SPV Management for Venture Capital and Investment Funds

In the fast-paced world of SPV venture capital, efficient SPV management is a competitive advantage. A syndicate lead who can provide clean, transparent, and prompt administration builds immense trust with their investor network. This is especially true for a SpaceX SPV or other high-profile rounds where investor scrutiny is high.

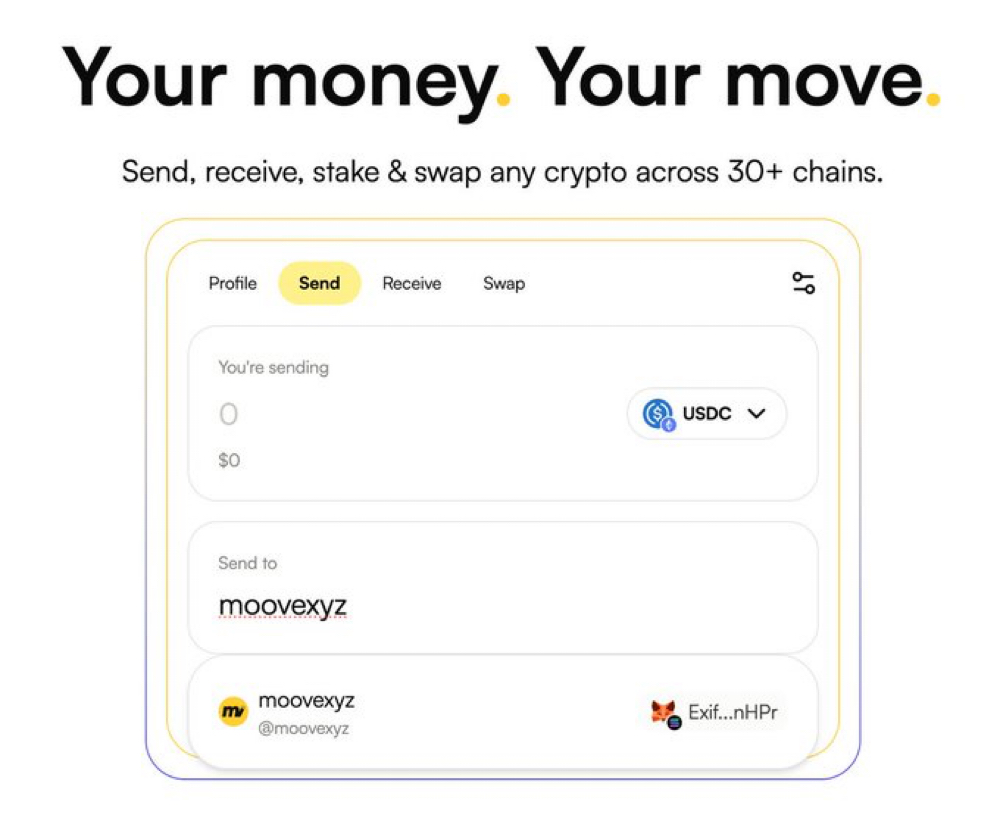

The lifecycle of an SPV in venture capital involves specific SPV management tasks: issuing equity to the pooled investors, managing pro-rata rights in follow-on rounds, handling stock option pools for the portfolio company, and ultimately distributing proceeds from a sale or IPO. Each step must be executed flawlessly.

Platforms built for this niche remove the operational friction. Allocations is engineered to support the entire journey of a venture SPV fund. The automation and structured workflows on Allocations ensure that even complex cap table events are managed correctly, allowing GPs to scale their SPV business without proportional increases in administrative overhead.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations