Central Bank Digital Currencies

Introduction: Fundamental Concepts of Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) represent a paradigm shift in the landscape of modern finance. As we delve into the intricate world of CBDCs, it becomes imperative to understand the fundamental concepts that underpin these digital currencies. At its core, a CBDC is a digital form of a nation's currency, issued and regulated by the central bank. Unlike decentralized cryptocurrencies such as Bitcoin, CBDCs are centralized and typically rely on advanced technologies like blockchain to ensure security and transparency. This introduction aims to unravel the essential characteristics and motivations behind the creation of CBDCs, offering readers a comprehensive understanding of the transformative potential these digital currencies hold in reshaping the traditional monetary system.

Technological Infrastructure: Blockchain and Security

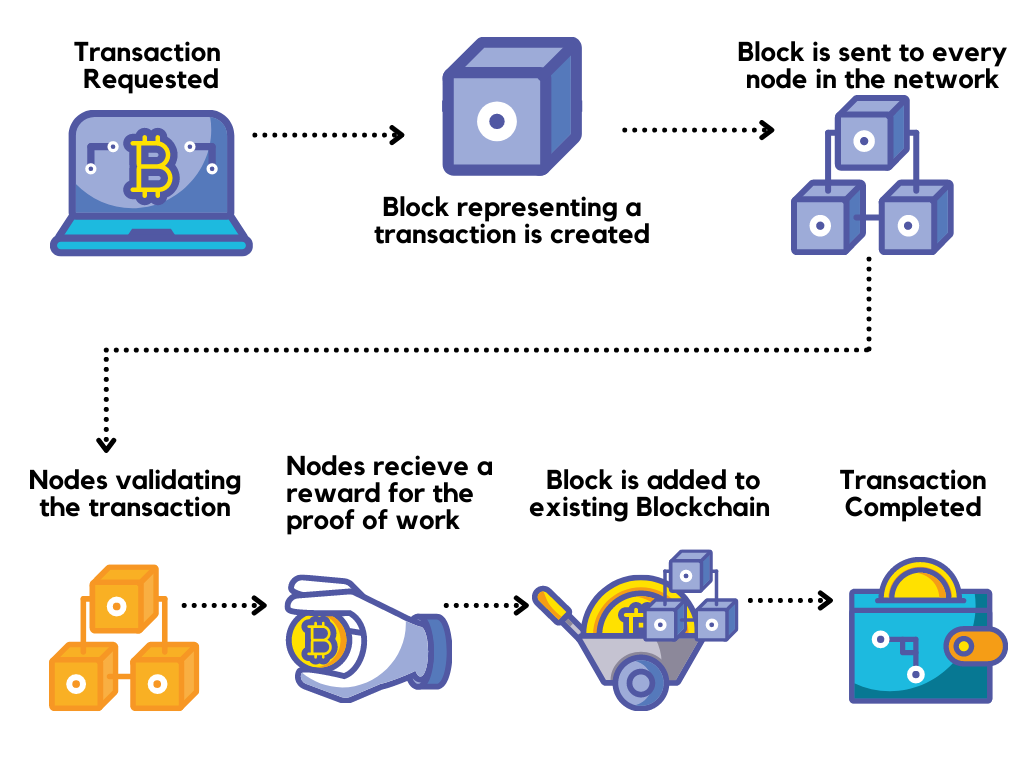

The advent of Central Bank Digital Currencies (CBDCs) brings forth a pivotal shift in the technological underpinnings of modern financial systems. At the heart of this transformation lies the innovative utilization of blockchain technology to secure and facilitate transactions. Blockchain, a decentralized and distributed ledger, ensures transparency, immutability, and cryptographic security for CBDCs. By leveraging blockchain, central banks can enhance the integrity of financial transactions, mitigate the risk of fraud, and establish a tamper-resistant record of currency issuance and circulation. The emphasis on security in CBDCs extends beyond the use of blockchain, encompassing robust encryption protocols and authentication mechanisms. This section explores the intricate relationship between CBDCs and blockchain, shedding light on the technological infrastructure that not only defines their functionality but also reinforces the trust and security essential for the widespread adoption of digital currencies.

