NFTs: Bubble or Digital Revolution?

NFTs: Bubble or Digital Revolution?

Introduction

In recent years, the world has witnessed the meteoric rise of Non-Fungible Tokens (NFTs), a unique category of digital assets that have taken the art, entertainment, and investment industries by storm. NFTs are essentially digital certificates of ownership backed by blockchain technology, often linked to artwork, music, videos, virtual real estate, and more. Their surge in popularity has raised eyebrows—while some believe NFTs represent a groundbreaking shift in the digital economy, others argue that they are a speculative bubble destined to burst. This debate has captivated the tech, finance, and creative sectors, sparking discussions about the long-term value of NFTs and their place in the digital economy.

NFTs have already transformed the way digital art is perceived and traded, offering creators a new avenue for monetization and ownership. However, the rapid increase in prices and the involvement of speculative investors have led many to question whether NFTs are a sustainable, innovative technology or merely a financial bubble inflated by hype. This essay will explore the fundamentals of NFTs, the arguments for and against their lasting impact, and the potential future of NFTs in the digital landscape.

1. Understanding NFTs: The Basics

To understand whether NFTs represent a digital revolution or a speculative bubble, it is essential to first explore what NFTs are and how they work.

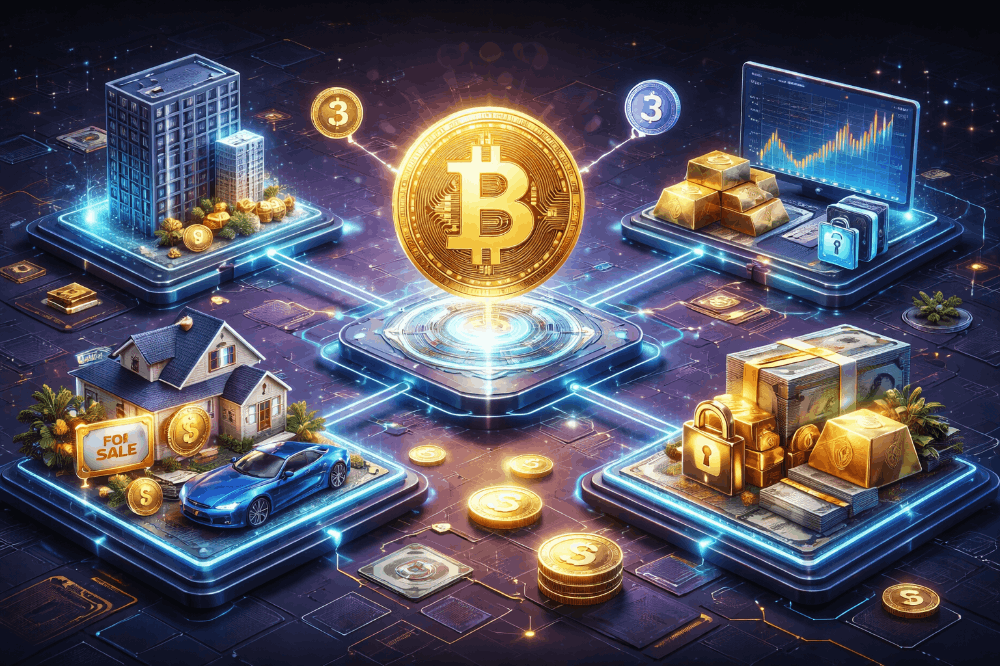

Non-Fungible Tokens (NFTs) are digital tokens that represent ownership of a unique item or piece of content. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible (meaning each unit is interchangeable with another), NFTs are unique and cannot be replaced or exchanged on a one-to-one basis. Each NFT is distinct and is usually associated with a specific digital asset, such as an image, video, music track, or virtual real estate in online environments like Decentraland or The Sandbox.

