All You Need to Know about Polygon 2.0

Introduction: Polygon's Mission and Value Proposition

Polygon has set two primary objectives as its mission and value proposition: achieving infinite scalability for blockchain dApps and establishing Unified Liquidity.

Infinite Scalability:

Polygon aims to construct a robust web3 infrastructure to facilitate widespread adoption. The current bottleneck for mass adoption lies in the lack of scalability. Polygon's vision is to attain "infinite scalability," akin to the Web2 model, where launching numerous apps becomes feasible due to the availability of all necessary resources (such as infinitely scalable cloud infrastructure, GitHub, and an app store).

Unified Liquidity:

Polygon 2.0 streamlines the efficient transfer of liquidity between Layer 2 (L2) chains without the need to directly interact with Ethereum. This unique feature empowers users to transfer value seamlessly from any chain to another, creating the perception that liquidity remains confined to a single chain.

Polygon 2.0 Protocol Architecture Overview:

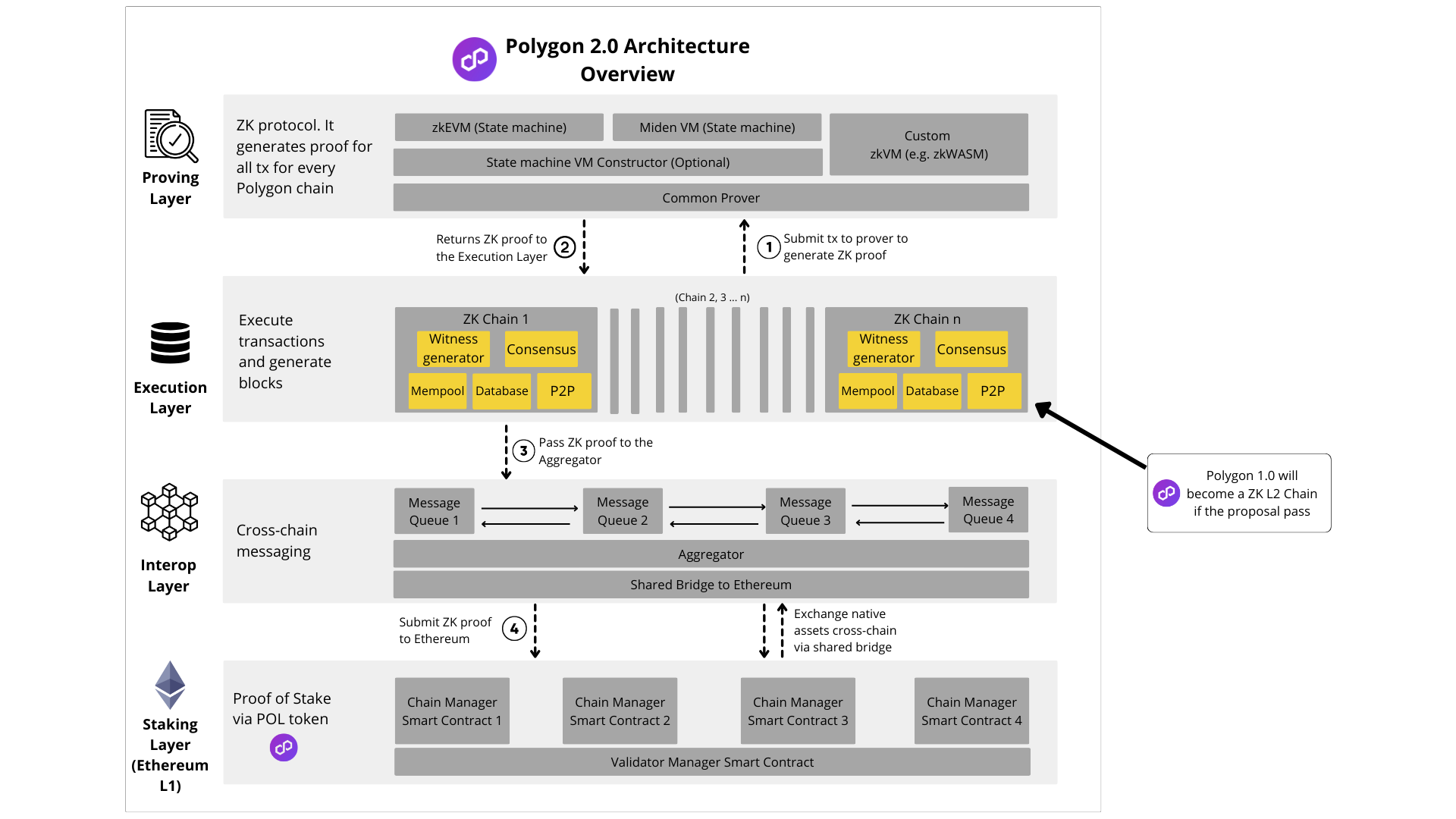

The architecture of Polygon 2.0 is built on a Zero-Knowledge (ZK) based Layer 2 network, organized into distinct protocol layers. This design resembles the structure of TCP/IP, the set of protocols forming the Internet network, with each layer serving a specific purpose in unison.

Polygon 2.0 Layered Architecture:

1) Staking Layer:

1) Staking Layer:

This layer utilizes a Proof of Stake (PoS) protocol and Polygon's native token, POL, to introduce decentralization across all Polygon chains. Implemented on the Ethereum blockchain through two types of smart contracts:

a) Validator Manager Contract: This contract holds pivotal significance as it manages the shared validator pool accessible to all Polygon chains. Its key responsibilities include:

- Tracking all validators

- Handling staking and unstaking requests

- Allowing validators to subscribe (restake) across multiple Polygon chains

- Managing slashing events

b) Chain Manager Contract: Each Polygon chain has its own Chain Manager contract, responsible for:

- Setting the level of decentralization, determining the number of validators

- (Optional) Defining additional requirements for validators (e.g., GDPR compliance, stake in another token besides Polygon's native token, etc.)

