Automating Trading With Smart Rebalancing Bots: Do They Really Work?

Investing in cryptocurrencies is akin to riding a rollercoaster: exhilarating highs punctuated by heart-stopping drops. While the potential for gains is undeniable, the inherent volatility can leave even seasoned investors feeling like they’re on a runaway train. Therein lies the theoretical utility of trading bots — more specifically, the Smart Rebalancing Bots, which promise to simplify automate portfolio management — or, do they really?

Investing in cryptocurrencies is akin to riding a rollercoaster: exhilarating highs punctuated by heart-stopping drops. While the potential for gains is undeniable, the inherent volatility can leave even seasoned investors feeling like they’re on a runaway train. Therein lies the theoretical utility of trading bots — more specifically, the Smart Rebalancing Bots, which promise to simplify automate portfolio management — or, do they really?

Balancing Act on Autopilot

Think of your crypto portfolio as a carefully constructed seesaw, each coin meticulously positioned based on your risk tolerance and return expectations. As not all cryptocurrencies are made the same, when market winds whip through the crypto landscape, the position of these coins inevitably differ, given differing performances of each cryptocurrency asset. This is where a smart rebalancing bot steps in, acting as your ever-vigilant portfolio guardian.

Understanding the Process

- Target Allocation: You define your desired percentage allocation for each asset in your portfolio, reflecting your investment strategy.

- Constant Monitoring: The bot seamlessly tracks the market values of your holdings.

- Threshold Trigger: When a coin’s price movement causes its weight in your portfolio to deviate from your target by a preset threshold (e.g., 5%), the bot springs into action.

- Automated Rebalancing: The bot strategically buys and sells portions of your assets to restore your portfolio back to your intended proportion.

Mechanisms of Portfolio Equilibrium

Smart Rebalancing Bots offer two distinct approaches to achieving balance:

- Threshold-based: The bot triggers trades when the weight of a single asset deviates from your target by a predefined percentage. Think of it as an “alert system” for individual coins.

- Time-based: The bot rebalances at regular intervals (e.g., daily, weekly) regardless of individual asset fluctuations. This ensures your overall portfolio stays on track over time.

Imagine this scenario

- You have an equal mix of Bitcoin, Ethereum and USDT (stablecoin) in your portfolio.

- Bitcoin rises by 20%, outperforming Ethereum and (obviously) USDT. As such, the proportion of Bitcoin is now more than that of Ethereum and USDT.

- The bot automatically sells that part of your Bitcoin holdings in exchange for the underperforming coins (in this case Ethereum and USDT), so that the final proportions of your cryptocurrency portfolio return to baseline, generating capital from the sale of that “surplus” amount of Bitcoin.

My Experience

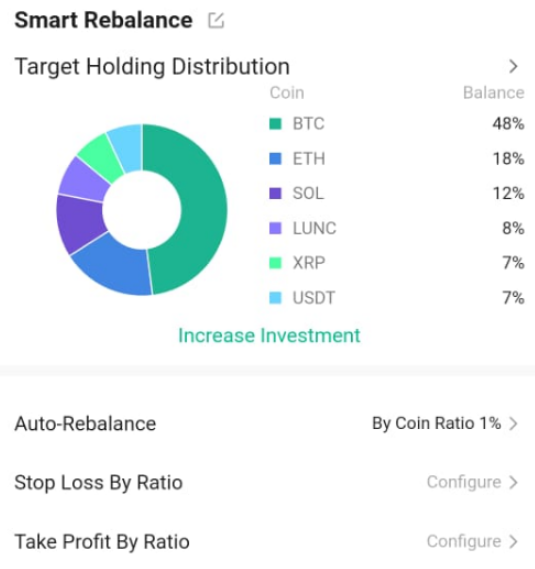

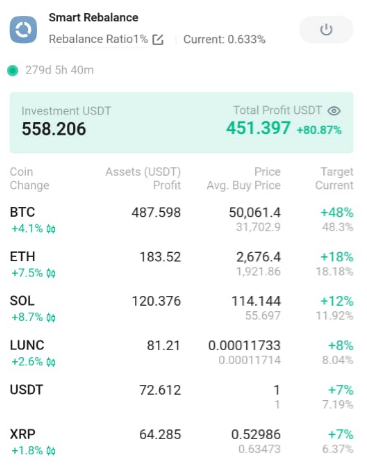

To further illustrate the concept of a smart rebalancing bot, consider this trading bot of mine, started since 280 days ago.

