Do to Earn: A spammer's paradise... or hell

Only Possible on Solana

Solana has the lowest cost of transactions out of all the major blockchains. And the lowest cost of transactions out of any blockchain if you calculate by cost per MB.

This is the major driving factor for certain types of projects to launched on the Layer 1 blockchain.

See Dynamo DeFi's article on the technological upgrades Solana has rolled out over the past year (including those announced recently at Breakpoint) and what they mean for applications building on the chain today for more on this:

The Solana Renaissance: Firedancer, DePIN, consumer dApps and more

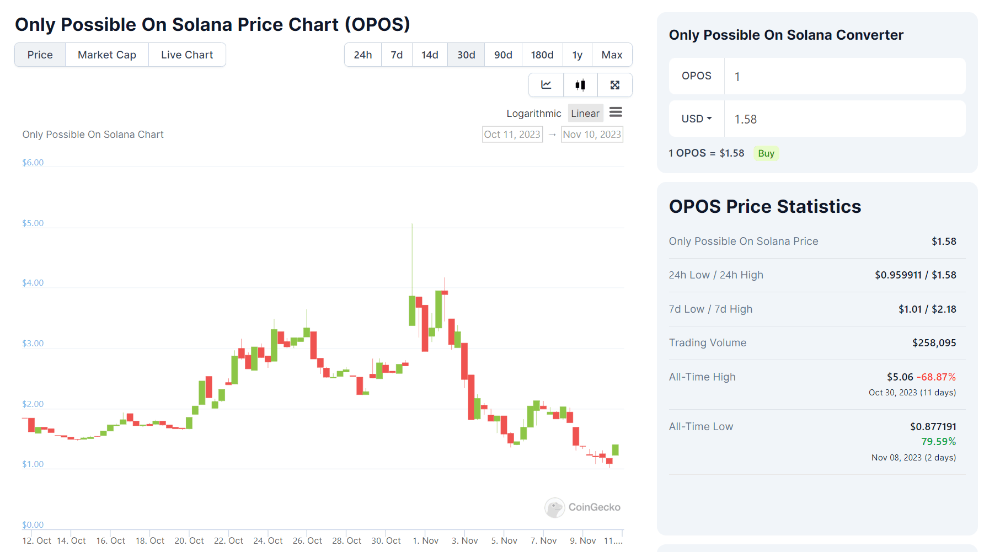

The phrase 'Only Possible on Solana' has been a recent rallying cry amongst the community to describe the characteristics of the blockchain that make certain types of high scaling applications possible. It even spawned a memecoin: $OPOS

https://opos-sol.netlify.app/#/

https://www.coingecko.com/en/coins/only-possible-on-solana

The Consumer Validator Network

So it's on this backdrop we see the type of consumer applications we are familiar with in web2 being built on Solana in a broad category that has become known as: X to Earn or Do to Earn.

This moniker can encompass many different aspects but they are all rooted in consumer grade activities. We've seen things like:

- Move To Earn: Stepn was a hugely successful fitness app which saw such a boom in users and transaction volume they also launched their own DEX and NFT Marketplace before seeing their user base and total market cap crash at the start of the market downturn. They remain a popular app and there is every chance they'll see user numbers climb again as the market sentiment shifts given they have kept building and refining their product all through the bear market.

- Read/Write/Engage to Earn: Apps like BULB and Solcial reward users for engaging with and creating content for their respective social media platforms.

- Play to Earn: Games have always used rewards models and complex in-game economies to incentivise desired behaviour from their players. They reward this with in game currency and items. The addition of the blockchain isn't revolutionary in so much as it's just another way to skin this cat. Games like Star Atlas or Aurory have simply replaced their in-games currencies with tokens that can be easily traded for fiat currencies within the Solana ecosystem. But even this isn't strictly "new". We've been able to trade in-game items on non official marketplaces in web2 games for over a decade. Warcraft gold mining and CounterStrike skins trading are well known and highly developed online markets. Even now many web2 games are gradually introducing legitimate in-game currency conversion to their models. Roblox is a prominent example of this.