- (Optional) Specifying slashing conditions.

2) Interop Layer:

The Interop Layer serves as the vital bridge facilitating seamless cross-chain communication within the expansive Polygon ecosystem. At its core, this layer establishes a shared bridge to Ethereum, ushering in an era of effortless cross-chain transfers for native Ethereum assets and ensuring the expeditious execution of atomic cross-chain transactions.

Built upon the robust LxLy protocol, the Interop Layer introduces a novel approach using Message Queues. This innovative concept ensures that each individual Polygon chain maintains a dedicated local queue of outbound messages. These messages, in turn, become integral components of the Zero-Knowledge (ZK) proofs generated by the respective chain.

In a strategic move to optimize cross-chain transactions, the Interop Layer introduces a groundbreaking Aggregator component. Positioned strategically between Polygon chains and Ethereum, this Aggregator consolidates ZK proofs into a unified proof, which is then transmitted to Ethereum for verification. This decentralized Aggregator operation is designed to uphold continuous functionality, mitigating the risk of censorship and bolstering the overall robustness of the network.

3)Execution Layer:

The Execution Layer stands as a pivotal component, empowering each Polygon chain to orchestrate sequenced batches of transactions or blocks seamlessly. In the dynamic framework of Polygon 2.0, every ZK Chain possesses its own dedicated Execution Layer.

Adhering to a standardized protocol layer model reminiscent of other prominent blockchains such as Bitcoin and Ethereum, the Execution Layer incorporates a suite of essential components. These include P2P (Peer-to-Peer) communication, Consensus mechanisms, Mempool for transaction storage, a Database for efficient data management, and a Witness Generator for generating transaction witnesses. Each component plays a distinctive role in the comprehensive process of transaction execution.

4)Proving Layer:

The Proving Layer, marked by its flexibility and efficiency, is the cornerstone of the Zero-Knowledge (ZK) proving protocol within Polygon 2.0. This layer is responsible for generating meticulous proofs for all transactions, irrespective of whether they are internal or external, across every Polygon chain.

