OKX vs. Coinbase: Which Crypto Exchange is Best?

Coinbase has been one of the dominant players in the exchange industry since its launch back in 2012 and has served as a fantastic exchange for those new to crypto or anyone looking for a simple crypto trading platform.

Like any highly competitive industry, there is a lot of innovation happening in the space, with many crypto exchanges taking market share away from Coinbase and battling to get into the coveted top five ranking for exchanges by trading volume.

OKX is one of those exchanges, enjoying a faster rate of growth than much of the competition and making waves in the crypto space. Already ranked as the #8 exchange in the world for Spot and #2 for Derivatives trading, OKX is quickly becoming the preferred place for many traders and crypto enthusiasts. Today’s OKX vs. Coinbase review will help you determine if OKX or Coinbase is right for you.

OKX vs Coinbase

OKX and Coinbase are both fantastic exchanges for users looking for a safe, reputable, regulated and licensed exchange. Because of US regulatory compliance, Coinbase will probably be the preferred choice for US-based users while OKX is often favoured for anyone located outside of the States.

These two exchanges are quite different in their products and features. Here is a quick TL; DR to summarise these two at a glance:

Like most US-based exchanges, Coinbase does not offer nearly as many tradeable instruments or products as many of its international counterparts. Users will find OKX significantly outmatches Coinbase when it comes to advanced trading features, tradeable instruments, derivatives and margin trading.

OKX also features a robust earn platform, a Launchpad, Bot trading, and plenty of other features that Coinbase does not, making OKX better suited to a wider range of users. It is also worth mentioning the OKX Web Wallet, a pretty nifty self-custodial wallet that is a potential game changer. It may just be the most versatile and useful software crypto wallet made to date.

It is also worth mentioning the OKX Web Wallet, a pretty nifty self-custodial wallet that is a potential game changer. It may just be the most versatile and useful software crypto wallet made to date.

As Coinbase is regulated in the US and is a publicly traded company, unfortunately, there seems to be a lot of red tape dictating what products they can and cannot offer, making their product and asset selection not the greatest. Though many crypto users do not consider that to be too much of a weakness, and as they are the second biggest exchange in the world, it doesn’t seem to hold them back too severely.

Many consider Coinbase’s simplicity and lack of products/features as a strength, as it makes Coinbase the perfect exchange for new users. It is incredibly beginner-friendly, and most crypto veterans you talk to will likely tell a similar story that Coinbase was where they bought their first Bitcoin before graduating to other platforms like Binance, KuCoin, or OKX. Along with SwissBorg and Kraken, Coinbase is often recommended to new users and the one major benefit Coinbase has over OKX is the ability to withdraw fiat to bank account with full fiat on and offramp services. Many crypto users will have accounts at more than one crypto exchange and use Coinbase primarily as a fiat on and offramp and conduct their trading elsewhere. Coinbase really is one of the best platforms for crypto users who enjoy simplicity and is one of the safest exchanges for fiat to crypto transactions.

Along with SwissBorg and Kraken, Coinbase is often recommended to new users and the one major benefit Coinbase has over OKX is the ability to withdraw fiat to bank account with full fiat on and offramp services. Many crypto users will have accounts at more than one crypto exchange and use Coinbase primarily as a fiat on and offramp and conduct their trading elsewhere. Coinbase really is one of the best platforms for crypto users who enjoy simplicity and is one of the safest exchanges for fiat to crypto transactions.

Let’s take a closer look at each exchange individually, but first, we will cover an overview of our findings when we compared OKX to Coinbase.

OKX vs. Coinbase: Products Offered

As mentioned above, OKX has a far better selection of products to offer its users than Coinbase. Coinbase is primarily a cryptocurrency exchange with a few basic methods for users to earn passive income via staking, lacking behind the earn features offered by competitors such as Binance and OKX.

Both Coinbase and OKX offer an NFT marketplace, OKX provides an easy way for users to get involved in Polkadot parachain slot auctions, while Coinbase users can enjoy the use of the Coinbase crypto debit card.

