Bitcoin ETFs after 4 months of approval - Attracting more than 12 billion USD

On January 10, 2024, the US SEC officially approved 11 spot Bitcoin ETFs. How are these Bitcoin ETFs performing so far? What is their impact on Bitcoin price?

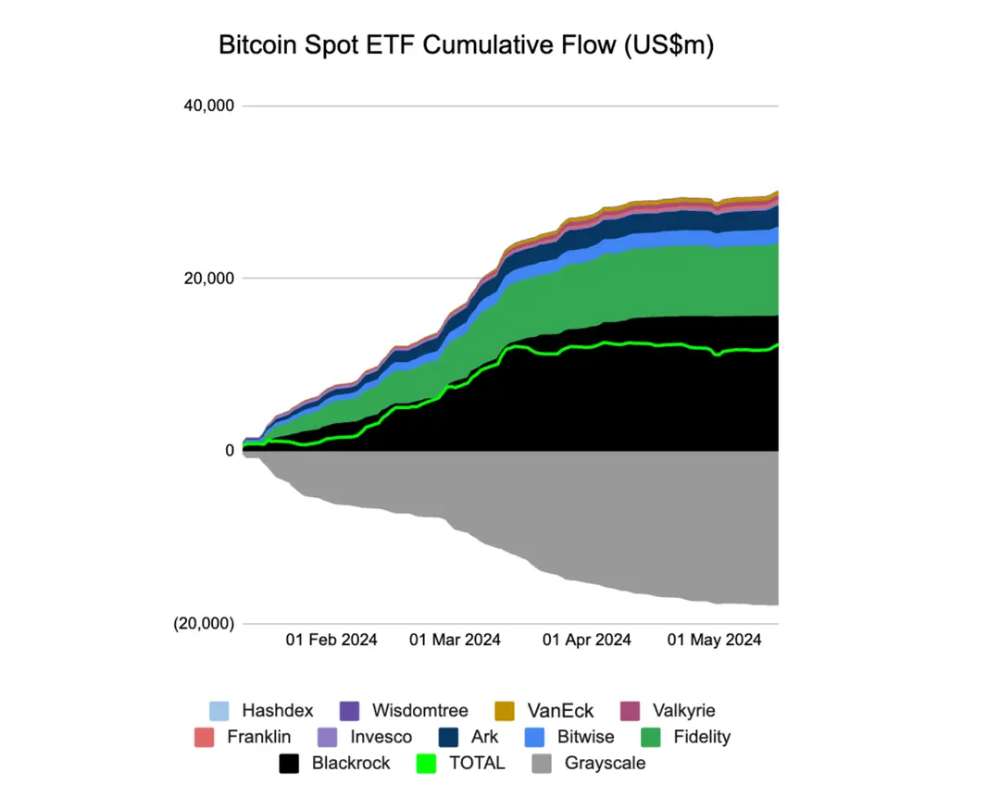

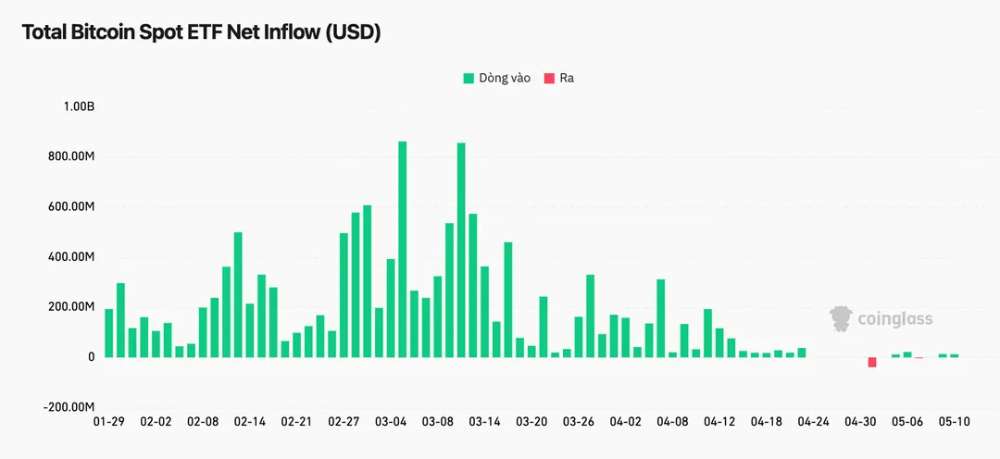

Bitcoin ETFs push Bitcoin price up by $30,000

For every $1 billion spent buying Bitcoin, Bitcoin's price increases by $2,300, with a standard error of about $3,600, according to Econometrics. Up to now, a total of 12.4 billion USD has been flowed into Bitcoin from spot Bitcoin ETFs, Bitcoin price also increased by about 33,000 USD from 40,000 to an all-time high of USD 73,000 USD. On average every day, about $141 million is used to buy Bitcoin, according to Farside.

The role of Bitcoin ETFs in the demand and price changes of Bitcoin is huge. If MicroStrategy bought an average of 386 Bitcoins per day, Grayscale bought an average of 959 Bitcoins per day between 2020-2021, then Bitcoin ETFs bought an average of 2,593 Bitcoins per day, according to Econometrics.

