CoinGecko: Crypto market capitalization surged 64% in Q1

CoinGecko experts published a report on the crypto market for the first quarter, noting the growth in sector capitalization.

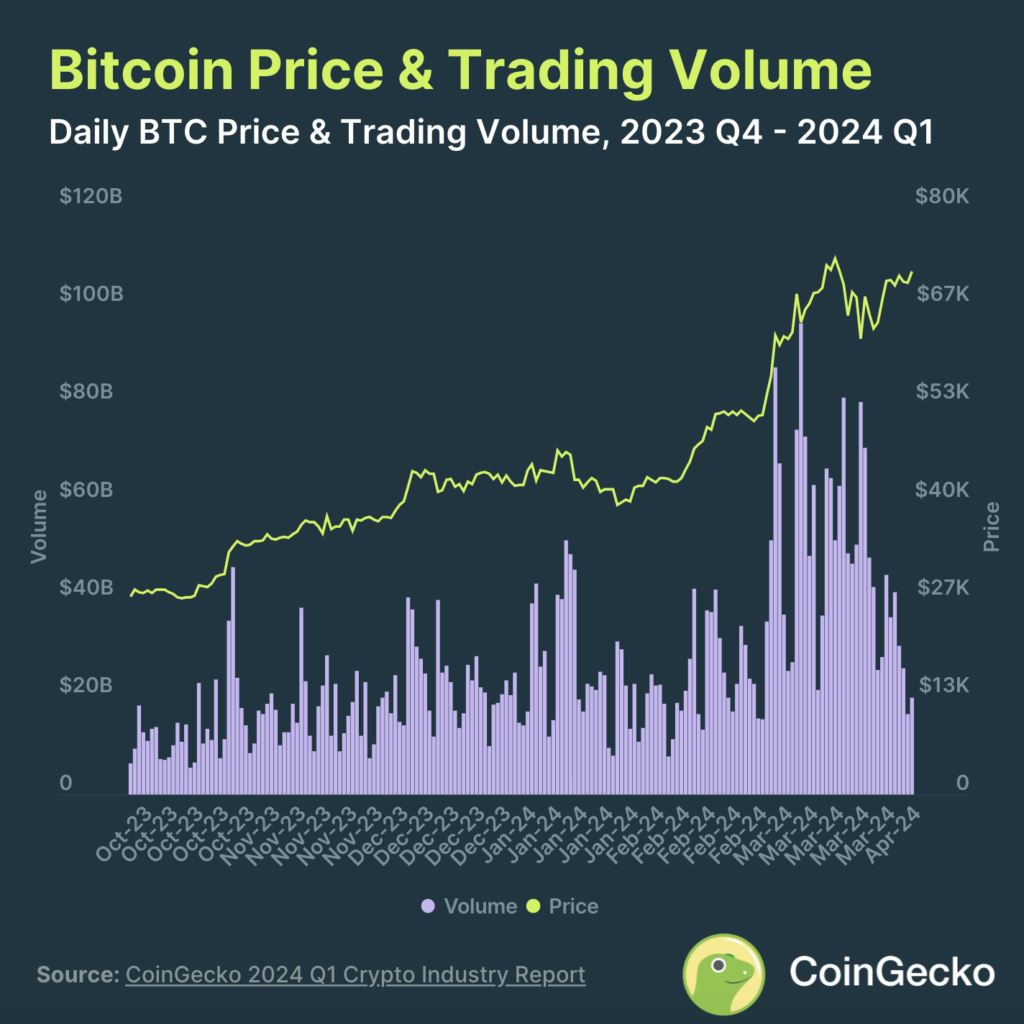

In the first quarter, the crypto market showed growth, according to a CoinGecko report. The segment’s capitalization grew by 64.5%, reaching a peak of $2.9 trillion in March.

In total, capitalization increased by $1.1 trillion. The report indicates that this is almost double the increase in the fourth quarter of 2024 of $0.61 trillion. During this period, capital inflows into the spot Bitcoin ETFs sector, which were approved on Jan. 10, increased significantly.

