THE HIDDEN TRUTH BEHIND ALTSZN .

Most think altszn needs billions. Nah.

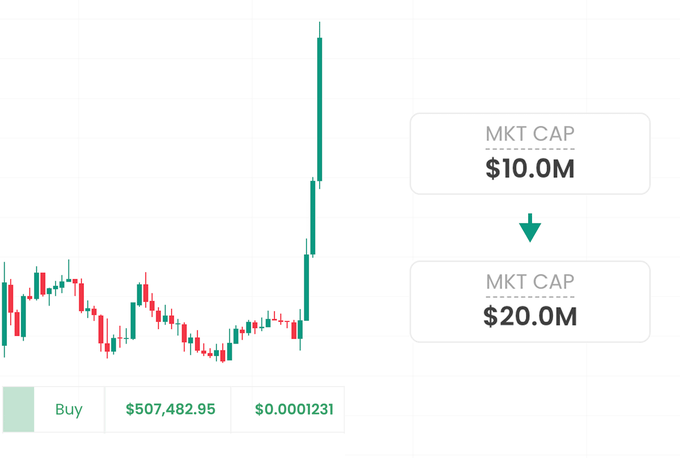

Imagine this:

– Market cap: $10M

– Price: $10

Think it takes $10M to reach $20?

Nope. Just $500K.

To dump it to $5? Maybe $200K.

It’s not about volume.

It’s about liquidity. And that changes everything.

No one breaks this down properly. I will.

This 🧵 will flip how you see alts 👇

✧ What liquidity really means

✧ And how little it can take to pump or nuke a coin

If you’re one of them?

It could cost you big (maybe it already has).

Let’s break it down 👇

2/➮ To really grasp how a coin or asset grows (or crashes), you’ve gotta understand a few key metrics:

- Market Cap

- FDV (Fully Diluted Valuation)

- Liquidity

- Vesting Schedule

These aren’t just buzzwords—they define how much impact your (or anyone’s) money can actually have.

Let’s break each one down:

(If you’re already familiar, skip to 6/ for the liquidity deep dive) 👇

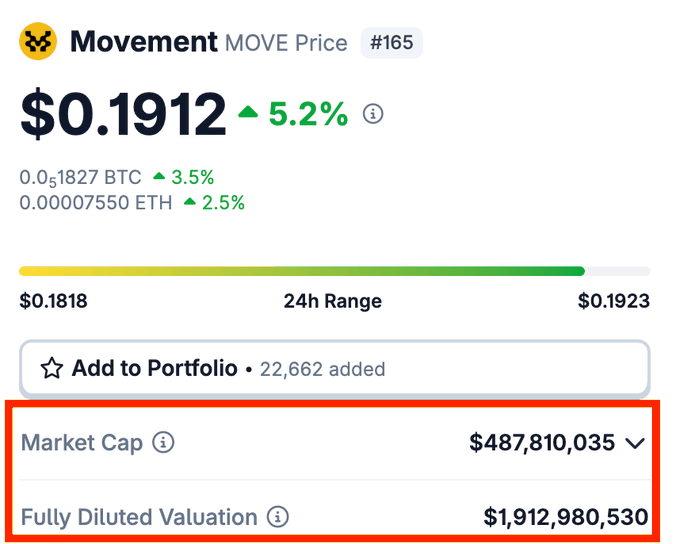

3/➮ The easiest one: Market Cap

✧ It’s the total value of all circulating tokens. Think of it as what the market thinks the asset is worth right now.

✧ Simple math:

Market Cap = Token Price × Circulating Supply

It looks big, sounds important—but it doesn’t mean it takes that much $$ to move the price. That’s where most get fooled.

✧ Market Cap = Circulating Supply × Price

✧ FDV (Fully Diluted Valuation) = Total Supply × Price

Why it matters:

FDV shows the potential value if all tokens were in circulation.

Newbies ignore this, aping in at launch...

Then VCs & insiders dump on them every unlock.

Understand the difference—or pay for it.

✧ It’s just what someone’s willing to pay right now—pure supply and demand.

