Coinbase Institutional Analyzes Upcoming Bitcoin Halving, Drawing Parallels to 2018-2022 Cycle

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

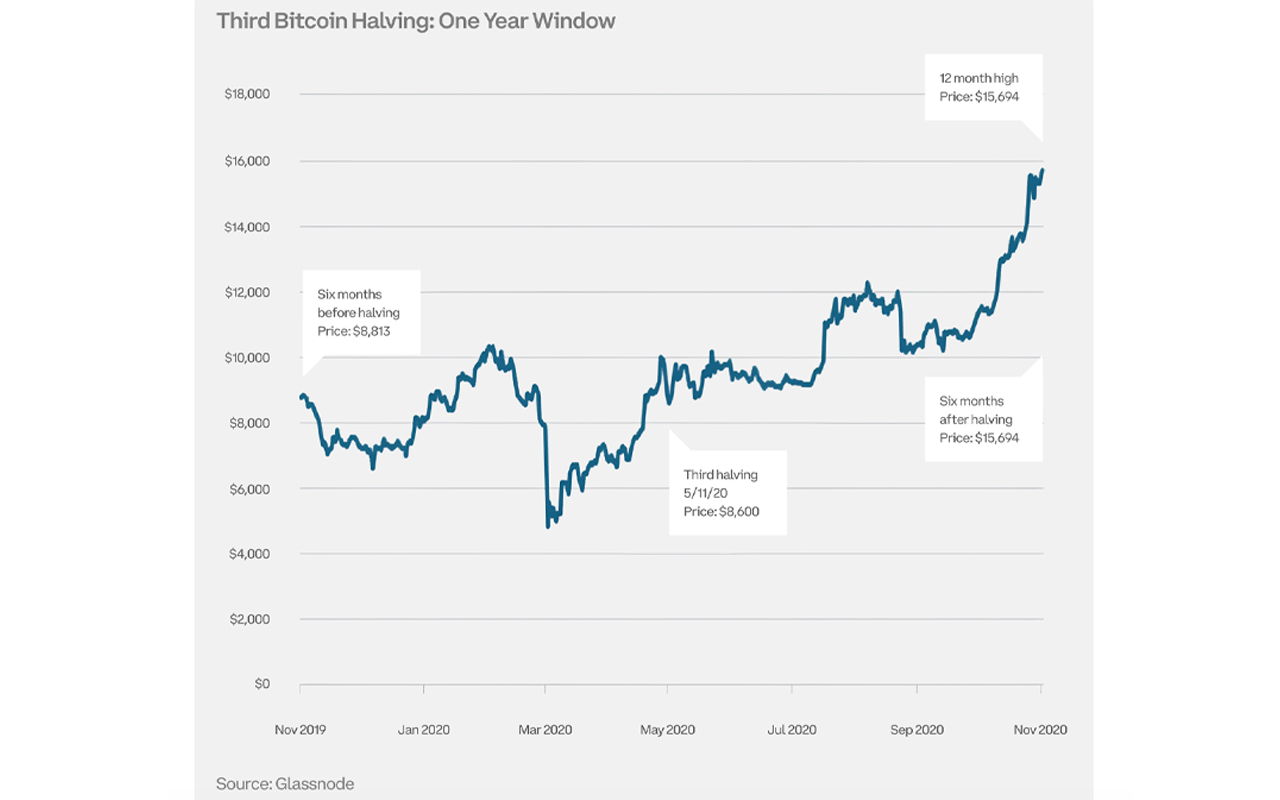

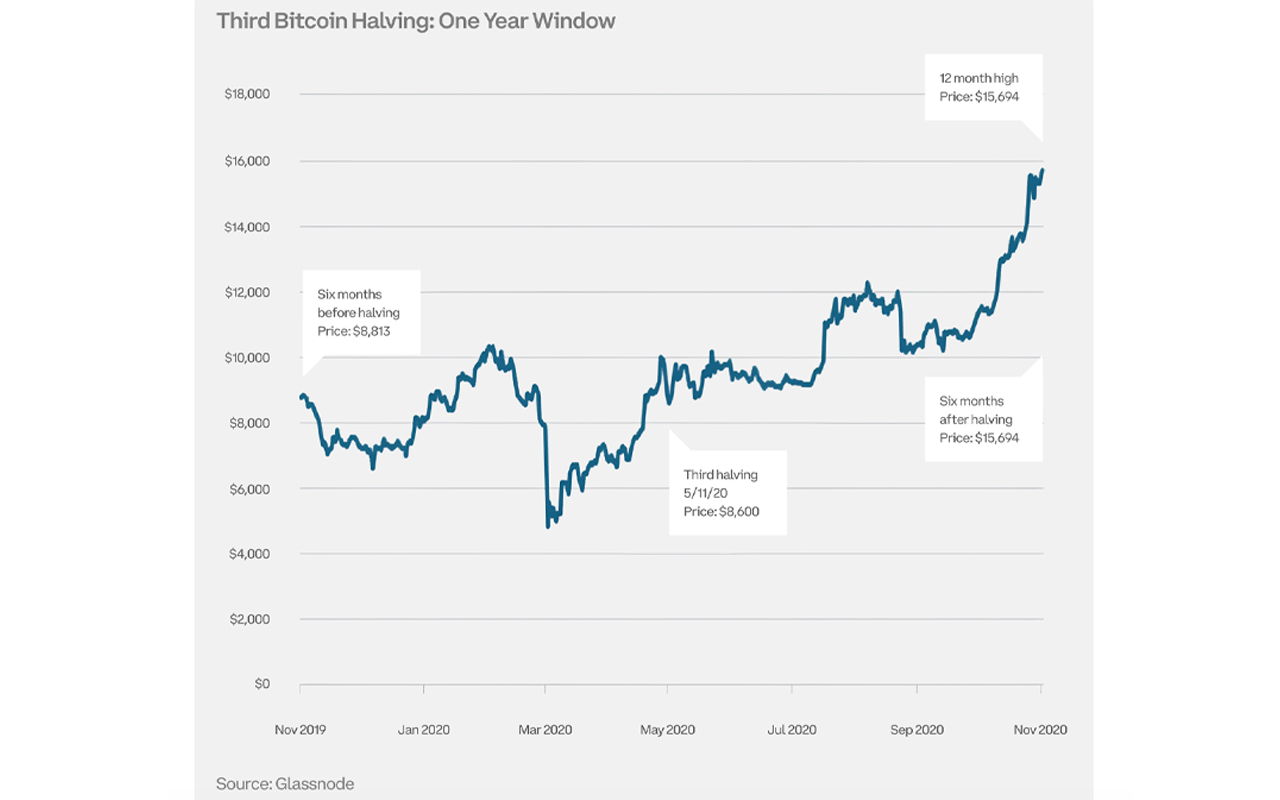

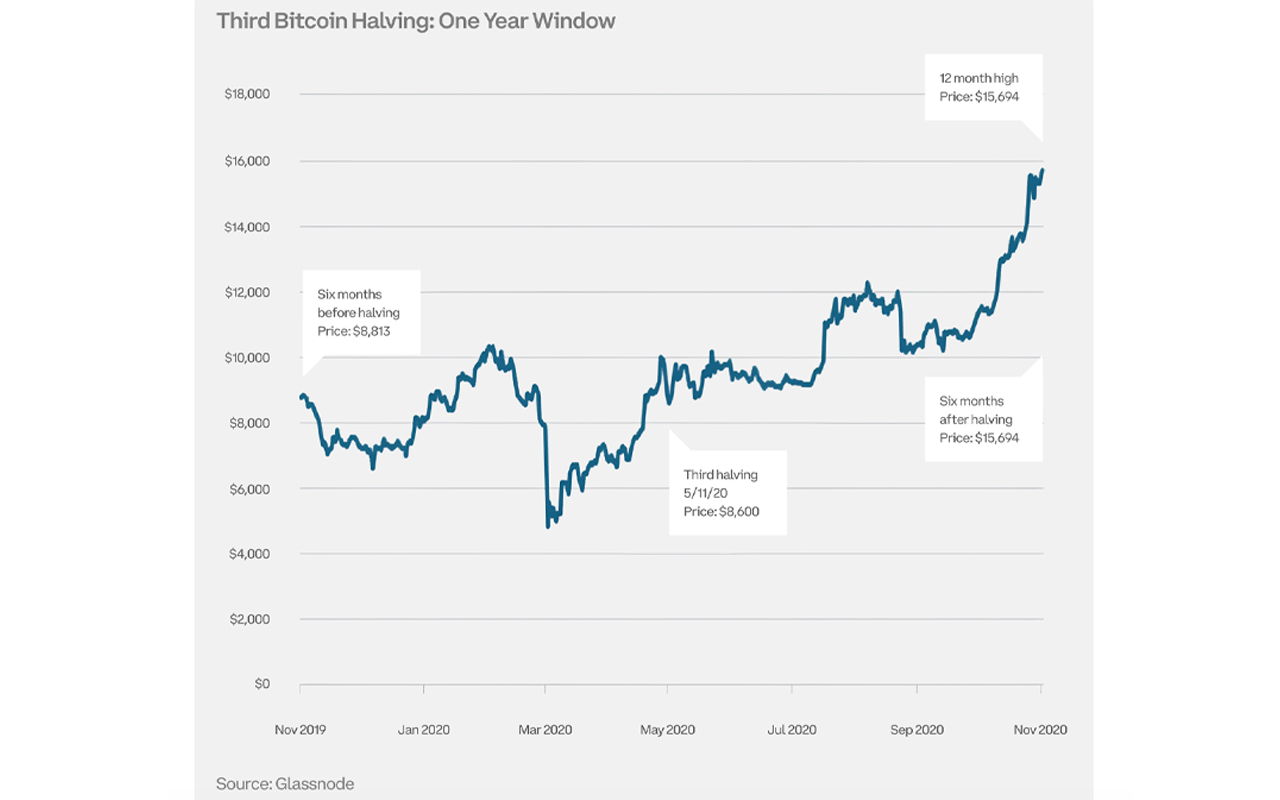

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

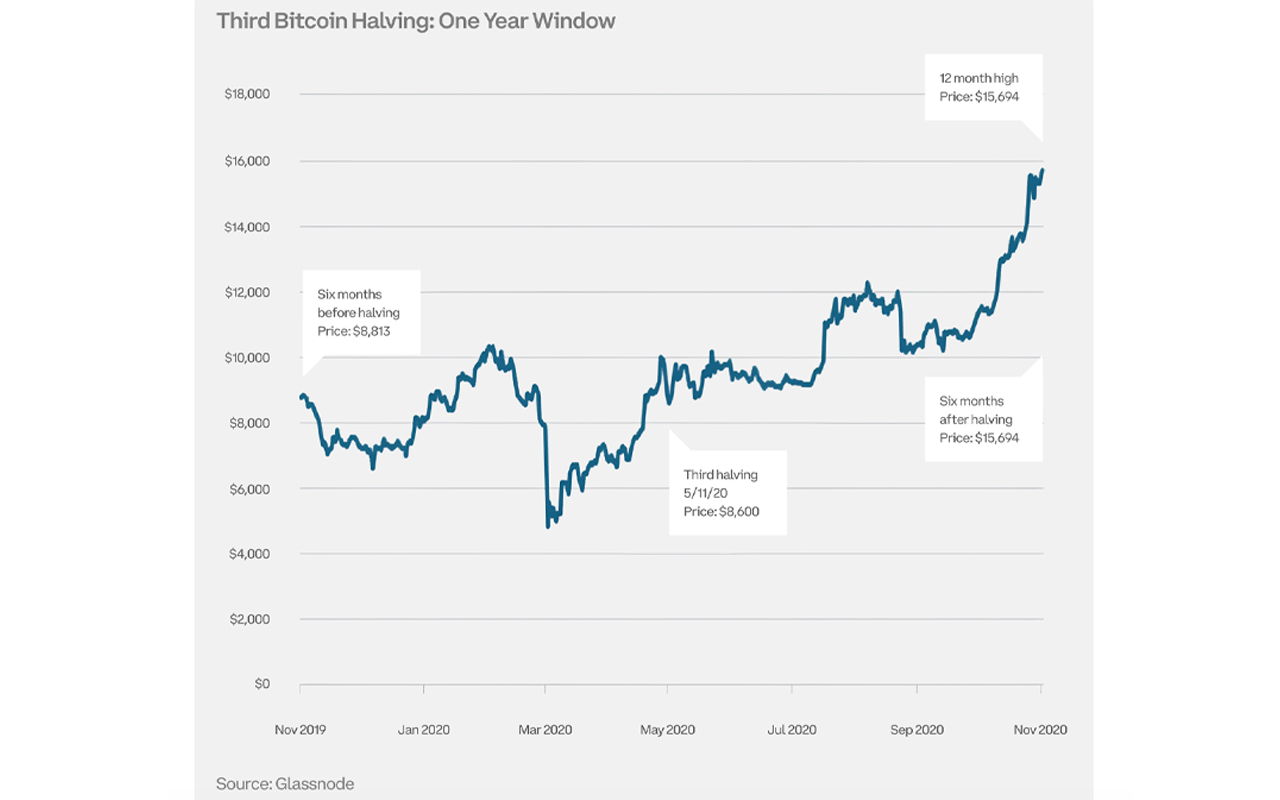

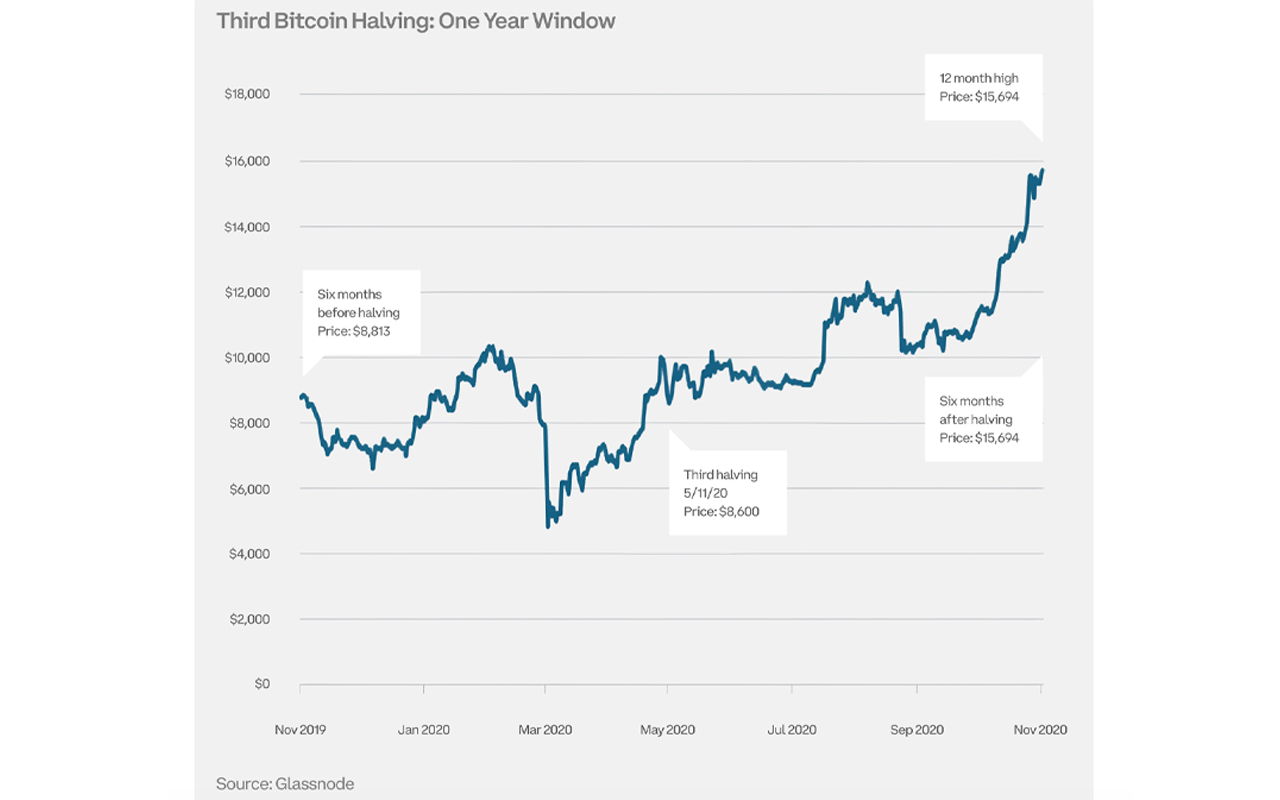