The Proving Layer is composed of essential components:

- Common Prover: An exceptionally performant ZK prover crafted by Polygon’s team of ZK researchers. This prover offers a clean and sophisticated interface tailored to accommodate arbitrary transaction types in state machine formats. The deployment of a singular prover streamlines the intricate processes of proof aggregation and verification, ensuring a high degree of efficiency.

- State machine constructor (optional): An innovative framework devised by Polygon’s ZK researchers to define state machines. This constructor abstracts the intricacies of proving mechanisms, providing developers with an accessible interface to construct state machines effortlessly.

- State machine: The virtual representation of the execution environment and transaction format undergoing verification by the prover. Presently, there are two active State machine implementations—zkEVM and MidenVM—with future plans to introduce additional implementations such as zkWASM. This forward-looking approach ensures the adaptability and scalability of the Proving Layer as the ecosystem evolves.

From Polygon 1.0 (PoS) to ZK Layer 2:

The existing architecture of Polygon 1.0 (Proof of Stake) operates within a three-layer framework, consisting of the Bor Layer, Heimdall Layer, and Ethereum Layer. In this setup, Bor nodes, managed by incentivized validators staking MATIC tokens, act as block producers, aggregating transactions into blocks. The Heimdall Layer serves as the proof-of-stake validation layer, consolidating blocks from Bor into a Merkle tree and periodically releasing the Merkle root to the Ethereum mainnet. The Ethereum Layer hosts staking contracts on the Ethereum mainnet.

so

- Bor Layer: Bor nodes, managed by incentivized validators that stake MATIC tokens, serve as the block producers, aggregating transactions into blocks. Currently, Bor operates on a fundamental Geth implementation, modified to suit specific consensus algorithm requirements used by Polygon PoS.

- Heimdall Layer: Acts as the proof of stake validation layer, managing the consolidation of blocks from Bor into a Merkle tree and periodically releasing the Merkle root to the root chain (Ethereum). This regular release of Bor snapshots is referred to as checkpoints.

- Ethereum Layer: Hosts staking contracts on the Ethereum mainnet.

Current Challenges:

While Polygon PoS and its bridge to Ethereum have achieved notable success with 100 validators securing over $2 billion worth of MATIC tokens, there are several challenges that require attention. These include concerns related to the security model, reliance on legacy technology stacks such as forks of Cosmos SDK and Geth, and user experience issues like deep chain reorganizations and inefficiencies in gas estimation models.

- Security Model: The existing model can be enhanced to fully inherit the higher security of Ethereum with zkEVM.

- Legacy Tech Stack: Maintaining forks of Cosmos SDK and Geth is not optimal due to the workload and the availability of more advanced L2 technologies like Polygon’s zkEVM.

- UX Issues: The system has experienced deep chain reorgs and inefficiencies in the gas estimation model.

Proposed Solution

Polygon Labs proposes a major upgrade to Polygon PoS to convert it into a zkEVM validium.

