Exploring the Modern Technology of Online Banking Systems.

In an increasingly digital world, the banking industry has undergone a significant transformation, and one of the most notable advancements is the advent of online banking systems. Online banking has revolutionized the way we manage our finances, providing convenience, accessibility, and enhanced security. This blog post delves into the modern technology behind online banking systems and highlights the key features that have made them an integral part of our daily lives.

Enhanced User Experience:

Modern online banking systems prioritize user experience, aiming to simplify financial management and make banking operations seamless. User-friendly interfaces and intuitive design ensure that customers can navigate through various banking services effortlessly. From checking account balances and transferring funds to managing investments and applying for loans, all these operations can be performed at the click of a button.

Mobile Banking:

The rise of smartphones and mobile apps has propelled the popularity of mobile banking. With mobile banking apps, customers can access their accounts, make transactions, and receive real-time notifications on their phones. Biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security to mobile banking, ensuring that only authorized individuals can access sensitive financial information.

Robust Security Measures:

Online banking systems employ state-of-the-art security measures to safeguard customer data and prevent unauthorized access. Encryption techniques, secure socket layer (SSL) protocols, and multi-factor authentication (MFA) are commonly used to protect sensitive information during transmission. Advanced fraud detection systems continuously monitor transactions and identify any suspicious activity, providing customers with peace of mind.

Artificial Intelligence and Chatbots:

Artificial Intelligence (AI) plays a crucial role in modern online banking systems, enabling personalized customer experiences and efficient customer support. AI-powered chatbots are available 24/7, addressing customer queries, providing account information, and even assisting with financial planning. Natural Language Processing (NLP) allows chatbots to understand and respond to customer inquiries effectively, offering prompt assistance while reducing the need for human intervention.

Open Banking and Integration:

Open banking initiatives have opened up new possibilities for online banking systems. Through secure APIs (Application Programming Interfaces), customers can integrate their bank accounts with third-party applications, allowing for seamless sharing of financial data. This integration fosters innovation, enabling users to access a range of financial services such as budgeting apps, investment platforms, and personalized financial advice, all within the online banking system.

Personal Financial Management:

Online banking systems often incorporate personal financial management tools that help customers gain better control over their finances. These tools provide insights into spending patterns, categorize expenses, and generate detailed reports, empowering users to make informed financial decisions. Budgeting features, goal setting, and savings trackers are additional tools that assist customers in achieving their financial objectives.

Digital Payments and Wallets:

Online banking systems have facilitated the widespread adoption of digital payment methods and mobile wallets. Customers can make secure and convenient payments using platforms like Apple Pay, Google Pay, and PayPal. These systems often integrate with online banking accounts, allowing users to link their bank cards and make seamless transactions with just a few taps on their mobile devices.

Real-Time Account Monitoring:

Online banking systems provide customers with real-time access to their account information. Users can monitor transactions, view account balances, and track their financial activities instantly. This feature enables individuals to stay updated on their financial health and detect any unauthorized transactions or fraudulent activities promptly.

Paperless Banking:

The digitization of banking processes has significantly reduced the reliance on paper documents. Online banking systems allow customers to receive e-statements, e-receipts, and digital documents, eliminating the need for physical paperwork. This not only saves time and effort but also contributes to a more eco-friendly approach to banking.

Seamless International Transactions:

Modern online banking systems have made international transactions faster and more accessible. With features like wire transfers, foreign currency exchanges, and international payment gateways, customers can conveniently send and receive money across borders. These systems often provide competitive exchange rates and lower transaction fees compared to traditional banking methods.

Advanced Analytics and Insights:

Online banking systems leverage data analytics to provide customers with personalized financial insights. By analyzing spending patterns and transaction history, these systems can offer tailored recommendations, such as budgeting tips, investment opportunities, and savings strategies. These insights empower users to make better financial decisions and achieve their financial goals.

24/7 Customer Support:

Online banking systems offer round-the-clock customer support to address any queries or concerns. Alongside AI-powered chatbots, customers can also access helplines, email support, or live chat options for more complex inquiries. This availability ensures that customers can receive assistance whenever they need it, enhancing their overall banking experience.

Biometric Authentication:

To enhance security and combat fraud, online banking systems increasingly utilize biometric authentication methods. Biometric data, such as fingerprints or facial recognition, is unique to each individual and serves as an additional layer of authentication when accessing online banking accounts. This technology helps prevent unauthorized access and ensures that only the account holder can perform sensitive transactions.

Two-Factor Authentication (2FA):

Two-Factor Authentication has become a standard security measure in online banking systems. It adds an extra layer of protection by requiring users to provide two separate forms of identification when accessing their accounts. This commonly involves entering a password or PIN (something the user knows) along with a verification code sent to their registered mobile device (something the user possesses). 2FA significantly reduces the risk of unauthorized access even if a password is compromised.

Voice Banking:

The rise of voice recognition technology has led to the development of voice banking features. Users can interact with their online banking systems using voice commands through virtual assistants like Amazon's Alexa or Apple's Siri. Voice banking enables customers to check balances, make transactions, and receive account information simply by speaking, providing a hands-free and convenient banking experience.

