Cryptocurrency

A cryptocurrency, crypto-currency, or crypto[a] is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it.[2]

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership.[3][4][5] Despite the term that has come to describe many of the fungible blockchain tokens that have been created, cryptocurrencies are not considered to be currencies in the traditional sense, and varying legal treatments have been applied to them in various jurisdicitons, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice.[6][7][8] Some crypto schemes use validators to maintain the cryptocurrency. In a proof-of-stake model, owners put up their tokens as collateral. In return, they get authority over the token in proportion to the amount they stake. Generally, these token stakers get additional ownership in the token over time via network fees, newly minted tokens, or other such reward mechanisms.[9]

Cryptocurrency does not exist in physical form (like paper money) and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency (CBDC).[10] When a cryptocurrency is minted, created prior to issuance, or issued by a single issuer, it is generally considered centralized. When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[11]

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.[12]

History

In 1983, American cryptographer David Chaum conceived of a type of cryptographic electronic money called ecash.[13][14] Later, in 1995, he implemented it through Digicash,[15] an early form of cryptographic electronic payments. Digicash required user software in order to withdraw notes from a bank and designate specific encrypted keys before it can be sent to a recipient. This allowed the digital currency to be untraceable by a third party.

In 1996, the National Security Agency published a paper entitled How to Make a Mint: The Cryptography of Anonymous Electronic Cash, describing a cryptocurrency system. The paper was first published in an MIT mailing list[16] and later in 1997 in The American Law Review.[17]

In 1998, Wei Dai described "b-money", an anonymous, distributed electronic cash system.[18] Shortly thereafter, Nick Szabo described bit gold.[19] Like Bitcoin and other cryptocurrencies that would follow it, bit gold (not to be confused with the later gold-based exchange BitGold) was described as an electronic currency system which required users to complete a proof of work function with solutions being cryptographically put together and published.

In January 2009, Bitcoin was created by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash function, in its proof-of-work scheme.[20][21] In April 2011, Namecoin was created as an attempt at forming a decentralized DNS. In October 2011, Litecoin was released which used scrypt as its hash function instead of SHA-256. Peercoin, created in August 2012, used a hybrid of proof-of-work and proof-of-stake.[22]

Cryptocurrency has undergone several periods of growth and retraction, including several bubbles and market crashes, such as in 2011, 2013–2014/15, 2017–2018 and 2021–2023.[23][24]

On 6 August 2014, the UK announced its Treasury had commissioned a study of cryptocurrencies, and what role, if any, they could play in the UK economy. The study was also to report on whether regulation should be considered.[25] Its final report was published in 2018,[26] and it issued a consultation on cryptoassets and stablecoins in January 2021.[27]

In June 2021, El Salvador became the first country to accept Bitcoin as legal tender, after the Legislative Assembly had voted 62–22 to pass a bill submitted by President Nayib Bukele classifying the cryptocurrency as such.[28]

In August 2021, Cuba followed with Resolution 215 to recognize and regulate cryptocurrencies such as Bitcoin.[29]

In September 2021, the government of China, the single largest market for cryptocurrency, declared all cryptocurrency transactions illegal. This completed a crackdown on cryptocurrency that had previously banned the operation of intermediaries and miners within China.[30]

On 15 September 2022, the world's second largest cryptocurrency at that time, Ethereum transitioned its consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS) in an upgrade process known as "the Merge". According to the Ethereum Founder, the upgrade can cut both Ethereum's energy use and carbon-dioxide emissions by 99.9%.[31]

On 11 November 2022, FTX Trading Ltd., a cryptocurrency exchange, which also operated a crypto hedge fund, and had been valued at $18 billion,[32] filed for bankruptcy.[33] The financial impact of the collapse extended beyond the immediate FTX customer base, as reported,[34] while, at a Reuters conference, financial industry executives said that "regulators must step in to protect crypto investors."[35] Technology analyst Avivah Litan commented on the cryptocurrency ecosystem that "everything...needs to improve dramatically in terms of user experience, controls, safety, customer service."[36]

Formal definition

According to Jan Lansky, a cryptocurrency is a system that meets six conditions:[37]

- The system does not require a central authority; its state is maintained through distributed consensus.

- The system keeps an overview of cryptocurrency units and their ownership.

- The system defines whether new cryptocurrency units can be created. If new cryptocurrency units can be created, the system defines the circumstances of their origin and how to determine the ownership of these new units.

- Ownership of cryptocurrency units can be proved exclusively cryptographically.

- The system allows transactions to be performed in which ownership of the cryptographic units is changed. A transaction statement can only be issued by an entity proving the current ownership of these units.

