3 AI Crypto’s Expected to Boom by 2025?

3 AI Crypto’s Expected to Boom by 2025?

Albert Peter

In the rapidly evolving landscape of cryptocurrency, the intersection with artificial intelligence (AI) is becoming increasingly prominent, paving the way for innovative projects poised for substantial growth by 2025. Among these, three AI-focused cryptocurrencies stand out as potential frontrunners in the upcoming years. These currencies leverage AI technologies to enhance various aspects of their platforms, from security and scalability to user experience and decentralized applications.

Their unique approaches to integrating AI into blockchain technology set them apart, promising investors and enthusiasts alike a glimpse into the future of AI-driven decentralized finance. As the cryptocurrency development market continues to mature, these AI-focused cryptocurrencies are positioned to not only survive but thrive, offering innovative solutions that could revolutionize the way we interact with digital assets and decentralized systems.

What is AI Crypto?

AI Crypto refers to cryptocurrencies that leverage artificial intelligence (AI) technologies to enhance various aspects of their platforms. These cryptocurrencies utilize AI algorithms to improve security, scalability, and user experience, among other things. One of the key applications of AI in crypto is trading bots, which use machine learning to analyze market trends and execute trades automatically. AI Crypto also includes projects that aim to use AI for data analysis, smart contract execution, and decentralized application development.

By incorporating AI into their systems, these cryptocurrencies aim to provide more efficient and effective solutions compared to traditional cryptocurrencies. The intersection of AI and crypto holds great promise for the future, as it could lead to the development of more advanced and intelligent decentralized systems. As the technology continues to evolve, AI Crypto projects are likely to play a significant role in shaping the future of the crypto industry.

3 AI Crypto to Boom by 2025

1. GraphLinq Chain

GraphLinq Chain is a blockchain platform that focuses on providing powerful tools for creating and executing automated workflows, known as “graphs.” These graphs can be used to automate various processes across different blockchain networks, making it easier to create complex, interconnected systems.

One of the key features of GraphLinq Chain is its ability to integrate with multiple blockchains, allowing users to create graphs that interact with different blockchain networks simultaneously. This interoperability makes it possible to create versatile applications that leverage the strengths of different blockchains.

GraphLinq Chain also offers a visual interface for creating graphs, making it accessible to users without extensive programming knowledge. This visual approach enables users to quickly design and deploy automated workflows, streamlining development and deployment processes.

Additionally, GraphLinq Chain provides a marketplace where users can buy and sell pre-made graphs, further enhancing the platform’s usability and expanding its ecosystem. Overall, GraphLinq Chain aims to simplify the development of blockchain-based applications and accelerate the adoption of decentralized technologies.

- Purpose: Acts as the foundation for the GraphLinq Protocol, enabling secure and reliable automation processes.

- Consensus Mechanism: Utilizes Proof-of-Authority (PoA) to ensure smooth operation of the network. In a PoA system, a select group of validators verify transactions.

- Future Plans: The developers plan to expand the GraphLinq Chain ecosystem to support a wider range of decentralized applications (dApps).

- GraphLinq Chain’s native token is GLQ, which can be tracked on cryptocurrency tracking websites like CoinMarketCap and CoinGecko. As of today, March 19, 2024, GLQ is priced at around $0.14.

- The GraphLinq Protocol itself offers a no-code approach to automation, allowing users to build automation through a drag-and-drop interface.

The upcoming year could see even more rapid growth for the platform. As user interaction becomes simpler and blockchain technologies become more mainstream, the demand for Graphlinq Chain coins is likely to rise. The concept of decentralized automation without code has the potential to not only survive but thrive, even during shifts in market sentiment or a transition to a bearish market.

2. Fetch.ai (FET-USD)

Fetch.ai (FET) is a decentralized artificial intelligence (AI) and machine learning (ML) platform that aims to enable a decentralized digital economy. The project focuses on creating a scalable and secure infrastructure for autonomous agents to perform tasks such as data sharing, transactions, and coordination without human intervention.

One of Fetch.ai’s key features is its Multi-Agent System (MAS), which allows autonomous agents to interact with each other, negotiate, and collaborate to achieve common goals. These agents can represent individuals, businesses, or IoT devices, enabling a wide range of applications in industries such as finance, supply chain, and healthcare.

Fetch.ai also introduces a unique consensus mechanism called the “Proof-of-Stake Time” (PoST) consensus, which aims to achieve a balance between security, scalability, and energy efficiency. Post consensus relies on a combination of staking and a novel resource-oriented architecture to validate transactions and reach consensus.