✧ But price alone is meaningless without context.

Example:

A token with 1 trillion supply at $0.000001?

That’s already a $1M market cap.

To hit $1, it’d need a $1 TRILLION market cap.

That’s bigger than most countries.

So stop dreaming in prices.

Start thinking in market caps.

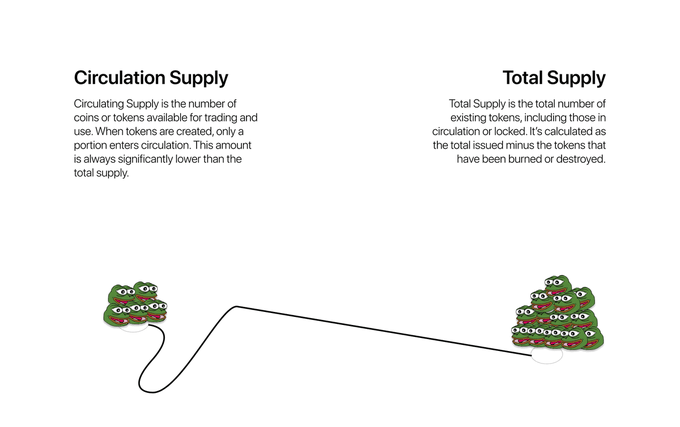

6/➮ Supply vs Circulating Supply — key difference most overlook:

✧ Total Supply = Max coins that will ever exist

✧ Circulating Supply = Coins currently in the market and tradable

Why this matters:

You can get wrecked by FDV and unlock schedules if you’re not paying attention.

Imagine:

Market Cap = $10M

FDV = $200M

And each month, new tokens = 2× current supply?

That’s a flood of sell pressure.

📉 Example: $APT

Launched with ~130M circulating, but 1B total.

Market cap looked cheap at $500M…

But real valuation (FDV) was $4B+.

Each unlock = more tokens = more dump.

Always check unlock schedules.

You might think you're early...

But you're really just exit liquidity.

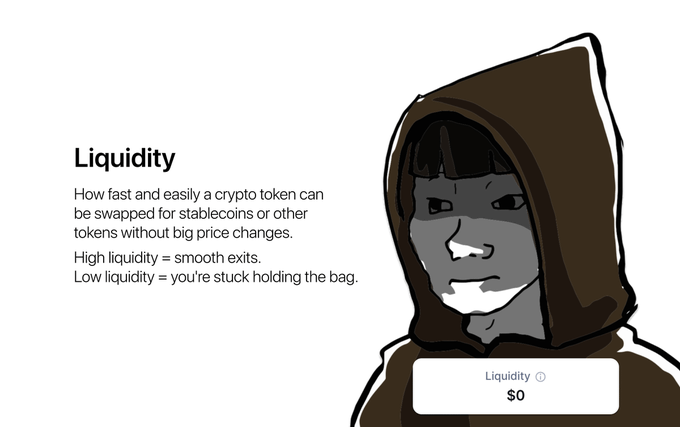

Here’s where most traders get it wrong:

✧ “Coin X is $1, supply is 1B → $1B market cap”

✧ “So to 2x the price, we’d need $1B in buys”

Sounds logical. But it’s completely false.

Prices don’t move based on market cap—

They move based on liquidity, and that changes everything 👇

8/➮ It sounds like simple math—until you factor in liquidity.

✧ Liquidity = How easily you can buy/sell a coin without moving its price too much.

High liquidity = smooth trades

Low liquidity = big slippage, price swings

Think of it like this:

You can have a memecoin with a $500M market cap...

But if there’s only $50K in real liquidity?

Try selling even $10K—and watch it crash.

It’s not about how much it’s worth on paper—

It’s about how much money is actually sitting there, ready to match trades.

✧ You can’t sell more than the market can absorb.

✧ You can’t buy much either without pushing the price way up.

Now picture this:

✧ Coin X is listed on one DEX

✧ That DEX has just $30M in liquidity

What does that mean?

It means the entire price curve is based on how much is in that $30M pool.