Financial Transformation: Transition from Traditional Monetary Systems to Digital Currencies

The concept of Central Bank Digital Currencies (CBDCs) marks a significant phase in the evolution of financial systems, representing a departure from conventional monetary frameworks. This financial transformation is characterized by the gradual shift from traditional forms of currency, such as banknotes and coins, towards digitized representations regulated by central banks. CBDCs offer a host of advantages, including increased efficiency, reduced transaction costs, and enhanced financial inclusion. The transition also holds the potential to reshape the banking landscape, influencing how individuals and businesses engage with the financial ecosystem. As CBDCs gain prominence, this section delves into the multifaceted aspects of the financial transformation, exploring the implications for monetary policy, banking operations, and the overall dynamics of the global economy in this new era of digital currencies.

User Experience: Impacts of Central Bank Digital Currencies on End Users

The introduction of Central Bank Digital Currencies (CBDCs) brings about a transformative shift in the way individuals and businesses interact with their finances. The impact on end users is profound, as CBDCs introduce innovative avenues for conducting transactions and managing assets. With the integration of CBDCs, end users can experience streamlined payment processes, quicker cross-border transactions, and increased financial accessibility. Mobile wallets and digital payment platforms become key components of this user-centric landscape, offering a convenient and secure means of engaging with CBDCs. Additionally, CBDCs have the potential to foster financial inclusion, providing access to banking services for individuals who were previously underserved or excluded from traditional banking systems. This section delves into the user experience aspect, exploring how CBDCs shape the everyday financial interactions of individuals and businesses, ultimately contributing to a more efficient and inclusive financial ecosystem.

Monetary Policy and Economic Effects

The introduction of Central Bank Digital Currencies (CBDCs) presents a new frontier in the realm of monetary policy, with far-reaching implications for economic dynamics. As central banks delve into the issuance of digital currencies, they gain unprecedented tools to implement and fine-tune monetary policies. CBDCs allow for more direct and instantaneous control over the money supply, interest rates, and inflation. The increased transparency and traceability of transactions facilitated by CBDCs also offer central banks a clearer view of economic activities, enabling more informed policy decisions. However, this shift is not without challenges, as the potential impact on commercial banks, traditional lending practices, and overall financial stability necessitates careful consideration. This section explores the intricate relationship between CBDCs and monetary policy, scrutinizing the economic effects that arise from the adoption of digital currencies by central banks, and how these effects ripple through the broader economic landscape.

Global Perspective: Impacts of Central Bank Digital Currencies on the International Financial System

The emergence of Central Bank Digital Currencies (CBDCs) introduces a global dimension to the evolution of the financial landscape. As nations explore the implementation of CBDCs, the potential impacts on the international financial system become increasingly significant. CBDCs hold the promise of revolutionizing cross-border transactions, trade settlements, and overall financial cooperation on a global scale. The efficiency and speed offered by digital currencies can streamline international payments, reducing transaction costs and enhancing financial inclusivity. However, the widespread adoption of CBDCs also poses challenges, including issues related to interoperability, regulatory harmonization, and the potential reconfiguration of global economic power dynamics. This section delves into the global perspective, examining how the integration of CBDCs may reshape international finance, foster new avenues for economic collaboration, and prompt the development of a more interconnected and resilient global financial system.

My Other Articles

Web3 in Action: DApps, Protocols, and the Evolution of the Internet

Metamask: Navigating the World of Cryptocurrency with Ease

The Greatest Threat in World History: World War III and Warnings for the Future

Coins vs. Fiat: The Battle for Dominance in the Financial Landscape

AVAX: From High-Performance Cryptocurrency Beyond Blockchain to Digital Financial Revolution