The FET token is used within the Fetch.ai ecosystem to pay for services, incentivize participation, and facilitate transactions between autonomous agents. Overall, Fetch.ai seeks to revolutionize the way AI and ML are used in decentralized systems, unlocking new possibilities for automation and collaboration in the digital economy.

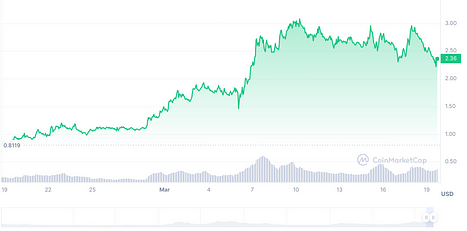

- Price: Fetch.ai is trading around $2.24, which is a decrease of roughly 17.46% in the last 24 hours.

- Market Cap: The total market capitalization of Fetch.ai sits at approximately $1.88 billion.

- Circulating Supply: There are currently 839.75 million FET coins in circulation.

- Recent Developments: The Fetch.ai Mainnet Upgrade, known as “Capricorn,” introduced significant improvements, including enabling inter-blockchain communication (IBC) and allowing permissionless smart contract development.

In the last month, FET has outpaced the market’s growth. Starting at $0.66 in mid-February, this AI crypto has surged over fourfold, surpassing the $2 threshold for the first time. With a market cap of $2.2 billion, Fetch.ai ranks among the top 100 cryptocurrencies. Analysts are optimistic about the coin’s future, citing its strong market position and innovative approach. Some predict it could reach $5 even before Bitcoin’s halving.

3. Ocean Protocol (OCEAN-USD)

Ocean Protocol (OCEAN) is a decentralized data exchange protocol that allows individuals and organizations to share and monetize data while maintaining privacy and control. The protocol enables data providers to tokenize and publish data assets, which can then be accessed and consumed by data consumers using the Ocean Protocol network.

One of the key features of Ocean Protocol is its focus on data privacy and security. The protocol allows data providers to specify the terms and conditions under which their data can be accessed, ensuring that data remains secure and private. Additionally, Ocean Protocol uses blockchain technology to provide transparency and traceability, allowing users to verify the authenticity and integrity of data assets.

Another important aspect of Ocean Protocol is its data marketplace, where data providers can list their data assets for sale or exchange. Data consumers can browse the marketplace to discover and purchase data assets that meet their needs, creating a decentralized ecosystem for data exchange.

The OCEAN token is used within the Ocean Protocol ecosystem to facilitate transactions, incentivize data sharing, and govern the protocol. Token holders can stake their tokens to participate in governance decisions and earn rewards for contributing to the network.

Overall, Ocean Protocol aims to democratize data access and empower individuals and organizations to share and monetize data securely and transparently, ultimately driving innovation and collaboration in the data economy.

Current Price:

- There seems to be some discrepancy between different sources on the current price of OCEAN.

- Binance lists OCEAN at $1.14.

- CoinMarketCap has a lower price of $0.97.

Market Performance:

- Regardless of the exact price, there’s disagreement on the daily performance as well.

- Binance shows a price increase of around 9% in the last 24 hours.

- CoinMarketCap suggests a decrease.

Overall Market Cap and Supply:

- Market capitalization is around $600 million to $650 million, placing it roughly around #150 on CoinGecko.

- Circulating supply is around 568 million OCEAN tokens.

This coin doesn’t just thrive during bullish times in the crypto market, setting it apart from many other AI cryptos. In early 2023, it even tripled its value thanks to the ecosystem’s active development. Regardless of the sentiment among crypto investors in 2025, OCEAN could keep growing thanks to a steady wave of demand.

How Ai Crypto Is Used In Trading, Analytics, And Security

Artificial Intelligence (AI) plays a significant role in various aspects of the cryptocurrency industry, including trading, analytics, and security. Here’s how AI is used in each of these areas:

- Trading: AI is used in crypto trading to analyze market trends, predict price movements, and execute trades. AI algorithms can analyze vast amounts of data, including historical price patterns, trading volume, and market sentiment, to identify profitable trading opportunities. AI-powered trading bots can also execute trades automatically based on predefined strategies, helping traders take advantage of market fluctuations 24/7.