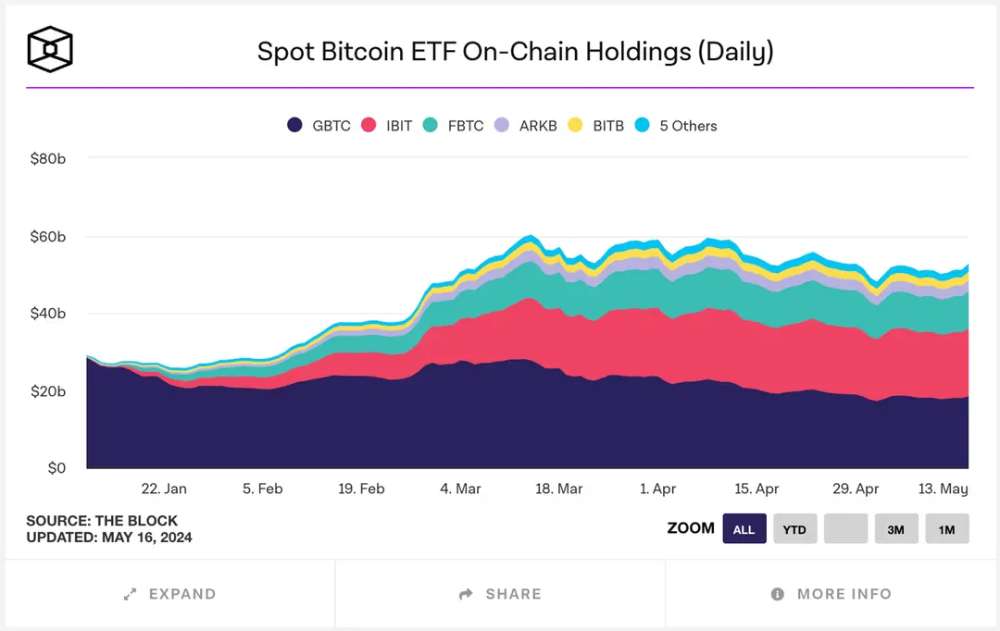

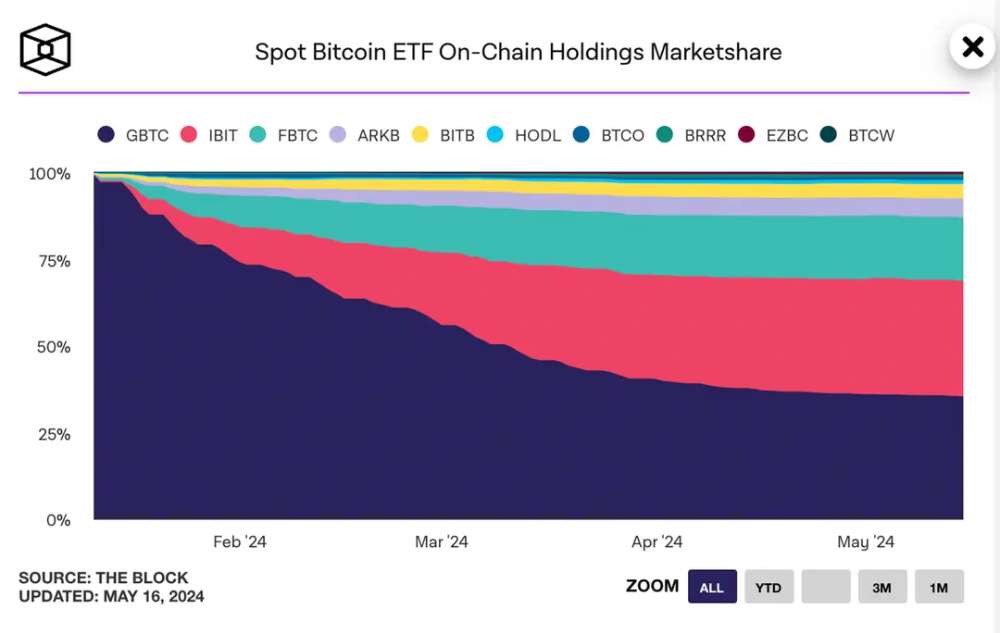

To date, Bitcoin ETFs are holding about 820,000 Bitcoin with a total value of about 52.5 billion USD. Of which, Grayscale holds 18.42 billion USD, BlackRock holds 17.53 billion USD, Fidelity holds 9.58 billion USD, ARK 21Shares holds 2.92 billion USD... This number decreased slightly compared to the beginning of March 2024 when funds held digital assets. Bitcoin is worth about $60 billion, according to The Block.

