SEC Pauses Ethereum Spot ETF Announcement: A Closer Look at the Implications

Introduction:

In a recent turn of events, the U.S. Securities and Exchange Commission (SEC) has decided to pause the announcement of a much-anticipated Ethereum (ETH) spot exchange-traded fund (ETF). This decision has sent ripples through the crypto community, raising questions about the future of ETH investment products and the regulatory landscape surrounding digital assets. In this blog post, we will delve into the details of the SEC's decision and explore its potential impact on the broader cryptocurrency market.

The SEC's Decision:

The SEC's decision to pause the Ethereum spot ETF announcement comes amidst a period of heightened scrutiny and increased regulatory oversight in the cryptocurrency space. While the crypto community has been eagerly anticipating the approval of an ETH spot ETF, the SEC has decided to take a step back to thoroughly evaluate the implications and risks associated with such a product.

One of the key concerns raised by the SEC is the potential for market manipulation in the Ethereum spot market. The regulatory body aims to ensure that any ETF product introduced meets the necessary standards for investor protection and market integrity. By pausing the announcement, the SEC is signaling a cautious approach to the fast-evolving world of digital assets.

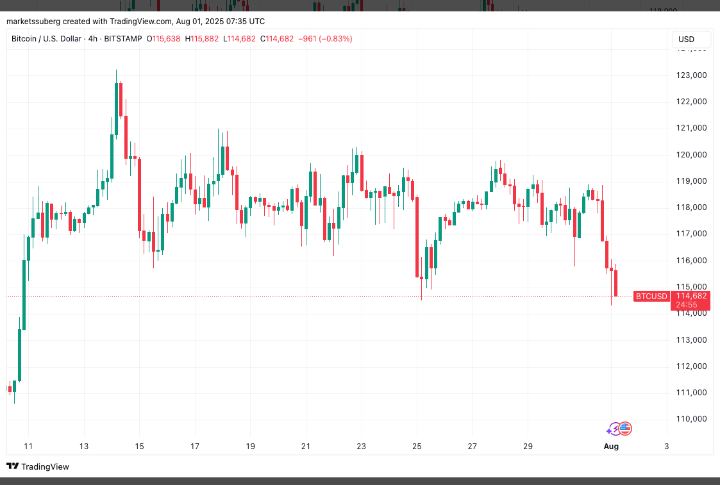

Market Reaction:

The news of the SEC's decision has had an immediate impact on the cryptocurrency markets. Ethereum, which had experienced a surge in price in anticipation of the ETF announcement, saw a temporary dip as investors digested the regulatory uncertainty. However, the long-term impact remains uncertain, and market participants are closely monitoring developments for clues about the SEC's future stance on Ethereum and other digital assets.

Implications for Investors:

For investors, the SEC's decision underscores the importance of regulatory clarity in the cryptocurrency space. While the pause may be disappointing for those who were hoping for a quick approval, it also highlights the SEC's commitment to ensuring a robust regulatory framework that safeguards investors' interests.

As the regulatory landscape evolves, investors may need to exercise patience and stay informed about developments in the SEC's approach to digital assets. Regulatory clarity is crucial for the mainstream adoption of cryptocurrencies and the creation of a stable investment environment.

Conclusion:

The SEC's decision to pause the Ethereum spot ETF announcement reflects the challenges and complexities associated with integrating digital assets into traditional financial markets. While the crypto community eagerly awaits regulatory approval for investment products, the SEC's cautious approach signals a commitment to thorough evaluation and investor protection.

As the cryptocurrency market continues to mature, it is likely that regulatory bodies will play an increasingly significant role in shaping its future. The SEC's decision, while temporarily impacting market sentiment, serves as a reminder that the path to widespread adoption involves navigating a carefully regulated landscape. Investors and enthusiasts alike will be watching closely as the regulatory journey unfolds, shaping the future of Ethereum and other digital assets.