There are several platforms offering Smart Rebalancing Bot which have a similar modus operandi — of which the example illustrated here is running on Kucoin, a popular cryptocurrency exchange.

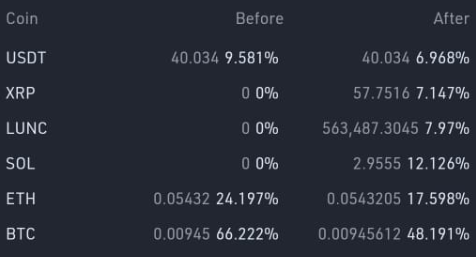

This was how my portfolio looked like upon starting the Smart Rebalancing Bot.

The proportion of my cryptocurrency portfolio was as shown above — set with the option for auto-rebalancing to occur whenever there is a change in the ratio of the coins by 1%.

The proportion of my cryptocurrency portfolio was as shown above — set with the option for auto-rebalancing to occur whenever there is a change in the ratio of the coins by 1%.

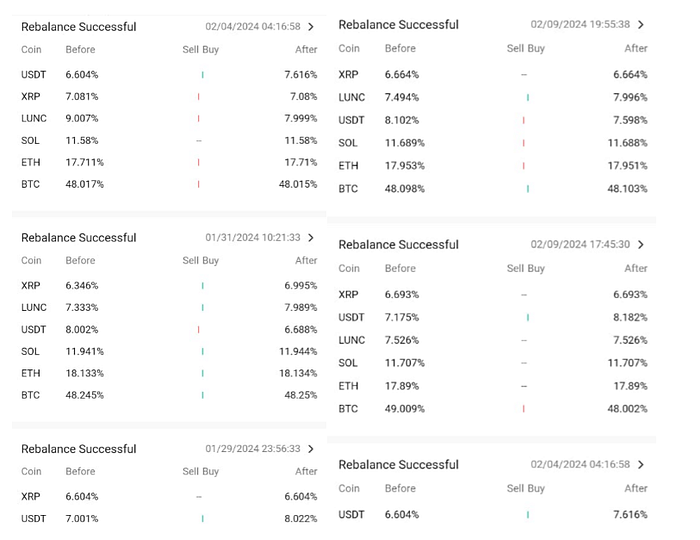

Thus began the journey of trading automation seamlessly in the background. After 280 days through the bull market, a net profit of $451 was generated, which in other words translated to a stellar 80% gain! However it is noteworthy that this is not so much the result of the trading processes that have occured, as it is the result of appreciation in value of the cryptocurrencies themselves. As such, the Smart Rebalancing Bot can be likened to a slightly more active form of HODL-ing.

After 280 days through the bull market, a net profit of $451 was generated, which in other words translated to a stellar 80% gain! However it is noteworthy that this is not so much the result of the trading processes that have occured, as it is the result of appreciation in value of the cryptocurrencies themselves. As such, the Smart Rebalancing Bot can be likened to a slightly more active form of HODL-ing.

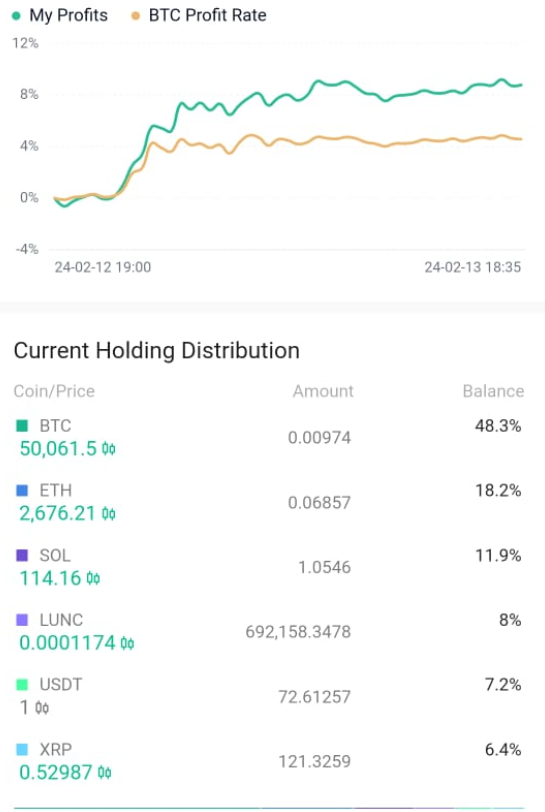

As shown above, the proportions of my cryptocurrency holdings have remained constant throughout this entire period of time; however, the final amount of the cryptocurrency assets have differed somewhat considerably. Consider the diagram below that compares my cryptocurrency holdings at the start of the bot, and at the current time of writing.