The upward trend began in late January and lasted until mid-March when the capitalization rate reached an intermediate maximum. Source: CoinGecko

Source: CoinGecko

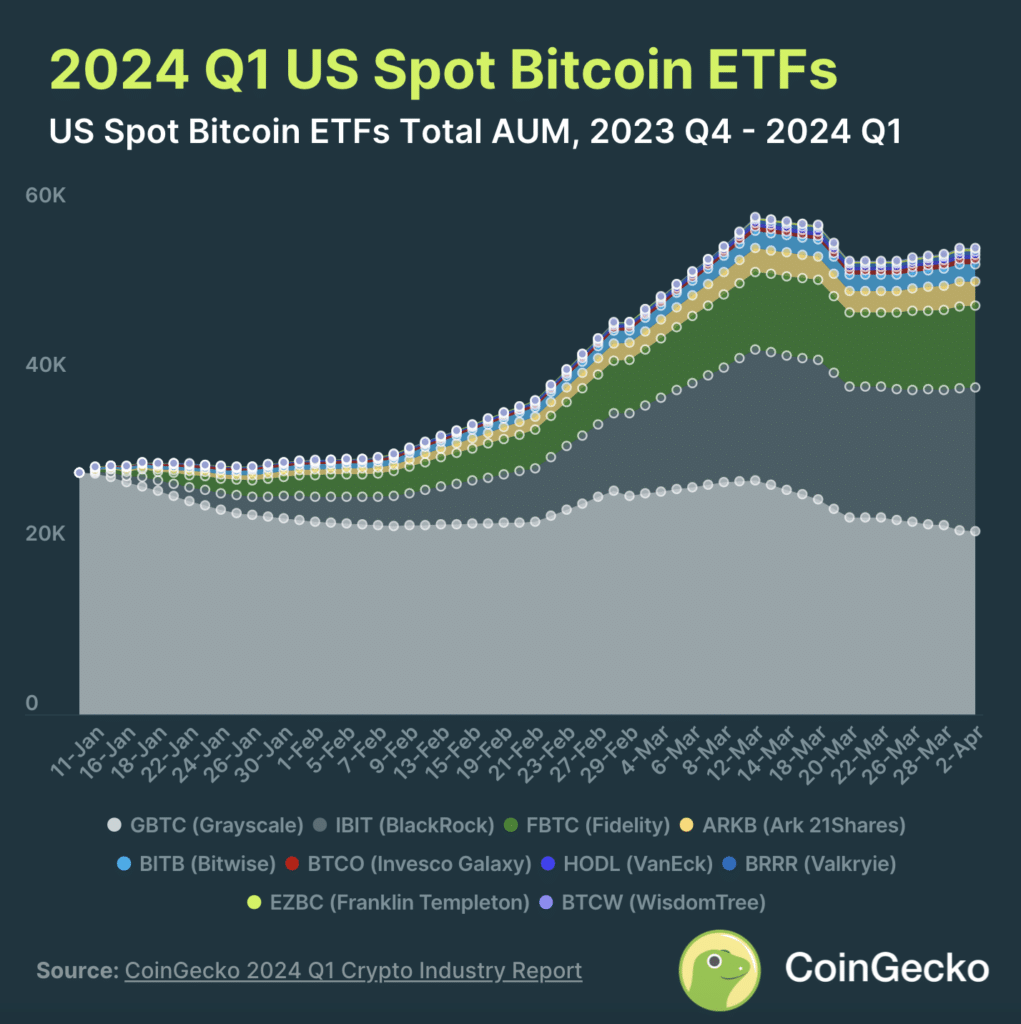

CoinGecko experts noted that U.S. Spot Bitcoin ETFs assets under management (AUM) grew to $55.1 billion. Grayscale Bitcoin Trust ETF (GBTC) still controls the largest share, but the iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) have significantly reduced the gap.

According to analysts, Bitcoin grew 68.8% over the past quarter and reached its all-time high. Source: CoinGecko

Source: CoinGecko

Binance Research previously reported that the market capitalization increased by 16.3% in just a month. Although the inflow of capital into spot Bitcoin ETFs slowed at the end of March, this did not stop funds from showing positive dynamics.

Since January, Bitcoin exchange-traded funds have attracted over $12 billion in investments.

You might also like:

Grayscale’s Bitcoin ETF fund has lost half of assets since launch

Follow Us on Google News

READ MORE ABOUT

bitcoin

coingecko

crypto research

The winners and losers from Bitcoin’s halving

By Connor Sephton

April 17, 2024 at 1:40 pm Edited by Lena Bozhkova

Edited by Lena Bozhkova

FEATURES

Collect the article

share

It will be a box office halving for exchanges and ETFs — but a miserable moment for miners and rival cryptocurrencies.

