How Crypto Equalises Investing for the Average Person

The critical advantage that the implementation of smart contracts provides is the ability to cut out the middle man when it comes to ensuring the parties in the contract are abide by the terms laid out. This calls upon a tsunami of use cases in the real world with one big game-changer being access to investment opportunities.

The investing world isn’t fair. It might seem crazy that there are some people who wouldn't take your money if you threw it at them (ok, extreme analogy but you get the point) but that is what you deal with as an ordinary individual when it comes to investing in opportunities.

Why isn’t it fair?

Firstly, access to markets isn’t the same between retail investors and institutional investors. Institutional investors are able to access more complex or higher-risk assets that retail investors are barred from due to government regulations (requirements to be accredited which usually require a large amount of capital) or a lack of an intermediary (OTC markets) that can regularly organise a market for the asset. Even when retail investors aren’t stopped from entering a market, institutional investors have access to larger pools of capital and thereby can be involved in the purchase of more expensive assets that don’t have active pooled investment vehicles. An extreme example of this is fine art but this also extends to startups where most won’t take an angel check below a certain amount (say $10,000) limiting the retail investor's opportunity (unable to spread bets across multiple startups).

Secondly, even if retail investors are able to jump into the opportunities above, many of these investments are not liquid. For many OTC derivates, the market is small and the fees to trade them are very expensive. For startups, the investment is entirely illiquid until the company is either acquired or goes public. Selling your stake before then is difficult, there is no active market for stakes in early startups. This means retail investors who are generally investing a much larger share of their net worth compared to institutional investors are exposed to a higher risk in their portfolio. It also makes it difficult to capitalise on any upside throughout the progression of the startup. Exit times ranged from 5 years to 9 years according to Crunchbase research.

Crypto comes in…

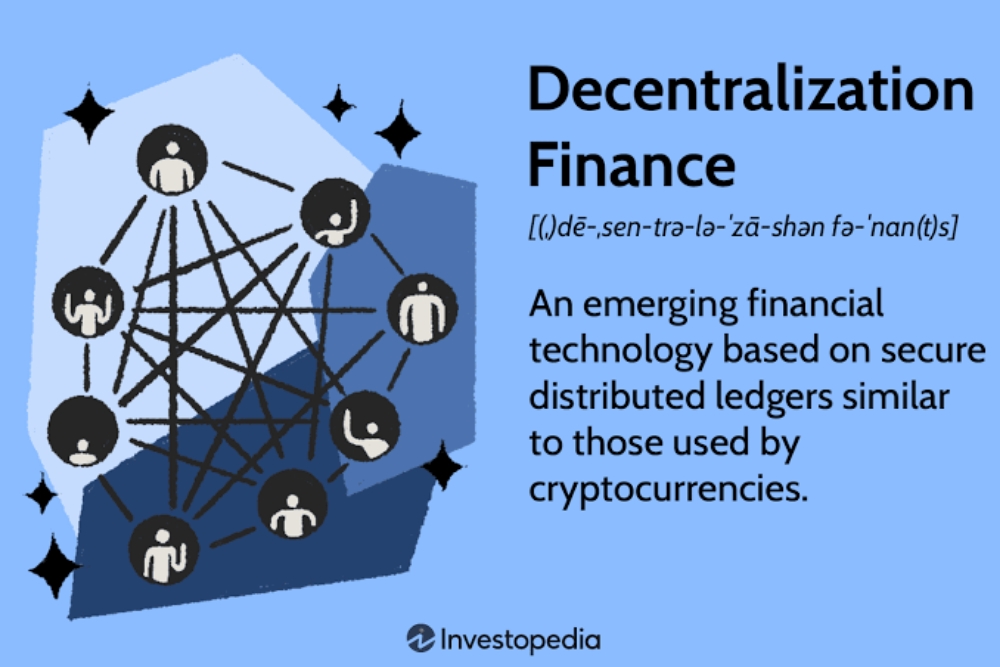

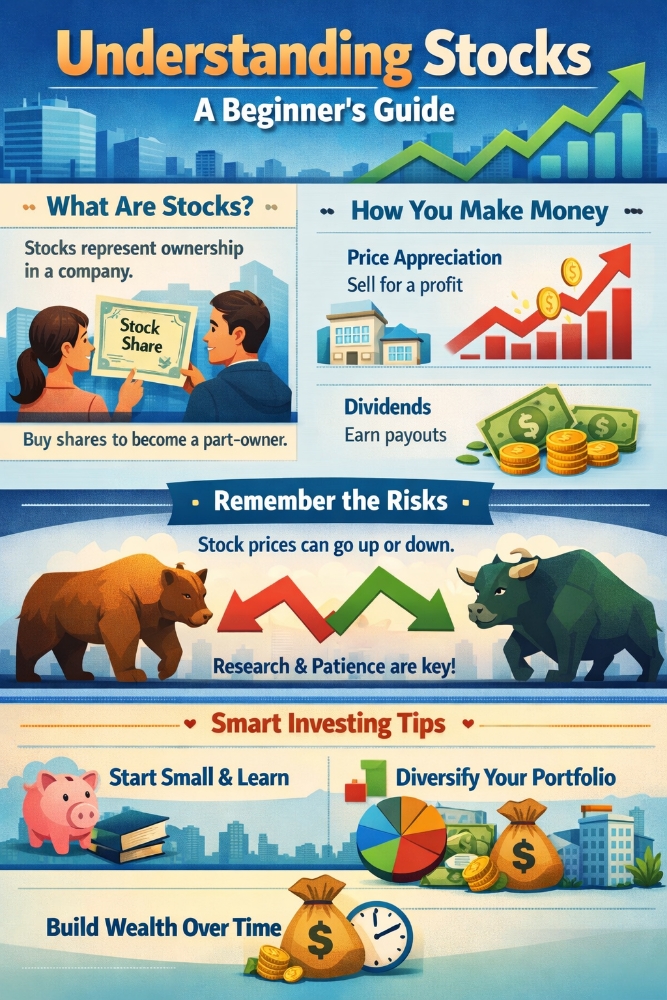

How does crypto solve this? By removing intermediaries and providing the much-needed liquidity. Startups looking for funding can raise funds via an ICO much like an IPO but without the hassle of regulation. The tokens raised are immediately liquid and their prices reflect the health of the startup. Even if you are not one of the funds or angels that can invest pre-product, you have the chance to buy in sooner rather than later. Another reason for limiting investors at the start for many startups is the governance issues with larger investor counts. A smaller investment body means leaner decision-making since decision-making processes in person are bureaucratic and tedious. This can be resolved in crypto with governance tokens utilising smart contracts to enact voting procedures.

Investors can also access complicated instruments now. In the world of DEFI, derivatives can also be created and markets can be made overnight without the need for an active intermediary.

Conclusion

Crypto is a nascent industry and the lack of regulation does also come at a detriment with scams being much more rampant. However, for investors willing to do their due diligence and understand the risk involved the greater opportunities to invest are there and they will continue to increase.