- If two different instructions for changing the ownership of the same cryptographic units are simultaneously entered, the system performs at most one of them.

In March 2018, the word cryptocurrency was added to the Merriam-Webster Dictionary.[38]

Altcoins

Further information: List of cryptocurrencies

After the early innovation of Bitcoin in 2008, and the early network effect gained by Bitcoin, tokens, cryptocurrencies, and other digital assets that were not Bitcoin became collectively known during the 2010s as alternative cryptocurrencies,[39][40][41] or "altcoins."[42] Sometimes the term "alt coins" was used,[43][44] or disparagingly, "shitcoins".[45] Paul Vigna of The Wall Street Journal described altcoins in 2020 as "alternative versions of Bitcoin"[46] given its role as the model protocol for cryptocurrency designers. A Polytechnic University of Catalonia thesis in 2021 used a somewhat broader description. Not just as alternative versions of Bitcoin itself, but for any cryptocurrency other than bitcoin. "As of early 2020, there were more than 5,000 cryptocurrencies. Altcoin is the combination of two words "alt" and "coin" and includes all alternatives to Bitcoin."[42]: 14  The logo of Ethereum, the second largest cryptocurrency

The logo of Ethereum, the second largest cryptocurrency

Altcoins often have underlying differences when compared to Bitcoin. For example, Litecoin aims to process a block every 2.5 minutes, rather than Bitcoin's 10 minutes, which allows Litecoin to confirm transactions faster than Bitcoin.[47] Another example is Ethereum, which has smart contract functionality that allows decentralized applications to be run on its blockchain.[48] Ethereum was the most used blockchain in 2020, according to Bloomberg News.[49] In 2016, it had the largest "following" of any altcoin, according to the New York Times.[50]

Significant market price rallies across multiple altcoin markets are often referred to as an "altseason".[51][52]

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable level of purchasing power.[53] Notably, these designs are not foolproof, as a number of stablecoins have crashed or lost their peg. For example, on 11 May 2022, Terra's stablecoin UST fell from $1 to 26 cents.[54][55] The subsequent failure of Terraform Labs resulted in the loss of nearly $40B invested in the Terra and Luna coins.[56] In September 2022, South Korean prosecutors requested the issuance of an Interpol Red Notice against the company's founder, Do Kwon.[57] In Hong Kong, the expected regulatory framework for stablecoins in 2023/24 is being shaped and includes a few considerations.[58]

Architecture

This section duplicates the scope of other articles, specifically Blockchain. Please discuss this issue and help introduce a summary style to the section by replacing the section with a link and a summary or by splitting the content into a new article. (August 2022)

This section duplicates the scope of other articles, specifically Blockchain. Please discuss this issue and help introduce a summary style to the section by replacing the section with a link and a summary or by splitting the content into a new article. (August 2022)

Cryptocurrency is produced by an entire cryptocurrency system collectively, at a rate which is defined when the system is created and which is publicly stated. In centralized banking and economic systems such as the US Federal Reserve System, corporate boards or governments control the supply of currency.[citation needed] In the case of cryptocurrency, companies or governments cannot produce new units, and have not so far provided backing for other firms, banks or corporate entities which hold asset value measured in it. The underlying technical system upon which cryptocurrencies are based was created by Satoshi Nakamoto.[59]

Within a proof-of-work system such as Bitcoin, the safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties referred to as miners. Miners use their computers to help validate and timestamp transactions, adding them to the ledger in accordance with a particular timestamping scheme.[20] In a proof-of-stake blockchain, transactions are validated by holders of the associated cryptocurrency, sometimes grouped together in stake pools.

Most cryptocurrencies are designed to gradually decrease the production of that currency, placing a cap on the total amount of that currency that will ever be in circulation.[60] Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies can be more difficult for seizure by law enforcement.[3]

Blockchain

The validity of each cryptocurrency's coins is provided by a blockchain. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography.[59][61] Each block typically contains a hash pointer as a link to a previous block,[61] a timestamp and transaction data.[62] By design, blockchains are inherently resistant to modification of the data. It is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way".[63] For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.

Blockchains are secure by design and are an example of a distributed computing system with high Byzantine fault tolerance. Decentralized consensus has therefore been achieved with a blockchain.[64]

Nodes

A node is a computer that connects to a cryptocurrency network. The node supports the cryptocurrency's network through either relaying transactions, validation, or hosting a copy of the blockchain. In terms of relaying transactions, each network computer (node) has a copy of the blockchain of the cryptocurrency it supports. When a transaction is made, the node creating the transaction broadcasts details of the transaction using encryption to other nodes throughout the node network so that the transaction (and every other transaction) is known.

