WTF is bitcoin ETF? Entry of crypto in stock market!

No need of crypto exchange for trading crypto. Quite hypocritic but true, because crypto is on stock exchange (Yes, but indirectly). Every retail investor can trade crypto, like they trade stocks, all thanks to ETF (Exchange-Traded Fund).

Long story short

Wait, I am going to explain everything but the short story is —

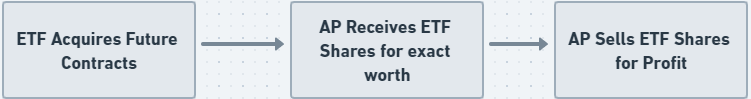

Certain exchanges, such as the Chicago Mercantile Exchange (CME), offer Bitcoin futures contracts. Institutional entities (ETF Issuer) acquire these contracts with the help of Authorized Participants (AP). ETF shares are created using these contracts and ETF becomes eligible for listing on the stock market. And that’s how retail investors can seamlessly invest in ETF shares through their Demat accounts. Flowchart of entire process

Flowchart of entire process

This story has 4 characters:-

— Futures Contracts

— Chicago Mercantile Exchange (CME)

— ETF

— Authorized Participants (AP)

If you are still alive, let’s dive deep into it

Theory of Future Contract

Suppose, the current price of stock is $100, and you predict the price will shoot up to $200 in April. To make sure you can buy it at the current $100 price, you enter into a special agreement called a futures contract that says, “Hey, I’ll buy this stock from you in April at today’s price of $100, no matter what happens.”

If you are right — In April, you will have those stocks of $200 at the price of $100 (Half the price), and you can sell again at $200 to make a sweet profit.

If you are wrong — You could have bought it for $50 in April, but you have to buy it at $100 (Double the price) as per your futures contract, and the seller makes the profit here

Here you bought a future at $100, with an expiry of 3 months. Expiry time of the contract varies, but when it ends, you must follow the agreement. Till end the price of the stock and the futures contract will fluctuate.

Chicago Mercantile Exchange (CME) — The control unit

CME is a platform for the trading of various financial derivatives, including futures contracts. CME serves as a marketplace where buyers and sellers can trade variety of future contracts.

The CME establishes the terms of future contracts, including the contract size, expiration date, and specifications. Its job is to track Bitcoin’s price and update it every day at 4 PM, hence the contract’s value changes every day as per market condition.

The Bitcoin future contract of CME has 5 bitcoins. By current BTC value, the value of one contract become $2,15,000. And obviously you can’t afford it ✌️

Exchange-traded Fund (ETF)

ETF is a type of fund comprising a collection of assets like stocks/bonds/securities/commodities. Some ETFs hold futures contracts. These are known as futures-based ETFs. These funds invest in futures contracts linked to Bitcoin. Bundle of Bitcoin Futures Contract at ETF

Bundle of Bitcoin Futures Contract at ETF

ETF issuers, such as financial institutions or asset management companies. They create ETFs by purchasing bitcoin futures contracts, these contracts are then bundled into a fund, and the shares of ETF are created.

The initial value of these shares are decided by the ETF issuers. Issuer can adjust the composition of the fund by buying or selling futures contracts based on market conditions and the fund’s investment strategy.

When the value of bitcoin increases, then the value of future contracts also increases, and hence the value of ETF stock also increases. Retail investors make a profit like they do in a normal market.

The futures contracts allow investors to gain exposure to the value of the underlying bitcoin without physically owning it. ETFs can be purchased or sold on a stock exchange in the same way that a regular stock can.

ETF can’t buy contracts themselves, as they are too costly, hence they need bigger players, with more money power — like JP Morgan?

Authorized Participants (AP) — Unsung heroes

It’s someone with a lot of buying power, mostly large financial institutions like banks. It is the AP’s job to acquire the bitcoin contracts that the ETF wants to hold.

Both parties benefit from the transaction: The ETF get the future contracts they want and the AP gets plenty of ETF shares, which then can sell for profit when ETF shares will rise. ETF shares are created in a block of 50,000 shares, called creation block. AP receives the same value of shares against the securities they provide. If the AP purchased securities worth $10 million, they would receive a creation unit of ETF shares with an equivalent value of $10 million. Means, 1 share = ($10 million/50,000) = 20$ per share. This $20 will be the starting share price of ETF.

ETF shares are created in a block of 50,000 shares, called creation block. AP receives the same value of shares against the securities they provide. If the AP purchased securities worth $10 million, they would receive a creation unit of ETF shares with an equivalent value of $10 million. Means, 1 share = ($10 million/50,000) = 20$ per share. This $20 will be the starting share price of ETF.

ETFs race against time — Expiring contracts

Futures contracts have expiration dates, and ETFs typically hold a mix of near-month (Closer expiration date) and longer-term (late expiration date) future contracts.

As contracts approach expiration, the fund “rolls” or replaces them by selling the expiring contract and buying a new one with a later expiration. This process can result in gains or losses, and will change share price of ETF depending on the price Bitcoin Future Contract during the replacing.

This process helps maintain exposure to the latest price of bitcoin.

Conclusion

The short story I discussed at the start is the conclusion. Read and understand that again.

ETFs are very recent to market and depend on many parameters like regulatory rules, APs, rolling process, etc. In our next blog, we’ll delve deeper into how the world is reacting to these instruments now and what it means for the broader landscape of investment and digital assets.

Hit a like if you’ve like and un