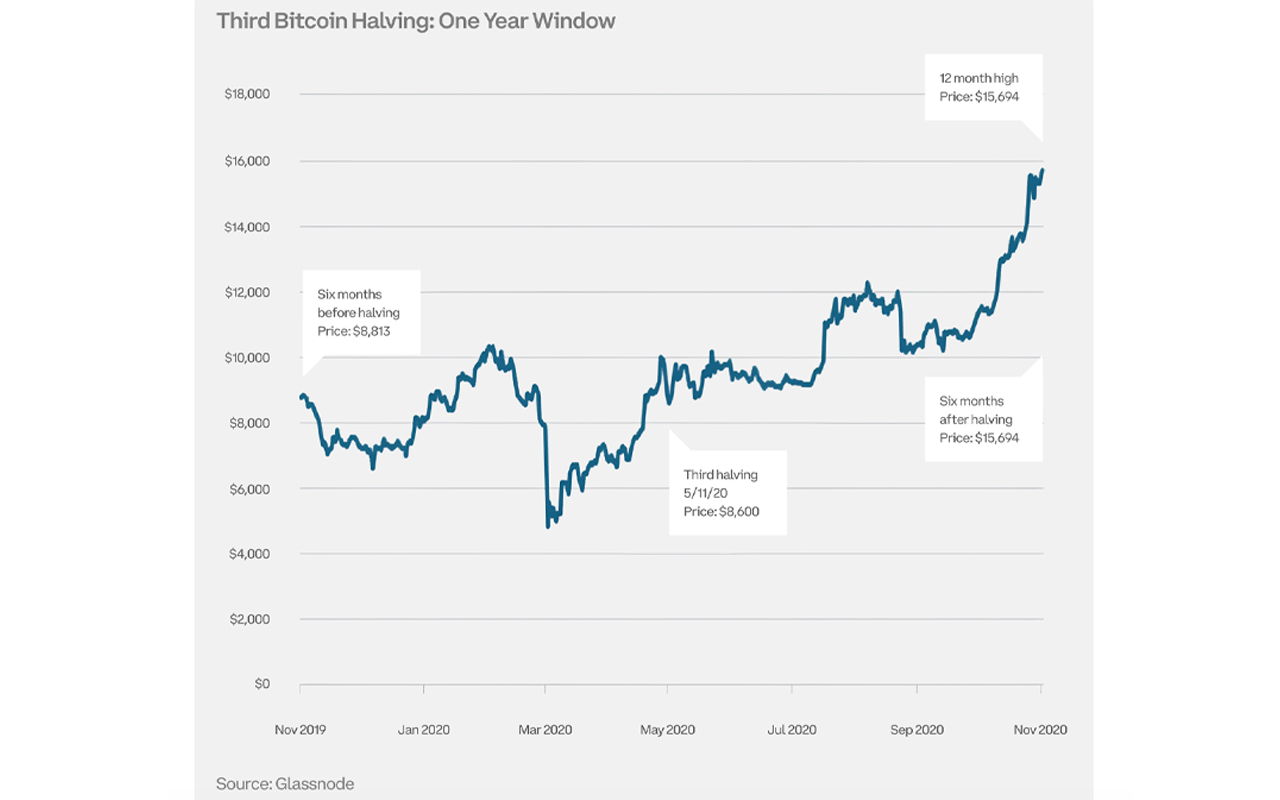

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

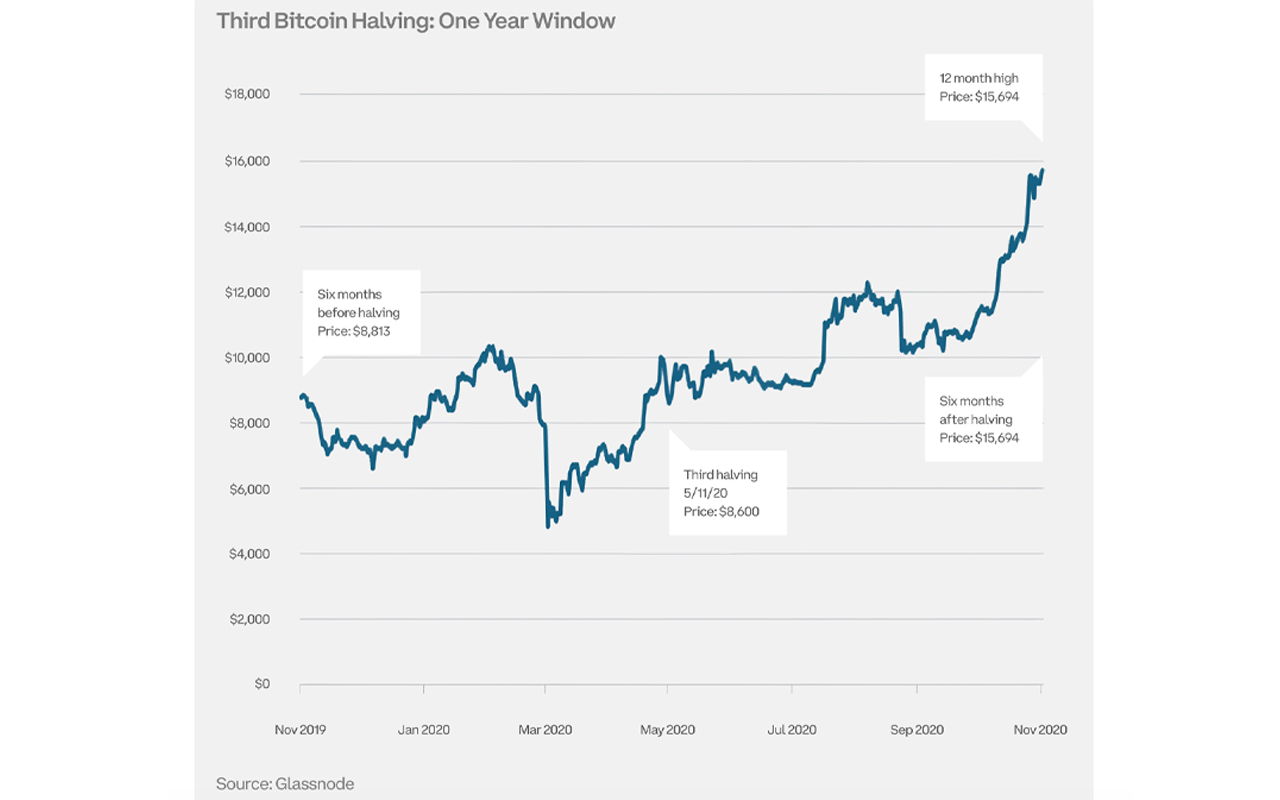

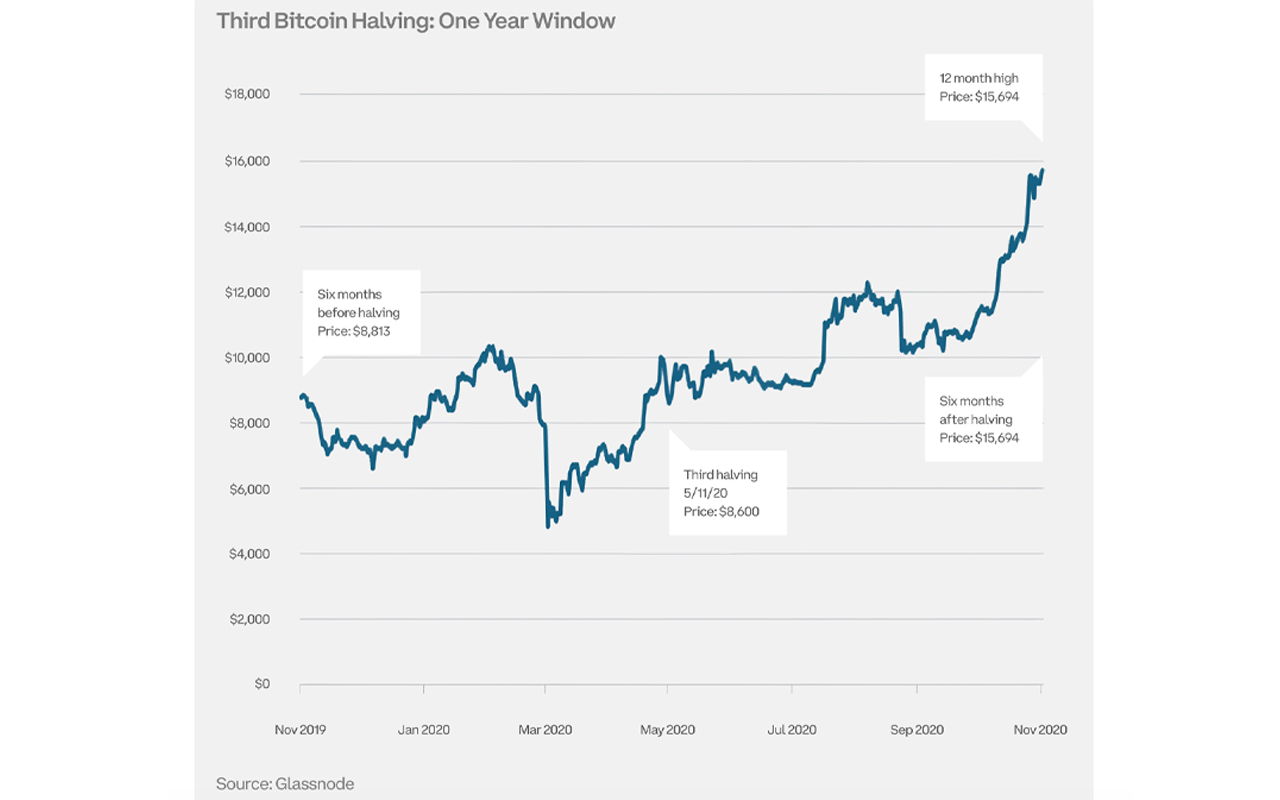

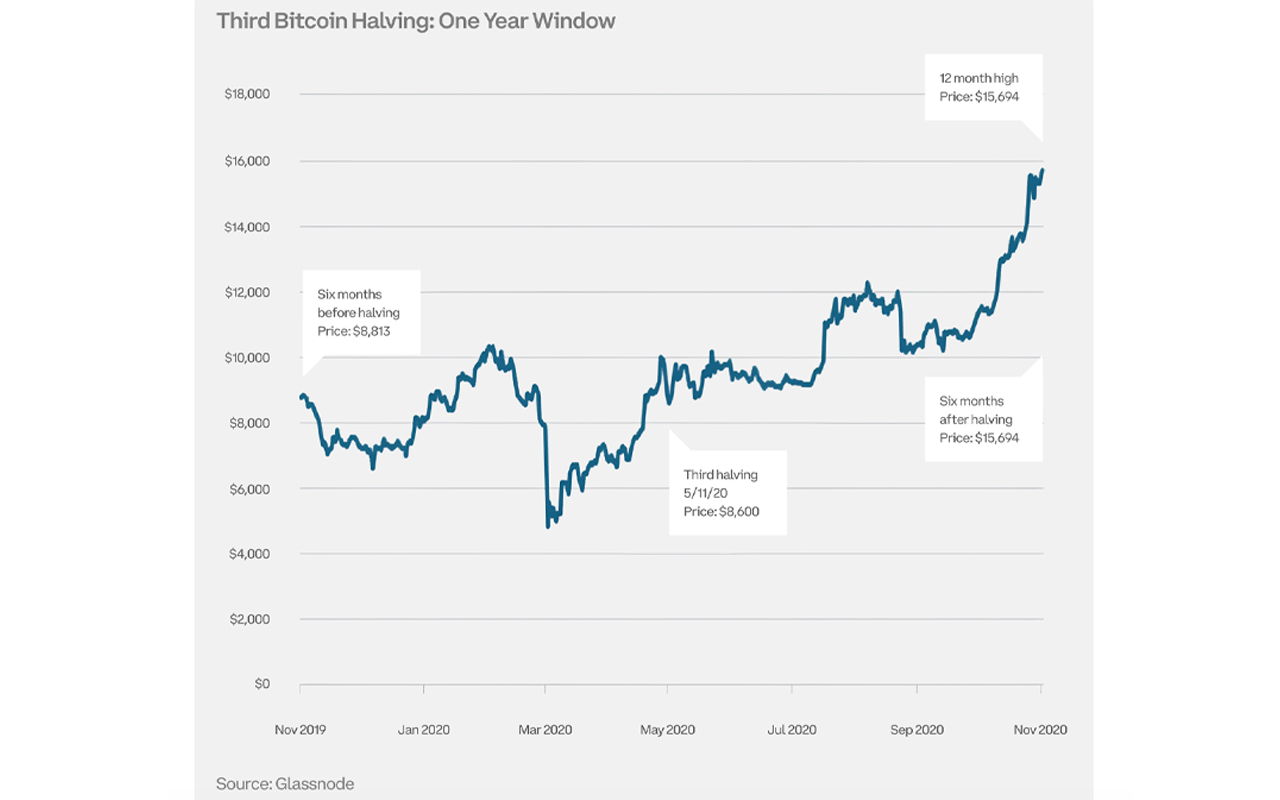

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

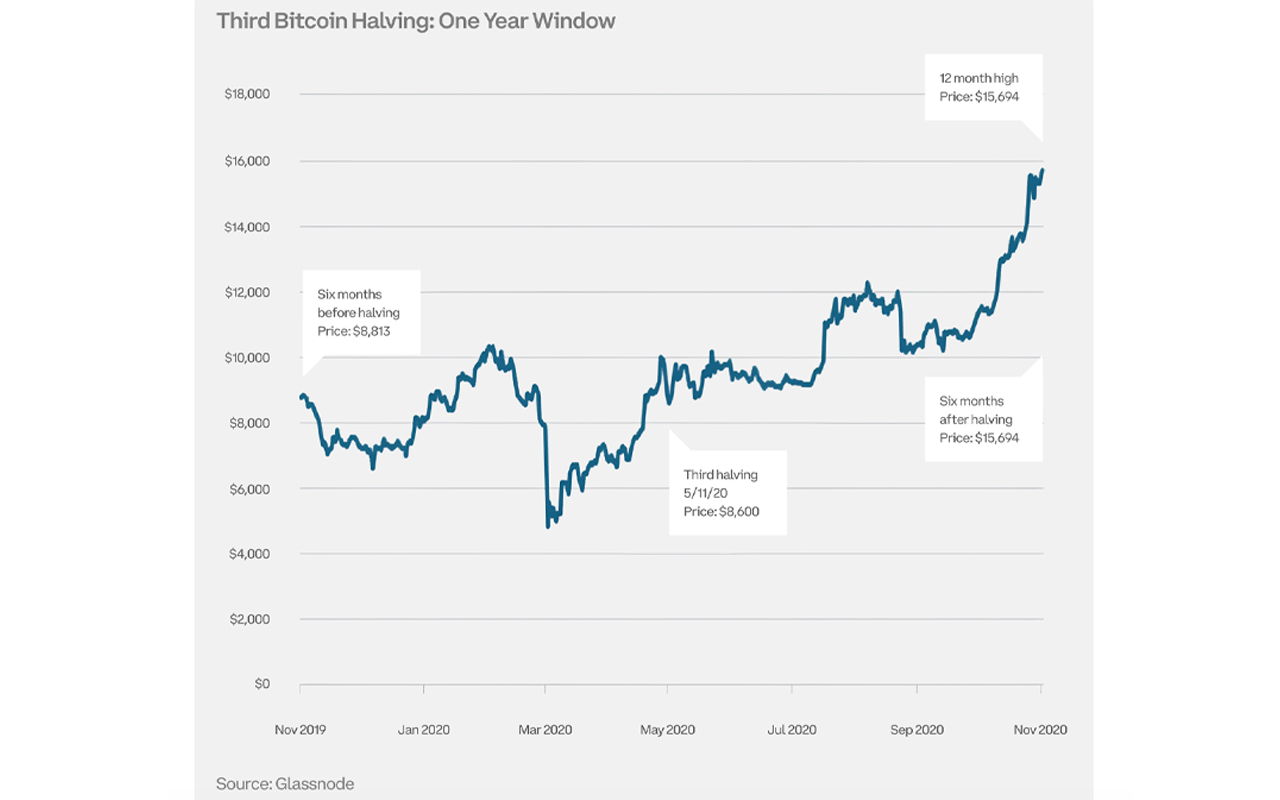

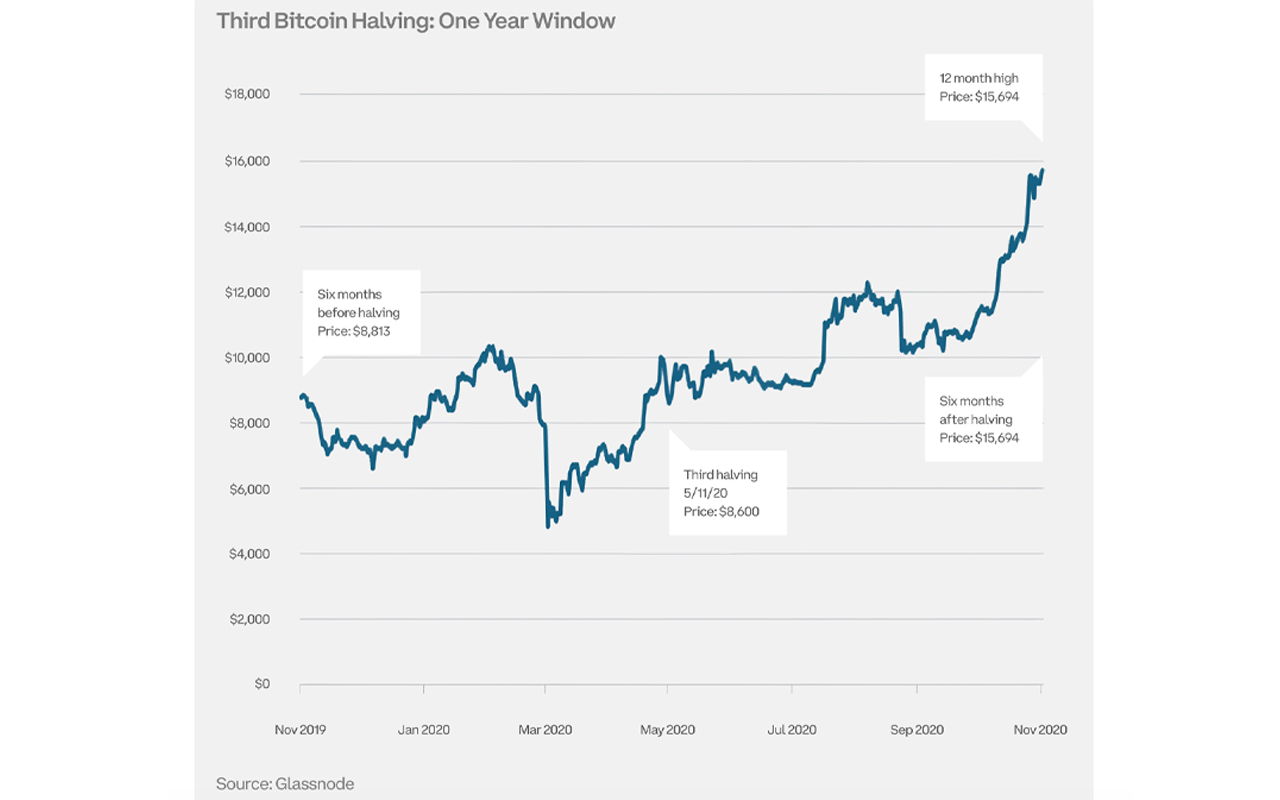

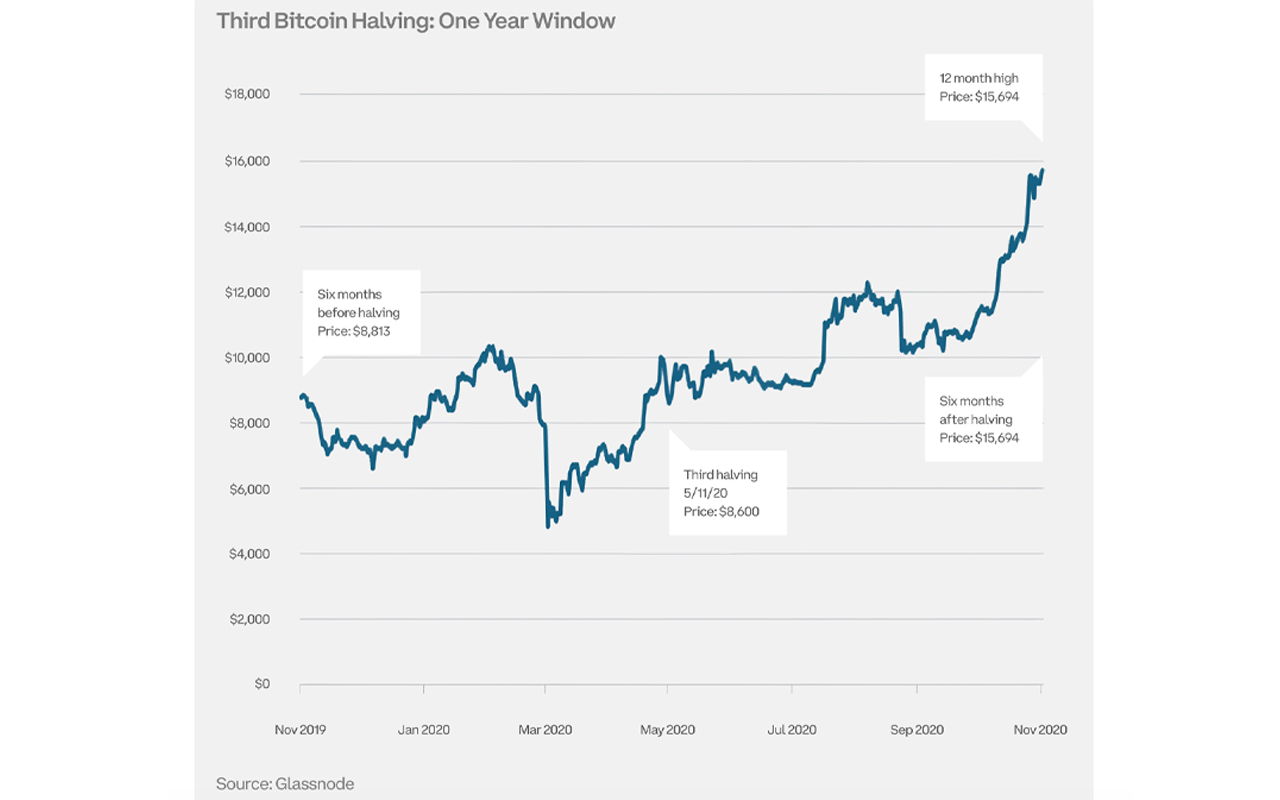

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.

