Riding the Rollercoaster: Understanding FOMO in the Crypto Space

In the fast-paced world of cryptocurrency, there's a term that frequently pops up in discussions, causing both excitement and anxiety: FOMO, or Fear Of Missing Out. It's a phenomenon that's all too familiar to many investors, particularly in the volatile realm of digital assets. Let's delve into what FOMO on crypto really means, how it impacts investors, and how to navigate it.

What is FOMO in Crypto?

FOMO, in essence, is the fear that if you don't act quickly, you'll miss out on an opportunity for significant gains. In the context of cryptocurrency, where prices can skyrocket or plummet in a matter of hours, FOMO can be especially intense. It often arises when an investor sees others profiting from a particular coin or token and feels compelled to jump on the bandwagon before it's too late.

The Impact of FOMO

FOMO can lead investors to make impulsive decisions, such as buying into a coin at its peak or selling in a panic during a dip. This reactive behavior can result in significant financial losses and a rollercoaster of emotions. Moreover, FOMO can also perpetuate market bubbles, as investors pour money into assets solely because they fear missing out on potential gains, rather than investing based on sound fundamentals.

Navigating FOMO

- Do Your Research: Before investing in any cryptocurrency, take the time to thoroughly research the project, its team, technology, and potential for long-term growth. Understanding the fundamentals can help you make informed decisions rather than succumbing to FOMO-driven impulses.

- Set Clear Goals: Define your investment goals and risk tolerance before entering the market. Having a clear plan in place can help you resist the urge to chase quick profits based on FOMO.

- Practice Discipline: Stick to your investment strategy and avoid making decisions based on emotional reactions to market movements. Remember that cryptocurrencies are highly volatile, and prices can fluctuate wildly in the short term.

- Diversify Your Portfolio: Spreading your investments across different assets can help mitigate risk and reduce the impact of FOMO on your overall portfolio. Diversification can also provide exposure to a range of projects with varying growth potential.

- Stay Informed, but Avoid Overexposure: While it's essential to stay informed about market developments and emerging trends, consuming too much information can fuel FOMO. Strike a balance between staying informed and maintaining a healthy perspective on market dynamics.

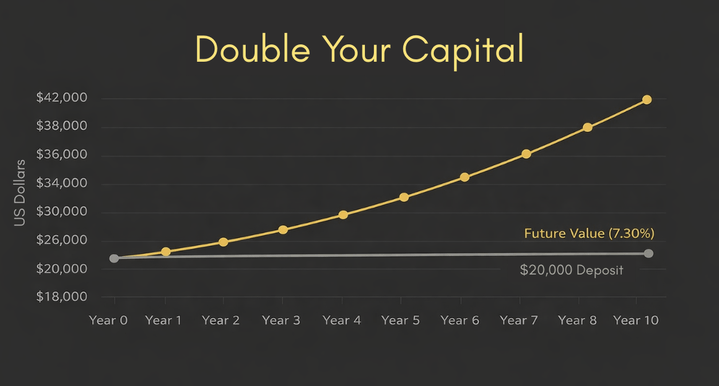

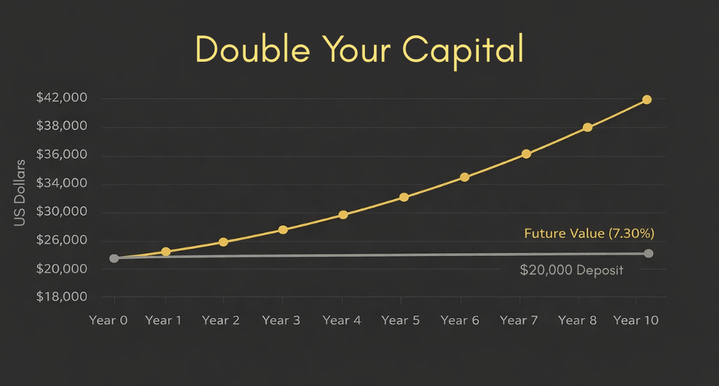

- Focus on the Long Term: Instead of fixating on short-term price movements, focus on the long-term potential of the projects you invest in. Keep in mind that cryptocurrency markets experience cycles of boom and bust, and patience is often rewarded in the end.

Final Thoughts

FOMO is a natural emotion that all investors experience at some point, especially in the fast-paced world of cryptocurrency. However, it's essential to recognize its influence and take steps to mitigate its impact on your investment decisions. By staying informed, disciplined, and focused on your long-term goals, you can navigate the crypto markets with confidence and resilience, even in the face of FOMO-induced volatility.