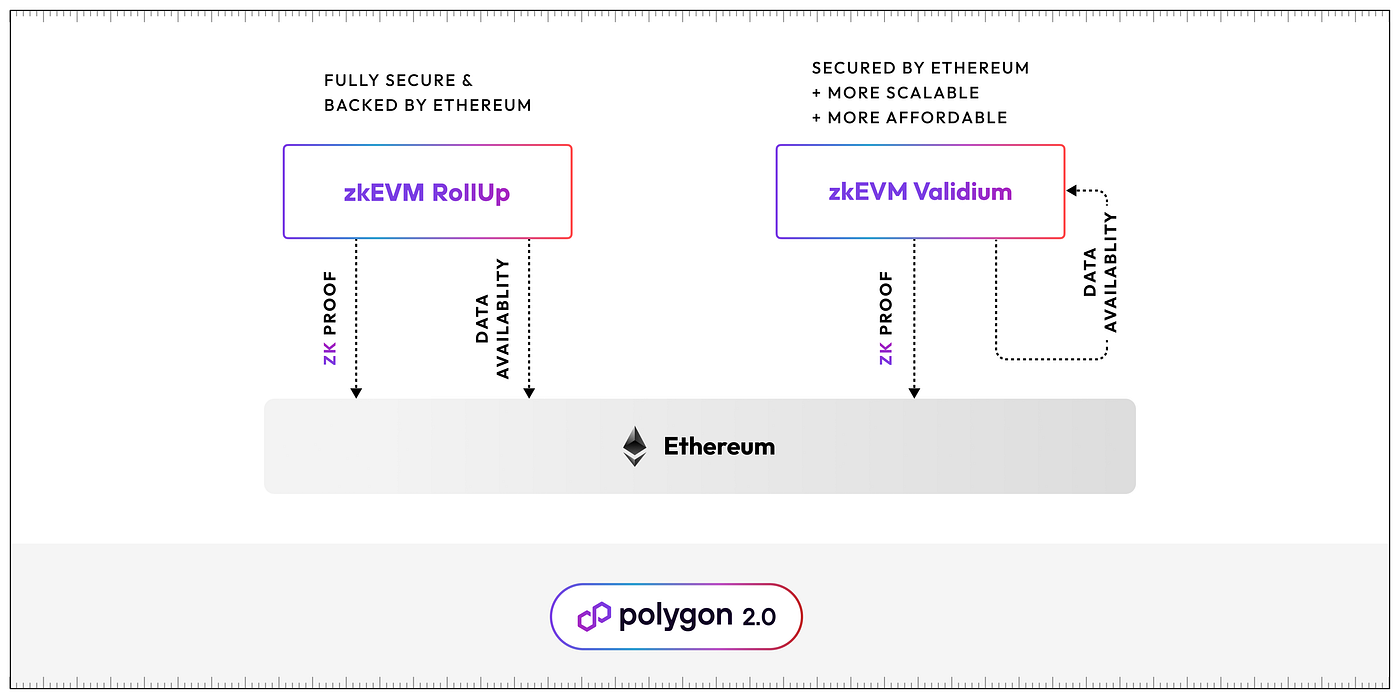

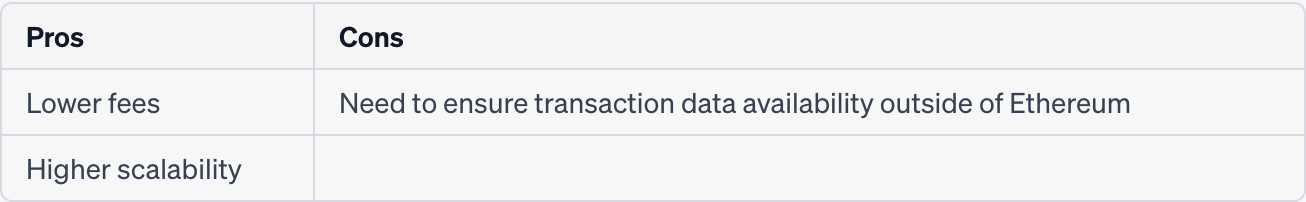

Validiums and rollups are the two primary approaches to implementing zk-powered L2s. Both submit ZK proofs to L1 (Ethereum), but validiums do not publish transaction data to Ethereum, offering lower fees and higher scalability.

The only con is that when using Validium, a chain must ensure the Data availability outside.

Pros and Cons of using Validium ZK

The Polygon sidechain, which already has 100 validators and secures over 2B+ USD worth of assets can be used as a Data availability layer for the Validium.

The Polygon team is sure that the upgrade is deemed viable, straightforward, and beneficial for the chain. The image shows how Polygon 1.0 will fit into the new Polygon 2.0 multi-chain architecture —Image by the author

The image shows how Polygon 1.0 will fit into the new Polygon 2.0 multi-chain architecture —Image by the author

The activation of the upgrade on the mainnet is scheduled between February 2024 and March 2024.

Expected Benefits

The main benefits include increased security and a future-proof tech stack.

Additional advantages encompass reorg elimination, faster transaction confirmations, increased scalability, improved fee estimation, greater decentralization, and compatibility with Polygon 2.0.

Practical Concerns

Users and apps are not required to make any changes.

Validators and full nodes need to upgrade to the latest version of Polygon PoS client software.

The running costs of Polygon PoS are not expected to increase and might even decrease in the long run. $MATIC will continue to be the staking token, and the upgrade does not alter the economics of the chain.