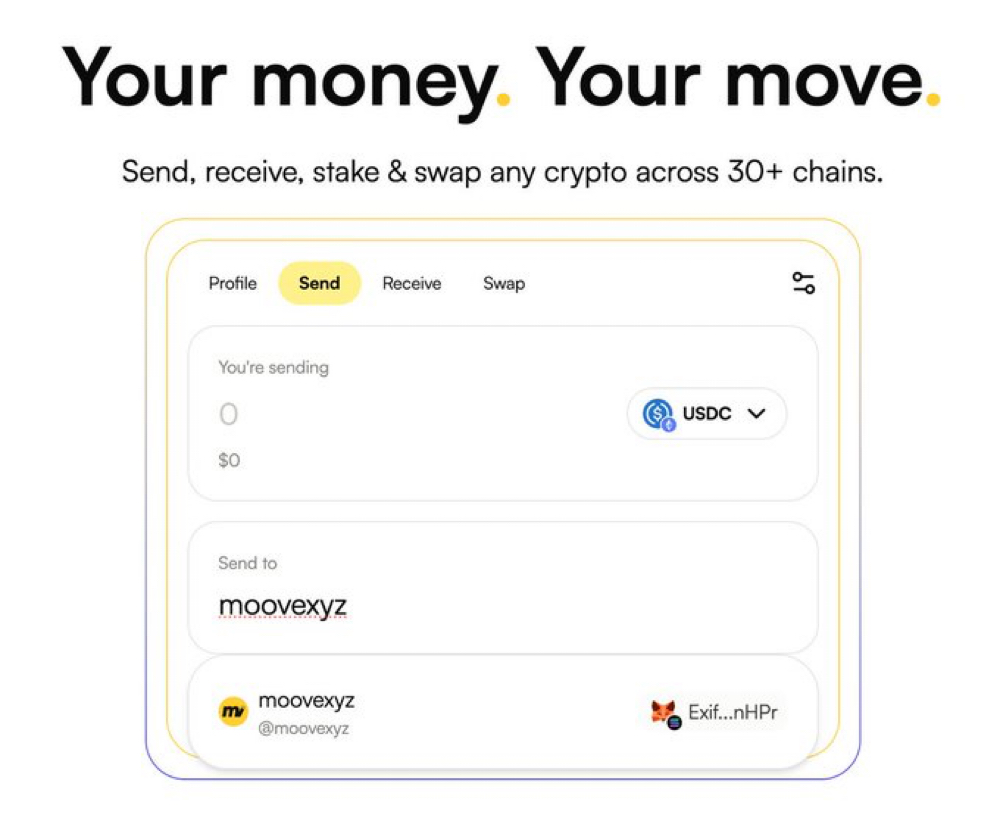

NFTs are built using blockchain technology, primarily on the Ethereum blockchain, although other blockchains like Binance Smart Chain and Flow also support NFTs. Blockchain ensures the authenticity and ownership of the token, making it nearly impossible to alter or duplicate the ownership records. When an individual purchases an NFT, they acquire a unique digital certificate that verifies their ownership of the associated asset, regardless of whether the actual item itself (e.g., a digital artwork) can be freely copied or shared.

One of the most appealing features of NFTs is the ability for creators to embed royalties into the tokens. This means that whenever the NFT is resold, the original creator can receive a percentage of the sale price, creating an ongoing revenue stream. This aspect has attracted a wide range of creators, including digital artists, musicians, and game developers, who can now monetize their work in innovative ways.

2. The NFT Hype: A Digital Revolution?

Proponents of NFTs argue that these digital assets represent a revolutionary shift in various industries, particularly in the world of digital art, entertainment, and online gaming. The arguments in favor of NFTs as a digital revolution include:

2.1. Empowering Creators and Artists

One of the key features of NFTs is their ability to provide digital artists and creators with a new method of monetization. For years, digital artists struggled to sell their work online, as anyone could easily replicate and share digital images without compensation. NFTs address this issue by establishing provenance—a verifiable record of ownership—that allows creators to sell their work while retaining control over its uniqueness. This has the potential to disrupt the traditional art market, where physical works are often sold through galleries, dealers, and auction houses.

Moreover, NFTs offer artists a way to earn royalties on secondary sales. As digital art is resold on various NFT marketplaces, the original artist can earn a percentage of each transaction, creating a continuous revenue stream. This model is a departure from traditional art sales, where artists only profit from the initial sale of their work.

