Is the Crypto Winter Coming to an End?

The purpose of this article is not to speculate on the Bitcoin price. However, with the expected upward movement in Bitcoin prices , altcoin prices will also be affected, and new projects that remain unfinished or have not yet started due to the crypto winter will accelerate with the increasing investment appetite. “As funding is allocated for these projects, we can expect an increase in infrastructure developments that will enhance the ecosystem. Additionally, ecosystem communities will actively promote production by attracting new users through marketing efforts.”As a result, the revival in all verticals of the ecosystem will increase market volumes and values. Looking at the issue only from a buy-sell perspective creates a limited view.

Crypto winter refers to a prolonged bear market characterized by a significant decline in prices and market sentiment in the cryptocurrency industry. While the exact timing of the end of the crypto winter is difficult to predict, I have summarized my various arguments suggesting a potential recovery in the near future.

Bitcoin price history:

Bitcoin made its previous ATH ( all -time- high ; the highest level in history) at $68K in November 2021. Since then, we have experienced a continuous decline and a very narrow price range at certain levels for a long time. At the bottom (after the ATH), we saw it at $16K in November 2022. During this period, we experienced the Luna and FTX incidents. Why I Think We’re Nearing the End of the Crypto Winter:

Why I Think We’re Nearing the End of the Crypto Winter:

Individual and Institutional Demand:

The market is deepening and new players are entering every day. Let’s divide these new players into individuals and institutions:

- Individuals’ cryptocurrency knowledge is increasing day by day. The elderly population that cannot adapt to these new techniques and methods is decreasing day by day while the incoming younger generation is increasing.

- According to a joint study by FINRA and CFA, Generation Z makes their first investments with 44% in cryptocurrencies, 32% in stocks, and 21% in investment funds. https://rpc.cfainstitute.org/-/media/documents/article/industry-research/Gen_Z_and_Investing.pdf

- Nevertheless, a large portion of individuals find the markets complex and are hesitant to trade and/or invest. However, user-friendly applications are reducing these difficulties and entry-barriers. In addition, those unfamiliar with the market and/or hesitant to use crypto related products, they can trade and invest in products which are very similar to the conventional financial products, like ETF’s.

- On the corporate side, regulations are still awaited. However, the situation here is not either 0 or 1. The gray area of the legislations are constantly decreasing. Especially, many various activities that were banned by China between 2014 and 2017 are no longer an issue. The finalization and gradual implementation of Mica in Europe has already enabled institutions to establish their infrastructure and develop various innovative products and services.

- Moreover, the fact that the “I did it, it happened” approaches taken by Microstrategy and Tesla since 2019 were not met with high reactions by the regulatory authority and no sanctions were imposed. This situation encouraged other institutions; Driven by innovation and product diversity, the corporate world’s involvement in the crypto asset ecosystem is increasing.These factors will affect the cryptocurrency prices, especially Bitcoin, of which prices have been suppressed for 20–22 months, very soon.

Product Diversity is Increasing:

Every day, companies and start-ups are diversifying their products and services involving cryptocurrencies and making their applications more user-friendly. These include cryptocurrency custody services, cryptocurrency data analysis services, ICO analysis services, cryptocurrency portfolio management services, cryptocurrency ETF’s, and tokenization services. These products contribute to the popularization of cryptocurrencies and, therefore, increase demand. With new platforms and blockchain technologies, issues of speed, cost, and scalability have greatly decreased, and with the spread of DeFi, innovative services and products beyond conventional finance have begun to enter our daily lives.

Spot ETF:

In the previous point, I mentioned that with the diversification of products, adoption will increase, and hence, demand will increase. However, spot ETFs will create an impact that deserves to be examined in a separate paragraph.

An ETF is an exchange-traded fund. This means that shares of a traditional mutual investment fund are issued and traded on the stock exchange in the form of shares. When we say spot ETF, it means that the bitcoins to be placed in the ETF will be bought in the spot market, not in futures. In other words, extra demand will be created for the existing spot bitcoin.

As of the time I am sharing my views (mid-October 2023), there are already two spot ETFs trading in the world. One is listed in the Netherlands and the other in Canada. Other than these two spot ETS, when an approval from U.S. SEC is declared, it will have a very positive impact on the prices. There are basically two reasons for this:

- The SEC will demonstrate that it has now consented to the widely adoption of Bitcoin in the U.S. and has accepted that it cannot stop it.