The Bitcoin halving is fast approaching, but while early investors will be popping open champagne following the cryptocurrency’s recent rally, the 50% cut to block rewards isn’t great news for everyone.

So, who are the winners and losers following this rare event, and how might this affect the markets going forward?

Read more:

What will future Bitcoin halvings look like?

The winners

“OGs” who have had exposure to Bitcoin for years top the list of beneficiaries. The halving means just 450 new BTC a day are going to enter circulation, but this won’t matter much to those who started stacking sats a long time ago.

Someone who has held on to their Bitcoin since the first halving in November 2012 will have seen their investment surge by a jaw-dropping 502,693%. The world’s biggest cryptocurrency has appreciated by 9,578% since the second halving eight years ago and by 607% following the last halving during the coronavirus pandemic in May 2020.

Exchanges

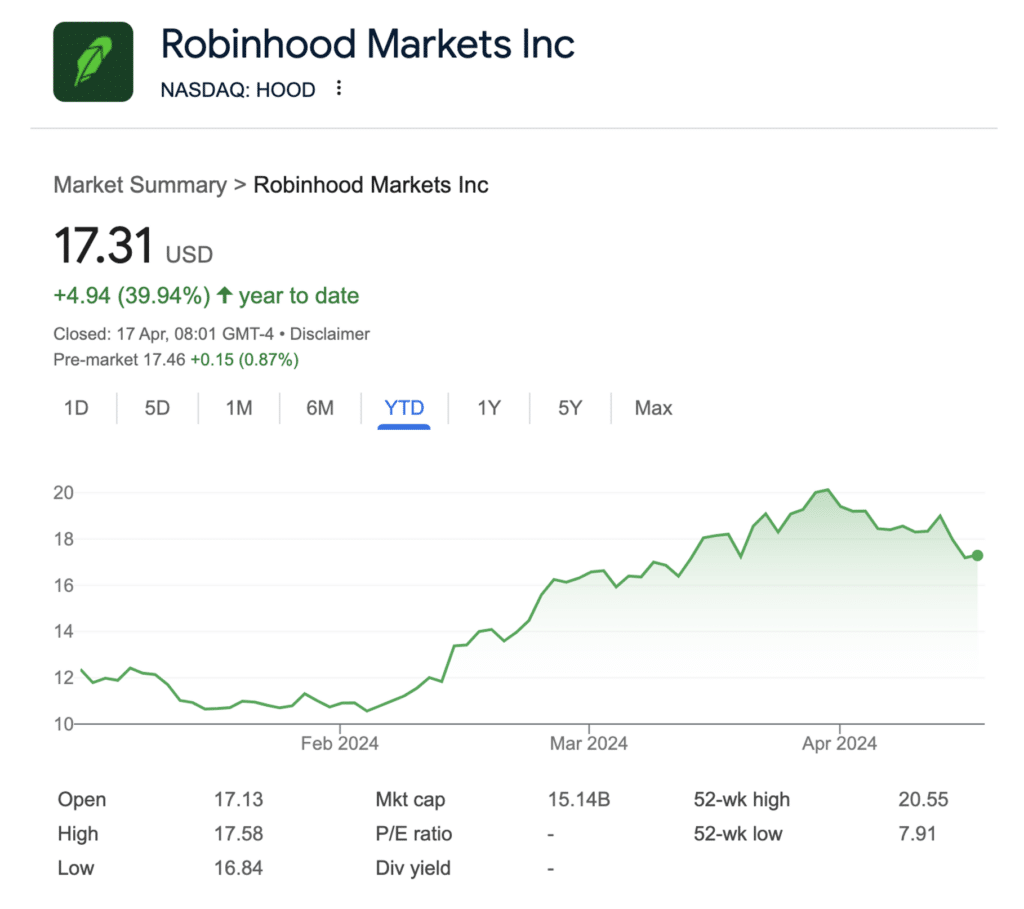

Platforms like Robinhood and Coinbase will also be rubbing their hands with glee as the halving kicks in, and curious consumers open accounts to see what the fuss is all about. Increased volumes among established traders will also bring in bumper fees.

Both companies are now listed on the stock market and have seen their share prices surge since the start of the year. Robinhood’s stock price in the year to date | Source: Google

Robinhood’s stock price in the year to date | Source: Google

And while we’re nowhere near the market mania seen during the last bull run, when adverts for crypto exchanges dominated the Super Bowl, firms are starting to notch up their marketing spend once again. Grayscale has released a new commercial in recent days, with Coinbase taking out TV spots during high-profile basketball games. In a nod to Bitcoin Pizza Day, it’s simply explained this cryptocurrency’s staying power with a fitting food analogy.

ETFs

Exchange-traded funds based on Bitcoin’s spot price were approved in the U.S. in January — and have helped propel BTC to a new all-time high even before the halving’s taken place.

BlackRock’s iShares Bitcoin Trust has quickly established itself as a leader in this congested market. With $17.1 billion in assets under management, it could be a key beneficiary if the halving sparks a renewed rush of inflows from retail and institutional investors.

Michael Saylor

Someone else who comes out of the halving smelling of roses is Michael Saylor.

The founder of MicroStrategy turned heads when he started aggressively buying Bitcoin to hold on its balance sheet in August 2020.

Fast forward to now, and MicroStrategy has now amassed a war chest of 214,000 BTC, with each costing just $33,706 on average. That officially means that just one company owns 1% of all the BTC that will ever exist, and is currently sitting on paper profits of about $6.5 billion.

It wasn’t always easy. When BTC plunged to lows of $16,000 during a punishing bear market in 2022, Saylor’s big bet was hugely in the red — and funded by eye-watering levels of debt.

Saylor has now taken a step back as CEO and is now MicroStrategy’s executive chairman, giving him more time to advocate for Bitcoin. He does a lot of that on X.

Journalists

Any list of winners from Bitcoin’s halving would be incomplete without crypto reporters. Hey, it keeps us busy! We’ll be covering every twist and turn on crypto.news.

The losers

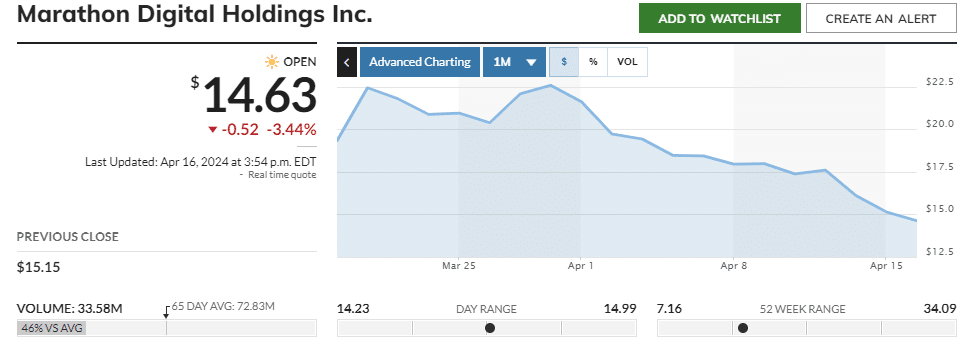

You’ll be unsurprised to know that miners are going to be hit hard by the halving. In the space of one block, the rewards they receive for keeping the network secure will plunge from 6.25 to 3.125 BTC — that’s a drop of about $197,000 in cash terms.

Miners in areas with higher energy costs, and those with older equipment, may find it’s no longer financially viable to continue. Even publicly listed mining giants have seen their stock price battered amid concerns over what the halving will mean for their bottom line. Shares in both Marathon Digital Holdings and Riot Platforms have slumped by 35% over the past month. You might also like:

You might also like:

Bitcoin miners could liquidate $5b in BTC post-halving

Other cryptocurrencies

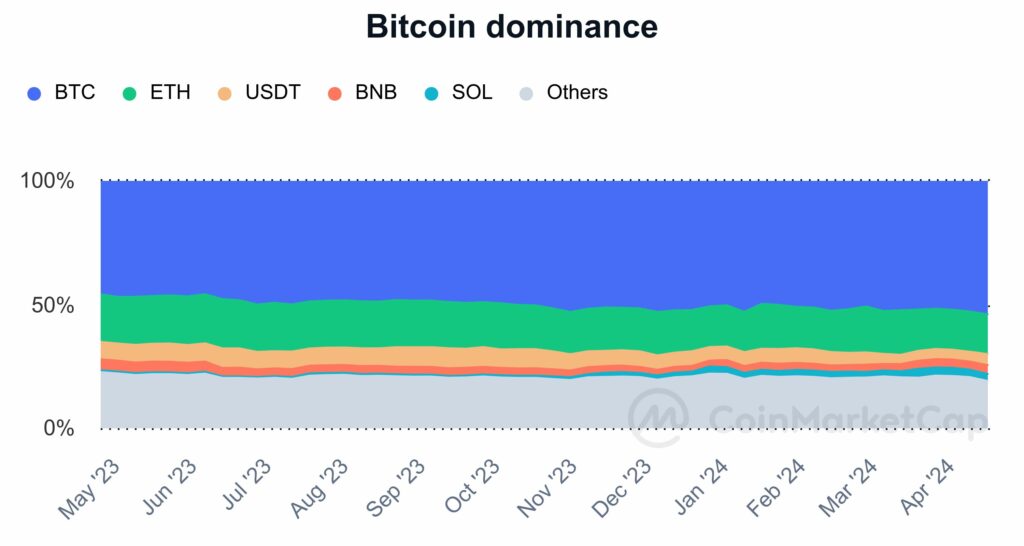

Bitcoin’s dominance now stands at 54.2%, compared with 45.8% a year ago.

The increase in BTC’s market share has been at the expense of Ether and smaller altcoins. Bitcoin’s dominance over the past 12 months | Source: CoinMarketCap

Bitcoin’s dominance over the past 12 months | Source: CoinMarketCap

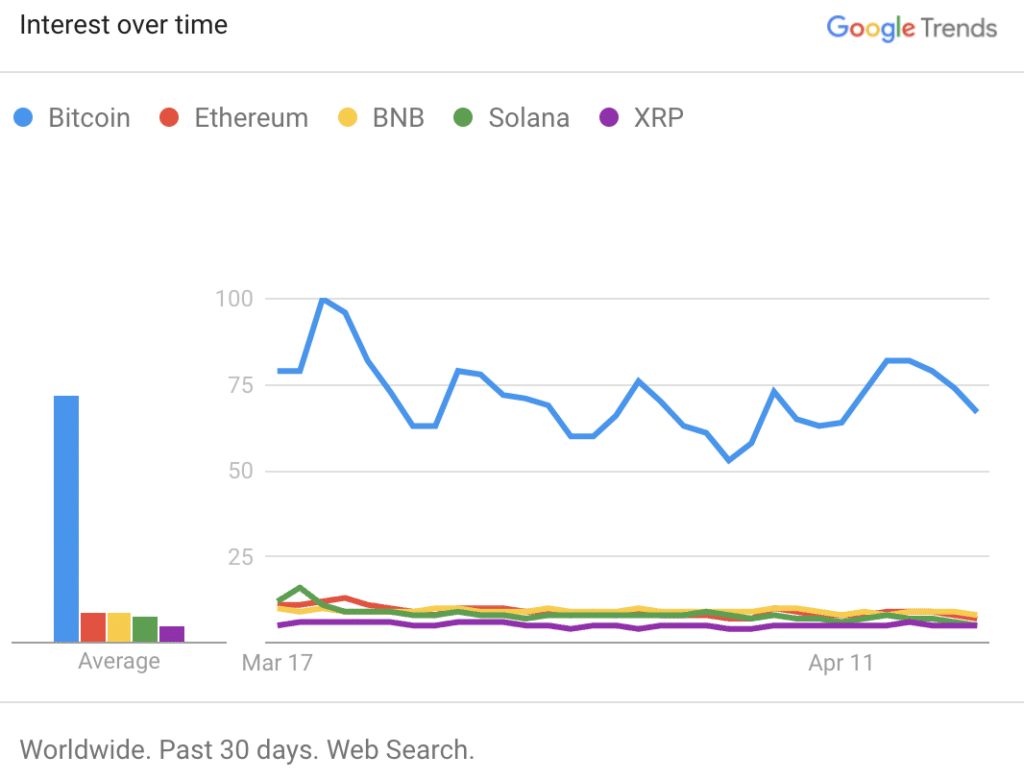

Investors aren’t just voting with eir wallets. Google Trends data shows that search interest in Bitcoin is far outpacing rival cryptocurrencies, which are struggling to get a look in right now. Analysts

Analysts

There’s no shortage of pundits willing to step forward and make ambitious predictions about where Bitcoin prices will go next.

The likes of JPMorgan have suggested that BTC could be heading for a post-halving slump to $42,000, while Fundstrat Global Advisors founder Tom Lee is adamant that a rally to fresh highs of $150,000 could lie ahead in the next 12 months.

Not everyone can be right — and by the end of the year, some analysts who made pie-in-the-sky predictions will have egg on their faces.

Read more: