What will future Bitcoin halvings look like?

In the next decade, the diminishing block rewards in Bitcoin mining will significantly impact miners and the broader ecosystem reliant on the blockchain. As Bitcoin's protocol halves the rewards every four years, miners face the prospect of receiving only a fraction of the Bitcoin they once did.

In the next decade, the diminishing block rewards in Bitcoin mining will significantly impact miners and the broader ecosystem reliant on the blockchain. As Bitcoin's protocol halves the rewards every four years, miners face the prospect of receiving only a fraction of the Bitcoin they once did.

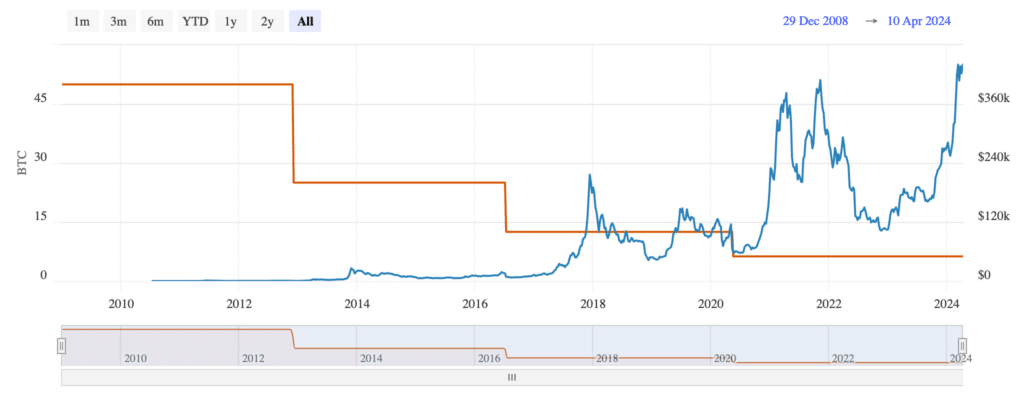

Originally, miners were rewarded with a substantial 50 BTC per block when Bitcoin launched in 2009. This reward has since halved multiple times, with the most recent halving in May 2020 reducing it to a mere 6.25 BTC per block. With each halving, the rate of Bitcoin issuance diminishes, making the remaining rewards scarcer and more challenging to obtain.

For miners, this trend implies a shift towards a more competitive landscape where profitability becomes increasingly reliant on factors such as energy efficiency, low operational costs, and access to advanced mining equipment. Those unable to adapt may find it economically unviable to continue mining Bitcoin.

Moreover, the diminishing block rewards have broader implications for the Bitcoin ecosystem. With a limited supply of Bitcoin available, scarcity becomes more pronounced, potentially driving up the price of Bitcoin over time. This could influence investor behavior, as they anticipate future scarcity and seek to acquire Bitcoin as a store of value or investment asset.

However, the reduction in block rewards also impacts transaction fees, which become a more significant source of income for miners. As block rewards diminish, miners may increasingly rely on transaction fees to sustain their operations. This could lead to changes in the dynamics of fee markets, as users compete to have their transactions included in blocks by offering higher fees.

The ongoing reduction in block rewards underscores the need for continual adaptation within the Bitcoin mining ecosystem. Miners and stakeholders must navigate changing economic incentives while ensuring the network remains secure and sustainable in the long term. Certainly, for miners, there's a mixed bag of news. On the downside, the recent halving in April 2024 means that only 450 Bitcoin are available for mining each day, a stark contrast to the 7,200 BTC that could be mined daily 15 years ago.

Certainly, for miners, there's a mixed bag of news. On the downside, the recent halving in April 2024 means that only 450 Bitcoin are available for mining each day, a stark contrast to the 7,200 BTC that could be mined daily 15 years ago.

However, there's a silver lining in the form of skyrocketing fiat value for Bitcoin. Presently, 3.125 BTC is valued at hundreds of thousands of dollars according to current market rates. This is a significant increase compared to the early days of Bitcoin, where 50 BTC would have been worth a mere $600 at the time of the first halving in 2012.

When are future Bitcoin halvings?

Looking ahead, the schedule of Bitcoin halvings provides a roadmap for how the rewards for miners will continue to decrease over time. The next halving, anticipated around 2028 when the Bitcoin network reaches a block height of 1,050,000, will reduce miner rewards to 1.5625 BTC per block.

As we move into the 2030s, predictions from figures like Cathie Wood suggest that the value of a single Bitcoin could soar to remarkable levels, reaching as high as $1.5 million. Even in a more conservative scenario, the value would still be an impressive $258,000. However, this period also marks a significant milestone as the 2032 halving will see block rewards drop below one whole Bitcoin for the first time, settling at 0.78125 BTC.

The trend continues with subsequent halvings, with rewards diminishing to 0.390625 BTC by 2036. This reduction means only 56.25 BTC will be released into circulation every day, further emphasizing the scarcity of Bitcoin.

The halving events, occurring every four years in sync with the Summer Olympics, will persist into the mid-21st century, gradually reducing miner rewards to increasingly minuscule amounts. By 2052, miners will receive just 0.0244140625 BTC per block, translating to a mere $1,660 in fiat terms based on current valuations.

This ongoing reduction in rewards underscores the finite nature of Bitcoin's supply, with the process ultimately concluding in 2140 when the last Bitcoin is mined. As rewards become increasingly negligible, miners will need to rely more heavily on transaction fees to sustain their operations, potentially altering the dynamics of the Bitcoin ecosystem.

What does this mean for miners?

Becoming a Bitcoin miner entails significant costs, including electricity expenses and the continual need for powerful computing hardware updates. The increasing difficulty of mining due to the requirement for more computational power necessitates frequent hardware upgrades.

Historically, the rising price of Bitcoin has been able to counteract the impact of each halving event, as demonstrated by the following examples:

- In November 2012, following the halving, the new block reward was 25 BTC, with Bitcoin priced at $12.53.

- By July 2016, despite the block reward halving to 12.5 BTC, the price of Bitcoin had risen to $650.96.

- In May 2020, when the block reward reduced to 6.25 BTC, the price of Bitcoin had surged to $8,601.80.

These instances illustrate how the appreciation of Bitcoin's value has mitigated the effects of halving events on miners' profitability.

As the supply of cryptocurrency diminishes, miners must prioritize cost efficiency to sustain their operations. Transaction fees from blockchain users will increasingly serve as a crucial revenue stream for miners. While this doesn't necessarily imply exorbitant fees for everyday transactions—Layer 2 solutions like the Lightning Network will address such concerns—the fees for large transfers may need to rise to ensure miners' profitability.

Galaxy's recent report forecasts a rise in mergers and acquisitions among mining firms to reduce energy expenses, enhance efficiency, secure funding, and foster expansion. Already, smaller operators are consolidating. However, this trend toward consolidation may come at the expense of decentralization, a core tenet of blockchain technology.

The 2024 halving stands out for several reasons. It occurs amid the launch of Bitcoin ETFs in the U.S., attracting a surge of new investors. Additionally, this year marks the first time Bitcoin's price has reached a new all-time high before block rewards have been halved. As market conditions evolve, miners must adapt to ensure their continued viability.