Deri Protocol: A Deep Dive into Decentralized Derivatives Trading

Introduction

Understanding Derivatives Trading

Before diving into Deri Protocol, it's crucial to grasp the concept of derivatives. These are financial contracts that derive their value from an underlying asset, such as cryptocurrency. Unlike simply buying and holding crypto, derivatives allow for:

1. Hedging: Protecting your crypto holdings from price fluctuations.

2. Speculation: Making bets on the future price movements of cryptocurrencies to potentially amplify gains.

3. Arbitrage: Profiting from price discrepancies between different markets.

Derivatives come in various forms, including options contracts (giving the right, but not the obligation, to buy or sell an asset at a specific price by a certain time) and futures contracts (obligating the buyer and seller to exchange the asset at a predetermined price on a future date).

What is Deri Protocol?: The Decentralized Derivatives Powerhouse

Deri Protocol positions itself as a user-centric platform for trading derivatives on various Blockchains. Unlike traditional derivatives exchanges, Deri leverages Blockchain technology to facilitate peer-to-peer (P2P) derivatives trading, eliminating the need for a central intermediary. This fosters transparency, security, and potentially, lower fees.

Built initially on the Binance Smart Chain (BSC) and Arbitrum, Deri has recently expanded its reach to zkSync Era, with plans for further multi-chain integration. This multi-chain approach caters to users seeking faster transaction speeds and lower gas fees offered by these alternative layer-one and layer-two scaling solutions.

A Spectrum of Derivatives Products

Deri Protocol boasts a diverse product suite, offering traders a range of options to tailor their strategies:

1. Perpetual Futures: These are the most common derivative contracts, allowing users to speculate on the future price of an underlying asset without a fixed expiry date. Positions are maintained by continuously paying funding fees.

2. Everlasting Options: A unique innovation by Deri, Everlasting Options address the liquidity fragmentation issue prevalent in traditional options markets. These options lack an expiry date, offering greater flexibility and potentially improved liquidity. Deri utilizes the DPMM (Delta-Neutral Pricing Maker Mechanism) algorithm to price Everlasting Options.

3. Power Perpetuals: Designed for experienced traders, Power Perpetuals offer leveraged exposure to the underlying asset. This allows for amplified returns (and magnified losses) compared to traditional perpetual futures.

4. Gamma Swap (Beta Testing): This upcoming feature introduces a novel way to manage options risk. Gamma Swap allows users to hedge their options positions and potentially earn additional yield.

A Feature-Rich Trading Experience

- Web3-integrated TradingView: Deri integrates a familiar charting interface powered by TradingView. This empowers traders with advanced technical analysis tools and charting functionalities directly within the platform.

- Margin Trading: Users can leverage their holdings to amplify their potential returns. However, this also magnifies potential losses, so proper risk management is crucial.

- Funding Fees: As with perpetual futures on other platforms, Deri employs a funding mechanism to maintain market peg. Users holding long positions pay funding fees to those holding short positions, and vice versa.

- Testnet Environment: Deri offers a dedicated testnet environment for developers to build and test their strategies before deploying them on the mainnet. This minimizes risk and allows for a smoother development experience.

Deri Protocol (DERI) Token

- Governance: DERI token holders can participate in the protocol's governance process, voting on proposals that impact the platform's development and future direction.

- Staking: Users can stake their DERI tokens to earn rewards and potentially generate passive income.

- Fee Discounts: Holding DERI tokens can entitle users to discounted trading fees on the platform.

The current price of the DERI token (as of April 15, 2024) is around $0.013, with a relatively low trading volume. It's important to remember that, like all cryptocurrencies, the price of DERI is subject to market fluctuations.

Deri Protocol in the DeFi Landscape

1. dYdX: A leading player known for its high liquidity and user interface. However, dYdX operates on a permissioned model, with some restrictions on user access.

2. Perpetual Protocol: Another prominent platform offering perpetual futures contracts. Perpetual Protocol utilizes a virtual Automated Market Maker (vAMM) to facilitate trading.

3. Hegic: A pioneer in decentralized options trading. While offering a broader range of option types, Hegic may have a steeper learning curve for new users.

Deri Protocol differentiates itself through its unique product offerings, particularly Everlasting Options and Gamma Swap (still in beta). Additionally, its multi-chain approach and integration with familiar tools like TradingView make it an attractive option for a wider audience.

Deri Protocol Architecture: Overview

1. The xDapp Architecture

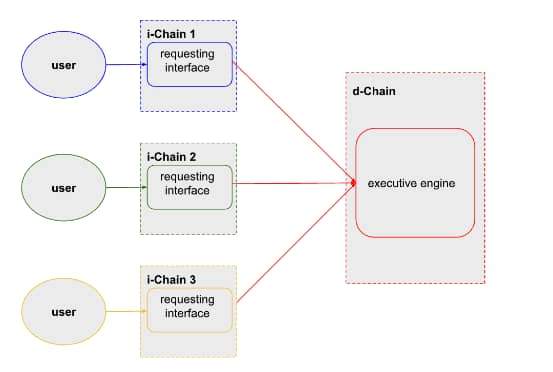

Deri Protocol's innovative architecture consists of two main components: a requesting interface and an executive engine, implemented as two groups of smart contracts.