- Currently, 11 portfolio management companies are still awaiting approval for spot ETFs, and the assets under management (AUM) of these companies are close to 18 trillion dollars. Even if only one-thousandth of this amount is directed to Bitcoin, the high demand will lead to a fast and significant increase in prices.

It is worth noting that these ETFs will not only be buyers; but due to their then existing portfolio management strategies, they may also be seller time to time. That is, their purchases will be of high value and will greatly boost the market, but their sales may lead to significant price declines as well. However, the initial approval of spot ETFs will significantly impact Bitcoin prices with the expectation that “these funds will start by buying anyway.”

Market Perception:

The prolonged duration of the crypto winter has created a sense of stagnation in the market. We have experienced the market-reducing effects of bad news up until now. Now, the impact of these negative news has diminished. Market players have entered a mood of welcoming positive news more positively.

Regulatory Developments:

Both bans and gray areas have been reducing the activities of players in the market for a long time. Mica, which we have been waiting for since 2016, has now taken its final form for the time being. We say “for the time being” because Mica will continue to evolve due to the difficulties and/or gaps seen in its applications. Nevertheless, we now have a concrete regulation. This will lead institutional investors to translate their existing interest in these markets into action.

Economic Outlook:

The global economy is signaling a slowdown. This situation may initially seem to have a negative impact on cryptocurrency prices. However, central banks will increase market liquidity to avoid entering a recession. I believe the Fed’s interest rate hike process has now been completed. In fact, we may even see an interest rate cut from the Fed in the remaining months of the year. “Expectation management” is an effective method in the market. Even if the Fed does not lower interest rates for the rest of the year, the expectation that it will start monetary expansion (easing) at the nearest opportunity will spread.

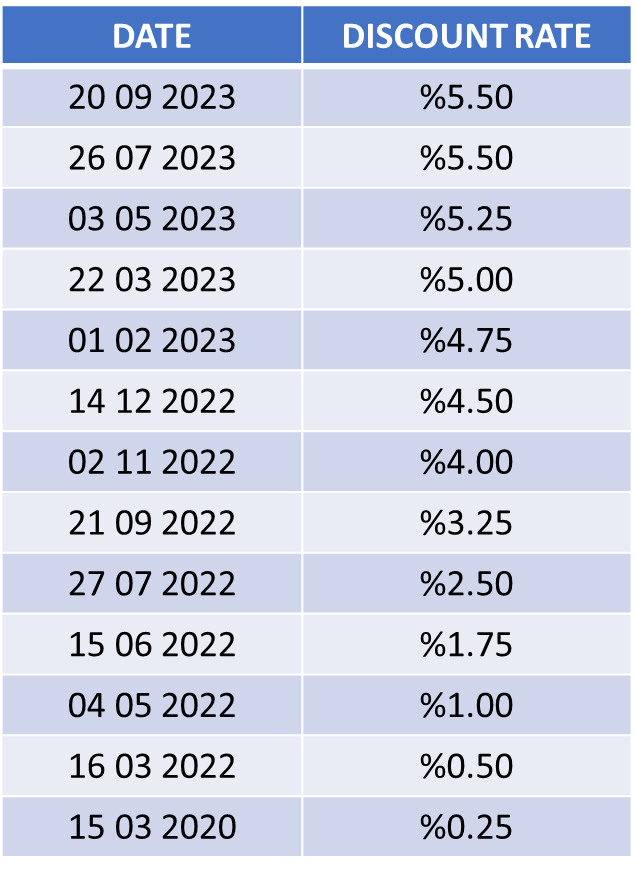

In March 2020, the Fed’s interest rate was 0.25% and it was raised to 5.5% in July 2023 step by step. These steps have been very steep and now the rates have settled down. The interest rate has been kept the same in the last two meetings.

The November 2024 American elections will make liquidity injection even more necessary. Since the election economy will be implemented, the FED will increase money printing between December and January and will relieve the markets in terms of liquidity. As we have seen before, some of the increased liquidity will go to the stock market and cryptocurrency . This will have a positive impact on prices.