Users interested in launchpad investing or auto-trading bots will opt for OKX, as will any traders looking for better asset support and leverage trading. But Coinbase has one thing that no other exchange can match, and that is the confidence Coinbase users have in knowing that they are trusting one of the safest, most reputable, respectable, regulated and licensed crypto exchanges in the world. Breaking down the products, here is what OKX offers its users:

Breaking down the products, here is what OKX offers its users:

- Buy crypto with over 90 fiat currencies.

- Swap crypto easily with the convert feature.

- Access an advanced trading interface for spot, margin, and derivatives trading.

- 125x leverage on Futures, 5x Leverage on spot pairs.

- Easy integration to DeFi and Web3 DApps.

- OKX Web3 Wallet

- Trading bots.

- Earn section, crypto lending, and launchpad.

- NFT marketplace.

- Safety + security with comprehensive licensing and regulatory compliance and robust security measures.

Here is what Coinbase has going on:

- Buy crypto with 3 fiat currencies

- Deposit and withdraw fiat with full banking services

- Trade with a beginner-friendly interface

- Access to advanced trading interface for experienced traders

- Coinbase Crypto card

- Basic crypto staking support

- Coinbase Wallet

- Spot and derivatives trading

- NFT marketplace

- Safety + Security with the most trusted exchange in crypto.

That covers the products and features at a high-level overview. How else do these two measure up?

Coinbase vs OKX: User Friendliness

For anyone who has ever used an online bank or a brokerage account, you should have no issues navigating either of these platforms. They are both very easy to use and have an intuitive layout and design.

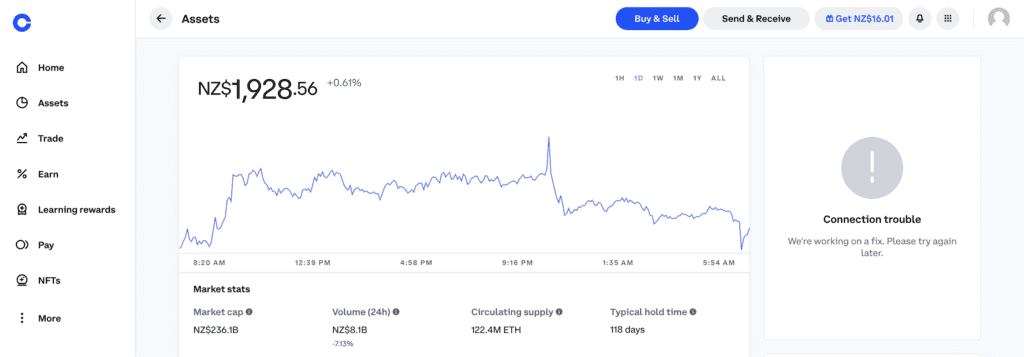

I think most would agree that OKX has a more aesthetically pleasing interface and is more beautifully designed, with the eye candy providing a satisfying user experience. I mean, just look at the homepage: But it isn’t all about the looks, is it? Functionality is more important and when it comes to the user-friendliness of these platforms, you can’t beat the simplicity and cleanliness of Coinbase.

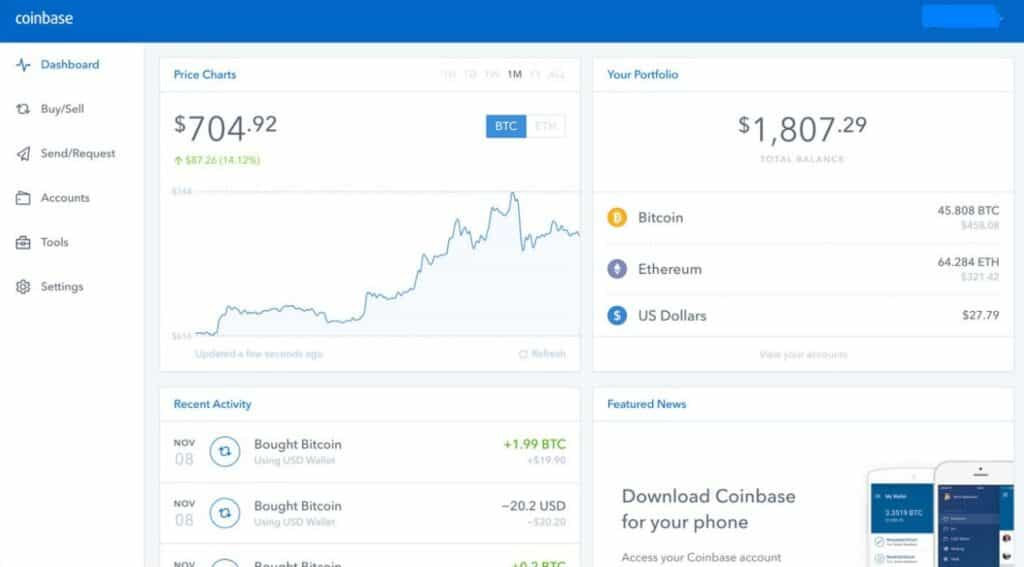

But it isn’t all about the looks, is it? Functionality is more important and when it comes to the user-friendliness of these platforms, you can’t beat the simplicity and cleanliness of Coinbase. If I had to recommend one of these exchanges to my grandfather, at the worry of OKX giving the guy a heart attack, I’d have to recommend Coinbase.

If I had to recommend one of these exchanges to my grandfather, at the worry of OKX giving the guy a heart attack, I’d have to recommend Coinbase.

Coinbase is so simply designed that you can get familiar with all the features, functions, and settings of the platform in no time. It’s a true minimalist's dream.

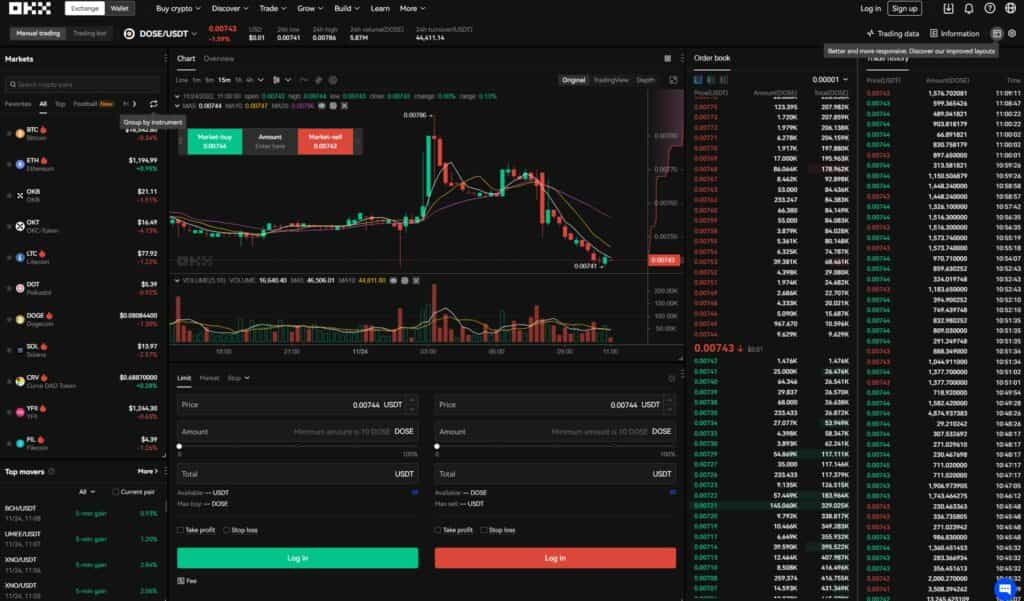

In the defence of OKX, I don’t know how anyone could design a platform as robust as OKX, with so many products and features without having the site be a little overwhelming and cluttered. Despite it not being as easy to use as Coinbase, it is still a very well-designed platform, highly intuitive and functional enough to navigate. I think the OKX team absolutely nailed their platform design; the millions of users around the world who use the OKX exchange would likely agree.

