2024 Bitcoin Halving Could Trigger the Mother of All Bull Runs

With less than 3,000 blocks left until the next Bitcoin halving event, the crypto space is buzzing with excitement and speculation. This pivotal moment, set to occur in mid-April 2024, will mark the fourth time the Bitcoin network's block reward is reduced by 50%. While past halvings have precipitated incredible bull runs, this upcoming event is poised to be the most impactful yet.

Bitcoin's halving events have become some of the most highly anticipated and analyzed moments in the cryptocurrency world. These cyclical supply shocks have historically triggered significant price rallies, as scarcity increases and investors rush to get a piece of the digital gold.

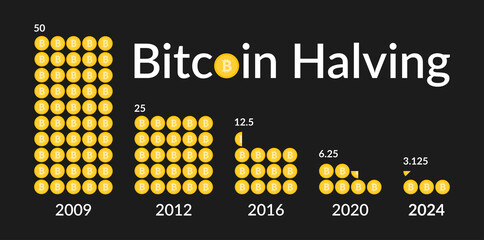

Bitcoin's halving is a key mechanism built into the network's protocol that reduces the reward miners receive for validating transactions. This occurs every 210,000 blocks or approximately every 4 years. The first halving occurred in 2012, the second in 2016, and the third in 2020. Each time the halving occurs, the amount of new Bitcoin entering circulation is cut in half. This reduces the overall supply growth rate, making Bitcoin an increasingly scarce asset over time. The next halving will see the block reward decrease from 6.25 BTC to just 3.125 BTC.

The crypto market has matured a lot since the previous halvings, with more big-name companies and investors getting involved. This could amplify the effects of the 2024 halving, leading to an even bigger surge in Bitcoin and cryptocurrency prices.

What is the Bitcoin Halving?

The Bitcoin halving is a programmed event that occurs approximately every 4 years, whereby the reward given to miners for validating transactions on the Bitcoin network is reduced by 50%. This process continues until the total supply of 21 million Bitcoins has been reached, which is estimated to occur around the year 2140.

The purpose of the halving is to maintain Bitcoin's deflationary characteristics and ensure its scarcity over time. By reducing the rate at which new Bitcoins enter circulation, the halving helps to preserve Bitcoin's value and disinflationary monetary policy.

Why Does the Bitcoin Halving Happen?

The Bitcoin halving is a crucial component of the network's monetary policy. By reducing the block reward given to miners, the halving slows the rate at which new Bitcoins are created, making the cryptocurrency increasingly scarce over time. This scarcity is designed to maintain Bitcoin's value and mimic the characteristics of a deflationary asset, such as gold.

The idea behind this is to make Bitcoin more valuable as a limited, scarce asset - similar to how gold has value due to its scarcity. By slowing down the creation of new Bitcoins, the halving is designed to increase demand and drive up the price over the long run.

What Happens During a Bitcoin Halving?

The Bitcoin halving is a highly anticipated event that can have a significant impact on the cryptocurrency market. During a halving, several key things occur:

- Block Reward Reduction: As mentioned, the block reward for miners is reduced by 50%, from 6.25 BTC to 3.125 BTC.

- Slowed Supply Growth: The rate at which new bitcoins are created is effectively halved, reducing the overall supply growth of the cryptocurrency.

- Increased Miner Costs: With the block reward cut in half, miners must find ways to maintain profitability, often by improving efficiency or reducing operational costs.

- Market Volatility: The halving event is often accompanied by increased price volatility in the Bitcoin market, as investors speculate on the potential impact of the reduced supply growth.

- Increased Attention: The halving typically garners significant attention from the media, investors, and the broader cryptocurrency community, as it is seen as a crucial milestone in Bitcoin's development.

How the Bitcoin Halving Affects Prices

One of the key questions on investors' minds is how the Bitcoin halving will impact the cryptocurrency's price. Historical data suggests that Bitcoin's price has often experienced significant gains in the months and years following a halving event.

- After the 2012 halving, Bitcoin's price increased by over 8,000% in the following 12 months.

- The 2016 halving was followed by a similar price surge, with Bitcoin's value rising by more than 2,800% in the following year.

- The 2020 halving, however, played out a bit differently. While Bitcoin's price did see a significant rally in the following months, reaching an all-time high of over $60,000, the market also experienced a major correction afterwards.

This illustrates that the halving's impact on prices is not always straightforward, and can be influenced by various factors.

As the 2024 halving approaches, it's important to note that the cryptocurrency landscape has evolved significantly, with increased institutional participation and changing investor behaviours. These factors may alter the market's reaction to the upcoming halving event, making it difficult to predict the exact price trajectory.

Effects on Traders, Investors, Altcoins, and the Crypto Market

The Bitcoin halving can have far-reaching effects on various segments of the cryptocurrency market:

- Traders: The halving event is often accompanied by heightened volatility, which can present both opportunities and challenges for traders. Some may seek to capitalize on the price swings, while others may adopt a more cautious approach to mitigate the risks.

- Investors: Long-term investors may view the halving as a bullish catalyst, potentially leading them to accumulate Bitcoin in anticipation of a post-halving price rally. However, the market's reaction may not be as straightforward as in previous cycles, requiring investors to carefully evaluate their strategies.

- Altcoins: The Bitcoin halving can also have an impact on alternative cryptocurrencies, or altcoins. Historically, the altcoin market has tended to rally in the months following a Bitcoin halving, as investors seek out potential "alt season" opportunities. However, the degree of this correlation may shift as the crypto market matures.

- Crypto Market: The Bitcoin halving can influence the overall sentiment and dynamics of the broader cryptocurrency market. As the flagship cryptocurrency, Bitcoin's performance can have a ripple effect on other digital assets, potentially driving increased mainstream adoption and regulatory attention.

While past Bitcoin halving events have followed a familiar pattern of price rallies, the 2024 halving is taking place against a backdrop of a more mature and institutionalized crypto market. And with the recent approval of Bitcoin ETFs, this could lead to some deviations from the historical playbook.

How to Prepare for the Bitcoin Halving and Potential Bull Market

As the Bitcoin halving approaches, investors and traders should take proactive steps to prepare for the potential market volatility and opportunities that may arise:

- Stay Informed: Closely follow the latest developments, news, and analyses surrounding the Bitcoin halving to understand the market dynamics and potential implications.

- Diversify Portfolio: Consider diversifying your cryptocurrency holdings to include a range of assets, not just Bitcoin, to mitigate risks and potentially capitalize on the broader market movements.

- Adopt Long-Term Strategies: Given Bitcoin's historical price appreciation in the post-halving period, long-term holding strategies may be favorable, rather than attempting to time the market.

- Optimize Trading Approaches: Traders may want to review their strategies and consider adjusting their risk management, leverage, and position-sizing to account for the increased volatility.

- Monitor Altcoin/ Memecoin Trends: Keep a close eye on the altcoin market, as the Bitcoin halving has often been a catalyst for "altcoin seasons".

The 2024 halving is a historic moment that could cement Bitcoin's status as a globally recognized and adopted asset. So get ready, the greatest bull market in financial history is just getting started.