Martinez warns of whales halting Bitcoin accumulation, while analysts predict 100% increase by 2024

The trend of Bitcoin BTC/USD-0.24%+ Free Alerts

whales accumulating the cryptocurrency appears to have halted, according to a popular analyst. What Happened: On Tuesday, Ali Martinez, took to social media platform X, formerly Twitter, to alert the community about the cessation of Bitcoin accumulation by whales. Martinez’s post was accompanied by a chart of the accumulation trend score, an indicator of the on-chain accumulation behavior of large entities.

As the accumulation trend score has now dropped to zero, Martinez believes this indicates that whales are either distributing or not accumulating Bitcoin at current levels.

“#Bitcoin accumulation trend score has dropped to zero, indicating that whales are distributing or not accumulating $BTC at the current levels!” Ali wrote.

The Accumulation Trend Score is a measure that shows how much Bitcoin different entities are acquiring or selling on-chain. It combines two factors: the size of the entities’ Bitcoin holdings (their participation score) and whether they’re getting more coins or selling them over the last month (their balance change score).

A score closer to 1 suggests that larger entities or a significant portion of the network are accumulating Bitcoin, while a score closer to 0 indicates they’re selling or not acquiring more. This helps us understand the size and behavior of market participants in terms of Bitcoin accumulation over the past month, according to Glassnode Academy.

Whales are typically large holders of Bitcoin, and their accumulation or distribution behavior can significantly impact the market. This shift in their behavior could potentially signal a change in the market’s direction.

Why It Matters: The news of Bitcoin whales halting their accumulation comes at a time when the cryptocurrency’s future value is a topic of much debate. Despite a recent pullback, a Standard Chartered analyst has predicted a more than 100% increase in Bitcoin’s value by the end of 2024. This forecast, combined with the whale behavior, could indicate a significant shift in the market’s dynamics.

Additionally, the BRICS nations are exploring the use of stablecoins and CBDCs to reduce their reliance on the U.S. dollar, potentially impacting the global cryptocurrency market. Meanwhile, meme coins are gaining traction, with a trader predicting that at least three meme coins will surpass a $100 billion market cap.

In this special report, you will learn the four best strategies for trading options, how to stay safe as a complete beginner, a 411% trade case study, PLUS how to access two new potential winning options trades starting today.Claim Your Free Report Here.

However, some traders have expressed concerns about the current state of the market, with one warning that the market is overvalued and the current cycle may not be as favorable as the previous one.

These developments, combined with the change in whale behavior, suggest that the cryptocurrency market may be on the verge of a significant shift.

Price Action: According to the data from Benzinga Pro, Bitcoin is currently priced at $66,843, marking a 0.64% increase over the past 24 hours. Impressively, it has surged by 51.33% since the beginning of the year.

PayPal’s Blockchain Research Group has joined Energy Web and DMG Blockchain Solutions to support “sustainable” Bitcoin mining. According to the paper, the collaboration “presents an opportunity to accelerate the clean energy transition” using crypto-economic incentives.

PayPal Research On Bitcoin Mining

In a recently published paper, PayPal’s Blockchain Research Group (BRG) proposed “the possibility for a more sustainable future” in Bitcoin mining. The investigation revealed that, as of April 2, data estimates the annualized emissions to be over 85 million metric tons of carbon dioxide due to Bitcoin’s Proof-of-Work (PoW) consensus mechanism:

The reason behind this significant impact is the proof-of-work (PoW) consensus mechanism that secures the Bitcoin network. In PoW, miners engage in a competitive race to find solutions (i.e., cryptographic hashes) for Bitcoin blocks, requiring powerful computational hardware like ASIC machines.

This race and its demand for robust computational power require significant electricity. Miners’ use of carbon-based energy sources consequentially “results in the underlying greenhouse gas emissions footprint of the Bitcoin network.”

As a solution, PayPal’s BRG aims to “incentivize desired activity with crypto-economics” to improve and optimize “existing, proven strong networks.” Additionally, the firm wishes to support “more environmentally responsible” mining and encourage other miners to shift towards cleaner energy sources.”

Bitcoin Rewards For “Green Mining”

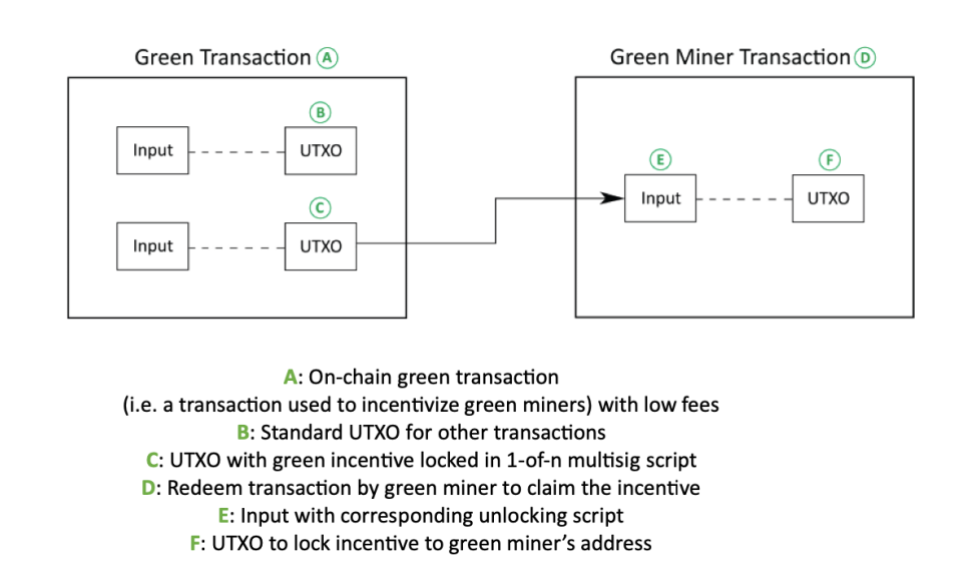

The paper suggests routing on-chain transactions to “green miners” via low transaction fees with a BTC reward “locked” in a multisig payout address. The rewards would serve as an incentive to mine these transactions, as only green miners would be eligible to receive them.

The solution is based on identifying miners that use low-emissions energy sources. After identification, their public keys, referred to as “green keys,” would be used to reward miners with Bitcoin in a trust-independent method through a “1-of-n multisig script.” As a result, the payout address would allow the miners with green keys to claim the rewards.

Proposed solution to incentivize green Bitcoin mining. Source: PayPal's BRG

Providers such as Energy Web would help to identify the green miners and onboard them to the solution. The non-profit organization offers a “Green Proofs for Bitcoin” initiative that promotes transparency and “supports alignment between Bitcoin mining and global decarbonization effort.”

Miners would apply for and share their sustainable mining certifications through the Green Proofs for Bitcoin validation platform.

Moreover, the proposed solution has been successfully tested with DMG. The firm broadcasted multiple low-fee transactions to test how effectively they would operate under different levels of on-chain transaction volumes.

Depending on the transaction volume, the low-fee ones would “either take a long time to confirm or eventually be dropped by the network.” This would increase the green miners’ chances to pick them up.

Per the paper, the trade-offs were “acceptable,” however, alternative solutions could be evaluated:

It is possible to design alternative solutions where transactions and rewards can be sent to miners via a private mechanism rather than using the public mempool.

Exploring technologies like smart contracts or the lighting network is also proposed as an alternative way to address the issues. However, they could come at the expense of “trust dependence and a more complex implementation.”

However, it is worth noting that Bitcoin mining has been controversial. While many legacy companies, such as PayPal and others, have targeted the network due to its alleged intense electrical consumption and carbon emissions, other research has pointed to the increasing use of renewable energy ad the low carbon emissions the nascent industry produces, as seen in the chart below. Bitcoin mining carbon emissions are much lower than those of other industries. Source: Cambridge Research

Bitcoin mining carbon emissions are much lower than those of other industries. Source: Cambridge Research

In an article posted by Forbes, analyst Jonathan Buck pointed out:

the CCAF has determined that the bitcoin industry uses a significant amount of renewable energy, sometimes more than half, depending on the jurisdiction. This is a testament to the industry’s commitment to sustainability and its potential role in the green revolution.

BTC is trading at $65,972.43 on the one-day chart. Source: BTCUSDT on TradingView