Embracing the Future: Exploring the Intersection of Technology and Finance

In today's rapidly evolving digital landscape, the convergence of technology and finance is reshaping the way we interact with money, access financial services, and manage our wealth. From the rise of cryptocurrencies and blockchain technology to the proliferation of fintech startups and digital banking solutions, the intersection of technology and finance is driving innovation, disruption, and transformation across the financial industry. In this comprehensive blog post, we'll delve into the key trends, opportunities, and challenges shaping the future of finance in the digital age.

With the rise of digital currencies, online banking, and automated investment platforms, it's clear that the future of finance is deeply intertwined with technological advancements. As we embrace this future, it's important to explore the ways in which technology is shaping the financial landscape and how it is impacting both businesses and consumers.

The Rise of Cryptocurrencies

Cryptocurrencies have emerged as a revolutionary force in the financial world, offering decentralized, secure, and borderless digital currencies that challenge traditional fiat currencies and banking systems. Bitcoin, the pioneering cryptocurrency introduced in 2009, has paved the way for a myriad of alternative cryptocurrencies, or altcoins, each with its own unique features and use cases. With a total market capitalization surpassing $2 trillion, cryptocurrencies have gained widespread acceptance and adoption, attracting investors, institutions, and governments alike.

One of the most significant developments in recent years has been the emergence of digital currencies, such as Bitcoin and Ethereum. These cryptocurrencies have gained widespread attention for their potential to revolutionize the way we think about money and transactions. With their decentralized nature and use of blockchain technology, digital currencies offer a level of security and transparency that traditional forms of currency cannot match. As a result, many businesses are now considering the incorporation of digital currencies into their operations, and consumers are increasingly using them for everyday transactions.

Blockchain Technology

At the heart of cryptocurrencies lies blockchain technology, a decentralized, distributed ledger system that enables transparent, secure, and immutable record-keeping of transactions. Beyond cryptocurrencies, blockchain technology has applications across various industries, including supply chain management, healthcare, real estate, and digital identity verification. By leveraging blockchain technology, organizations can streamline processes, reduce costs, mitigate fraud, and enhance trust and transparency in transactions.

