Understanding Cryptocurrency Private Sales

Introduction

In the dynamic world of blockchain technology and cryptocurrency, fundraising mechanisms are as diverse as the projects themselves. Among these methods, cryptocurrency private sales stand out as a pivotal avenue for project funding and investor engagement. This comprehensive guide aims to unravel the complexities of cryptocurrency private sales, shedding light on their workings, advantages, disadvantages, and key considerations for both project teams and investors.

Understanding Cryptocurrency Private Sales:

At its core, a cryptocurrency private sale represents a strategic fundraising round wherein a project's tokens are offered exclusively to a select group of investors before being made available to the broader public. Unlike initial coin offerings (ICOs) or initial exchange offerings (IEOs), which involve public token sales, private sales operate on a more exclusive basis, catering to institutional investors, venture capitalists, accredited individuals, and strategic partners.

The Mechanisms Behind Private Sales:

The process of conducting a cryptocurrency private sale is intricate, involving several key steps:

1. Invitation:

Project teams meticulously curate a list of potential investors, often based on factors such as expertise, influence, and strategic alignment. Invitations are extended to these individuals or entities, initiating the private sale process.

2. Negotiation:

Once invitations are accepted, negotiations ensue regarding the terms of the private sale. These negotiations cover crucial aspects such as token price, allocation size, vesting schedules, lock-up periods, discounts, and bonuses. Both parties strive to reach mutually beneficial agreements that align with their respective objectives.

3. Investment:

With terms finalized, investors commit funds to the project in exchange for a predetermined number of tokens at the agreed-upon price. This financial infusion serves to bolster the project's coffers and propel its development efforts forward.

4. Token Distribution:

Following the conclusion of the private sale, the project team disburses tokens to the investors' designated wallets. Token distribution typically occurs post-mainnet launch or token generation event (TGE), marking a significant milestone in the project's trajectory.

Benefits of Cryptocurrency Private Sales:

The allure of cryptocurrency private sales lies in their array of benefits for both project teams and investors:

1. Early Access:

Private sale participants gain early access to project tokens, affording them a privileged position in the project's ecosystem. This early entry often comes with the added incentive of acquiring tokens at a discounted price compared to public sale offerings.

2. Strategic Partnerships:

Private sales pave the way for strategic collaborations between projects and investors. Institutional backers, venture capitalists, and industry experts bring invaluable expertise, resources, and networks to the table, fostering symbiotic relationships that fuel project growth.

3. Fundraising Flexibility:

Unlike rigid fundraising models, private sales offer flexibility in structuring terms and conditions. Project teams can tailor agreements to suit the unique needs and preferences of investors, fostering a conducive environment for collaboration and innovation.

4. Capital Injection:

Private sales serve as a potent means of injecting capital into blockchain projects, empowering teams to finance development, marketing, and operational endeavors. This influx of funds accelerates project milestones and enhances its competitive edge in the market.

Drawbacks of Cryptocurrency Private Sales:

However, alongside their myriad benefits, cryptocurrency private sales are not without their share of drawbacks:

1. Exclusivity:

Private sales inherently prioritize select investors over the broader community, potentially excluding retail participants from accessing tokens at an early stage. This exclusivity may engender feelings of disenchantment among those unable to participate in the private sale.

2. Lack of Transparency:

The opaque nature of private sales raises concerns regarding transparency and accountability. With negotiations conducted behind closed doors, the broader community may be left in the dark regarding token allocation, sale terms, and distribution mechanisms.

3. Regulatory Risks:

Regulatory uncertainty looms large over cryptocurrency private sales, particularly in the context of securities laws and investor protections. Projects must navigate a complex regulatory landscape to ensure compliance with relevant regulations and mitigate legal risks.

4. Investor Lock-up:

Private sale participants often find themselves subject to lock-up periods, during which they are prohibited from selling or transferring their tokens. This lack of liquidity poses challenges for investors seeking to liquidate their holdings or diversify their portfolios.

