Mars Protocol: A new frontier in DeFi lending & borrowing

Mars is a novel interchain credit protocol primitive facilitating non-custodial borrowing and lending for the #Cosmos ecosystem and beyond. Its hub and outpost architecture allows Mars to operate on any chain in the Cosmoverse, and enables a new primitive: the Rover. Rovers could give their pilots #DeFi superpowers to engage in virtually every governance-approved activity they might encounter on a centralized exchange: spot trading, margin trading, #lending and #borrowing — all in a single decentralized credit account represented by a transferable #NFT.

https://blog.marsprotocol.io/blog/pathfinder-using-mars-red-bank-to-create-leveraged-long-and-short-positions

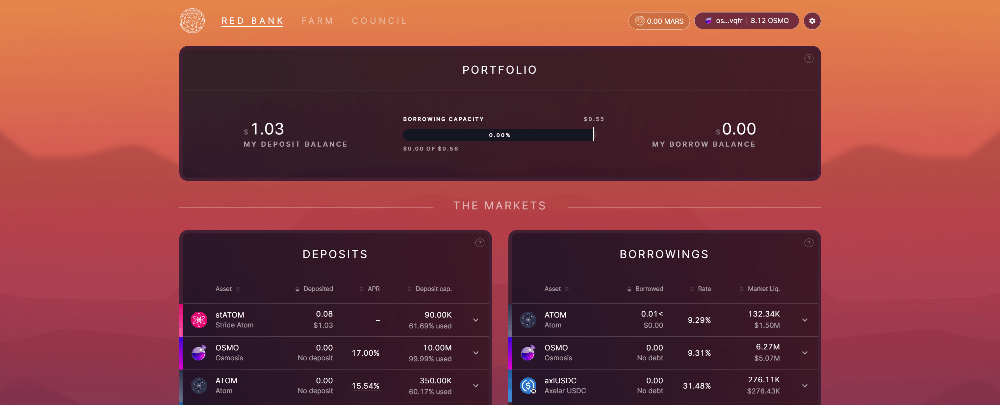

Mars Protocol is a Cosmos chain, integrated with Osmosis (gas in $OSMO) so that means: Cheap transaction fees and easy movement between tokens and chains.

All these will be familiar to most degens. What they don't cover in the blog is staking. You can borrow $ATOM or $OSMO and then stake that on Stride, and take your liquid tokens and stake them in Osmosis LPs to get returns (I'd stick to staked to non staked pools to limit impermanent loss).

Because you're depositing and borrowing in the same token your risk of market movements is very low as your collateral and borrowed asset will move together.

At time of writing the borrow/lend APY on like for like tokens is weighted in favour of deposits so you could just loop inside Mars to maximise your returns. When you look at the deposit APY it's being incentivised by $MARS so expect those incentives to run out at one stage, at which you'll probably need to fix up your position by repaying down some of your debt. Maybe not though, as time goes on the positives returns will pay down your debt as well.

I'm staking the $MARS token currently in an Osmosis pool (Pool #907). If Mars becomes Cosmos's Aave, which they are aiming for, then their token will benefit. At present the token just secures the chain but you've got to think they'll also be launching some sort of Safety Module like Aave down the track.

They have also recently launched automated leverage via vaults. Only two are available at present, but I expect more will be deployed as more Cosmos protocols integrate with Mars Protocol.

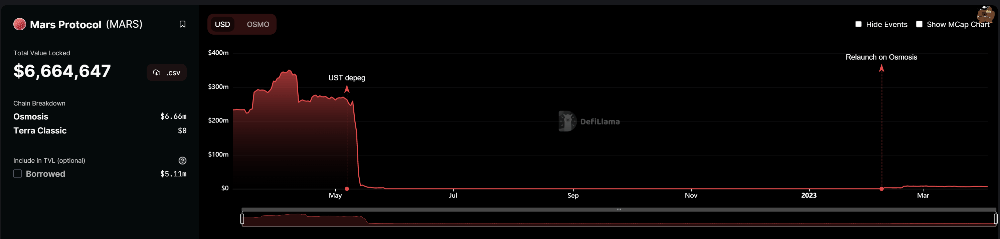

It's been a comeback story for Mars Protocol. They started life riding the wave of the Terra Cosmos chain (as many influential defi protocols did) but they saw huge outflows when the UST de-peg happened and LUNA, the token of the Terra chain, collapsed bringing most of the ecosystem down with it.

Since then the Mars Protocol team have worked to deploy on their own Cosmos chain. They launched right at the end of Jan 2023.

In a single chain like Ethereum all dapps can access any lending facility that is on the same chain with them. It has led to a flourishing defi ecosystem that is well stocked with various mechanism providers.

In Cosmos, even though each chain has access to each other via IBC, it's definitely a lot harder to deploy products properly cross-chain (like lending and borrowing).

Defi credit has, up until now, been defined by it's conservatism. Ironically for industry (cryptocurrency) often closely associated with extreme risk taking, defi lending has been built on the theory of over-collateralised lending with auto liquidations.

The upsides are obvious: This design system is low risk (collateral can be auto liquidated to repay lenders) and very cheap (fully automated via smart contracts).

The biggest downside is this design has meant access to credit has been quite limited at as users need to deposit assets to borrow and then they can only borrow a percentage of those deposited assets.

Traditional finance is mainly concerned with under-collateralised lending, where a borrower only has to deposit a percentage of the total amount they want to borrow. That system relies on an expensive array of risk profiling and management tools in order to maintain stability, along with heavy regulatory oversight, but even then banking failures are worryingly frequent and severe.

The major upside is the under-collateralised lending system is able to provide much more capital for borrowers to access, and much wider access to capital.

Mars Protocol is looking to solve for this with their innovative lending contract-to-contract (C2C). The innovation is a set of smart contracts, using C2C, which they're calling The Fields of Mars.

The core idea is the 'Fields' contracts control their own collateral and can borrow from The Red Bank (the central Mars Protocol liquidity reserve), within certain limits imposed by the core contract parameters, without needing to post collateral. As Mars Protocol puts it:

Some protocols refer to this as ‘uncollateralized lending.’ However, it’s not that collateral doesn’t exist, but rather which applications control the collateral. In this case, the Fields application controls the collateral instead of the Red Bank itself.

These Twitter threads go into a lot more detail and are worth digging into.

- https://twitter.com/larry0x/status/1421164692547022853

- https://twitter.com/ZeMariaMacedo/status/1490714332589658118

There's a lot of new products that can be unlocked with access higher levels of liquidity at lower cost. If dapps are able to deploy Fields Contracts on Mars Protocol that can leverage different trade off between risk and reward that opens to the door to more innovation.

It's a brave new world in defi and, once again, it's a Cosmos app-chain leading the way.