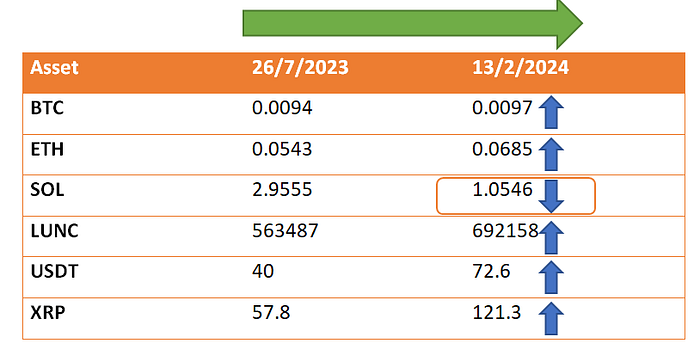

As shown above, the proportions of my cryptocurrency holdings have remained constant throughout this entire period of time; however, the final amount of the cryptocurrency assets have differed somewhat considerably. Consider the diagram below that compares my cryptocurrency holdings at the start of the bot, and at the current time of writing. All the cryptocurrencies above have increased in position sizes, with the exception of Solana, which has gone down from 2.95 units to 1.05 units. This is attributable to Solana’s outstanding performance against all the other cryptocurrency assets here for the past few weeks — as it gains in values, it keeps getting sold off to buy the other assets, so that the final proportions of the portfolio holdings remain the same.

All the cryptocurrencies above have increased in position sizes, with the exception of Solana, which has gone down from 2.95 units to 1.05 units. This is attributable to Solana’s outstanding performance against all the other cryptocurrency assets here for the past few weeks — as it gains in values, it keeps getting sold off to buy the other assets, so that the final proportions of the portfolio holdings remain the same.

So, Is It Worth it?

As my portfolio contained a relatively diverse mix of coins that have had quite a varying degree of performance throughout the market cycles, there was a potential gain to be made by having sold overbought coins, and buying oversold coins at different points in time.

However, the beneficial effects may be negated if the performance of an asset differs significantly from the others. Take Solana for example. On 26/7/2023, Solana was trading at approximately $24. At the current phenomenal price of $110, Solana has seen a tremendous appreciation in price of 450% over the past 280 days — which contrasts sharply to that of my Smart Rebalancing Bot which only saw a 80% growth! In other words, had I simply HODL-ed that same amount of Solana instead of putting it into the Smart Rebalancing Bot, I would have earned so much more profits for the same amount of asset; as putting an outperforming asset into the common basket simply “diluted” its performance!

Which brings us to the next section on the limitations of this trading strategy.

A Balancing Act with Caveats

While smart rebalancing bots offer undeniable benefits, it is not without its own caveats.

- Impermanent losses: The loss in potential profits in the scenario above is hugely reminiscent of a concept often heard in the space of DeFi, particularly liquidity mining — that of impermanent losses. Essentially, impermanent losses occur because the user ends up with more units of an undervalued asset and fewer of the appreciated asset, translating to an impermanent loss compared to simply holding the coins.

- Trading fees: A rebalancing act occurs by executing trades which involves fees — if this happens too often, the trading fees incurred would negate any potential gains generated. As such, a balance needs to be made between executing a sufficient amount of trades that maintains the portfolio balance well, while keeping the trading fees reasonably low.

Take-Home Messages

Drawing upon the information above, here are some some ways to maximise the utility of a Smart Rebalancing Bot

- Design your cryptocurrency portfolio meticulously! Do your own research thoroughly and only include reliable cryptocurrency assets in your portfolio. Bearing in mind the mechanism of action of Smart Rebalancing Bots, if you have a shitcoin on your portfolio that keeps depreciating in value, the bot would only incessantly buy the dip of that coin by trimming off positions from other cryptocurrencies, resulting in a general dwindling of the entire portfolio value.

- Consider having a portion of stablecoins in your portfolio from which the Bot can purchase cryptocurrencies in the event of a price dump, and into which the Bot can sell cryptocurrencies off in the event of a price hike.

- Rebalance by coin ratio rather than time interval (especially one that is too frequent eg hourly) — so that trading only occurs if there is a significant disparity in the proportions of your cryptocurrency holdings, rather than doing so needlessly at fixed time intervals.

The Verdict

Smart rebalancing bots can be valuable allies for crypto investors seeking to automate portfolio management and maintain a disciplined investment strategy. However, responsible risk management and a clear understanding of their limitations are essential before entrusting them with your hard-earned capital. As such, always be sure to do your own research diligently!

This article was originally published on my Medium blog on 14th February 2024

You may also be interested in:

Stablecoins Unravelled: Are They Really Stable?

Harvesting Income with Grass: How To Turn Bandwidth into Bucks

How To Stake Solana To Earn Passive Income: An Introduction

Automating Trading With Grid Trading Bots ★Free apps to earn money without any capital!★

★Free apps to earn money without any capital!★

🎁 Honeygain A passive income app to earn money off your unused internet bandwidth. Get $3 for free, no investment required.

🎁 Grass An innovative web-based platform that rewards you for sharing your unused network resources.

🎁 IPRoyal Pawns A passive income app to earn money off your unused internet bandwidth.

🎁 EarnApp A passive income app to earn money off your unused internet bandwidth.

🎁 Peer2Profit A passive income app to earn money off your unused internet bandwidth.

🎁 JumpTask Earn free crypto when you complete microtasks!

🎁 CryptoTab Earn free Bitcoin while surfing the internet!

🎁 Bitcoin Faucet Sites: FreeBitco.in, Cointiply

🎁 StormX: Earn crypto as you shop online!

★Cryptocurrency Investment/ Trading Platforms★

🎁 Bake A one-stop investment platform that bakes passive cashflow at APYs of up to 100%! Get a $50 bonus in DFI with a $50 deposit.

🎁 Nexo An advanced, regulated digital assets institution offering instant crypto loans, daily earning on assets with APYs of up to 36%, an exchange, with services in 40+ fiat currencies in more than 200 jurisdictions. Get a $25 bonus with a $100 deposit.

🎁 Binance The world’s largest cryptocurrency exchange that needs no introduction!

🎁 Bitget A leading cryptocurrency exchange offering free advanced trading bots and copy trading.

🎁 Kucoin An expansive cryptocurrency exchange, with interesting offerings like staking, free trading bots and bitcoin cloud mining services.

🎁 HTX A cryptocurrency exchange with diverse offerings, free airdrops and trading bots.

🎁 MEXC A cryptocurrency exchange with interesting listings and frequent airdrops from holding the MX token.

🎁 Crypto.com A cryptocurrency exchange based in Singapore. Get $25 in CRO on staking for a Ruby card.

🎁 TradingView An invaluable charting platform for various markets. Get up to $30 discount off a paid plan here!

★Cryptocurrency Trading Bots★

🎁 3Commas A cryptocurrency trade management platform offering DCA bots, Grid bots, Options bots, Futures bots, HODL bots, Scalper Terminal, and full Portfolio management all from a single convenient interface.

🎁 Jet-bot An advanced spot and futures trading bot with Copy Trading functionality. 3-day trial period available with demo account.

🎁 Pionex A free multifunctional arbitrage trading bot that automates the process of buying low and selling high, 24/7.

🎁 Wundertrading An automated cryptocurrency trading bot offering a 7 day trial period with full functionality.

🎁 One Click Crypto An AI bot powered by neural networks that manage your cryptocurrency portfolio on autopilot.

★For Malaysian investors★

🎁 Moomoo Get a free Apple share!

🎁 Luno Get a RM75 bonus in BTC with a RM250 purchase of BTC!

🎁 Stashaway Get free investing for 6 months!

🎁 Wahed code ‘KENLIE1’ RM10 signup bonus!

🎁 Capbay P2P code ‘8879c6’ RM100 signup bonus!

🎁 Versa Get a RM10 bonus with a RM100 deposit!

🎁 KDI Get a RM10 bonus with a RM250 deposit!

🎁 Klook Get a RM15 signup bonus!

Connect with me Medium | Read.cash | Publish0x | BulbApp | YouTube | Twitter