Galaxy Digital Estimates $80 Billion to Flow into Spot Bitcoin ETFs Within 3 Years of Launch

Galaxy Digital, a leading cryptocurrency investment firm, has estimated that $80 billion will flow into spot Bitcoin ETFs within 3 years of launch. This estimate is based on the firm's analysis of the US wealth management industry, which it believes is the most likely and immediate market for Bitcoin ETFs.

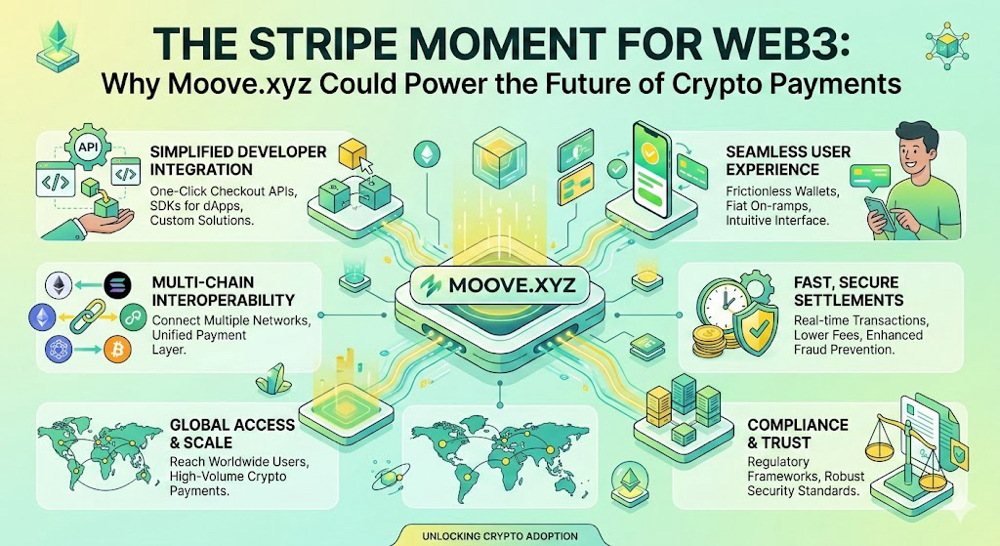

What is a Spot Bitcoin ETF?

A spot Bitcoin ETF is an exchange-traded fund that tracks the price of Bitcoin. Unlike futures-based Bitcoin ETFs, which track the price of Bitcoin futures contracts, spot Bitcoin ETFs hold actual Bitcoin. This means that investors in spot Bitcoin ETFs will have direct exposure to the price of Bitcoin.

Why Galaxy Digital Believes $80 Billion Will Flow into Spot Bitcoin ETFs

Galaxy Digital believes that spot Bitcoin ETFs will be attractive to a wide range of investors, including institutional investors such as pension funds and endowments. The firm also believes that spot Bitcoin ETFs will be more popular than futures-based Bitcoin ETFs because they offer investors direct exposure to the price of Bitcoin.

The Potential Impact of Spot Bitcoin ETFs

The approval of spot Bitcoin ETFs could have a significant impact on the cryptocurrency market. It could make Bitcoin more accessible to a wider range of investors, which could increase demand for Bitcoin and drive up its price. It could also lead to increased institutional adoption of Bitcoin, which could further legitimize the cryptocurrency.

Conclusion

Galaxy Digital's estimate that $80 billion will flow into spot Bitcoin ETFs within 3 years of launch is a bullish sign for the cryptocurrency market. It suggests that there is significant demand for Bitcoin from institutional investors. The approval of spot Bitcoin ETFs could be a major catalyst for the next Bitcoin bull run.

Additional Thoughts

It is important to note that Galaxy Digital's estimate is just that - an estimate. There is no guarantee that $80 billion will flow into spot Bitcoin ETFs in the next 3 years. However, the firm's analysis suggests that there is significant potential for growth in the Bitcoin ETF market.

The approval of spot Bitcoin ETFs would be a major milestone for the cryptocurrency industry. It would signal to regulators and investors that Bitcoin is a mature and legitimate asset class. It would also make it easier for investors to invest in Bitcoin, which could lead to increased demand for the cryptocurrency.

Overall, I believe that the approval of spot Bitcoin ETFs is a positive development for the cryptocurrency industry. It has the potential to bring new investors to Bitcoin and to further legitimize the cryptocurrency.