The Future of Tokenization

In the past five years, the crypto industry has undergone continuous evolution, introducing new buzzwords and themes. Initially, the notion of decentralization in blockchain garnered widespread attention, followed by emerging trends like GameFi, Move-to-Earn (M2E), and blockchain-driven Metaverse projects. However, many of these trends failed to address the fundamental question of ‘why blockchain?’ for the average person.

In contrast, recent themes such as “Tokenization” and “Real World Assets (RWA)” are making the benefits of blockchain more understandable to individuals less familiar with the technology. With this in mind, this article aims to delve into the concept of tokenization and explore its advantages and limitations, drawing insights from the ‘Tokenization: Overview and Financial Stability Implications” report published by the FED.

What is Tokenization & Real-World Assets (RWA)?

“Tokenization” involves converting a specific asset into a digital form using distributed ledger technology. In this process, the value of the token becomes directly linked to the value of the underlying asset, and the token holder obtains legal ownership of that asset. Essentially, tokenization transforms an asset into a tradable digital form on the blockchain.

“RWA” stands for Real World Assets, which means that any real-world asset, not limited to securities, can be tokenized and brought onto the blockchain. Recent efforts have been made to tokenize assets like U.S. Treasuries, gold, currencies, funds, and more. According to the Boston Consulting Group, the RWA market is projected to reach approximately $16 trillion by 2030. Moreover, BlackRock CEO Larry Fink has emphasized that the future of finance lies in asset tokenization, stating, “The next generation of financial markets and securities will be built on the tokenization of assets.”

Representative Projects of RWA

(1) Circle (https://www.circle.com/en/) — Tokenized U.S. Dollar ($USDC)

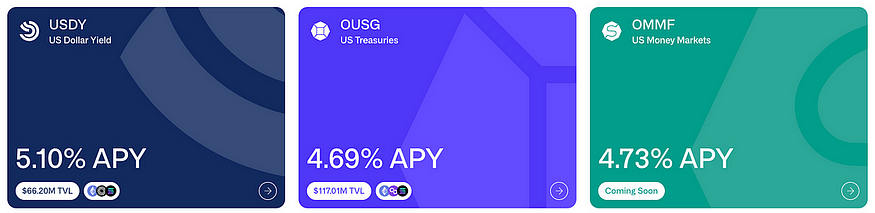

(2) Ondo (https://ondo.finance/) — Tokenized U.S. Treasuries ($OUSG), Tokenized Money Markets ($OMMF) Source: Ondo Finance

Source: Ondo Finance

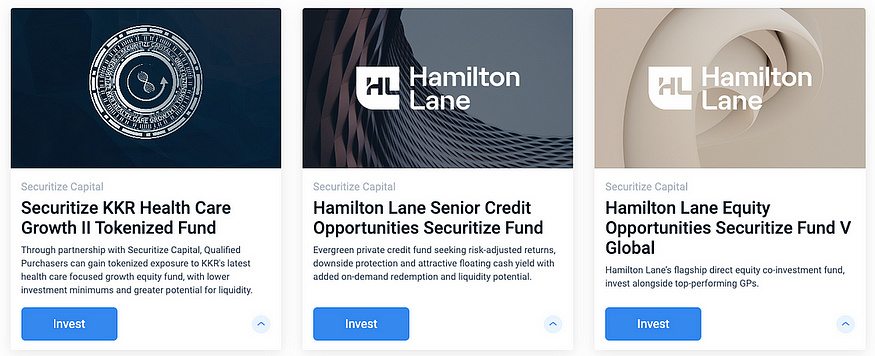

(3) Securitize (https://securitize.io/) — Tokenized Fund (ex, KKR Health Care Growth II Tokenized Fund) Source: Securitize

