Bitcoin Prices Spike Over 8%, Marking Highest Point Since Late April

Bitcoin Prices Spike Over 8%, Marking Highest Point Since Late April

Bitcoin Prices Spike Over 8%, Marking Highest Point Since Late April

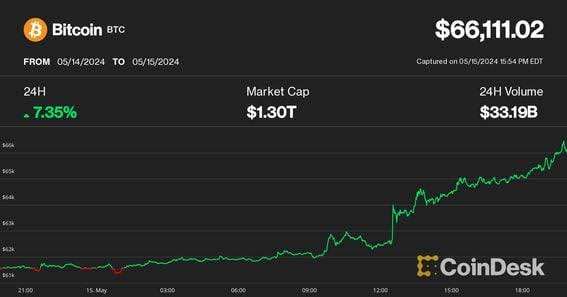

Bitcoin has once again captured the spotlight as its prices surged over 8%, reaching their highest point since late April. This recent rally underscores the dynamic nature of the cryptocurrency market, driven by a confluence of economic, technological, and institutional factors. In this comprehensive analysis, we delve into the latest updates that have propelled Bitcoin to new heights and examine the broader implications for the market.

The Current State of Bitcoin

As of the latest data, Bitcoin's value has climbed significantly, pushing it to levels not seen in several weeks. This increase has sparked renewed optimism among investors and analysts, with many attributing the rally to a variety of bullish factors.

Economic Factors Driving the Surge

Modest Inflation Rates

One of the primary drivers behind Bitcoin's recent surge is the broader economic context, particularly modest inflation rates. Inflation measures the rate at which the general level of prices for goods and services is rising. When inflation is modest, it often signals a stable economic environment, which can be favorable for assets like Bitcoin. Investors may seek to diversify their portfolios with alternative assets that can serve as a hedge against potential inflationary pressures.

Accommodative Monetary Policies

Central banks around the world, including the Federal Reserve in the United States, have maintained relatively accommodative monetary policies. Low interest rates and ongoing quantitative easing measures have increased liquidity in the financial system. Some of this liquidity has flowed into the cryptocurrency market, boosting demand for Bitcoin.

Positive Market Sentiment

Investor sentiment has also been bolstered by positive developments in the crypto space. News of regulatory clarity, technological advancements, and increasing institutional adoption have all contributed to a more optimistic outlook for Bitcoin.

Technological Advancements

Network Upgrades

The Bitcoin network continues to evolve with ongoing upgrades aimed at improving scalability, security, and transaction speed. Innovations such as the Lightning Network, which enables faster and cheaper transactions, and the Taproot upgrade, which enhances privacy and smart contract capabilities, have made Bitcoin more functional and appealing.

Adoption of Layer 2 Solutions

Layer 2 solutions like the Lightning Network are gaining traction, allowing for more efficient transactions and reducing congestion on the main Bitcoin blockchain. These technological improvements are crucial for supporting the growing number of users and transactions on the network.

Institutional Adoption

Major Financial Institutions

One of the most significant trends in recent years has been the growing interest and involvement of institutional investors in the cryptocurrency market. Major financial institutions, including investment banks and asset managers, have started to offer Bitcoin-related products and services to their clients. This institutional interest adds a layer of legitimacy to Bitcoin as an asset class and increases demand.

Bitcoin ETFs

The approval and launch of Bitcoin Exchange-Traded Funds (ETFs) in various regions have also played a crucial role in driving institutional adoption. ETFs provide a regulated and accessible way for investors to gain exposure to Bitcoin without directly purchasing the cryptocurrency. This has opened the door for more traditional investors to enter the market.

Regulatory Developments

Regulatory Clarity

Regulatory clarity is essential for the long-term growth and stability of the cryptocurrency market. Countries around the world are gradually establishing clearer frameworks for the operation and taxation of cryptocurrencies. This regulatory clarity reduces uncertainty for investors and encourages greater participation in the market.

Global Regulatory Landscape

Different regions are taking varied approaches to cryptocurrency regulation. For instance, the United States has seen increased scrutiny from regulatory bodies like the Securities and Exchange Commission (SEC), while other regions like Europe and Asia are also working on comprehensive regulatory frameworks. These efforts are aimed at protecting investors while fostering innovation in the crypto space.

The Road Ahead

Market Volatility

While the recent surge in Bitcoin prices is encouraging, it is important to acknowledge the inherent volatility of the cryptocurrency market. Prices can fluctuate rapidly based on a variety of factors, including regulatory news, macroeconomic trends, and technological developments. Investors should remain vigilant and informed to navigate these fluctuations effectively.

Long-Term Prospects

Despite the volatility, the long-term prospects for Bitcoin remain strong. Its decentralized nature, fixed supply, and growing adoption make it an attractive option for those looking to diversify their investment portfolios and hedge against traditional market risks. As technological advancements continue and institutional adoption increases, Bitcoin's role in the global financial system is likely to expand.

Conclusion

Bitcoin's recent price surge, climbing over 8% to its highest point since late April, highlights the complex interplay of economic, technological, and institutional factors driving the cryptocurrency market. With modest inflation rates, accommodative monetary policies, and positive market sentiment, Bitcoin's appeal as a store of value and hedge against traditional financial risks is growing.

Technological advancements and increasing institutional adoption further bolster Bitcoin's position in the market. However, investors should remain mindful of the inherent volatility and risks associated with this dynamic asset. Conducting thorough research and staying informed about the latest developments will be key to making informed investment decisions in the evolving landscape of cryptocurrencies.

As Bitcoin continues its journey, the ongoing dialogue between regulators, technologists, and investors will shape its future. For now, the recent rally is a testament to Bitcoin's resilience and its potential to redefine the financial landscape in the years to come.