The Evolving Landscape of Cryptocurrency: Trends and Impacts

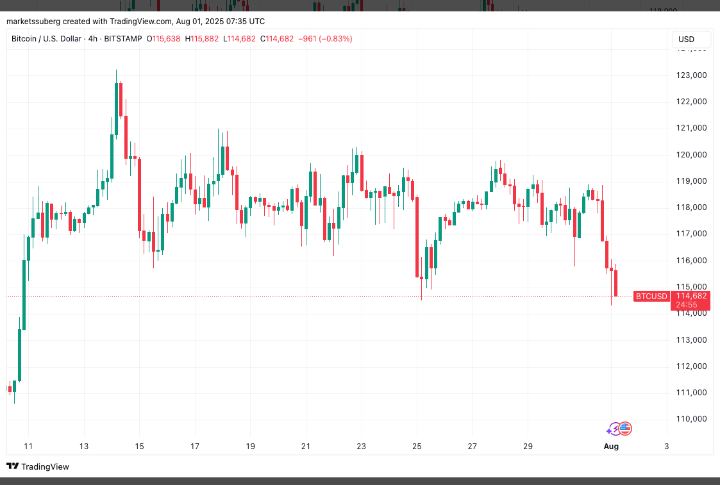

Cryptocurrency, the digital currency powered by blockchain technology, continues to captivate the world with its disruptive potential. Since the inception of Bitcoin in 2009, the cryptocurrency landscape has witnessed remarkable growth and transformation. In this blog post, we will delve into the latest trends shaping the cryptocurrency industry, providing insights into the evolving nature of digital assets and their impact on the global economy.

1. Mainstream Adoption: One of the most significant trends in the cryptocurrency space is the increasing mainstream adoption of digital assets. Over the past few years, cryptocurrencies have transitioned from being a niche interest to gaining recognition from major financial institutions and companies. Established payment processors like PayPal and Square have integrated cryptocurrency payment options, allowing users to transact in digital assets seamlessly. Furthermore, renowned companies such as Tesla and MicroStrategy have added Bitcoin to their balance sheets, signaling confidence in the long-term value of cryptocurrencies. This growing acceptance paves the way for broader adoption and integration of cryptocurrencies into our daily lives.

2. Central Bank Digital Currencies (CBDCs): Central Bank Digital Currencies (CBDCs) have emerged as a prominent trend in the cryptocurrency space. CBDCs are digital representations of fiat currencies issued and regulated by central banks. Several countries, including China, Sweden, and the Bahamas, have made significant progress in exploring and piloting their own CBDCs. These digital currencies aim to leverage the benefits of blockchain technology, such as increased transaction speed and transparency, while maintaining central bank control over monetary policy. The development of CBDCs has the potential to reshape traditional banking systems and enhance financial inclusion on a global scale. 3. Decentralized Finance (DeFi): Decentralized Finance, or DeFi, has gained immense popularity and has become one of the most transformative trends in the cryptocurrency industry. DeFi refers to a range of financial applications built on blockchain platforms that aim to provide traditional financial services without intermediaries. Through the use of smart contracts, DeFi protocols enable users to participate in activities such as lending, borrowing, and trading with greater transparency and efficiency. The growth of DeFi platforms like Compound, Aave, and Uniswap has unlocked new opportunities for individuals to access financial services and earn passive income by providing liquidity to decentralized liquidity pools. However, the rapid expansion of DeFi also presents challenges around security, regulation, and scalability that need to be addressed for its long-term sustainability.

4. Non-Fungible Tokens (NFTs): Non-Fungible Tokens (NFTs) have taken the digital world by storm, revolutionizing the concept of ownership and provenance. NFTs are unique digital assets that represent ownership or proof of authenticity of a particular item, such as artwork, music, or virtual real estate. Artists, musicians, and content creators have embraced NFTs as a means to monetize their work directly, bypassing traditional intermediaries. The sale of high-profile NFT artworks and collaborations with celebrities have garnered significant attention. NFTs have also extended their reach into other industries, including gaming, collectibles, and even real estate, offering new avenues for innovation and revenue generation.

5. Environmental Sustainability: The environmental impact of cryptocurrency mining has become a growing concern within the industry. Bitcoin, in particular, has faced criticism for its energy-intensive mining process. In response, there is a growing emphasis on finding sustainable solutions. Some cryptocurrencies, such as Ethereum, are transitioning from the energy-intensive Proof-of-Work (PoW) consensus mechanism to the more energy-efficient Proof-of-Stake (PoS) mechanism. PoS requires validators to hold a certain amount of cryptocurrency to create new blocks, reducing the need for excessive computational power. Additionally, initiatives promoting renewable energy sources for mining operations have gained traction, aiming to mitigate the carbon footprint associated with cryptocurrencies. Conclusion: The cryptocurrency landscape is constantly evolving, driven by innovative trends that have the potential to reshape traditional financial systems and unlock new opportunities. Mainstream adoption, CBDCs, DeFi, NFTs, and environmental sustainability are just a few of the prominent trends shaping the future of cryptocurrencies. As with any rapidly evolving industry, it is crucial for individuals, businesses, and policymakers to stay informed and adapt to the changing landscape. By embracing these trends responsibly, we can harness the true potential of cryptocurrencies, fostering financial inclusivity, innovation, and economic growth in the digital era.