Investing in Cryptocurrencies: Tips for Navigating the Volatile Market.

Introduction:

Investing in cryptocurrencies can be an exciting and potentially rewarding venture. However, the market's inherent volatility requires caution and a strategic approach. To navigate the unpredictable world of cryptocurrencies successfully, it's important to understand the risks involved and implement effective investment strategies. In this article, we will provide you with some valuable tips to help you navigate the volatile cryptocurrency market.

1. Do Your Homework:

Before investing your hard-earned money, it's crucial to educate yourself about cryptocurrencies and their underlying technology, blockchain. Familiarize yourself with different cryptocurrencies, their use cases, and the teams behind them. Keep up with the latest news, attend conferences, and follow reputable sources to stay informed about market trends and developments. Thorough research will help you make more informed investment decisions and avoid falling for scams or hype.

2. Start with a Solid Foundation:

When it comes to investing in cryptocurrencies, it's important to build a solid foundation for your portfolio. Begin by investing in established cryptocurrencies with a proven track record, such as Bitcoin and Ethereum. These coins have a larger market capitalization and are generally less volatile than newer, riskier altcoins. As you gain experience and confidence, you can gradually explore smaller, lesser-known projects.

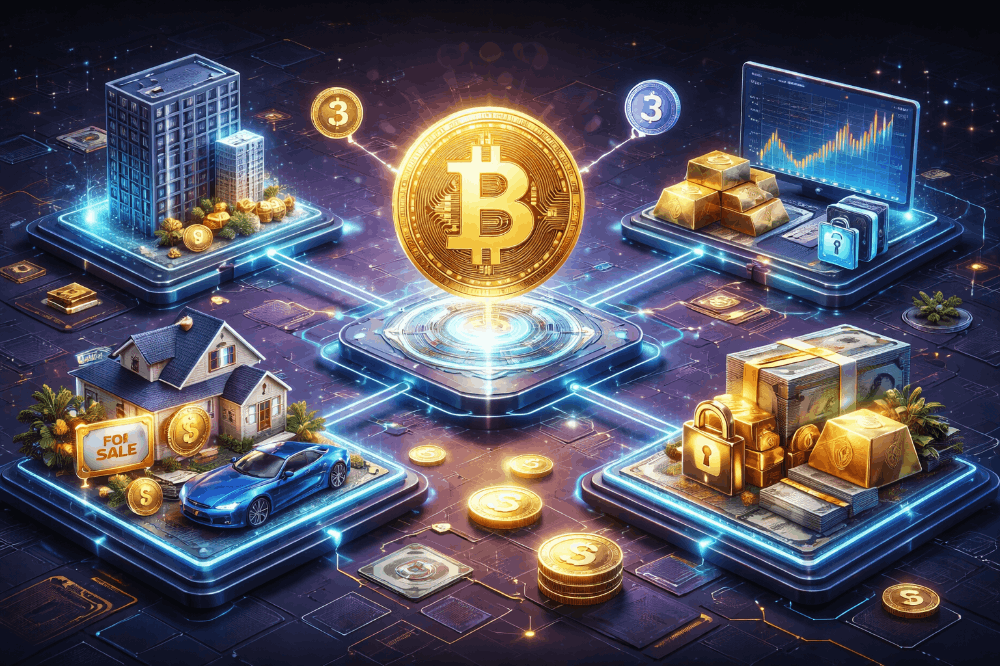

3. Diversify Your Portfolio:

Diversification is a key strategy to mitigate risk in any investment portfolio, and cryptocurrencies are no exception. Spread your investments across various types of cryptocurrencies, sectors, and geographic regions. This diversification can help reduce the impact of volatility on your overall portfolio. Additionally, consider investing in other asset classes like stocks, bonds, or real estate to further diversify your investment portfolio.

4. Set Realistic Goals:

Define your investment goals and risk tolerance before entering the cryptocurrency market and stick to your strategy. Determine if you are investing for the short term or long term, and adjust your approach accordingly. Without clear goals, it's easy to become influenced by short-term market fluctuations and potentially make rash decisions. Keep your emotions in check and focus on the bigger picture.

5. Manage Risk and Set Stop Loss Orders:

Volatility is inherent in the cryptocurrency market, and prices can fluctuate significantly within short periods. To protect yourself against potential losses, set stop loss orders – predetermined price points at which you automatically sell your holdings. This way, if the price of a cryptocurrency drops below a certain threshold, you limit your potential losses and ensure you exit the market before experiencing significant damage. Implementing stop loss orders can help you manage risk and protect your investment capital.

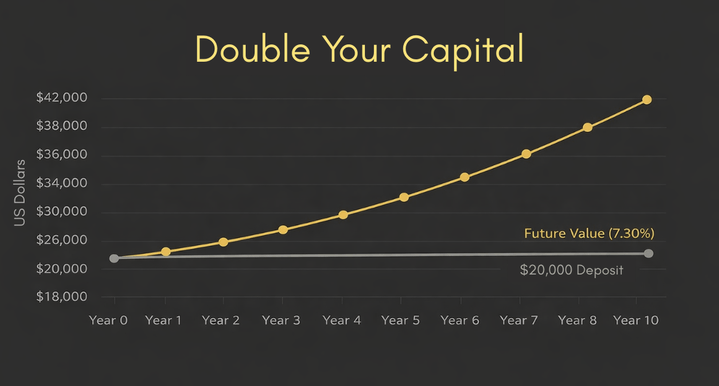

6. Dollar-Cost Averaging:

One way to mitigate the impact of volatility is to practice dollar-cost averaging. Instead of investing a lump sum all at once, consider investing a fixed amount at regular intervals. This technique reduces the risk of buying at the peak of a market cycle and allows you to spread your investments over time. By consistently investing, you can take advantage of both market dips and peaks, potentially maximizing your returns in the long run.

7. Stay Updated on Regulatory Developments:

Regulatory changes can significantly impact the cryptocurrency market. Stay updated on the legal and regulatory landscape in your country or region, as new regulations can affect the market's dynamics. Complying with regulatory requirements not only ensures you are investing within the boundaries of the law but also protects your investment from potential legal risks.

8. Secure Your Investments:

As with any investment, security is of utmost importance. Cryptocurrency wallets can be vulnerable to malicious attacks, so it's vital to adopt robust security measures. Consider using hardware wallets, which offer greater protection against hacks and theft. Additionally, make use of strong, unique passwords, enable two-factor authentication, and avoid sharing sensitive information online.

9. Seek Professional Advice:

If you are new to cryptocurrency investing or feel overwhelmed by the market's volatility, consider seeking professional advice. A financial advisor with expertise in cryptocurrency investments can offer guidance tailored to your specific needs and risk appetite. Their experience can help you make informed decisions, manage risk, and navigate the cryptocurrency market with more confidence.

Conclusion:

Investing in cryptocurrencies can be rewarding, but it comes with its fair share of risks. By doing your homework, diversifying your portfolio, setting realistic goals, and managing risks, you can increase your chances of success in the volatile cryptocurrency market. Stay informed, keep emotions in check, and seek professional advice when needed. Remember, patience and a long-term perspective are key when it comes to cryptocurrency investments.