OKX seems to have anticipated the concern about all the products and functions being overwhelming to new users and has done a fantastic job in segregating their platform into different areas for users with different needs so new users don’t have to be bombarded with all the features they are unlikely to use. When doing research for both of these platforms, I found both OKX and Coinbase have fairly robust knowledge base/self-help sections. This is pretty important for users, especially new ones as many of the issues faced may be a quick knowledge base article away from being able to resolve within minutes on your own.

When doing research for both of these platforms, I found both OKX and Coinbase have fairly robust knowledge base/self-help sections. This is pretty important for users, especially new ones as many of the issues faced may be a quick knowledge base article away from being able to resolve within minutes on your own.

I found the OKX knowledge base easier to find the information that I was searching for as the search function returned more relevant articles. The search function on Coinbase is pretty terrible, to be honest, you may be better off using Google to find Coinbase help articles if you need them.

One thing Coinbase deserves serious Kudos for is their dedication to crypto education. Obviously, for us here at the Coin Bureau, we place a lot of emphasis and importance on educating the world in all things crypto-related, and it is good to see platforms like Coinbase also fighting the good fight. Coinbase Learn is a great resource to soak up as much crypto knowledge as you can, and you can even earn free crypto by going through some lessons. To sum up this section, Coinbase is considerably more user-friendly, clean, and has a minimalist interface, but it comes at the cost of having fewer features and products. The OKX platform has a lot of bells and whistles and is more robust for experienced traders or users with crypto needs outside of just trading, though new users may find it overwhelming.

To sum up this section, Coinbase is considerably more user-friendly, clean, and has a minimalist interface, but it comes at the cost of having fewer features and products. The OKX platform has a lot of bells and whistles and is more robust for experienced traders or users with crypto needs outside of just trading, though new users may find it overwhelming.

If we turn our attention to the main trading function itself, Coinbase offers two versions: simple and advanced. The simple version is designed with new traders in mind, and those who do not need advanced charting or order functionality.

With simple trading on Coinbase, all a trader needs to do is select the asset they want to trade, click the Buy or Sell button, enter the amount and they are done.

The advanced trading feature on Coinbase is similar to ones offered on the likes of KuCoin, Binance and OKX, which is powered by TradingView and capable of meeting the needs of advanced traders. OKX also offers a Convert feature that allows for “one-click-trading” similar to Coinbase, which is great for newbies or those looking for simplicity. For active traders, OKX houses an advanced trading interface with all the order types and charting capabilities needed, suitable for the most hardcore technical analysis traders.

OKX also offers a Convert feature that allows for “one-click-trading” similar to Coinbase, which is great for newbies or those looking for simplicity. For active traders, OKX houses an advanced trading interface with all the order types and charting capabilities needed, suitable for the most hardcore technical analysis traders. Along with the TradingView integration, OKX traders can also use its native trading interface, which supports a depth chart and additional functionality.

Along with the TradingView integration, OKX traders can also use its native trading interface, which supports a depth chart and additional functionality.

Both platforms offer industry-leading matching and trading engines with nearly flawless trade execution and deep liquidity, making either of these platforms suitable for professionals, institutions, and amateurs alike.

OKX vs Coinbase Fees

So far, we’ve covered that Coinbase is often considered the better platform for new users, while OKX caters to a more sophisticated level of trader looking for more functionality from a trading platform.

When it comes to fees, there is no getting around the fact that OKX takes a massive win in this category. These two are about as different as night and day.

The largest criticism against Coinbase, aside from poor customer support response times, is its brutally high fees, which has left me wondering how they have remained such a dominant exchange for so long. OKX is a leader in the low-cost space, along with the most popular exchange in the world, Binance.

Together, OKX, KuCoin, and Binance offer incredibly low trading fees while Coinbase remains on the higher end.