Key Considerations for Investors:

For investors contemplating participation in cryptocurrency private sales, several critical considerations come into play:

1. Project Viability:

Conduct thorough due diligence to assess the project's whitepaper, team composition, technological prowess, roadmap, and market potential. A robust understanding of these factors informs investment decisions and mitigates risks.

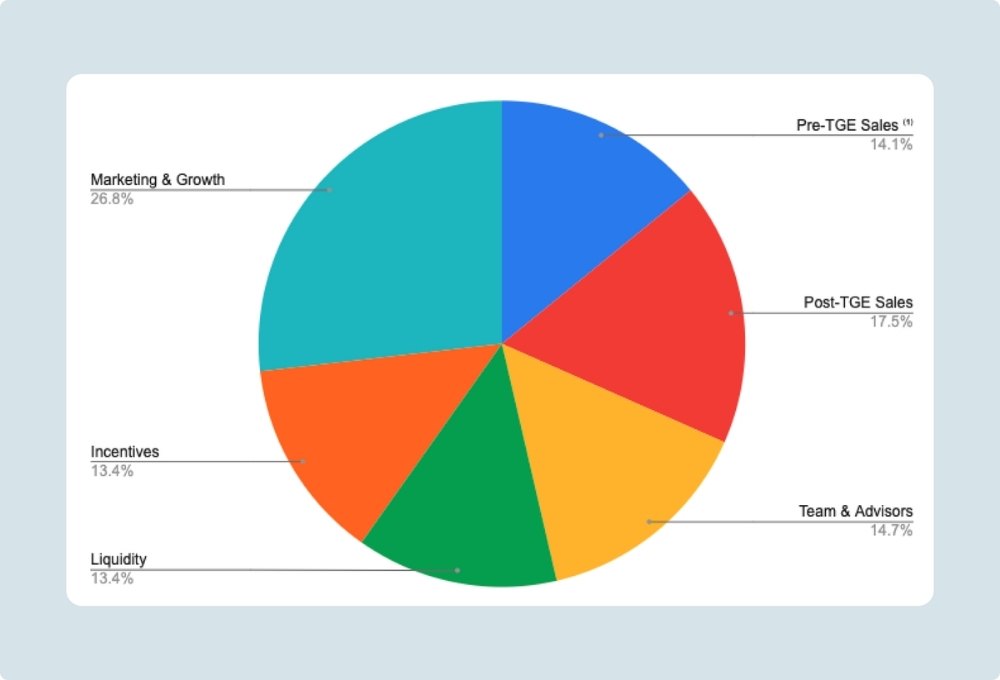

2. Tokenomics Analysis:

Delve into the project's tokenomics to evaluate factors such as token distribution, use case, utility, and potential for appreciation. Understanding the intrinsic value proposition of the token is instrumental in gauging its long-term viability.

3. Terms and Conditions Scrutiny:

Scrutinize the terms and conditions of the private sale meticulously. Pay close attention to aspects such as token price, vesting schedules, lock-up periods, discounts, and bonuses to ascertain their alignment with your investment objectives.

4. Regulatory Compliance Assurance:

Prioritize projects that demonstrate a commitment to regulatory compliance and investor protection. Seek clarity on the project's regulatory framework, legal standing, and compliance measures to mitigate regulatory risks.

5. Risk-Reward Assessment:

Conduct a comprehensive risk-reward assessment to weigh the potential returns against inherent risks. Consider factors such as market volatility, project execution risks, competitive landscape, and macroeconomic trends to make informed investment decisions.

Conclusion

Cryptocurrency private sales occupy a prominent position in the fundraising landscape of blockchain projects, offering a conduit for capital infusion, strategic partnerships, and early investor engagement. While laden with benefits, private sales entail complexities, risks, and challenges that demand careful navigation by both project teams and investors. By exercising prudence, conducting due diligence, and fostering transparency, stakeholders can harness the transformative potential of cryptocurrency private sales to propel the blockchain industry forward in its quest for innovation and disruption.

![[The Zero-Capital Masterclass] How AI & DePIN are Hacking the 2026 Airdrop Meta 🚀](https://cdn.bulbapp.io/frontend/images/de133e2f-b217-409c-a74b-c3428e2a7e40/1)