Personalized Financial Recommendations:

Modern online banking systems leverage artificial intelligence and machine learning algorithms to analyze customer data and provide personalized financial recommendations. By considering a user's spending habits, income, and financial goals, these systems can offer tailored suggestions for saving money, investing in suitable products, or optimizing debt management. This personalized guidance helps customers make informed financial decisions based on their specific circumstances.

Integration with Fintech Services:

Online banking systems often integrate with fintech services, allowing customers to access a wider range of financial tools and services within a single platform. These integrations can include budgeting apps, investment platforms, digital lending services, or even cryptocurrency wallets. By consolidating various financial services, online banking systems provide users with a comprehensive and unified experience for managing their finances.

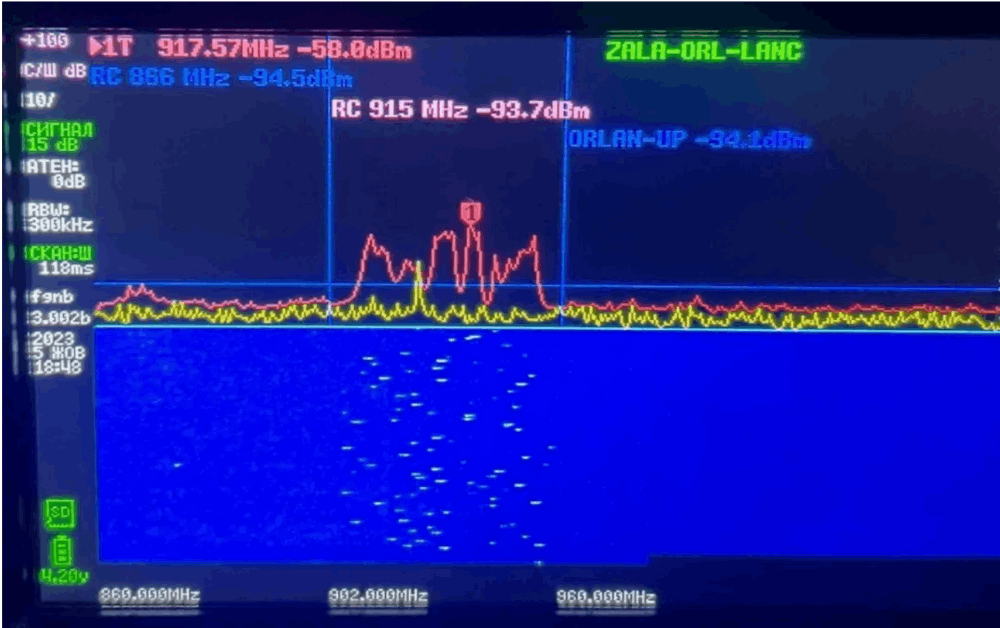

Enhanced Fraud Detection:

Online banking systems employ sophisticated fraud detection algorithms to identify and prevent fraudulent activities. By analyzing transaction patterns, monitoring for suspicious behavior, and leveraging machine learning techniques, these systems can detect and flag potentially fraudulent transactions in real-time. This proactive approach helps protect customers from financial losses and minimizes the impact of fraudulent activities.

Seamless Account Opening and Loan Applications:

Online banking systems have simplified the account opening and loan application processes. Through digital onboarding, customers can open new accounts remotely, providing required documents electronically and completing the necessary verification steps online. Similarly, loan applications can be submitted online with streamlined documentation processes, reducing paperwork and time-consuming visits to physical branches.

Data Privacy and Compliance:

As online banking systems deal with sensitive customer data, they prioritize data privacy and comply with regulatory standards. These systems implement robust data protection measures, including encryption, data anonymization, and secure storage practices. They also adhere to data privacy regulations, such as the General Data Protection Regulation (GDPR) or local privacy laws, to ensure that customer information is handled responsibly and securely.

In conclusion, the modern technology of online banking systems encompasses a wide array of features and innovations. From biometric authentication and voice banking to personalized recommendations and seamless integrations, these systems continue to evolve to meet the needs of customers in an increasingly digital world. With enhanced security, convenience, and personalized services, online banking systems have become an indispensable part of the financial landscape, offering customers greater control over their finances and transforming the way we interact with banking institutions.the modern technology employed in online banking systems has revolutionized the way we manage our finances. From enhanced user experiences and mobile banking to robust security measures and AI-powered chatbots, these systems offer convenience, accessibility, and peace of mind to customers. As technology continues to advance, online banking will undoubtedly evolve, presenting us with even more innovative features and services to further streamline our financial lives.The modern technology behind online banking systems has transformed the way we interact with our finances. The convenience, accessibility, and robust security measures offered by these systems have made them an indispensable part of our daily lives. As technology continues to evolve, online banking will likely witness further advancements, paving the way for more personalized and streamlined financial experiences. As customers, we can embrace these innovations and leverage the power of online banking to effectively manage our finances in the digital age.