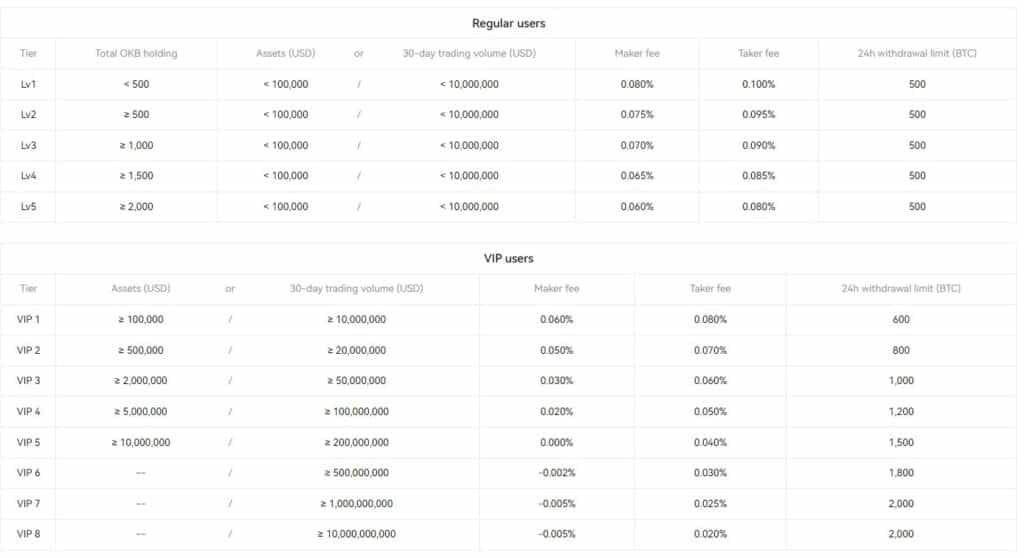

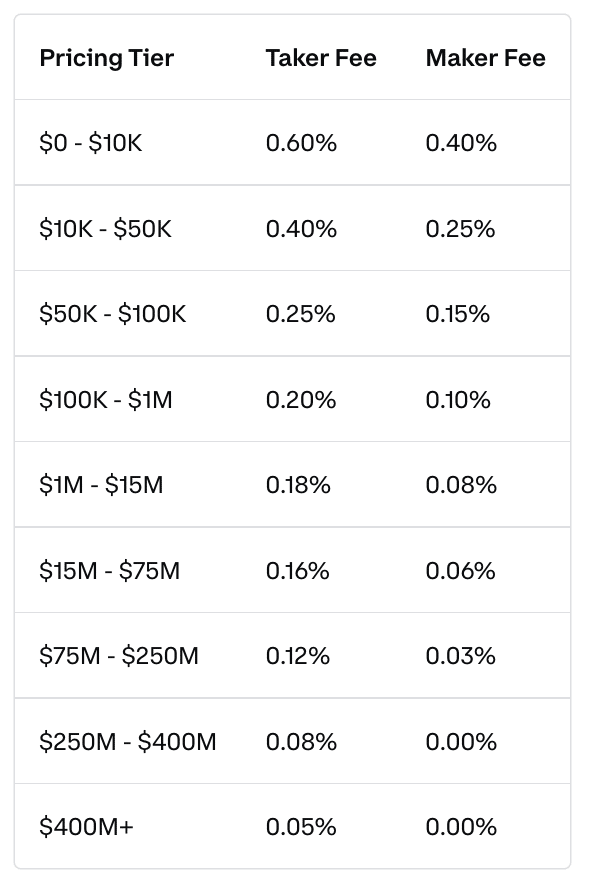

Both Coinbase and OKX use a maker/taker fee model, with fees being determined by trading volume and/or assets held. Entry-level traders on Coinbase can expect to pay 0.60% maker and 0.4% taker fees, while entry-level traders on OKX are looking at a mere 0.08% for maker and 0.1% for taker fees.

Here is a look at OKX fees for spot trading:

Here is a look at Coinbase fees: Pro Tip: With the same Coinbase account, Coinbase users can access Coinbase Pro for no extra cost. The trading fees on Coinbase Pro are lower than the standard Coinbase platform, so it is definitely worth learning to use it.

Pro Tip: With the same Coinbase account, Coinbase users can access Coinbase Pro for no extra cost. The trading fees on Coinbase Pro are lower than the standard Coinbase platform, so it is definitely worth learning to use it.

