Navigating the Crypto Seas:

A Comprehensive Guide to Understanding Cryptocurrencies" Introduction: In recent years, cryptocurrencies have taken the financial world by storm, creating a paradigm shift in how we perceive and use money. From Bitcoin's emergence in 2009 to the proliferation of various altcoins and blockchain technologies, the crypto landscape has evolved rapidly. In this article, we will delve into the fundamentals of cryptocurrencies, exploring their origins, functionalities, benefits, and potential challenges.

1. **The Genesis of Cryptocurrencies:** The journey begins with Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto. A decentralized, peer-to-peer digital currency, Bitcoin set the stage for a new era in finance. Understanding the underlying blockchain technology is crucial—a decentralized ledger that records all transactions across a network of computers.

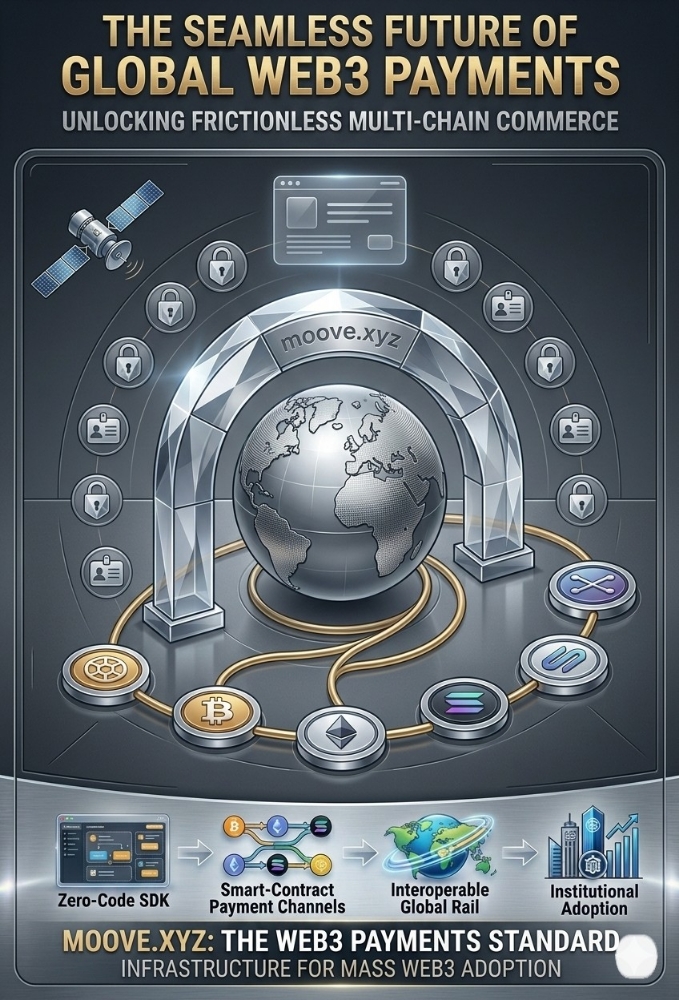

2. **Beyond Bitcoin: The World of Altcoins:** Bitcoin may have been the pioneer, but today there are thousands of alternative cryptocurrencies, each with its unique features and use cases. Ethereum, Ripple, Litecoin, and many others have expanded the possibilities beyond simple peer-to-peer transactions, enabling smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs).

3. **How Cryptocurrencies Work:** Cryptocurrencies operate on a decentralized network of computers, utilizing cryptographic techniques to secure transactions. This section will explain concepts such as public and private keys, mining, and consensus algorithms like Proof of Work (PoW) and Proof of Stake (PoS). 4. **Investing in Cryptocurrencies: Opportunities and Risks:** The crypto market offers significant investment opportunities, but it's essential to approach it with caution. This section will discuss factors influencing cryptocurrency prices, investment strategies, and the potential risks involved, including market volatility, regulatory uncertainties, and security concerns. 5. **Blockchain Technology: Building Trust in a Decentralized World:** Beyond currencies, blockchain technology has applications across various industries. Smart contracts automate and enforce agreements, while transparent and immutable ledgers enhance traceability and security. We'll explore the real-world use cases of blockchain beyond cryptocurrencies.

