What is Short-Selling | How Does Short-Selling Work | By Invest Therapy

What is Short Selling

What is Short Selling? :

When an investor sells the share that he does not own at the time of the trade is called short selling. In short Selling, the traders borrow shares from the owner with the help of the broker and sell it at the market with the hope that the price will fall. If the price fall the short seller buys the stock and book his/her Profit. Short Selling is a high-risk factor that has a high risk-reward ratio as it is capable of earning profit as well as huge losses. Below Is some key factor that you need to understand before short Selling:

- In short Selling, Traders does not own the stock that he sells, he borrowed it from another owner

- Retail, Institutional and Individual Investors are allowed to short sell

- Short Selling is based on speculation.

- The trader bets on a price drop on Short Selling. If price rise then the seller suffer loss.

- The trader has to meet their obligation and return the share to the owner after the time of settlement.

- The traders need to keep in mind that the transaction is going to short sell

- Short Selling is basically done in the bearish market when the price drop is high.

In the stock market, short Selling is used to earn profit in a short period. Long term Investor buys the stock and earns a profit if stock price rises on another hand short-seller sell the stock and earn a profit if the stock price fall.

Naked Short Selling:

Naked Short Selling or naked shorting is a type of short Selling where traders short sell the stock without borrowing it from the owner. Naked Short Selling is illegal in most countries because it violates the demand and supply rule.

Benefits of Short Selling:

Financial expert always argues for the benefit of short Selling. The global market regulator approves it's a practice as it is Help to balance the overpricing of the stock price it also helps in Liquidity, prevents the sudden rise of the bad stock and it makes sure that there is no manipulation in stock by promoters. Below Are some other benefits of short Selling:

- Capital Investment is low in short Selling

- Traders can earn huge profit

- Extra source of Liquidity and revenue.

The disadvantage of Short Selling:

Market manipulators always take illegal use of short selling method to collapse the price of the stock. It increases volatility and a significant risk in the market. The continuous decrease in stock price can also impact Companies' confidence and their fundraising capacity. Below Is some other disadvantage of Short Selling:

- There Is a chance of unlimited loss in short selling.

- Cost of margin interest

- short selling is also cost for opportunities

- Fees For Stock loan

Apart from the risk of losing money, there is another risk of short selling which we discuss in our next post.

How Short Selling Works:

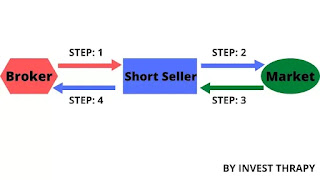

How Short selling Works

Short Selling is a type of trading where short seller borrows the stock that they do not own and sell the stock at the current market price. The goal is to re-buy the shares of the stock at a lower price in the future and return it to the lender.

For example, a trader short sell 1000 share of ₹100 each which lend ₹1,00,000 in his account. If the share price decline to ₹70 per share, the short seller could choose to exit his position by buying back 1000 share at ₹70,000. Once he exits his position the short seller booked a profit of ₹30,000 (1,00,000 - 70,000) from the trade.

In the below image you will understand how short selling works:

Step 1: Short Seller Borrow the stock From Broker

Step 2: Short Seller immediately sells the stock in the market.

Step 3: Short Seller buys back the stock From the market.

Step 4: Short Seller Return the borrowed share to the Broker.