In its latest “Halving Handbook,” Coinbase Institutional draws striking comparisons between the upcoming Bitcoin halving and the market cycle from 2018-2022, offering insights into the potential impacts on the crypto economy.

Coinbase’s Halving Handbook

The next Bitcoin halving, set for mid-April 2024, is poised to slash miner rewards from 6.25 BTC to 3.125 BTC, a change that has historically influenced the asset’s value and investor strategy. This halving marks the fourth of its kind, continuing Bitcoin’s design to limit inflation by decreasing the supply of new coins entering circulation. As with previous halvings, this event is anticipated with a mix of speculation and analysis, with Coinbase Institutional offering a detailed comparison to the cycle spanning 2018 to 2022, highlighting a 500% gain from its cycle low. Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

Analyzing past halvings, Coinbase reports varied outcomes post-event, with the first halving in 2012 leading to a significant 923% price surge in the following six months. However, subsequent halvings showed moderated yet positive impacts on bitcoin’s price, underlining the unique circumstances surrounding each event. Despite these historical uptrends, Coinbase advises caution, emphasizing the speculative nature of extrapolating past performance to predict future outcomes. “Investors should be cautious about accepting this view at face value,” Coinbase researchers detail. The report adds:

While it’s possible that the halving could have a positive impact on bitcoin’s performance, there’s still only limited historical evidence about this relationship, making it somewhat speculative.

The report also sheds light on the broader macroeconomic factors influencing bitcoin’s price, such as monetary policies and fiscal stimulus measures. Notably, the anticipation around spot bitcoin exchange-traded funds (ETFs) and the potential easing of Federal Reserve policies are highlighted as significant contributors to recent price rallies, suggesting that halvings are just one of many factors that can sway BTC’s market dynamics.

Onchain analytics, as presented by Coinbase’s report, offer another lens through which to view the halving’s potential impacts. Long-term holder (LTH) behavior and supply dynamics provide insights into market sentiment and the foundational shifts that may arise from the halving event. The high supply in the hands of LTHs, coupled with decreasing trends post-ETF introductions, paints a complex picture of supply and demand influences on bitcoin’s future price.