GOLD VS BTC

Gold vs Bitcoin

Gold vs Bitcoin, it’s a common question we hear at BullionByPost, and they are two very popular assets in recent years for investors to consider. Bitcoin has even been called ‘digital gold’ by some proponents, but the two are very different assets, with very different risk and reward profiles.

Below then we take a look at gold compared to Bitcoin; what each offer, and a head-to-head overview of performance in recent years. Please note BullionByPost do not provide investment advice, if you’re unsure whether gold or Bitcoin would be the best choice for your investment needs, we recommend speaking to a qualified, independent financial advisor.

Bitcoin vs Gold

Bitcoin:

It was inevitable that digital currency would grow in step with technological advances. The ease of payment via Near Field Technology (NFC) and improvements to online security mean that a lack of the physical presence of currency is more beneficial to people and with minimal risk. Contactless payments by card and smartphone are now commonplace, whereas 15 years ago they were just an idea, and a cashless society is increasingly on the horizon. Central Bank Digital Currencies are being explored by multiple countries on fears of being left behind by the growing crypto market. With changes to tech come opportunities for change, and banking and finance are one area of opportunity.

Bitcoin’s big sell is the blockchain technology involved. Blockchain is an anonymous public ledger – an ever-growing line of transaction data and history. A bank verifies your funds, holds your funds, and subtracts funds from your balance to credit others, but all of this relies on trusting your bank. The blockchain replaces their role as a database in this process and operates without interference. Data is encrypted, and Bitcoin ‘miners’ try and calculate the code to authorise the transaction. The winner gets to approve the payment and then bundle up the transaction with other payments (effectively hiding them in a crowd of data) and they will receive Bitcoin payment for their bundle being added to the blockchain.

Other miners use their own computers to verify against duplicate uses of funds within the bundled payment data. If you try and spend the same Bitcoin twice you have to revisit all the links down the chain which is so much effort as to render it pointless. The entire process takes a high calibre graphics card, a lot of electricity, and a lot of commitment, because the chain links previously authorised transactions to the new attempted payments. Given the power required to achieve such a feat, the cheat would probably cost more in electricity than the fraudulent gain.

An example of how Bitcoin mining operates. Small boxes replace standard PCs to be cost and space efficient.

You might wonder why is banking a problem, especially given how much work is involved in maintaining anonymity, but the simple fact is data protection is a big issue and one that has been suspected of breaches for quite some time. The recent news about Facebook’s information being used by Cambridge Analytica is a major incident, but it’s highly unlikely to be the only such data breach. People want to know that their personal information is safe and not being used for nefarious reasons, e.g. being sold on to companies to try and influence your voting in an election.

Some have argued that this is a nice idea but ultimately bad for trade, but there are ways and means to track a user’s activity, which is designed to factor in businesses and their need for proof of funds. Bitcoin has some scope to identify a source of funds, while currencies like Monero are wholly anonymous, but you choose your currency depending on your needs.

Already we see big businesses such as IBM and Maersk forming partnerships – in this case for shipping – as commerce seeks to keep pace with the times and make sure it’s operating in the most efficient and secure way possible. The same data relationship could allow for greater sharing of information within healthcare and other industries like cloud storage, where security is paramount.

The Blockchain Research Institute were recently interviewed by Quartz , with founders Alex and Don Tapscott referring to Bitcoin as the “first big app of the Internet of Value” and saying: “Email was the first big app of its predecessor, the Internet of Information. But what will be the equivalent of the World Wide Web—the general-purpose platform for application development?”

Cryptocurrencies have a big issue of price instability however, caused by a lack of regulation and the classic instance of panic responses in the face of large scale thefts, large scale sales, or a national government crackdown. Bitcoin and others are vaguely backed by other currencies. Governments don’t like this uncertainty, so they have been banning Initial Coin Offerings to start up currencies, and they have been banning the trading of cryptocurrencies.

Regulators like the SEC are increasingly clamping down on crypto exchanges that have engaged in illegal practices, and the collapse of exchanges like FTX has sparked mass sell-off of crypto assets like Bitcoin, crashing their prices in days and weeks.

Another problem is cyber-crime. Hackers have and always will be around. Millions of dollars in cryptocurrencies have been lost since 2010, with the case of BlackWallet’s theft being a good example. The Express reported the theft of $400,000 worth of Stellar Lumen currency, and the fear is that while some currency holding companies will repay, others might simply not have the funds to do so.

The final risk – which is more so for governments – is the involvement of cryptos on the dark web aka the black market of the internet. Illegal materials, drugs, weapons, and personal information are traded for payment, usually in anonymous cryptocurrency format to avoid detection. It was inevitable that criminals would find a use for it, but it’s an area that worries authorities and is why they are acting heavy handed to begin with.