Source: Securitize

Benefits of Tokenization

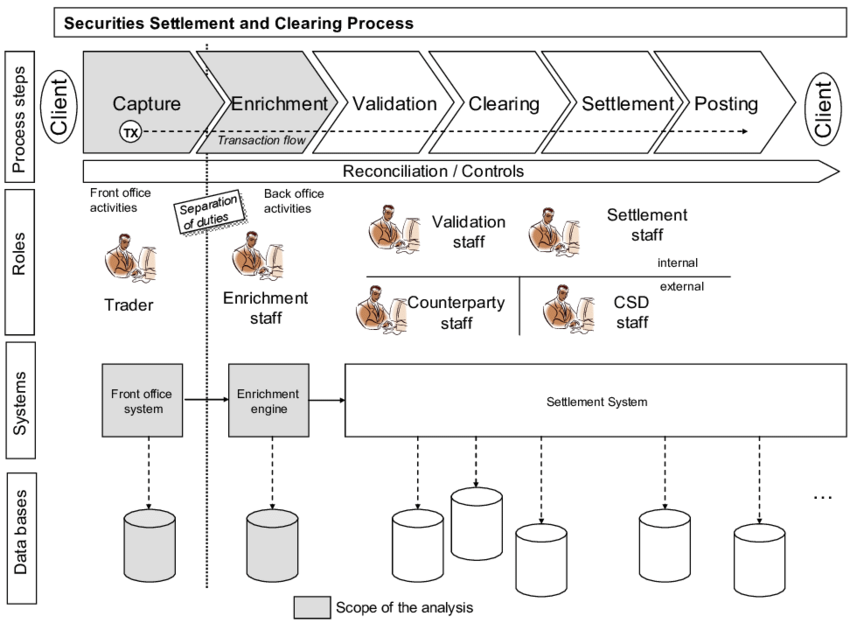

1. Swift Settlements with Reduced Costs

While many assume that financial transactions, such as stock trades, occur almost instantly, the reality is quite different. These transactions involve intensive labor in middle and back-office operations and often take longer than expected to reach a complete settlement. For instance, stock trades usually adhere to a T+2 model, which means that it takes a total of three business days, including the trade day, to finalize settlement. This timeframe encompasses reconciliation and verification processes involving multiple parties, such as registration with securities depositories and the recording of names into shareholder registers. However, through asset tokenization and the application of blockchain technology, these cumbersome processes and delays can be significantly minimized. Blockchain allows for real-time transaction recording and reduces the need for numerous intermediaries in the transaction process, eliminating unnecessary complexities and delays. Consequently, when compared to conventional financial transactions, tokenized assets can achieve finality (where the transaction cannot be altered) in a matter of minutes or even seconds, resulting in substantial cost savings through the elimination of intermediaries.

However, through asset tokenization and the application of blockchain technology, these cumbersome processes and delays can be significantly minimized. Blockchain allows for real-time transaction recording and reduces the need for numerous intermediaries in the transaction process, eliminating unnecessary complexities and delays. Consequently, when compared to conventional financial transactions, tokenized assets can achieve finality (where the transaction cannot be altered) in a matter of minutes or even seconds, resulting in substantial cost savings through the elimination of intermediaries.

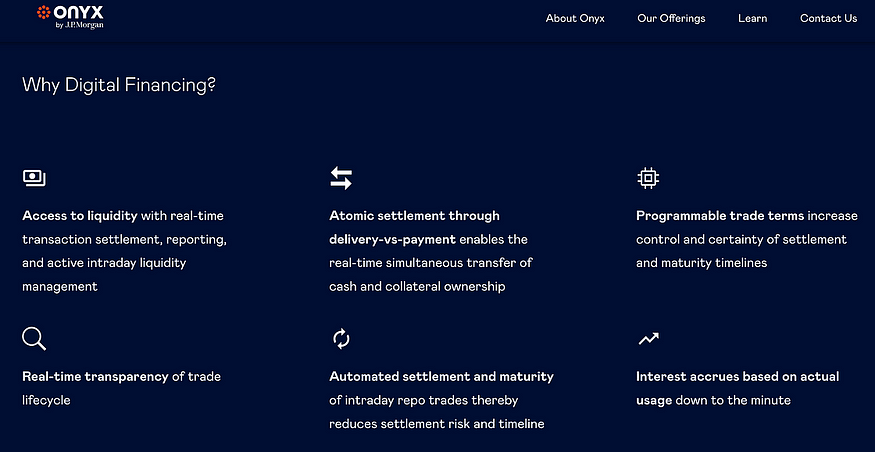

Leveraging these advantages, JPMorgan’s Onyx has introduced an intraday trading system similar to repo trading, known as the Intraday Borrowing Facility. Previously, same-day borrowing and repayment were impractical due to the protracted collateral and lending processes. However, thanks to the rapid trading and settlement capabilities offered by tokenized asset trading, same-day borrowing and repayment have become feasible. Furthermore, Citibank, in collaboration with the Monetary Authority of Singapore, recently conducted test involving trading tokenized US dollars and Singapore dollars, announcing plans for a new trading platform offering real-time settlement advantages. Source: Onyx by J.P.Morgan

Source: Onyx by J.P.Morgan

2. Innovative Investment Opportunities

Tokenization opens the door for investors to participate in smaller portions of larger assets that were traditionally challenging to access. Take, for instance, the realm of real estate investments, which typically demands substantial capital. However, with the advent of “fractional investment,” even retail investors with relatively limited funds can partake. This approach stands out because it offers the chance for a “direct investment” in a specific property, as opposed to investing in a “portfolio” of properties, such as Real Estate Investment Trusts (REITs).

Furthermore, private equity investments, historically limited to institutional investors, are becoming more attainable for the average investor thanks to tokenization simplifying the process and lowering transaction costs. This transformation is also leaving its mark on areas like music rights and art, which were previously challenging or even impossible to trade. As a result, tokenization is democratizing access to a wide array of assets, making investment opportunities more inclusive and accessible to a broader audience.