Why this isn't consensus or DePIN

Enlisting a wide range of users to do something isn't unique to Do To Earn. All blockchains are built on consensus mechanisms that require users to validate transactions in order to build the blocks of the blockchain. The "do" here is conducted by computer hardware often specially designed for the particular consensus mechanism of that blockchain.

The burgeoning DePIN movement (decentralised physical infrastructure network) has taken the above further by enlisting users to deploy homogenous devices to create infrastructure networks owned and operated by the network participants themselves. Various projects now exist on Solana for this:

- Helium: Mobile and IOT networks

- Hivemapper: Map data and 'street view' images. A Google Maps, Near Maps etc.. competitor

- Render Network: Originally built as a network of GPUs for rendering images (doing away with the need for on-site render farms or expensive dedicated cloud hardware) it has mostly transitioned into an on-demand AI model service as GPUs are the favoured processing unit for AI applications.

In all these cases the users own and operate the hardware but they operate it in accordance to strict requirements from the network.

The Do To Earn ecosystem is meant to incentive humans doing human behaviours. This is increasingly important in an online world awash with bots and human driven sweatshops (both online and physical) performing repetitive tasks not unlike bots. Both are low value and often connected with fraud. It's this issue we will turn to next.

Fraud + Spam = Sweatshops & Bots

Soon after Stepn broke out the development team began to see clear signs of fraudulent behaviour amongst the user base. Soon images surfaced of sweatshops in low-wage countries with sometimes thousands of devices hooked up to automation rigs and workers moving from device to device racking up points they would then cash out into crypto tokens. It took both a concerted effort from Stepn AND the crypto market crash to finally clean out a majority of these bad actors. Even now all we need see is a jump in token prices to have this flood of fraudulent users return.

Social media networks and online games are fighting a losing battle with bots and sweatshops which are lowering the quality of experience for legitimate, paying, users by flooding the platforms with spam (both content and behaviours) and various fraud schemes.

BULB itself has seen significant amounts of copyright posts and general low quality spam as users (and likely some bots) look to game the system to collect $BULB in hopes the token will soon list and they'll be able to cash out. It's resulted in a degraded experience for legitimate users who have to sometimes scroll though pages of low quality posts and comments in order to find engaging content.

This phenom isn't a new occurrence. Years ago GroupOn rocketed to a sky-high valuation based on engagement and usage metric driven by deep discounts. The problem was businesses often saw negative value from these promotions as when the discounts ended the users simply moved onto the next promotion leaving the business with no more users than they'd originally had and a bill for a products and services they'd often sold at a loss during promotion.

GroupOn now sits down over 99% from it's IPO price with a user base that has never stopped shrinking. They were only ever able to attract low quality users and those users were of little to no value to businesses that used GroupOn.

Frequent Flyer programs and other loyalty schemes have long suffered from large amounts of usage coming out of so-called 'power users' who look to optimise returns by gaming the system and producing negative value for the providers.

Blockchains are just the next place to grind

The majority of activity on all new blockchains (be they Layer 1 or 2) is rumoured to be sweatshop activity and large numbers of automated wallets belonging to a small number of users. These are the self styled 'airdrop hunters'. They are very low value users who conduct actions on-chain solely for the purpose of collecting handouts from the underlying protocols and once they've received these rewards they move their operations onto the next airdrop candidate.

The open secret in defi is that liquidity mining is a negative-sum game. You offer incentives to bolster trading/liquidity volumes but those incentives have to be high enough to steal users away from other apps and that means they often not sustainable. When you stop the incentives you lose all your volume.

So what's does this mean for Do To Earn? Let's see what the future holds for this very early concept.

Do To Earn needs consensus to stay relevant

Consumer grade applications are magnets for fraud and spam. By adding monetary rewards to user actions the Do To Earn sector is primed to become a hive of sweatshop and bot activity, not to mention fraud.

But all blockchains have mechanisms where user inputs (transaction validation) is rewarded (often quite handsomely) for money.

Why is it that we don't see the same mass fraud and spam hitting validator networks?

The answer, I believe, is: Consensus Mechanisms.

In order to validate transactions on a blockchain you have to follow a strict set of guidelines (be that Proof Of Work or Proof Of Stake) and have your work reviewed and approved by all the other validators in the network. There is little chance for fraud or spam as both are easily detected and punished as part of the core consensus mechanism.