The requesting interface, also known as the “i-chain” (with “i” signifying interface), serves as the pivotal entry point for user interactions. It adeptly handles a wide range of user requests, from traders initiating orders and managing margins to liquidity providers engaging in adding or removing liquidity.

These requests are seamlessly relayed to the executive engine. Deployed on a dedicated blockchain, this is our “d-chain”, where “d” represents “Deri”. Here, all the requests are processed.

There is only one d-Chain, which is an AppChain deployed by the Deri Protocol team using layer 3 technology. Whereas, i-Chain are all the major public layer 1s and layer 2s such as Ethereum, Arbitrum, BNBChain, zkEVM,and zkSync Era. While theoretically any layer 1 or layer 2 can be adopted as an i-Chain, in practice, the community will choose which ones to deploy.

2. DPMM Architecture

The chart below illustrates the architecture of the DPMM of Deri Protocol.

Potential Challenges/Drawbacks of Deri Protocol

1. Complexity of Derivatives Trading: Derivatives trading can be complex and involves significant risks. Users should thoroughly understand the mechanics of each derivative product before using Deri Protocol.

2. Volatility of Cryptocurrencies: The underlying crypto assets traded on Deri Protocol are inherently volatile, which can exacerbate potential losses in derivatives positions.

3. Smart Contract Risk: Like any DeFi platform, Deri Protocol relies on smart contracts. While generally secure, vulnerabilities in smart contracts can lead to several critical issues:

- Exploits: Malicious actors can exploit vulnerabilities in smart contracts to steal user funds, manipulate markets, or disrupt protocol operations. This risk is mitigated by thorough audits conducted by reputable security firms. Deri Protocol itself undergoes regular audits to identify and address potential vulnerabilities. However, even audited smart contracts cannot guarantee complete security.

- Unforeseen Bugs: Even with rigorous testing, unforeseen bugs in the code can lead to unintended consequences. These bugs could potentially lock user funds, miscalculate payouts, or cause unexpected behavior within the protocol.

- Immutable Code: The immutable nature of blockchain technology presents a challenge. Once a smart contract is deployed on the blockchain, it cannot be easily modified. If a critical vulnerability is discovered, fixing it may require a complex and potentially disruptive migration to a new smart contract.

Security Measures Employed by Deri Protocol

Deri Protocol acknowledges the inherent risks associated with smart contracts and implements several security measures to mitigate them:

- Regular Audits: As mentioned earlier, Deri Protocol undergoes regular security audits by independent firms. These audits help identify and address potential vulnerabilities in the smart contract code.

- Bug Bounty Program: Deri Protocol often runs bug bounty programs, incentivizing security researchers to discover and report vulnerabilities. This collaborative approach strengthens the overall security of the platform.

- Transparent Development: Deri Protocol's smart contract code is open-source, allowing anyone to review and scrutinize it. This transparency fosters community involvement and helps identify potential issues early on.

Additional Considerations for Deri Protocol Users

While Deri Protocol implements security measures, users also play a crucial role in protecting their assets:

- Understanding the Risks: Users should thoroughly understand the risks involved in derivatives trading before using Deri Protocol. This includes comprehending the mechanics of each derivative product and the potential for significant losses.

- Researching the Protocol: It's crucial to research Deri Protocol's history, audit reports, and community sentiment before depositing funds. This research can help users assess the platform's overall reliability.

- Starting Small: For beginners, it's advisable to start with small positions to gain experience and confidence before committing larger amounts of capital.

- Self-Custody: Deri Protocol is a non-custodial platform, meaning users retain custody of their funds. It's essential to use a secure crypto wallet and employ strong password practices to safeguard your assets.

Looking Ahead: The Future of Deri Protocol

1. Cross-chain Interoperability: Expanding support for additional blockchains can further enhance liquidity and cater to a broader user base.

2. Advanced Derivatives Products: Deri Protocol could introduce new and innovative derivatives products to cater to the evolving needs of sophisticated traders.

3. Improved User Interface: A user-friendly interface can make Deri Protocol more accessible to a wider range of users, including those with less experience in derivatives trading.

4. Decentralized Governance: Deri Protocol could explore the possibility of implementing a decentralized governance structure, allowing its community to participate in decision-making processes related to the protocol's development.

5. Decentralized Governance: Deri Protocol could explore the possibility of implementing a decentralized governance structure, allowing its community to participate in decision-making processes related to the protocol's development.

Conclusion

Deri Protocol offers a compelling alternative for those seeking to engage in decentralized derivatives trading. It provides a diverse range of products, leverages the benefits of blockchain technology, and prioritizes security measures. However, users should be aware of the inherent risks associated with derivatives trading and smart contracts. By carefully considering these factors, Deri Protocol can be a valuable tool for experienced traders and a promising platform for the future of DeFi derivatives.

https://docs.deri.io

https://www.flippening.co/web3-protocols/deri-protocol

https://docs.deri.io/how-it-works/architecture

https://www.gate.io/learn/articles/all-you-need-to-know-about-deri-protocol/514

https://messari.io/report/deri-protocol-the-future-of-derivatives-and-on-chain-market-making