Halvening:

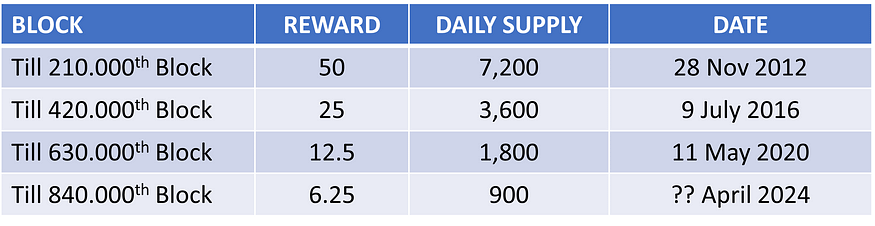

When Satoshi designed Bitcoin, he limited the money supply to 21 million and designed the speed of money supply to slow down continuously. In Bitcoin, the money supply takes place in the form of rewards given to miners. Currently, miners are rewarded with 6.25 BTC for every block found. This reward amount is halved every four years. This is called “halvening”.

Halving means that in the current supply and demand situation, the supply suddenly drops by half. This disrupts the supply-demand balance in favor of demand, causing prices to increase. We expect Bitcoin’s next halving in early April 2024.

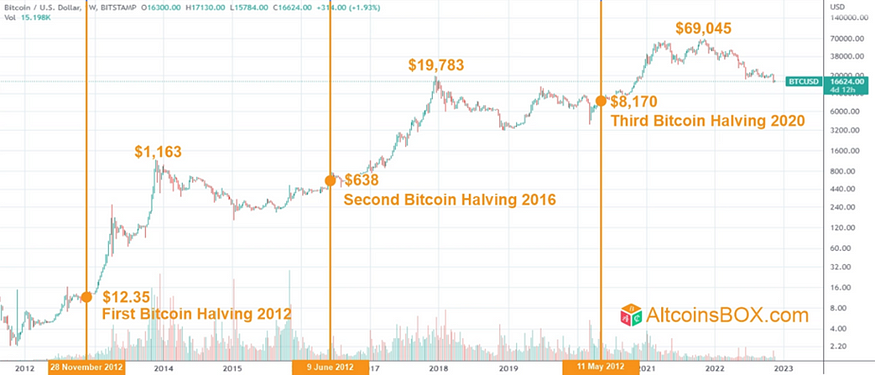

Let’s remember the previous halvenings:

The current reward amount means that the supply of Bitcoin 900 BTC per day. This small amount is not a significant amount that will create an excess supply in the market and hence, selling pressure. After all, Bitcoin’s market cap is over half a trillion dollars and its daily trading volume is over 20 billion dollars.

This situation causes the price-increasing effect of the halving to decrease. I predict that it will not be at the level of 4X or 5X as we have seen in previous halvings. For example, in the second halving, the daily supply amount decreased from 3,600 to 1,800, but in this halving, the supply amount will decrease from 900 to 450. In other words, the decrease in supply will disrupt the balance towards demand and will be less effective than previous halvings.

In the chart below (please note that the y-axis, representing spot price, is logarithmic, not linear), we see the price movements during halvening periods. I do not include the halvening in November 2012 into my analysis. Because at that time, Bitcoin had very little awareness and a very low market cap. When we look at the price during the second halvening ($640) and the subsequent ATH ($20K), we see a 30X increase. In the third halvening period, we see an increase rate of 8.5X (from $8.2K to $69K). I believe that the ATH after the next halvening will be between 2X and 2.5X the price at the time of halvening.

My personal opinion:

While Satoshi framed the issues of the total supply being limited and the supply speed constantly slowing down, I think that his framing of the slowdown as occurring every four years specifically coincided with the election economic cycles that America holds every four years. Since I do not have any concrete information or scientific evidence on this subject, I present this as my personal opinion. If you say “I do not accept” this view, which is also common among Bitcoin enthusiasts, unfortunately I do not have any records or documents to prove me right. This is my personal opinion and if you have any other suggestions or thoughts, I would be grateful if you could inform me with documentation.

Sword of Damocles:

Although I predict that the crypto winter will end around November — December and that we will begin the period of abundant increases in January 2024 at the latest, let’s not ignore that there are also big question marks. The situations of Tether and Binance remain a big question mark on the ecosystem. We can call these two possibilities “black swans”. Although the likelihood is quite low, if it were to occur, its negative effects on the market would be substantial.