There is currently no good models in Do To Earn which leverage this key factor of blockchain transaction validation.

The future of Do To Earn hinges on the ability of apps to build models that scale quality over quantity. Better BULB have a 5K legit writers than 100K of whom 70% are bots/sweatshops so that any user coming to the platform has to scroll through hundreds of pages of low quality content. Regular users can't compete with the output of fraudulent actors and no one wants to read garage content.

Even just a small percentage of fraudulent users can produce so much spam content that the platform becomes uninteresting for all legit users.

Same with apps like Stepn or web3 games. No one likes a community filled full of bots or sweatshop workers. They don't make for a good atmosphere or experience as their goals don't align with legit users.

Do To Earn needs to think less about scaling for users as it does for scaling for quality. Quality will scale the user base eventually, but quantity will not.

I see two likely outcomes for the future of Do To Earn. One positive and one negative.

Worst Case Scenario: It's Bots and Sweatshops all the way down

The worst case scenario for me is we see the same thing that happened to most Layer 2s and Layer 1s launched over the past year. They were largely beset with what became termed: 'Airdorp hunters'. These were low value users who sought to leech as much value from the incentive schemes before moving onto to the next opportunity.

They were identical to the plague of yield farmers (sometimes called: Mercenary Capital) that beset defi during the last bull market and who still are an issue today (albeit much smaller as defi has come up with a number of innovation to combat this behaviour).

These users crowded out legitimate users and sucked up huge amounts of value meant to help bootstrap the blockchain and it's first wave of applications. In some rare cases these incentive schemes showed some ROI for the protocols but largely, as with liquidity incentives for yield farmers, the returns have proved negative.

For consumer apps this effect will prove even worse. At least with yield farmers and airdrop hunters you are getting the behaviour you want (even if it's not long term) and it doesn't directly impact too greatly your legit users.

With Do To Earn you need quality behaviour and content but instead you're getting very low value behaviour and content that has a large negative effect on legit users. In many cases it drives them away from your platform.

In the worst case scenario we'll see a number of Do To Earn platforms spike in usage numbers and TVL only to have them collapse completely as rewards run out as legit (and paying) users abandon the platforms due to spam and fraud and the fraudulent actors then move operations to better ROI targets.

The sector is compromised to the point where it largely disappears from the web3 industry, seemingly proof that web3 consumer apps still can't properly handle web2 levels of fraud and spam.

Best Case Scenario: Do To Earn showcases the power of the consensus mechanism outside of purely technical use cases

In the best case scenario we see the web3 industry able to bring a wholly new solution to the tidal wave of spam and fraud currently plaguing web2.

That innovation is the application of consensus models to Do To Earn consumer apps.

Through the consensus model it becomes so costly for bots and sweatshops to operate that they are pushed out of the Do To Earn space entirely.

Innovations like:

- stake to participate: Users stake tokens in order to participate on a platform and can have that stake slashed if they are judged to be producing low value (spam/fraud) by the rest of the platform users

- stake to exist: Individual accounts need to stake non trivial amounts of a token to open and operate accounts. This is a vesting schedule, taken directly from defi innovations to combat mercenary capital, where that stake will unlock over time. You could even add a rewards scheme on top of this that saw accounts pick up extra rewards over time for contributing value

These types of mechanisms would push the cost to bots and sweatshops of opening thousands of accounts and spamming millions of interactions so high it would bankrupt nearly all those models.

But key to note: It would not (nor should it) guarantee only humans would be users.

Think about some of the accounts on social media you enjoy the most. Chances are quite a few are actually bot, but they're really good bots that produce content you enjoy and find valuable.

Is a piece of art any less enjoyable if you know AI created it over a human? No.

I see the best case scenario for Do To Earn ushering in a new type of consensus: Proof Of Value. This is consensus model which selects for users and content which are deemed valuable by the network and deselects those which are deemed negative value.

This would be the decisive moment in the battle between spammers and social applications and would see a huge wave of web2 application users, fatigued by fraud and spam, to move to web3 alternatives.