3. Enhanced Liquidity and Price Discovery

Crypto markets transcend geographical boundaries, granting accessibility to a global audience of investors. For instance, platforms like GoldFinch enable investments in African businesses from virtually anywhere, while individuals can acquire USDC on platforms like Circle, essentially owning assets equivalent to US dollars. Furthermore, the crypto markets boast the significant advantage of operating 24/7, ensuring that trading can occur at any moment, irrespective of one’s time zone. These advantages are poised to boost the liquidity of assets that were previously deemed illiquid, such as real estate and art, ushering in a new era of more precise price discovery process.

4. Leveraging Assets on the Blockchain

Tokenization unlocks the utility of an real world asset within the blockchain ecosystem. A prime example is the integration of tokenized assets into the realm of DeFi. In DeFi, these assets serve as collateral, streamlining and simplifying the lending and clearing processes, which were once lengthy and intricate through TradFi process. Through the tokenization of diverse assets, previously overlooked assets can now be employed as collateral, easing the lending procedures for all participants in the market. Moreover, as DeFi continues to evolve, we anticipate a broader range of applications for tokenized assets beyond lending, expanding their influence within the DeFi landscape. Source: Arcade

Source: Arcade

Remaining Homework

1. Regulatory Challenges: Fostering Trust and Security

As we have previously emphasized, the absence of comprehensive regulation remains one of the most significant impediments to the crypto industry’s advancement. Given the inherent characteristics of crypto market, a multitude of concerns arise, ranging from the ambiguity surrounding issuing entities to questions about accountability in the event of incidents like hacks. In the financial sphere, trust is paramount, and the participation of major institutions hinges on regulatory frameworks. It is evident that, without the presence of effective regulation and stabilizing mechanisms, establishing trust and ensuring safety within the crypto market will prove to be a formidable challenge.

2. The Pitfalls of Over-Leveraging and Excessive Utilization

The crypto market’s downturn in 2021 was triggered by the rampant use of excessive leverage, a practice that involves seeking higher returns through repeated borrowing against staked assets. This resulted in a domino effect of bankruptcies even with minor market turbulence, profoundly impacting not only the DeFi sector but the entire crypto industry. Given the crypto industry’s risk appetite to pursue profit maximization and the continued prevalence of high leverage, this behavior represents a substantial risk to the stability of financial markets.

3. Additional Considerations

- While tokenization offers the benefit of heightened liquidity for assets traditionally deemed illiquid, it also comes with the drawback of increased price volatility for those assets.

- Even though tokenized assets can be traded 24/7, certain underlying assets may have limited original market hours, and this discrepancy in trading hours should be taken into account.

- Various scenarios need to be examined. For instance, a drop in the price of Bitcoin could potentially impact the value of the tokenized asset, or the collateral for tokenized assets may be linked to conventional crypto assets.

Things to Think About

Considerations Regarding Tokenization and Price

The correlation between the widespread adoption of RWA and the price surge in the crypto market isn’t guaranteed. While it is evident that the ascent of RWA has a favorable influence on the overall crypto market, it might not be pragmatic to anticipate a straightforward rise in crypto prices solely due to adoption of tokenization. As indicated in the earlier definition of tokenization, it is more about transforming the form of an existing asset, underscoring the significance of blockchain technology over merely focusing on crypto asset prices.

From this perspective, RWA tokenization is poised to stimulate the practical application and innovation of blockchain technology, rather than being the primary driver of increased crypto prices. Tokenizing RWAs presents an opportunity to revolutionize the financial system, enhancing its efficiency and bolstering transparency and security in financial transactions. Consequently, it is crucial to recognize that while the proliferation of RWAs has the potential to positively impact the crypto market, it has much broader implication to the real world.

The Significance of Decentralization

In the early stages of the crypto industry, “decentralization” held a central position as a key message and was widely regarded as a critical factor within the industry. This emphasis led to a considerable skepticism towards permissioned blockchains, often considered as falling short of being “true” blockchains.

Nevertheless, the financial sector is characterized by a more conservative approach compared to other industries, placing utmost importance on stability and transparency in financial transactions. This inclination has prompted a significant portion of financial institutions and projects to embrace permissioned blockchains. Notably, blockchain initiatives such as JPMorgan’s Onyx have adopted their own permissioned blockchains, highlighting stability and adherence to regulatory compliance. Furthermore, numerous protocols and platforms necessitate KYC procedures for crypto purchases, and platforms like Securitze, facilitating the trading of KKR fund, exclusively grant access only to accredited investors. Consequently, it appears that the RWA industry puts more weight on “stability” over the original blockchain ideology “decentralization”.

Disclaimer

All content in this article is intended to communicate and provide information and is not intended as the basis for investment decisions or for recommendations or advice for investment. The contents of the text are not responsible in any shape or form including matters that pertain to investment, law, or tax matters