2.2. Innovation in Gaming and Virtual Real Estate

NFTs are also gaining traction in the world of gaming, where they enable players to own unique in-game assets. In traditional video games, items like weapons, skins, and characters are often confined to the game's ecosystem, with no real-world ownership or value. With NFTs, these assets can be tokenized and sold, traded, or even used across different gaming platforms. This introduces new opportunities for play-to-earn models, where gamers can earn real-world value by acquiring and trading rare digital assets.

In addition to gaming, virtual real estate has emerged as a key area where NFTs are making an impact. Platforms like Decentraland and The Sandbox allow users to buy, sell, and develop virtual land and properties, which are represented as NFTs. These virtual worlds are becoming increasingly popular, with individuals and companies purchasing digital real estate for various purposes, such as hosting virtual events, advertising, and developing digital experiences. The rise of NFTs in this space suggests that digital ownership will play an increasingly significant role in the future of entertainment and social interaction.

2.3. Cultural and Social Impact

NFTs have also become a cultural phenomenon, with celebrities, musicians, and influencers jumping on the bandwagon. The sale of NFTs linked to music, videos, and exclusive content has attracted significant attention. Musicians like Kings of Leon and Grimes have sold NFTs representing albums and artworks, while influencers and brands have used NFTs to create exclusive fan experiences.

NFTs also offer the potential for creating new forms of digital scarcity. In a world where digital content can be copied infinitely, NFTs provide a mechanism for making content scarce and valuable, mimicking the concept of ownership in the physical world. This scarcity is key to the value proposition of NFTs, as collectors seek rare, unique assets that hold cultural or financial significance.

3. The Dark Side: Is the NFT Market a Bubble?

While NFTs hold immense promise, critics argue that the NFT market is driven more by speculation and hype than by sustainable value. Several concerns have been raised about the potential for NFTs to be a financial bubble—an unsustainable surge in asset prices fueled by market hype, which eventually bursts, causing significant financial losses. The arguments against NFTs being a true revolution include:

3.1. Speculative Frenzy and Overvaluation

One of the most prominent concerns surrounding NFTs is the speculative nature of the market. In 2021, the NFT space witnessed a frenzy of sales, with certain digital artworks being sold for millions of dollars. For example, a digital artwork by the artist Beeple sold for $69 million at a Christie's auction, setting a record for the most expensive NFT sale. While this may seem like a groundbreaking achievement, many critics argue that such high prices are not indicative of true value but are rather the result of a speculative bubble driven by fear of missing out (FOMO).

In some cases, NFTs have been sold for astronomical prices without any clear intrinsic value. Critics argue that these inflated prices are fueled by flipping—a practice where investors buy NFTs with the sole intention of reselling them for a higher price, rather than appreciating the underlying content or supporting the creator. This speculative behavior has led some to compare NFTs to past financial bubbles, such as the Dotcom Bubble of the early 2000s or the Tulip Mania of the 17th century.

3.2. Environmental Concerns

Another major criticism of NFTs is their environmental impact. Most NFTs are built on the Ethereum blockchain, which operates on a Proof of Work (PoW) consensus mechanism. PoW requires significant computational power, which translates to high energy consumption. The environmental footprint of NFTs has raised alarms among environmentalists, as the energy used in minting, trading, and storing NFTs can be comparable to the energy consumption of entire countries.

Though Ethereum has plans to transition to a more energy-efficient Proof of Stake (PoS) system, the environmental concerns surrounding NFTs remain a significant issue. Critics argue that the environmental costs of NFTs undermine their long-term viability and ethical appeal, particularly in an era of increasing focus on sustainability and climate change.

