Japan’s “Great repatriation”

Bank of Japan, Yield Curve Control and Repatriation

After decades of deflation and the lack of growth, Bank of Japan (BoJ) established Yield Curve Control (YCC) in 2016. The purpose of the policy was to support lending, stimulate growth and increase inflation. The main difference of YCC from Quantitative Easing is that it mostly targets not short or medium-term rates, but longer-term ones. By shifting to YCC, BoJ sought to cap the yield on 10-year Japanese government bonds (JGB) at 0%. BoJ always intervenes in the market and purchases 10-year JGB whenever their yield rises above the peg. This massive buying by the central bank pushes long-term yields down to the peg, which is believed to stimulate the economy.

Why did the central bank of Japan choose to employ YCC? The main reason is to control, unsurprisingly, the yield curve, mostly its short- and medium-term part. These rates affect corporate borrowers. Setting short-term rates at negative 0.1% serves this purpose because they support economic growth. But very low long-term rates affect the profitability of long-term players, such as life insurers and pension funds. So, the idea was that “let’s keep short-term interest rate below zero thus stimulating economy, but without decreasing long-term rates too much which would depress the returns of big financial institutions with a longer time horizon”. The advantage of YCC for the central bank is that it allows BoJ to only purchase government bonds when long-term market yields are above the cap. Repatriation of funds

Repatriation of funds

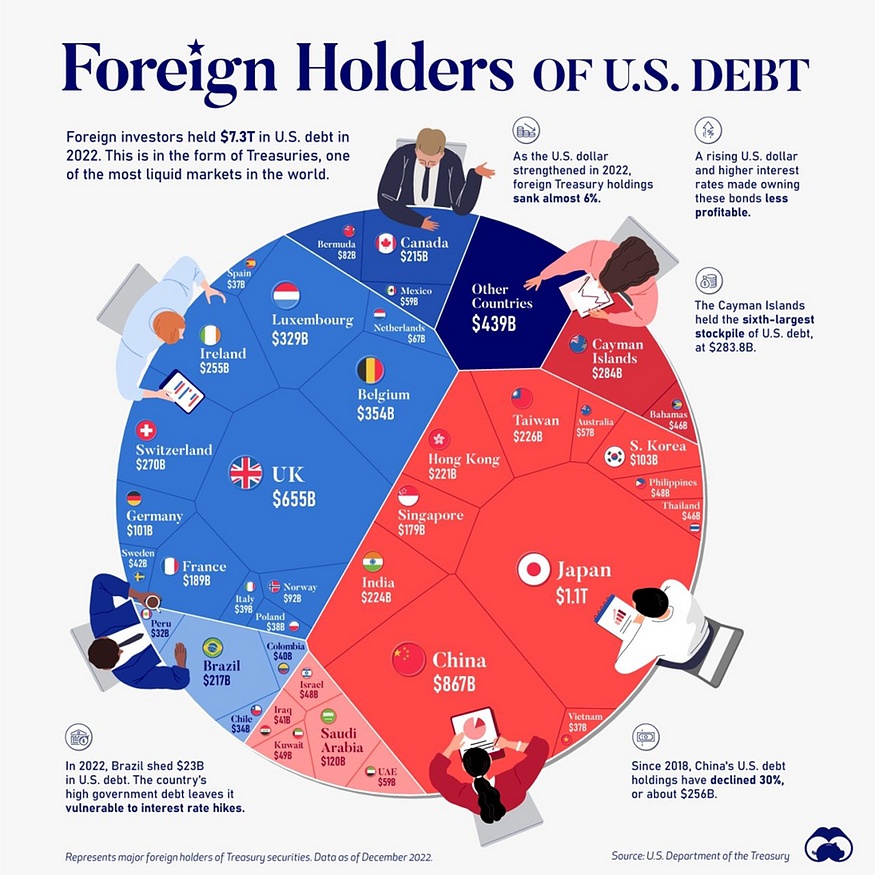

There can be huge consequences for the shift in the loose monetary policy of BoJ. If they go away from YCC, it will cause enormous volatility in financial markets. An increase in long-term rates will reduce interest rate differential between foreign and Japanese government bonds. This can lead to a massive repatriation of funds which is just a term for converting money from foreign currency into home currency. Why hold your money in USD or EUR if the yield in yen is not as low as it used to be? Given that, Japan is one of the largest holders of US debt, this will probably depress US Treasury bond prices increasing their yield.

When large Japanese investors, such as insurers, banks or pension funds buy foreign bonds, they hedge their positions against currency movements. As we all have seen and still continue to see interest rates are rising in the developed world where big Japanese players invest in bonds. This and the depreciation of yen against other currencies increase hedging costs which reduces the yield gap between Japan and other advanced economies. And this implies that JGBs don’t seem relatively bad for local investors.

Below is the chart showing that the yield on a 10-year JGB is higher than the currency-hedged yield on an equivalent Treasury bond. We see that the gap, which began to decrease when central banks in the developed world started hiking interest rates, is deepening at a “sub-zero territory”. This is the reason why Japanese investors have been selling their foreign assets within the past a yearn and a half despite the rising yields in Europe and the US. Therefore, when on 28th July a policy statement by BoJ stated that the yield on 10-year JGBs would be allowed to be as high as 1% (up from 0.5% previously), it caused huge volatility in the US and European bond markets. The reaction of global bond markets to the potential end to ultra-loose monetary policy of BoJ was rising global yields.

Therefore, when on 28th July a policy statement by BoJ stated that the yield on 10-year JGBs would be allowed to be as high as 1% (up from 0.5% previously), it caused huge volatility in the US and European bond markets. The reaction of global bond markets to the potential end to ultra-loose monetary policy of BoJ was rising global yields. Increasing yields in Japan will convince big local investors to get rid of their foreign assets which can lead to soaring bond yields in advanced economies. I think the great repatriation is just getting under way.

Increasing yields in Japan will convince big local investors to get rid of their foreign assets which can lead to soaring bond yields in advanced economies. I think the great repatriation is just getting under way.

Carry trades unwinding

Another significant result will be yen appreciation because repatriation of funds will increase the demand for Japanese currency.

Carry trading is borrowing at a low interest rate and investing at a high interest rate. It’s mostly popular in FX due to interest rate differentials. Let’s say, you can borrow at 0.5% in Japanese yen, and invest it at 5.5% in pound sterling. If the spot price of GBPJPY (Pound sterling against Japanese Yen) doesn’t change much, you’ll profit 5.0%. Due to its “easy money” nature, carry trading is massive in currency markets. Huge buying interest will increase the value of yen which will result in unwinding of carry trades. Given the high open interest in carry trades, this can send jitters not only in currency markets but all markets with serious consequences. Margin calls will make currency traders get out of their positions which will increase the value of yen which will make traders close their yen positions due to forced liquidations and so on.