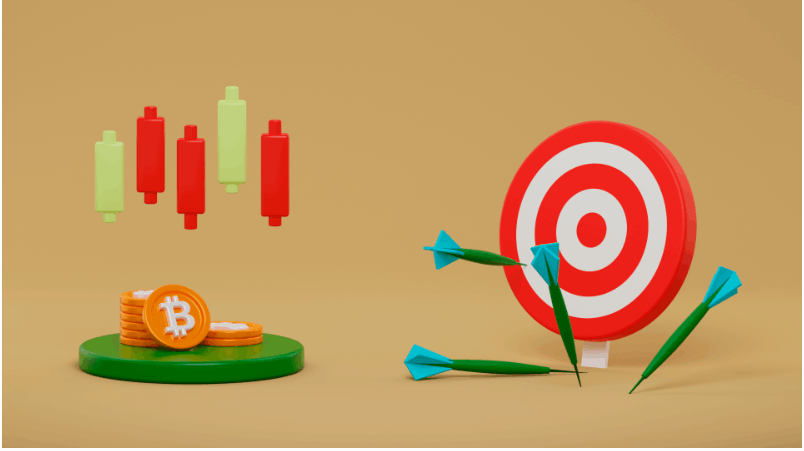

Is India’s Reduction of Crypto TDS to 0.1% a Typo?

The Indian government may have drastically reduced the Tax Deductible at Source (TDS) for crypto transactions

The TDS, which had earlier been slated to be 1% for each transaction, could now be levied at a rate of 0.1%

This was specified in the TDS guidelines recently released by India’s Income Tax Department. It was mentioned under Section 194S: Payment on transfer of Virtual Digital Asset

It further stated that this tax shall not be deducted if it is payable by any person other than a specified person. The same would be applied if its aggregate value does not exceed Rs. 10,000 during the financial year

Moreover, TDS shall also not be deducted if the consideration is payable by a specified person and its aggregate value does not exceed Rs. 50,000 during the financial year, the guidelines said

A specified person in India is any individual or Hindu Undivided Family (HUF) with a lower income bracket. They include those whose total sales or turnover does not exceed Rs.1 crore in case of business and Rs. 50 lakhs in case of a profession in the year following the one in which the digital asset was purchased, the notice said

However, it should be noted that another section of the guidelines mentions the tax as being one percent. This has led some to speculate that the 0.1% TDS mentioned elsewhere could just be a typo