3.3. Market Saturation and Lack of Utility

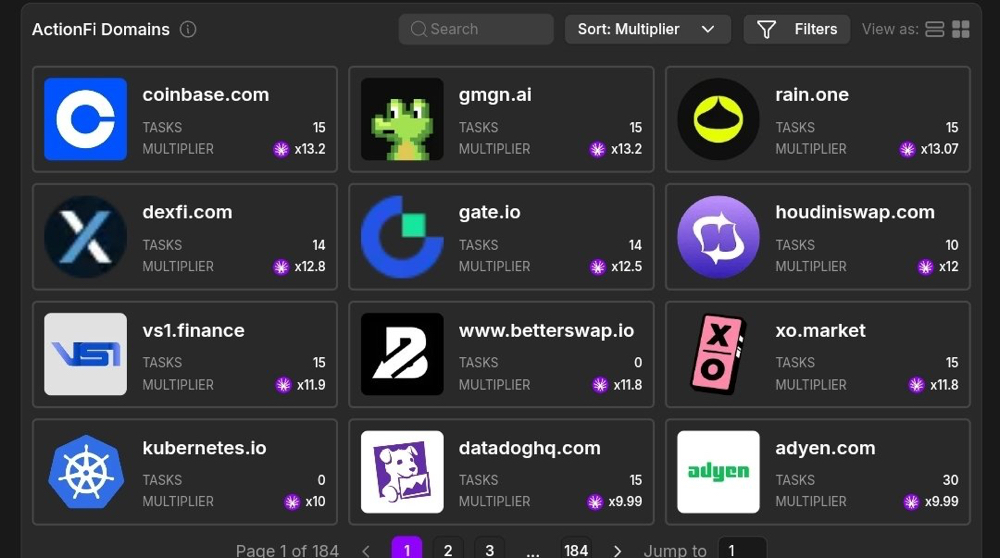

As the NFT market expands, many experts warn that it may become saturated, leading to a decline in prices and interest. While NFTs have been heralded as a groundbreaking technology, their long-term utility remains unclear. Beyond the realm of digital art and collectibles, it is uncertain how NFTs will integrate into more practical applications. Many NFT projects lack clear use cases, and some critics argue that the technology may not live up to the hype as the market matures.

Additionally, the ease with which new NFTs can be created has led to concerns about the proliferation of low-quality or fraudulent NFTs. Without adequate regulation or verification, the NFT market may become a breeding ground for scams, counterfeits, and intellectual property theft.

4. The Future of NFTs: Beyond the Hype

Despite the concerns about the speculative nature of the NFT market, there are compelling reasons to believe that NFTs have the potential to be more than just a passing trend. The continued development of blockchain technology, the rise of decentralized finance (DeFi), and the increasing adoption of digital art and virtual assets suggest that NFTs may have a lasting impact on various industries.

4.1. The Growth of the Creator Economy

NFTs are part of a broader movement known as the creator economy, where individuals and creators have more control over how they monetize and distribute their work. As this economy continues to grow, NFTs may become an essential tool for creators to engage with their audiences and generate revenue directly. The idea of digital ownership could revolutionize the relationship between creators and consumers, allowing for more direct, peer-to-peer transactions and a reduction in reliance on traditional intermediaries.

4.2. NFTs in the Metaverse and Virtual Real Estate

The growth of the Metaverse—a virtual universe made up of interconnected digital spaces—could offer NFTs an opportunity to thrive. NFTs may play a crucial role in representing ownership of virtual assets, including real estate, items, and experiences within the Metaverse. As virtual worlds become more immersive and sophisticated, NFTs could serve as the primary method for securing ownership of digital goods, similar to how physical property is owned in the real world.

4.3. Blockchain Integration and Innovation

As blockchain technology evolves, the use cases for NFTs will likely expand beyond art and collectibles. NFTs could become more integrated into various industries, such as real estate, fashion, music, and intellectual property. The ability to create verifiable, immutable ownership records for virtually anything could drive innovation in areas like ticketing, supply chain management, and digital identity verification.

Conclusion

NFTs have undeniably captured the imagination of the digital world, sparking debates about whether they represent a genuine revolution or are simply another financial bubble. While the market is currently fueled by speculation and hype, NFTs possess qualities that could make them an enduring part of the digital economy. They offer creators a new avenue for monetization, provide verifiable ownership in the digital space, and are paving the way for a new era of digital assets. However, the speculative nature of the market, environmental concerns, and the lack of clear utility for many NFTs suggest that the future of the space remains uncertain.

Ultimately, whether NFTs are a bubble or a digital revolution will depend on how the market matures, how blockchain technology evolves, and how society integrates NFTs into practical, everyday use cases. As the industry develops, it will be essential to distinguish between genuine innovation and unsustainable speculation to ensure that NFTs fulfill their potential as a transformative technology in the digital economy.