Node owners are either volunteers, those hosted by the organization or body responsible for developing the cryptocurrency blockchain network technology, or those who are enticed to

host a node to receive rewards from hosting the node network.[65]

Timestamping

Cryptocurrencies use various timestamping schemes to "prove" the validity of transactions added to the blockchain ledger without the need for a trusted third party.

The first timestamping scheme invented was the proof-of-work scheme. The most widely used proof-of-work schemes are based on SHA-256 and scrypt.[22]

Some other hashing algorithms that are used for proof-of-work include CryptoNote, Blake, SHA-3, and X11.

Another method is called the proof-of-stake scheme. Proof-of-stake is a method of securing a cryptocurrency network and achieving distributed consensus through requesting users to show ownership of a certain amount of currency. It is different from proof-of-work systems that run difficult hashing algorithms to validate electronic transactions. The scheme is largely dependent on the coin, and there is currently no standard form of it. Some cryptocurrencies use a combined proof-of-work and proof-of-stake scheme.[22]

Mining

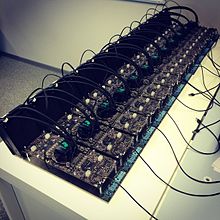

Hashcoin mine

Hashcoin mine

On a blockchain, mining is the validation of transactions. For this effort, successful miners obtain new cryptocurrency as a reward. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network. The rate of generating hashes, which validate any transaction, has been increased by the use of specialized machines such as FPGAs and ASICs running complex hashing algorithms like SHA-256 and scrypt.[66] This arms race for cheaper-yet-efficient machines has existed since Bitcoin was introduced in 2009.[66] Mining is measured by hash rate typically in TH/s.[67]

With more people entering the world of virtual currency, generating hashes for validation has become more complex over time, forcing miners to invest increasingly large sums of money to improve computing performance. Consequently, the reward for finding a hash has diminished and often does not justify the investment in equipment and cooling facilities (to mitigate the heat the equipment produces), and the electricity required to run them.[68] Popular regions for mining include those with inexpensive electricity, a cold climate, and jurisdictions with clear and conducive regulations. By July 2019, Bitcoin's electricity consumption was estimated to be approximately 7 gigawatts, around 0.2% of the global total, or equivalent to the energy consumed nationally by Switzerland.[69]

Some miners pool resources, sharing their processing power over a network to split the reward equally, according to the amount of work they contributed to the probability of finding a block. A "share" is awarded to members of the mining pool who present a valid partial proof-of-work.

As of February 2018, the Chinese Government has halted trading of virtual currency, banned initial coin offerings and shut down mining. Many Chinese miners have since relocated to Canada[70] and Texas.[71] One company is operating data centers for mining operations at Canadian oil and gas field sites, due to low gas prices.[72] In June 2018, Hydro Quebec proposed to the provincial government to allocate 500 megawatts of power to crypto companies for mining.[73] According to a February 2018 report from Fortune, Iceland has become a haven for cryptocurrency miners in part because of its cheap electricity.[74]

In March 2018, the city of Plattsburgh, New York put an 18-month moratorium on all cryptocurrency mining in an effort to preserve natural resources and the "character and direction" of the city.[75] In 2021, Kazakhstan became the second-biggest crypto-currency mining country, producing 18.1% of the global exahash rate. The country built a compound containing 50,000 computers near Ekibastuz.[76]

GPU price rise

An increase in cryptocurrency mining increased the demand for graphics cards (GPU) in 2017.[77] The computing power of GPUs makes them well-suited to generating hashes. Popular favorites of cryptocurrency miners such as Nvidia's GTX 1060 and GTX 1070 graphics cards, as well as AMD's RX 570 and RX 580 GPUs, doubled or tripled in price – or were out of stock.[78] A GTX 1070 Ti which was released at a price of $450 sold for as much as $1,100. Another popular card, the GTX 1060 (6 GB model) was released at an MSRP of $250, and sold for almost $500. RX 570 and RX 580 cards from AMD were out of stock for almost a year. Miners regularly buy up the entire stock of new GPU's as soon as they are available.[79]

Nvidia has asked retailers to do what they can when it comes to selling GPUs to gamers instead of miners. Boris Böhles, PR manager for Nvidia in the German region, said: "Gamers come first for Nvidia."[80]

Mining accelerator chips

Numerous companies developed dedicated crypto-mining accelerator chips, capable of price-performance far higher than that of CPU or GPU mining. At one point Intel marketed its own brand of crypto accelerator chip, named Blockscale.[81]

Wallets

An example paper printable Bitcoin wallet consisting of one Bitcoin address for receiving and the corresponding private key for spending

An example paper printable Bitcoin wallet consisting of one Bitcoin address for receiving and the corresponding private key for spending

Main article: Cryptocurrency wallet

A cryptocurrency wallet is a means of storing the public and private "keys" (address) or seed which can be used to receive or spend the cryptocurrency.[82] With the private key, it is possible to write in the public ledger, effectively spending the associated cryptocurrency. With the public key, it is possible for others to send currency to the wallet.