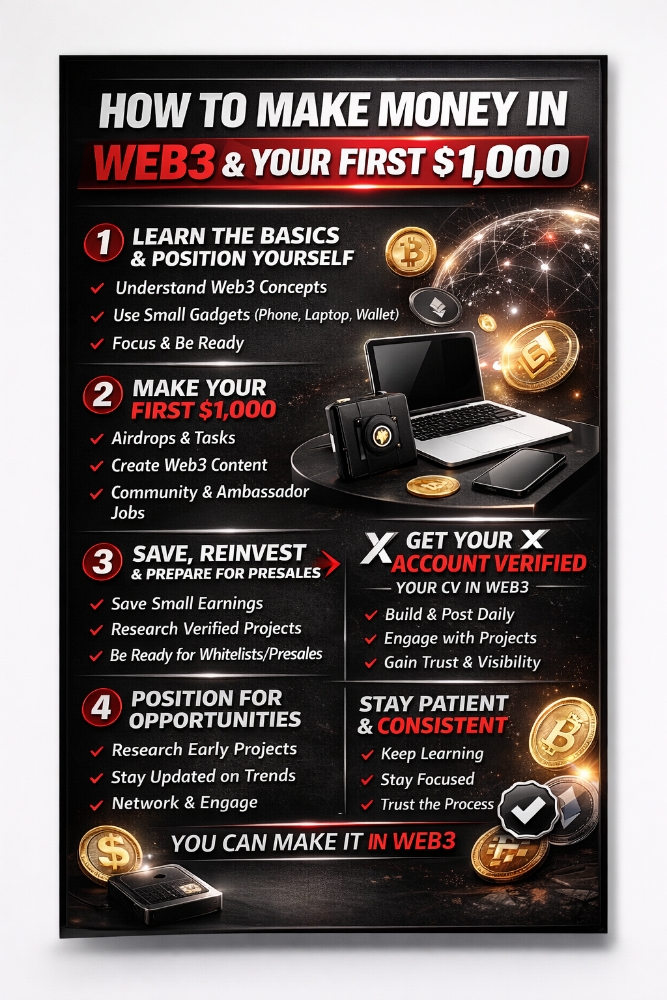

Certainly! Let's expand on a few sections to provide more depth and insights: **4. Investing in Cryptocurrencies: Opportunities and Risks:** While the potential for high returns has attracted many to the crypto market, it's crucial to understand the inherent risks. Market volatility, often characterized by significant price fluctuations, is a defining feature. Investors should conduct thorough research, diversify their portfolios, and only invest what they can afford to lose. Additionally, keeping an eye on regulatory developments worldwide is essential, as shifts in government policies can influence the market. Diving deeper into investment strategies, we can explore the differences between short-term trading and long-term holding. Some investors engage in day trading, capitalizing on short-term price movements, while others adopt a 'HODL' (Hold On for Dear Life) strategy, aiming for long-term gains. Each approach has its merits and challenges, and finding the right balance is a personal decision influenced by risk tolerance and investment goals. **5. Blockchain Technology: Building Trust in a Decentralized World:**

Beyond financial applications, blockchain technology is making strides in sectors such as supply chain management, healthcare, and identity verification. Smart contracts, self-executing contracts with the terms directly written into code, are revolutionizing how agreements are made and executed. Exploring specific use cases, such as IBM's Food Trust Network for supply chain transparency or Estonia's e-Residency program for secure digital identities, highlights the transformative potential of blockchain beyond cryptocurrencies. Interoperability between different blockchain networks is another emerging trend. Projects like Polkadot and Cosmos aim to create a more interconnected blockchain ecosystem, allowing different networks to communicate and share information seamlessly. This could lead to increased efficiency and collaboration across various decentralized applications (DApps) and platforms. **6. Challenges and Future Outlook:** Addressing the environmental concerns associated with energy-intensive proof-of-work consensus mechanisms, the industry is exploring more eco-friendly alternatives. The transition from PoW to PoS, where validators are chosen to create new blocks based on the number of coins they hold and are willing to "stake," is gaining traction. Ethereum's long-anticipated move to Ethereum 2.0 is a significant example of this transition. Regulatory developments play a crucial role in shaping the future of cryptocurrencies. Some countries embrace digital assets, while others approach them with caution. Clearer regulatory frameworks can provide a more stable environment for the industry to thrive, fostering innovation and responsible growth. **7. Security and Best Practices: Safeguarding Your Crypto Assets:** Beyond hardware wallets and two-factor authentication, staying informed about the latest security threats is essential. Phishing attacks, malware, and social engineering tactics are prevalent in the crypto space. Educating users on recognizing and avoiding these threats is crucial for maintaining the security of their assets.  Additionally, advancements in decentralized finance (DeFi) introduce new opportunities but also new risks. Smart contract vulnerabilities and exploits can lead to substantial losses. Engaging in due diligence and using reputable platforms with a track record of security can mitigate these risks. Conclusion: As the crypto landscape evolves, it's clear that the journey is multifaceted. Navigating the crypto seas requires a combination of understanding the foundational principles, staying informed about market trends, and adopting best practices for security. The potential for innovation and disruption is vast, and individuals who approach the crypto space with a combination of curiosity, caution, and responsibility are well-positioned to make the most of this dynamic financial frontier.

Additionally, advancements in decentralized finance (DeFi) introduce new opportunities but also new risks. Smart contract vulnerabilities and exploits can lead to substantial losses. Engaging in due diligence and using reputable platforms with a track record of security can mitigate these risks. Conclusion: As the crypto landscape evolves, it's clear that the journey is multifaceted. Navigating the crypto seas requires a combination of understanding the foundational principles, staying informed about market trends, and adopting best practices for security. The potential for innovation and disruption is vast, and individuals who approach the crypto space with a combination of curiosity, caution, and responsibility are well-positioned to make the most of this dynamic financial frontier.