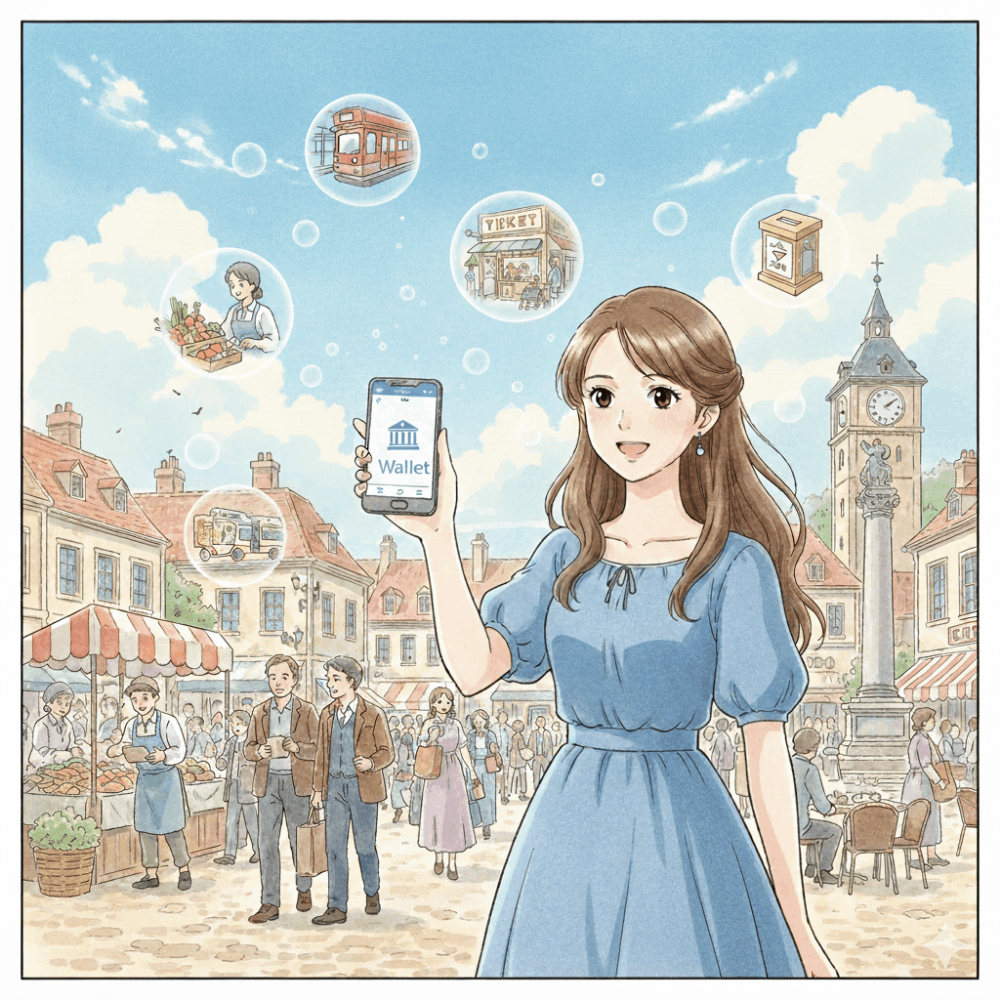

In addition to digital currencies, technology has also transformed the way we access and manage our finances. Online banking has become the norm for many individuals, providing a convenient and efficient way to handle everything from paying bills to transferring funds. Mobile banking apps have further streamlined the process, allowing users to check their accounts, make payments, and even apply for loans from the palm of their hand. These advancements have not only made financial management more accessible, but have also opened up new opportunities for financial institutions to reach and serve a wider audience.

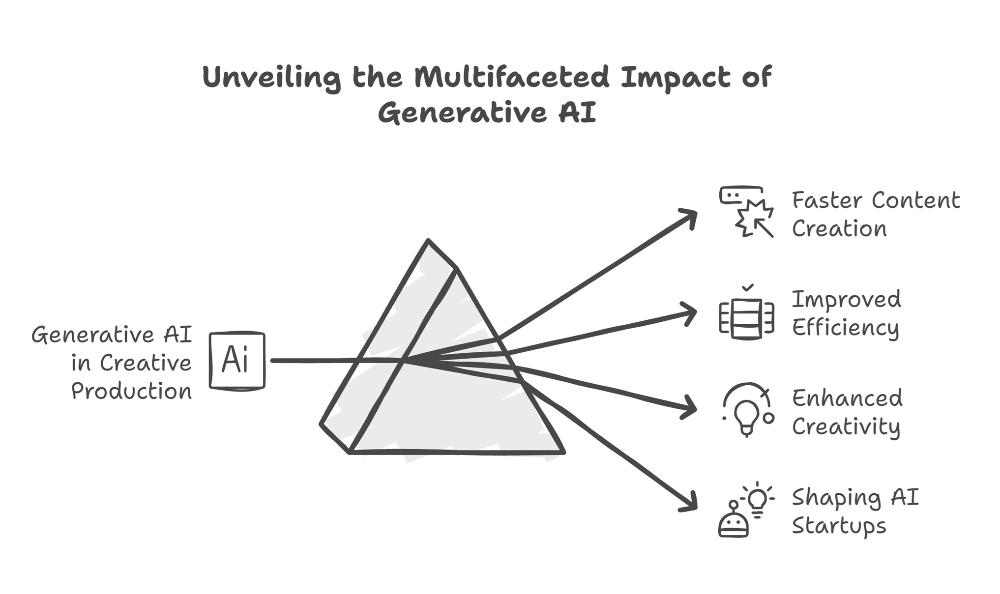

Fintech Innovation

The fintech revolution is reshaping the financial services landscape, driving innovation, and democratizing access to financial products and services. Fintech startups leverage cutting-edge technologies such as artificial intelligence, machine learning, big data analytics, and cloud computing to deliver innovative solutions that cater to the evolving needs of consumers and businesses. From digital banking and payment solutions to robo-advisors and peer-to-peer lending platforms, fintech companies are disrupting traditional banking models, enhancing customer experiences, and driving financial inclusion on a global scale.

Furthermore, technology has revolutionized the investment landscape, making it easier than ever for individuals to participate in the financial markets. Robo-advisors, for example, use algorithms to provide automated investment advice and portfolio management, offering a low-cost alternative to traditional financial advisors. This has democratized investing, allowing people with varying levels of wealth to access professional investment services and build diversified portfolios. Additionally, online trading platforms have empowered individuals to buy and sell securities with unprecedented ease, breaking down barriers to entry and giving more people the opportunity to grow their wealth through investing.