To double or crash the price? You don’t need billions—you just need a small piece of that liquidity 👇

10/➮ Token price is $1, market cap $1B.

✧ But thanks to liquidity, it takes only around $15M in buys to double the price.

✧ No need to inject the full $1B market cap.

✧ And that pump can be wiped out just as fast with $15M in sells.

If holders hold strong and don’t sell, the price can stay doubled.

A buy volume of $50M against a sell volume of $35M can easily push the price 2x — totally doable.

11/➮ A $1B market cap with only $30M liquidity is tough to wrap your head around...

But on Solana meme coins, it’s even crazier.

A meme token with a $300M cap might have just $5M in liquidity.

Do the math: buying or selling just 1% of the supply can swing the price 2x — up or down.

That’s why memes skyrocket.

But it doesn’t mean whales are cashing out at all-time highs.

Big holders often can’t exit near the top because every sell dumps the price hard.

This makes consolidation phases critical.

What shoots up parabolically?

Usually crashes just as fast.

12/➮ Recent example: $JELLYJELLY had a $60M market cap — and dumped 50% from just $1.2M in sell pressure.

Shows how little it takes to crash a coin when liquidity is tight.

13/➮ Exactly—this is how many memecoin creators rake in daily profits through clever setups:

✧ They launch their coin on just one or two DEXs with limited liquidity

✧ With shallow pools, they easily control price swings, running pump & dump schemes and more

Low liquidity = high price manipulation potential.

That’s the game behind many quick, flashy memecoin moves.

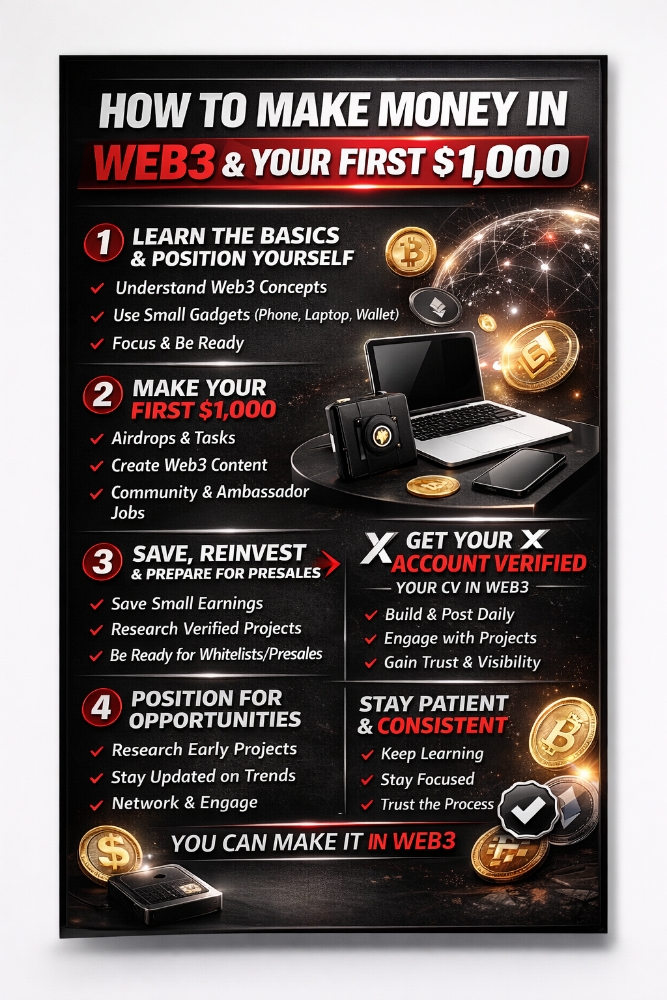

Price moves aren’t about market cap math—they’re about liquidity and flow.

A token with low float and thin liquidity can 2x on hype with just a small push… but it can crash just as fast.

What lasts? Projects with deep liquidity, slow unlock schedules, strong communities, and real utility or demand.

Chasing low caps might bring quick wins—but without solid liquidity, you’re always one big sell away from a 50% crash.