Though the trading fees are lower on OKX, Coinbase will likely be the cheaper platform for purchasing crypto with fiat in most cases. The reason for this is that Coinbase can natively accept bank transfers and deposits, unlike OKX, which facilitates its purchases through third-party payment providers, many of which charge higher fees on average.

Bank deposits will often be cheaper than purchasing crypto with card. OKX has a few fee-free bank deposit methods depending on the currency and method selected, but on average, Coinbase will be the cheaper place to buy crypto.

This is why it is common for many users to have an account on both Coinbase and OKX, choosing to buy crypto on Coinbase, and then transferring crypto to OKX to take advantage of trading or the plethora of other products.

OKX vs Coinbase Security

When it comes to Crypto exchanges, it is really import

It is important to disclose that Coinbase suffered a hack in May of 2021 where over 6,000 Coinbase customer accounts were drained. Another black eye for Coinbase happened when Fox released an article in December 2021 about a couple whose account was hacked and drained of $24,000 even though they stated they had two-factor authentication enabled and the account was password protected. It is not known how hackers gained access to the account but it is sad to see that Coinbase did not reimburse the couple as they do not cover unauthorised access to accounts. Coinbase reimbursed the funds to the over 6,000 customers that were hacked in May as the fault was found to be in a 2FA breach on the Coinbase platform.

It is not known how hackers gained access to the account but it is sad to see that Coinbase did not reimburse the couple as they do not cover unauthorised access to accounts. Coinbase reimbursed the funds to the over 6,000 customers that were hacked in May as the fault was found to be in a 2FA breach on the Coinbase platform.

Aside from the major breach in 2021, Coinbase is one of the most trusted and safest brands in crypto, even offering professional custodial services to institutions who trust Coinbase with hundreds of millions of dollars as Coinbase definitely knows a thing or two about how to keep funds secure.

Along with the standard 2FA security measures in place, Coinbase operates on a bulk cold storage policy where 98% of coins held by the company are located in air-gapped cold storage wallets.

Coinbase is one of the few exchanges that provide FDIC insurance to US customers, offer insurance protection for users who want extra coverage, and keep a reserve of their profits to reimburse customers in the event of a security breach.

Coinbase users will find the following security features on the platform:

- 2FA Verification

- Passwords stored in encrypted form using bcrypt algorithm

- Active monitoring of third-party breaches and darknet activity

- Users can access crypto vault

- Users can set up an option to receive security notifications for all major security changes to their account with the option to lock their account if they choose to do so.

Changing focus now to OKX, the OKX team have an ironclad grasp on the security of user funds, going steps further than most exchanges with their unique approach to mixing online and offline storage systems secured with multi-signature protection, multiple backups, and location-separated QR codes and restricted personnel access.

Here is a look at the security lengths undertaken by OKX:

- Each cold wallet address stores no more than 1,000 BTC and each address is only used once.

- Private keys never come into contact with the internet or USB drives. Each private key is encrypted and held on an offline computer using AES with any non-encrypted keys being deleted.

- Employees hold AES-encrypted passwords in different locations.

- The offline private keys are only accessible via QR codes, never coming into contact with the internet.

- QR codes are printed and copies are stored in separate bank vaults on different continents, each requiring in-person access.

OKX keeps 95% of funds in offline, air-gapped cold storage environments, outside of the reach of hackers. The other 5% of funds are held in hot wallets where OKX uses semi-offline multi-signature mechanisms and multiple risk management methods to verify deposits and withdrawals, reducing any likelihood of unauthorised access.

OKX has a solid security track record with no security breaches being noted in recent years, and in the unlikely event of a hack resulting in stolen funds, OKX has a risk reserve fund to reimburse users. All this together makes OKX one of the most secure exchanges in the world.

From a customer perspective, users can enable the following security options to secure their accounts:

- Login password

- Email verification

- 2FA for login

- Google Authenticator

- Mobile verification

- Secondary password for withdrawals

- Anti-phishing code