Digital Banking

The shift towards digital banking is accelerating, driven by changing consumer preferences, advancements in technology, and the need for greater convenience, accessibility, and efficiency. Digital banks, also known as neobanks, offer a range of digital-only banking services through mobile apps and online platforms, catering to the needs of tech-savvy consumers who prefer seamless, user-friendly banking experiences. With features such as mobile payments, budgeting tools, and real-time transaction tracking, digital banks are redefining the way we bank and manage our money.

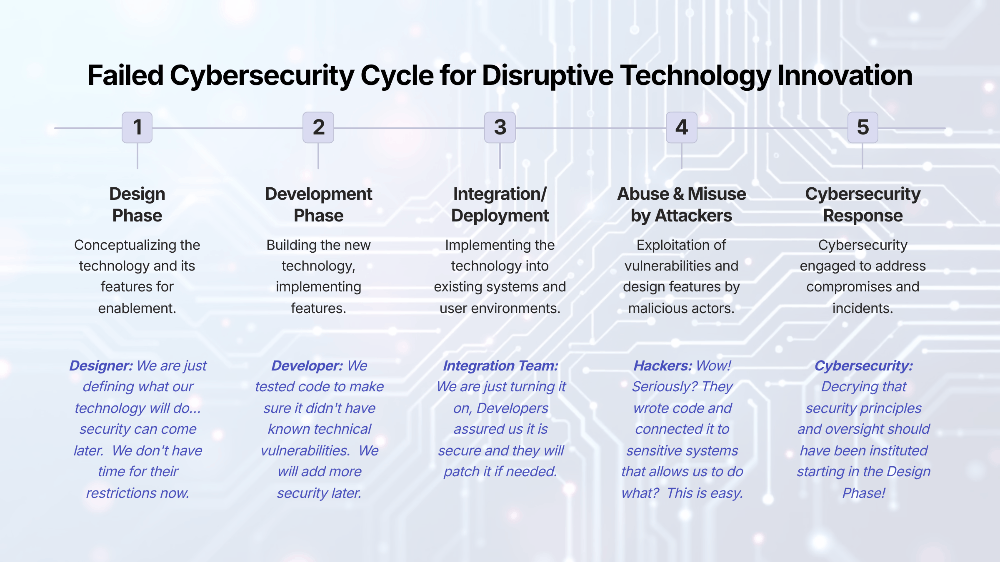

As we look to the future, it's clear that the intersection of technology and finance will continue to shape the way we interact with money and manage our financial lives. However, with these advancements come new challenges and considerations. Cybersecurity, for example, has become a paramount concern as more financial transactions are conducted online. Protecting sensitive financial information from cyber threats is essential to maintaining trust and confidence in digital financial systems.

Challenges and Opportunities

While the convergence of technology and finance presents unprecedented opportunities for innovation and growth, it also poses significant challenges and risks. Concerns around cybersecurity, data privacy, regulatory compliance, and financial stability must be addressed to ensure the integrity and resilience of the financial system. Moreover, the rapid pace of technological change and the emergence of new business models require banks, regulators, and policymakers to adapt and evolve to meet the evolving needs of consumers and businesses.

Regulatory considerations also come into play as technology continues to disrupt traditional financial systems. Governments and regulatory bodies are grappling with how to effectively oversee and regulate digital currencies, online banking, and automated investment platforms in a way that protects consumers while fostering innovation. Striking the right balance will be crucial in ensuring that technology can continue to drive positive change in the financial sector.

Ultimately, embracing the future means recognizing the immense potential that technology holds for transforming finance while also being mindful of the challenges that come with it. By staying informed and engaged with these developments, businesses and consumers can position themselves to take full advantage of the opportunities that arise while navigating the complexities that accompany them.

The intersection of technology and finance represents a powerful force that is reshaping the way we think about money, transactions, and investments. As digital currencies, online banking, and automated investment platforms continue to gain traction, it's essential for businesses and consumers alike to stay attuned to these changes and adapt accordingly. By doing so, we can harness the full potential of technology to create a more inclusive, efficient, and secure financial future for all.

The intersection of technology and finance holds immense promise for driving positive change, fostering financial inclusion, and empowering individuals and communities to thrive in the digital age. By embracing innovation, collaboration, and responsible practices, we can harness the transformative power of technology to create a more inclusive, resilient, and sustainable financial ecosystem. Together, let's embrace the future of finance and unlock the full potential of technology to shape a better tomorrow for generations to come.