20 Best KYC Providers in 2024 (part3)

15. Fenergo

Fenergo is a leading provider of client lifecycle management (CLM) software solutions for financial institutions. Founded in 2009 and headquartered in Dublin, Ireland, Fenergo specialises in developing technology platforms that help banks, asset managers, and other financial institutions streamline client onboarding, regulatory compliance, and data management processes.

Fenergo’s CLM platform offers a comprehensive suite of modules and tools to automate and digitise the end-to-end client lifecycle management process. This includes client onboarding, KYC compliance, AML screening, regulatory compliance, data governance, and client data management.

Fenergo’s solutions are used by some of the world’s largest financial institutions to manage regulatory compliance and client data across multiple jurisdictions and business lines. The company has received recognition for its innovative approach to CLM and has earned numerous awards in the financial services industry.

16. Fugu

Fugu Risk arises as a reliable guardian of transaction security. Headquartered in Israel, this company specialises in post-checkout payment tracking solutions through its innovative platform, FUGU. By meticulously tracking payments, FUGU empowers online sellers to overcome fraud and false declines confidently.

Catering to a diverse clientele ranging from eCommerce websites and payment gateways to SaaS providers and financial institutions, Fugu Risk’s solutions offer unparalleled protection across multiple industries. From mitigating chargeback liabilities to ensuring secure transactions in the gaming and investment sectors, Fugu Risk stands as a beacon of trust and reliability in online payments.

FUGU adapts to its clients’ unique needs with remarkable flexibility. Whether accessed through the cloud or deployed on-premises for Windows or Linux systems, Fugu’s solutions seamlessly integrate into existing infrastructures. From real-time chat assistance to comprehensive FAQs and forums, Fugu Risk ensures that its clients receive the guidance and support they need to overcome the complexities of online transactions with ease.

17. Know Your Customer

Know Your Customer revolutionises digital onboarding for financial institutions and regulated organisations worldwide, entering the next generation of compliance solutions. Their platform empowers compliance teams to safeguard their businesses efficiently by streamlining KYC and AML checks for individual and corporate customers.

They enhance operational efficiency while ensuring regulatory compliance by centralising the onboarding process into a remarkably user-friendly platform. Through Know Your Customer’s cutting-edge technology, they drastically reduce the time required to onboard new corporate clients, slashing the industry average from 26 days to just 1 day. This acceleration translates into significant cost savings for their clients, allowing them to allocate resources more effectively.

Headquartered in Hong Kong, with additional offices in Singapore, Shanghai, and Dublin, Know Your Customer has established itself as a global leader in the field, renowned for its excellence and innovation. Their extensive client portfolio includes banking, FinTech, insurance, payments, real estate, asset management, and legal firms operating in 18 jurisdictions worldwide.

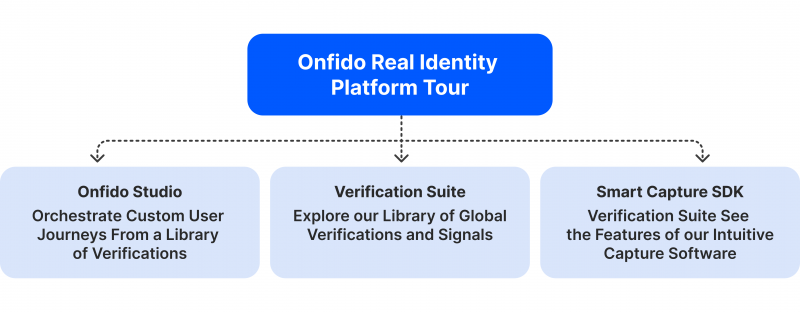

18. Onfido

Founded in 2012, Onfido provides document verification, facial biometrics, and fraud detection. The company’s platform uses machine learning algorithms to analyse identity documents and facial biometrics, allowing businesses to verify the authenticity of documents and match them to the individual presenting them.

Founded in 2012, Onfido provides document verification, facial biometrics, and fraud detection. The company’s platform uses machine learning algorithms to analyse identity documents and facial biometrics, allowing businesses to verify the authenticity of documents and match them to the individual presenting them.

Onfido serves various industries, including finance, e-commerce, the sharing economy, and healthcare.

The company has received recognition for its innovative approach to identity verification and has been named one of the leading providers in the industry.

19. Pliance

Pliance is a Swedish-based company that provides business compliance solutions, particularly in AML and KYC regulations. Founded in 2016, Pliance offers a platform that helps companies automate their compliance processes, reduce manual workloads, and ensure adherence to regulatory requirements.

The Pliance platform offers a range of features, including customer due diligence, transaction monitoring, sanctions screening, and risk assessment. It serves various industries, including fintech, banking, e-commerce, and cryptocurrency.

20. Quantifind

Quantifind is a company that specialises in providing data analytics and insights for businesses, particularly in marketing and risk management. Founded in 2009 and based in California, Quantifind uses advanced analytics and machine learning techniques to help organisations make data-driven decisions and identify growth or risk mitigation opportunities.

Quantifind’s solutions are designed to analyse large volumes of data from various sources, including social media, news articles, customer feedback, and financial data, to extract actionable insights and trends.

The company’s platform offers capabilities such as sentiment analysis, predictive modelling, anomaly detection, and network analysis, enabling businesses to uncover hidden patterns and correlations in their data.

Criteria Used for Selection

Several key factors were considered when ranking the top KYC providers for 2024, including the comprehensiveness of identity verification solutions offered, the accuracy and reliability of their data sources, the efficiency of their onboarding processes, the flexibility of their integration options with existing systems, the level of regulatory compliance they ensure, the scalability of their services to meet varying business needs, the quality of their customer support and training resources, the cost-effectiveness of their solutions, and the overall reputation and track record of the provider in the industry.

Conclusion

The landscape of KYC technology is continually evolving, with providers offering innovative solutions to meet the growing demands of businesses worldwide. Using advanced technologies and robust security measures, these top 20 KYC providers are helping organisations combat financial crimes, protect customer data, and maintain regulatory compliance. Ultimately, KYC is not just a regulatory obligation but a strategic imperative for businesses seeking to thrive in the modern digital age.