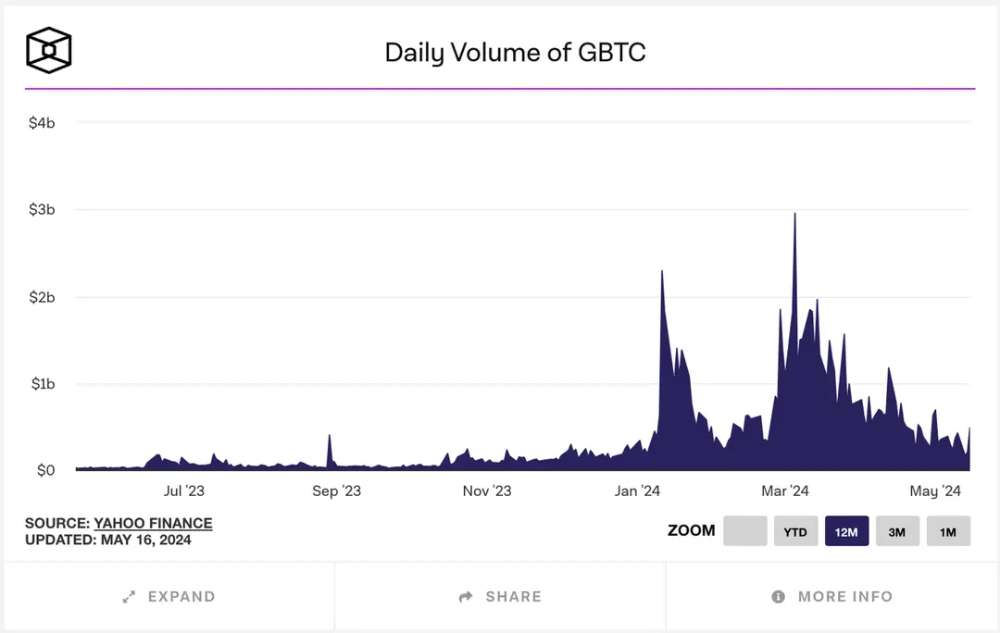

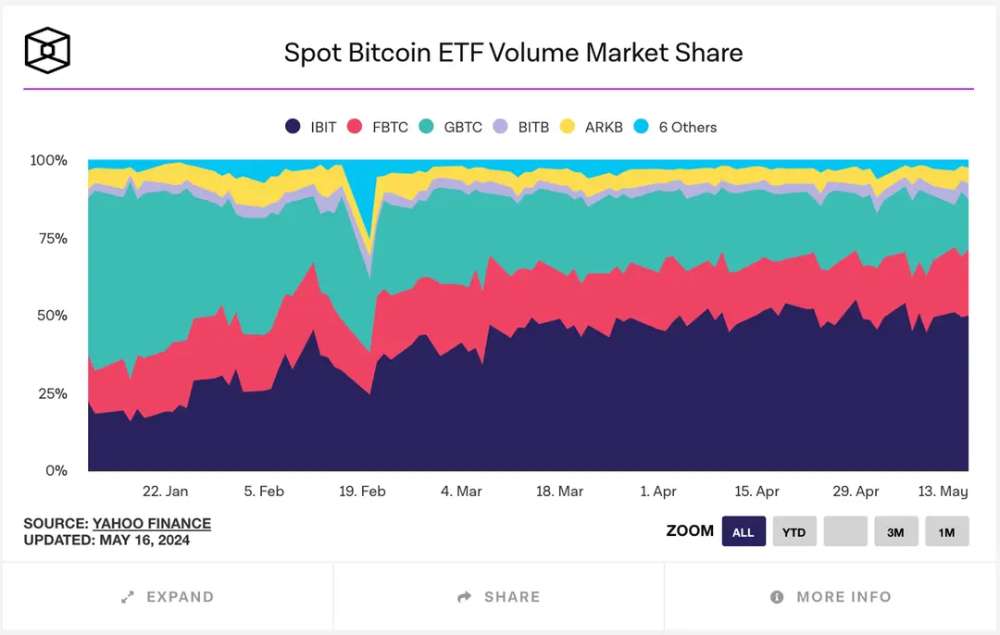

The total cumulative trading volume of Bitcoin ETFs reached 261 billion USD, especially increasing sharply from March to May 2024. At its peak, the daily trading volume of BlackRock Bitcoin ETFs exceeded 3 billion USD on February 28, March 5, March 8, March 12 and March 14.

Not only does it have overwhelming trading volume, BlackRock is also on track to beat Grayscale in terms of Bitcoin holdings as Grayscale continuously loses Bitcoin to BlackRock.