Polygon CDK

On August 29th, 2023, Polygon announced the release of CDK (Chain Development Kit). This is the official SDK allowing developers to easily launch ZK-powered L2.

Source: https://twitter.com/sandeepnailwal/status/1696618823422529898

Tokenomics

Below is a concise summary of the key points expressed in the Polygon 2.0 whitepaper.

POL token, a third-generation native token

Bitcoin’s BTC, the first successful native token, is unproductive; it doesn’t grant holders any role in the protocol, nor incentives to perform such a role. Ethereum’s ETH, a second-generation productive token, allows holders to become validators and earn rewards by securing the chain via staking.

Polygon’s POL introduces the third-generation, hyperproductive tokens.

Similarly to productive tokens, it enables its holders to become validators and receive rewards, but with two game-changing improvements:

- It allows validators to validate any number of chains;

- It allows validators to assume any number of roles, receiving corresponding rewards.

Token Design Goals

- Ecosystem Security: Incentivizes validators to secure many chains.

- Infinite Scalability: Supports thousands of Polygon chains without compromising security.

- Ecosystem Support: Sustains Polygon ecosystem development.

- Community Ownership: POL enables governance rights.

Utility

POL, Polygon’s native token, offers multiple utilities:

- Validator staking: Validators stake POL to join the validator pool and validate any Polygon chain.

- Validator rewards: To maintain decentralization and security, a predefined amount of POL will be continuously distributed to Polygon validators as rewards, encouraging onboarding and retention.

- Community ownership: POL is designed to hold governance rights.

- Protocol development: part of the POL supply will be managed by the Community treasury to fund the development of the protocol.

Initial Supply

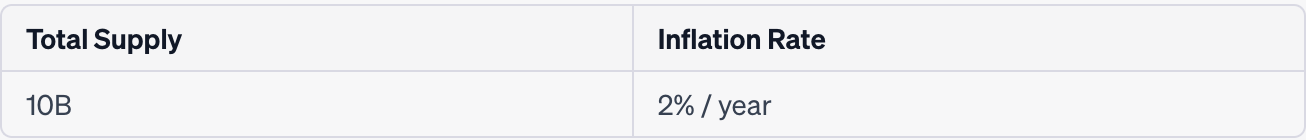

POL’s initial supply is 10 billion tokens, dedicated for migration from MATIC to POL.

Emission

POL is emitted at a predefined, deterministic rate:

- Base, protocol reward (i.e. validators reward): 1%/year for the next 10 years. ≈100 million POL/year.

- Community Treasury (support for further development and growth of the Polygon ecosystem): 1%/year for the next 10 years. ≈100 million POL/year.

POL Emission for the next 10 years

POL Emission for the next 10 years

Migration

MATIC holders can migrate using a swapping smart contract that will be developed once the proposal is accepted. The swapping contract will accept an amount of MATIC from any address and return the equivalent amount of POL to the same address.

For MATIC holders who keep their tokens with centralized crypto exchanges and custodians, the migration would normally be automatic, i.e. would not require any action.

The migration will be available for a prolonged period (4 years), to accommodate all MATIC holders, like those who have MATIC “locked” for multiple years in various DeFi or vesting contracts or the uninformed holders who find out about POL at some point in the future.

Conclusion

The purpose of this post was to deep dive into the major changes that Polygon 2.0 introduced, i.e. the ZK Layer 2 infrastructure which in my opinion will have a huge impact on the web3 world in the years to come and will help Ethereum to reach mass adoption through dApps.

There is a lot more to say about Polygon that I haven’t had the opportunity to touch in this post.

For example, there is the 3-pillars governance model which would deserve a separate post.

I have intentionally omitted discussions on “Supernets,” as the essential point to note is that this technology will be seamlessly integrated into Polygon 2.0. Essentially, all Supernets will evolve into ZK L2 chains.

Finally, there are other products that the Polygon foundation is developing: other than the zKEVM L2 infra (which is the most impactful upgrade on the ecosystem tough) there is also Polygon ID, which provides SSI (self-sovereign identity).