Bitcoin will continue to grow in popularity and importance. The Blockchain technology it relies on is here to stay and will be a crucial part of future commercial endeavours and data management. For now though there’s a lot of risk involved in cryptocurrencies. Anonymity works both ways – you might have avoided state or bank interference, but are you sure that that your digital coin is really worth its weight in Pound Sterling or gold? Gold:

Gold:

Gold bullion is popular for investors to store and protect their wealth. In comparison to Bitcoin, gold is old fashioned. Bullion coins and bars aren’t easy to carry around on you, and you can’t use them to pay for your shopping or to go to the cinema. It’s an investment resource (or a collectible), but old fashioned isn’t always a bad thing. Learn more about why investors buy gold bullion.

Whether you have it in person or stored securely, you physically have access to a source of true value. For this reason it’s seen as a safe-haven. At present, the rate of inflation in the UK is around 8%. Gold is considered an inflation hedge, improving in value during times of high inflation. While interest rates have risen in an attempt to bring inflation down, the likely result is recession and a pivot back toward the low interest rates of the past 15 years, a scenario that will also benefit gold.

Gold is less exciting than stocks or cryptocurrencies, nobody’s arguing that. When these markets hit their peaks, they were generating small fortunes for investors, and everyone loves a bit of hype and jumping on a bandwagon to enjoy the ride. With great gains come great falls though. These markets can’t sustain extremely high value for a long period of time and when they come down it’s gold and silver investors fall back on.

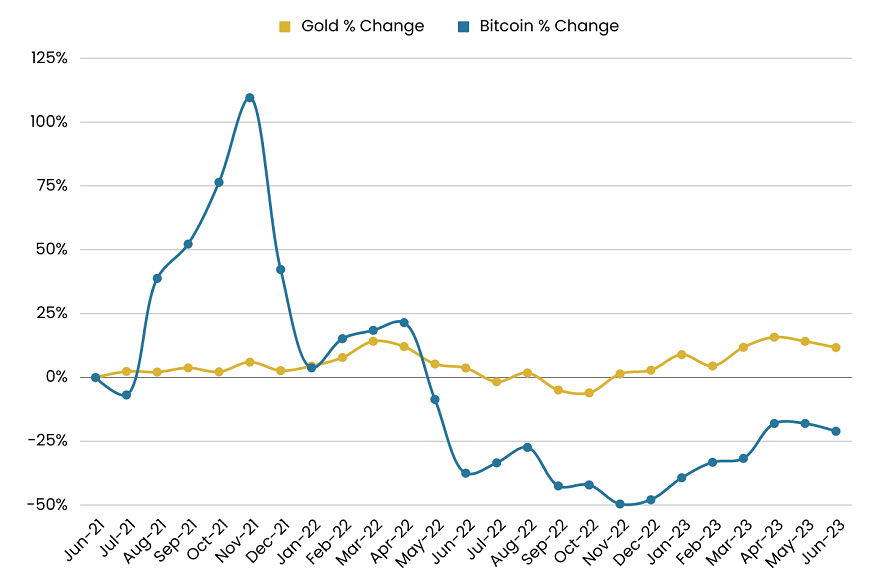

Bitcoin vs Gold graph

The chart above shows the percentage change in the values for both gold and bitcoin in the past two years, and sums up perfectly the risk of gold compared to Bitcoin. The chart is skewed by the huge gains made by Bitcoin in November 2021, when it reached its all-time high.

This all-time high was short-lived, with the value of Bitcoin more than halving in just over two months, and highlights the risks involved with crypto assets. Money can pour in quickly, driving the price up, but Bitcoin rallies typically fizzle out almost as quickly. For those who bought on the way up to the ATH in 2021, they are now faced with an investment far below that value. Gold on the other hand makes slow, steady gains increasing in value over time, without suffering the huge crashes seen in Bitcoin.

Gold vs Bitcoin 2023

2023 has been a difficult year for Bitcoin and other cryptocurrencies. The collapse of FTX in 2022 already saw the price of Bitcoin collapse, and there looks to be more pain to come. The SEC in America has filed suits against both Binance and Coinbase, two of the largest exchanges in the world.

As more central banks around the world look to adopt CBDC, they are increasingly anti-crypto. The lack of regulation, and ease for criminals to use things like Crypto for payments and money laundering, make it an easy target for the likes of the SEC to clamp down, and it remains to be seen what impact this will have on Bitcoin.

Bitcoin has performed well so far year-to-date, but as the chart above demonstrates, the price can fall very quickly. If the SEC suits lead to the closure of some of the largest US exchanges its likely that many investors will rush to pull their money out of the crypto market, bringing the price down even further.

Will Bitcoin ever reach the all-time high of November 2021 again? This remains to be seen. Gold meanwhile has tested all-time highs already in 2023, and the economic outlook means it is forecast to reach new all-time highs in 2023 and beyond.