Grayscale continuously sells Bitcoin

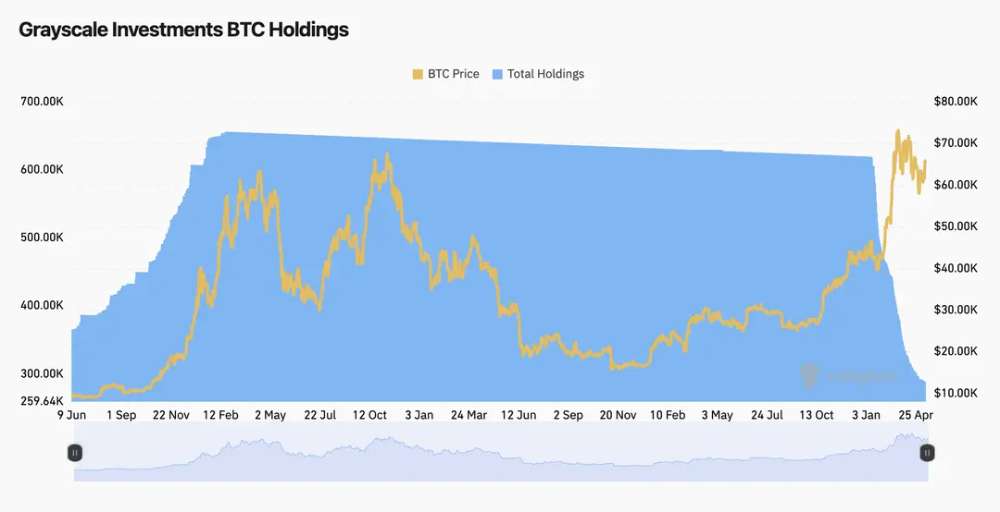

Grayscale was one of the first financial institutions to include Bitcoin in its investment portfolio. Specifically, Grayscale has operated the Grayscale Bitcoin Trust since September 2013. Grayscale began accumulating 365,000 Bitcoin in June 2020 and continuously increased its Bitcoin holdings to 653,000 Bitcoin as of February 2021.

