Navigating the Challenges of Cryptocurrency

Introduction

A cryptocurrency, crypto-currency, or crypto[a] is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.[2] A logo for Bitcoin, the first decentralized cryptocurrency

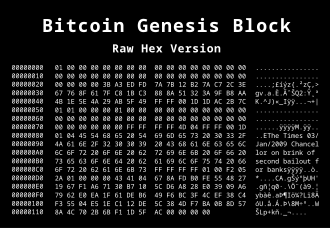

A logo for Bitcoin, the first decentralized cryptocurrency The genesis block of Bitcoin's blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

The genesis block of Bitcoin's blockchain, with a note containing The Times newspaper headline. This note has been interpreted as a comment on the instability caused by fractional-reserve banking.[1]: 18

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership.[3][4][5] Despite the term that has come to describe many of the fungible blockchain tokens that have been created, cryptocurrencies are not considered to be currencies in the traditional sense, and varying legal treatments have been applied to them in various jurisdicitons, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice.[6][7][8] Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get authority over the token in proportion to the amount they stake. Generally, these token stakers get additional ownership in the token over time via network fees, newly minted tokens, or other such reward mechanisms.[9]

Cryptocurrency does not exist in physical form (like paper money) and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC).[10] When a cryptocurrency is minted, created prior to issuance, or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[11]

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.[12] Throughout their existence, cryptocurrencies have been involved in criminal activities and multi-billion-dollar fraud schemes. Some economists and investors, such as Warren Buffett, considered cryptocurrencies to be a speculative bubble.

In recent years, cryptocurrencies have captured the imagination of both investors and technologists alike. Promising decentralization, security, and financial autonomy, these digital assets have disrupted traditional financial systems and sparked a wave of innovation. However, amidst the excitement, it's essential to recognize and address the significant challenges facing the cryptocurrency ecosystem. From regulatory hurdles to technological limitations, navigating these obstacles is crucial for the continued growth and adoption of cryptocurrencies.

- Regulatory Uncertainty: One of the most significant challenges facing cryptocurrencies is regulatory uncertainty. Governments around the world are grappling with how to classify and regulate these digital assets effectively. The lack of clear regulatory frameworks creates uncertainty for investors, businesses, and consumers alike, hindering mainstream adoption and investment. Without clear guidelines, cryptocurrency businesses may struggle to operate legally and face the risk of regulatory backlash.

- Security Concerns: Despite claims of enhanced security, cryptocurrencies are not immune to cyber threats. High-profile hacks and security breaches have plagued the industry, resulting in millions of dollars in losses for investors and exchanges. The decentralized nature of cryptocurrencies, while providing greater transparency and censorship resistance, also makes them attractive targets for malicious actors. As the value of cryptocurrencies continues to rise, ensuring robust security measures becomes increasingly critical to safeguarding assets and maintaining trust in the ecosystem.

- Scalability and Performance: Scalability remains a significant technical challenge for many cryptocurrencies. Bitcoin, the pioneering cryptocurrency, has faced limitations in transaction throughput and scalability, leading to congestion on the network and high transaction fees during periods of high demand. Similarly, other blockchain-based cryptocurrencies encounter scalability issues as they strive to accommodate growing user bases and transaction volumes. Improving scalability and performance without compromising decentralization remains a complex engineering challenge for blockchain developers.

- Volatility and Speculation: The inherent volatility of cryptocurrencies poses a challenge for both investors and merchants. Price fluctuations can be extreme, leading to rapid gains or losses for investors and complicating the use of cryptocurrencies as a medium of exchange. Additionally, speculation and market manipulation exacerbate price volatility, undermining confidence in the stability of cryptocurrencies as a store of value. Overcoming volatility requires increased market maturity, regulatory oversight, and broader adoption to reduce reliance on speculative trading.

- User Experience and Accessibility: Despite advancements in user-friendly wallets and interfaces, cryptocurrencies still face usability challenges for mainstream adoption. Managing cryptographic keys, understanding transaction fees, and navigating complex interfaces can be daunting for newcomers to the space. Moreover, the lack of interoperability between different cryptocurrencies and traditional financial systems presents barriers to seamless integration and widespread use. Improving user experience and accessibility through education, intuitive design, and interoperability initiatives is crucial for driving mass adoption of cryptocurrencies.

- Environmental Impact: The energy consumption associated with cryptocurrency mining, particularly for proof-of-work consensus mechanisms like Bitcoin, has raised concerns about its environmental impact. Critics argue that the energy-intensive nature of mining exacerbates carbon emissions and contributes to climate change. Addressing these concerns requires exploring alternative consensus mechanisms, such as proof-of-stake, that are more energy-efficient while maintaining network security.

In conclusion, while cryptocurrencies hold immense promise for transforming finance and fostering economic empowerment, they are not without challenges. Regulatory uncertainty, security risks, scalability limitations, volatility, usability issues, and environmental concerns represent significant hurdles that must be addressed for the sustainable growth and adoption of cryptocurrencies. Collaboration between industry stakeholders, regulators, and technologists is essential to overcome these challenges and unlock the full potential of cryptocurrencies in the digital age.

References

- Pagliery, Jose (2014). Bitcoin: And the Future of Money. Triumph Books. ISBN 978-1629370361. Archived from the original on 21 January 2018. Retrieved 20 January 2018.

- ^ Milutinović, Monia (2018). "Cryptocurrency". Ekonomika. 64 (1): 105–122. doi:10.5937/ekonomika1801105M. ISSN 0350-137X. Archived from the original on 16 April 2022. Retrieved 18 April 2022.

- ^ Jump up to:a b Andy Greenberg (20 April 2011). "Crypto Currency". Forbes. Archived from the original on 31 August 2014. Retrieved 8 August 2014.

- ^ Polansek, Tom (2 May 2016). "CME, ICE prepare pricing data that could boost bitcoin". Reuters. Archived from the original on 23 April 2022. Retrieved 3 May 2016.

- ^ Pernice, Ingolf G. A.; Scott, Brett (20 May 2021). "Cryptocurrency". Internet Policy Review. 10 (2). doi:10.14763/2021.2.1561. ISSN 2197-6775. Archived from the original on 23 October 2021. Retrieved 23 October 2021.

- ^ "Bitcoin not a currency says Japan government". BBC News. 7 March 2014. Archived from the original on 25 January 2022. Retrieved 25 January 2022.

- ^ "Is it a currency? A commodity? Bitcoin has an identity crisis". Reuters. 3 March 2020. Archived from the original on 25 January 2022. Retrieved 25 January 2022.

- ^ Brown, Aaron (7 November 2017). "Are Cryptocurrencies an Asset Class? Yes and No". www.bloomberg.com. Archived from the original on 1 April 2022. Retrieved 25 January 2022.

- ^ Bezek, Ian (14 July 2021). "What Is Proof-of-Stake, and Why Is Ethereum Adopting It?". Archived from the original on 5 August 2021. Retrieved 5 August 2021.

- ^ Allison, Ian (8 September 2015). "If Banks Want Benefits of Blockchains, They Must Go Permissionless". International Business Times. Archived from the original on 12 September 2015. Retrieved 15 September 2015.

- ^ Matteo D'Agnolo. "All you need to know about Bitcoin". timesofindia-economictimes. Archived from the original on 26 October 2015.

- ^ "Cryptocurrencies: What Are They?". Schwab Brokerage. Archived from the original on 14 September 2023. Retrieved 14 September 2023. However, as of June 2023, there were more than 25,000 digital currencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion