes Buying Power:

Think of your savings as a bag of apples. While the number of apples stays the same, inflation gradually shrinks their size. Imagine five years down the line; that same bag might not buy you the same groceries due to inflation. This means your saved money has less value in the future, potentially hindering your ability to achieve your financial goals.

2. Reduces Real Rate of Return:

Interest rates on savings accounts and other traditional investments often lag behind inflation. This means even if you're earning some interest, it might not be enough to keep up with the rising cost of living. In essence, your "real" rate of return, the income minus inflation, could be negative, effectively eroding your savings.

3. Impacts Long-Term Goals:

Saving for a down payment on a house, your dream retirement, or your child's education requires planning and anticipation of future costs. Inflation throws a wrench in that plan by making those future costs higher than you might have initially calculated. This could delay your goals or necessitate increased savings efforts.

How to Protect Your Savings from Inflation:

Fortunately, you're not powerless against inflation's bite. Here are some strategies to keep your savings in good shape:

1. Invest in Assets that Outpace Inflation:

Consider investing a portion of your savings in assets with historically strong returns against inflation, such as real estate, stocks, or even specific bonds like Treasury Inflation-Protected Securities (TIPS) that adjust their value with inflation. Do your research and invest cautiously, weighing risks and potential rewards.

2. Diversify Your Portfolio:

Don't put all your eggs in one inflation-hedging basket. Diversifying your portfolio across different asset classes can help spread risk and increase your chances of weathering inflationary storms.

3. Review and Adjust Regularly:

As inflation fluctuates, your approach to protecting your savings should too. Regularly review your investments and savings strategies, and adjust them as needed to maintain your purchasing power and long-term financial goals.

4. Increase Your Savings Rate:

If inflation is eating away at your existing savings, you might need to adjust and increase your contribution to keep up. Analyze your budget, cut back on non-essentials, and find ways to boost your income to ensure your savings goals stay on track.

Remember, inflation is a complex issue with ongoing debates about its best solutions. It's essential to stay informed, seek professional advice when needed, and adapt your strategies to ensure your savings continue to hold their value and pave the way for your financial future. Picture: https://edufund.in/blog/how-to-protect-your-savings-from-inflation

Picture: https://edufund.in/blog/how-to-protect-your-savings-from-inflation

Should You Put Your Savings in Crypto?

Reasons to Invest in Crypto:

- High Potential Returns: The history of leading cryptocurrencies like Bitcoin and Ethereum shows spectacular returns for early investors. If you're comfortable with high volatility and willing to hold for the long term, crypto has the potential to significantly grow your savings.

- Decentralization and Security: Cryptocurrencies operate on blockchain technology, a decentralized and secure network that removes the need for intermediaries. This offers potential advantages in terms of transparency, censorship resistance, and asset control.

- Hedge Against Inflation: Some view crypto as a potential hedge against inflation, as its supply is often pre-determined and limited. However, this aspect is debated with no guarantee of effectiveness.

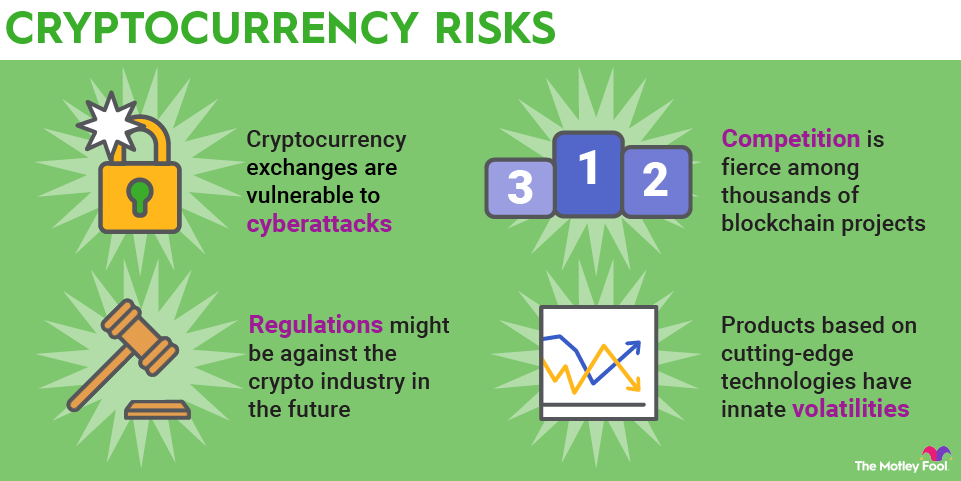

Reasons to Be Cautious About Crypto:

- High Volatility: Cryptocurrencies are notoriously volatile, experiencing extreme price swings that can lead to significant losses. Investing more than you can afford to lose is never advisable.

- Regulatory Uncertainty: The crypto market is still evolving, and regulations are currently in flux. This can create uncertainty and potential risks for investors.

- Technical Complexity: Understanding and managing crypto investments requires learning new technology and navigating unfamiliar platforms. This can be daunting for some individuals.

- Environmental Concerns: The energy consumption associated with some crypto mining practices raises environmental concerns. This ethical consideration might weigh on some investors.

Before you consider investing in crypto, here are some crucial steps:

- Do your research: Understand the technology, different types of cryptocurrencies, and the associated risks.

- Diversify your portfolio: Don't put all your eggs in the crypto basket. Consider it a small, high-risk portion of your overall investments.

- Invest what you can afford to lose: Never invest more than you can comfortably lose, as the market is unpredictable.

- Only invest on secure platforms: Use reputable cryptocurrency exchanges with solid security measures.

- Seek professional advice: Consult a financial advisor if you're unsure about the risks or suitability of crypto for your portfolio.

Ultimately, the decision of whether or not to invest in crypto is a personal one. Weigh the potential benefits and risks carefully, prioritize your risk tolerance, and ensure it aligns with your overall financial goals and long-term investment strategy. Remember, responsible and informed investing is key to building a secure financial future.

Check Out My Latest Blogs:

1- Don't Get Hooked:Crypto Phishing Scams (Great)

2- Demystifying the Portal to Web3: Your Guide to Web3 Wallets (Great)

3- A beginner-friendly guide to sidechains: Everything you need to know about it (Brilliant)

I'd love for you to leave a comment below. Did something resonate with you? Have a different perspective? Ask away! Your contributions make this space come alive, and I can't wait to dive into some awesome discussions with you all.