After the proposal to establish its Bitcoin ETFs was approved, Grayscale officially converted the Grayscale Bitcoin Trust into the Grayscale Bitcoin Trust ETF. Completing the conversion, Grayscale Bitcoin Trust's trading volume increased from 200 million USD to 2.29 billion USD in just 1 day.

However, since its launch, Grayscale has continuously sold Bitcoin. To date, Grayscale has sold about 330,000 Bitcoin, more than 50% of its total Bitcoin holdings since the ETFs were approved. This causes Grayscale's Bitcoin holdings chart to go almost straight down.

Grayscale officially became the Bitcoin ETF that sold the most Bitcoin in the world when it sold nearly the same amount of Bitcoin as other Bitcoin ETFs bought.

Every day, Grayscale sells an average of about $250 million worth of Bitcoin. Grayscale even sold $608 million worth of Bitcoin on March 1 and $618 million on March 19. Currently, Grayscale is only holding about 289,000 Bitcoin, down more than half compared to earlier this year.

The reason is said to be because some investors have speculated, continuously buying Bitcoin from the Grayscale Bitcoin Trust fund, with a total value of 2.5 billion USD, if calculating interest rate of 2.7 billion USD, before the Bitcoin ETF fund. of Grayscale approved. Immediately after the SEC approved Grayscale's Bitcoin ETFs, these investors may have taken profit-taking action.

According to JP Morgan, this $2.7 billion may completely leave Bitcoin after Bitcoin ETFs are approved, seriously affecting the price of Bitcoin.

In contrast to Grayscale, there is another financial institution that actively hoards Bitcoin. That is BlackRock.

BlackRock increases Bitcoin accumulation

Grayscale is currently the financial institution holding the most Bitcoin in the world. To date, Grayscale's total market share is 35.09%. The funds holding the next most Bitcoin are BlackRock with 33.3%, Fidelity with 18.31%, ARK 21Shares with 5.62%, Bitwise with 4.3%...

However, this will not last long as BlackRock is actively buying large amounts of Bitcoin. For example, on March 5, BlackRock bought $788 million worth of Bitcoin and $849 million on March 12.

Currently holding 274,180 Bitcoins, just by buying about 15,000 more Bitcoins, BlackRock will officially overthrow Grayscale, becoming the financial institution holding the most Bitcoins in the world. This is even more possible when considering Grayscale's continued actions of selling Bitcoin.

Not only does it continuously accumulate Bitcoin and have continuous positive cash flow, BlackRock also has Bitcoin ETFs spot trading volume dominating the market with 55.19%, Fidelity accounts for 18.92%, Grayscale accounts for 15.75%, ARK 21Shares accounts for 4.75%.. .

In the near future, BlackRock is likely to become the financial institution holding the most Bitcoin, with the highest trading volume of Bitcoin ETFs, significantly influencing the crypto market.

Bitcoin ETFs in Hong Kong

Up to now, there are only 3 Bitcoin ETFs in Hong Kong: ChinaAMC, Bosera Hashkey and Harvest. Bitcoin ETFs in Hong Kong have relatively modest trading volumes when compared to Bitcoin ETFs in the US. The volume of these three funds has only reached about 49 million USD since their launch on April 30, according to Yahoo Finance.

This is understandable because these funds were only launched in mid-April 2024, the cash flow into the crypto market is not really strong yet. More time is needed to consider the impact of Bitcoin ETFs in Hong Kong on the crypto market.

Conclusion

Bitcoin ETFs help many traditional investors easily access Bitcoin, creating a new door that allows billions of dollars from traditional investment money to easily flow into Bitcoin. BlackRock with $10.5 trillion in assets under management is expected to greatly influence the crypto market with its upcoming actions.