- Analytics: AI is used in crypto analytics to gain insights into market trends, investor behavior, and the overall health of the cryptocurrency market. AI algorithms can analyze data from various sources, such as social media, news articles, and trading platforms, to identify patterns and trends that human analysts may miss. This information can be used to make informed investment decisions and develop trading strategies.

- Security: AI is used in crypto security to detect and prevent fraudulent activities, such as hacking and phishing attacks. AI algorithms can analyze network traffic, user behavior, and transaction patterns to identify suspicious activities in real time. AI-powered security systems can also learn from past attacks and continuously improve their ability to detect and prevent future threats.

Overall, AI is revolutionizing the cryptocurrency industry by providing traders, investors, and businesses with powerful tools to improve trading performance, gain valuable insights, and enhance security.

Criteria for Identifying AI Cryptos with Potential

⇒ Technology: Evaluate the underlying technology of the AI crypto project. Look for projects that use advanced AI algorithms and have a strong technical team with expertise in AI and machine learning.

⇒ Use Case: Consider the use case of the AI crypto project. Look for projects that are solving real-world problems or have the potential to disrupt existing industries with innovative AI solutions.

⇒ Partnerships and Collaborations: Check if the AI crypto project has partnerships or collaborations with reputable organizations. This can indicate that the project has credibility and potential for future growth.

⇒ Team: Assess the team behind the AI crypto project. Look for a team with a strong background in AI, blockchain, and relevant industries. A strong team can increase the likelihood of project success.

⇒ Community and Adoption: Evaluate the project’s community and adoption rate. Look for projects with a strong and active community, as well as a growing user base. This can indicate that the project has the potential for long-term success.

⇒ Market Potential: Consider the market potential of the AI crypto project. Look for projects that are targeting large and growing markets, as this can indicate potential for future growth and adoption.

⇒ Transparency and Governance: Assess the project’s transparency and governance structure. Look for projects that are transparent about their operations and have a clear governance structure in place. This can help ensure that the project is well-managed and accountable to its stakeholders.

By considering these criteria, you can identify AI crypto projects with the potential for long-term success and growth in the rapidly evolving cryptocurrency market.

Factors Influencing the Boom of AI Cryptos by 2025

- Increased Adoption of AI: The widespread adoption of AI technologies across industries is likely to drive the demand for AI cryptos. As AI becomes more integral to businesses and everyday life, the value of AI-based cryptocurrencies is expected to increase.

- Growing Interest in Decentralized Finance (DeFi): The rise of DeFi platforms is creating new opportunities for AI cryptos. AI algorithms can be used to automate lending, trading, and other financial services in decentralized ecosystems, driving the demand for AI-based cryptocurrencies.

- Regulatory Clarity: Clear regulations around cryptocurrencies and AI applications are likely to boost investor confidence and encourage more widespread adoption of AI cryptos. Regulatory clarity can also attract institutional investors to the market.

- Technological Advancements: Advances in AI technologies, such as machine learning and natural language processing, are likely to enhance the capabilities of AI cryptos. These advancements could lead to new and innovative use cases for AI-based cryptocurrencies

- Increased Security: The use of AI in cybersecurity is expected to improve the security of AI cryptos, making them more attractive to investors and users. AI algorithms can help detect and prevent fraud, hacking, and other security threats in real-time.

- Market Demand: As the demand for AI-based products and services continues to grow, the value of AI cryptos is likely to increase. Companies and individuals looking to leverage AI technologies may turn to AI cryptos as a way to access AI services and applications.

- Global Economic Trends: Economic factors, such as inflation, currency devaluation, and geopolitical instability, can influence the demand for AI cryptos as investors seek alternative stores of value. AI cryptos could serve as a hedge against economic uncertainty.

Overall, these factors are expected to contribute to the growth and boom of AI cryptos by 2025, driving increased adoption and value in the cryptocurrency market.

Conclusion

In conclusion, the future looks promising for AI-focused cryptocurrencies, with three key players showing strong potential for significant growth by 2025. These projects are at the forefront of merging AI and blockchain technology, offering innovative solutions that could reshape the crypto landscape. Investors and enthusiasts should keep a close eye on these projects as they continue to develop and mature, as they could present lucrative opportunities in the coming years.

As the demand for AI-driven solutions grows across various industries, these cryptocurrencies are well-positioned to capitalize on this trend and establish themselves as leaders in the space. However, as with any investment, it’s important to conduct thorough research and consider the risks involved before making any decisions. Nonetheless, the outlook for these AI cryptocurrencies is undeniably bright, and they have the potential to boom in the years leading up to 2025.