There exist multiple methods of storing keys or seed in a wallet. These methods range from using paper wallets (which are public, private or seed keys written on paper), to using hardware wallets (which are hardware to store your wallet information), to a digital wallet (which is a computer with a software hosting your wallet information), to hosting your wallet using an exchange where cryptocurrency is traded, or by storing your wallet information on a digital medium such as plaintext.[83]

Anonymity

Main article: Privacy and blockchain

Bitcoin is pseudonymous, rather than anonymous; the cryptocurrency in a wallet is not tied to a person, but rather to one or more specific keys (or "addresses").[84] Thereby, Bitcoin owners are not immediately identifiable, but all transactions are publicly available in the blockchain.[85] Still, cryptocurrency exchanges are often required by law to collect the personal information of their users.[86]

Some cryptocurrencies, such as Monero, Zerocoin, Zerocash, and CryptoNote, implement additional measures to increase privacy, such as by using zero-knowledge proofs.[87][88]

A recent 2020 study presented different attacks on privacy in cryptocurrencies. The attacks demonstrated how the anonymity techniques are not sufficient safeguards. In order to improve privacy, researchers suggested several different ideas including new cryptographic schemes and mechanisms for hiding the IP address of the source.[89]

Economics

Cryptocurrencies are used primarily outside banking and governmental institutions and are exchanged over the Internet.

Block rewards

Proof-of-work cryptocurrencies, such as Bitcoin, offer block rewards incentives for miners. There has been an implicit belief that whether miners are paid by block rewards or transaction fees does not affect the security of the blockchain, but a study suggests that this may not be the case under certain circumstances.[90]

The rewards paid to miners increase the supply of the cryptocurrency. By making sure that verifying transactions is a costly business, the integrity of the network can be preserved as long as benevolent nodes control a majority of computing power. The verification algorithm requires a lot of processing power, and thus electricity in order to make verification costly enough to accurately validate public blockchain. Not only do miners have to factor in the costs associated with expensive equipment necessary to stand a chance of solving a hash problem, they must further consider the significant amount of electrical power in search of the solution. Generally, the block rewards outweigh electricity and equipment costs, but this may not always be the case.[91]

The current value, not the long-term value, of the cryptocurrency supports the reward scheme to incentivize miners to engage in costly mining activities.[92] In 2018, Bitcoin's design caused a 1.4% welfare loss compared to an efficient cash system, while a cash system with 2% money growth has a minor 0.003% welfare cost. The main source for this inefficiency is the large mining cost, which is estimated to be US$360 million per year. This translates into users being willing to accept a cash system with an inflation rate of 230% before being better off using Bitcoin as a means of payment. However, the efficiency of the Bitcoin system can be significantly improved by optimizing the rate of coin creation and minimizing transaction fees. Another potential improvement is to eliminate inefficient mining activities by changing the consensus protocol altogether.[93]

Transaction fees

Transaction fees for cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction.[citation needed] The currency holder can choose a specific transaction fee, while network entities process transactions in order of highest offered fee to lowest.

[citation needed] Cryptocurrency exchanges can simplify the process for currency holders by offering priority alternatives and thereby determine which fee will likely cause the transaction to be processed in the requested time.[citation needed]

For Ethereum, transaction fees differ by computational complexity, bandwidth use, and storage needs, while Bitcoin transaction fees differ by transaction size and whether the transaction uses SegWit. In February 2023, the median transaction fee for Ether corresponded to $2.2845,[94] while for Bitcoin it corresponded to $0.659.[95]

Some cryptocurrencies have no transaction fees, and instead rely on client-side proof-of-work as the transaction prioritization and anti-spam mechanism.[96][97][98]

Exchanges

Main article: Cryptocurrency exchange

Cryptocurrency exchanges allow customers to trade cryptocurrencies[99] for other assets, such as conventional fiat money, or to trade between different digital currencies.

Crypto marketplaces do not guarantee that an investor is completing a purchase or trade at the optimal price. As a result, as of 2020 it was possible to arbitrage to find the difference in price across several markets.[100]

Atomic swaps

Atomic swaps are a mechanism where one cryptocurrency can be exchanged directly for another cryptocurrency, without the need for a trusted third party such as an exchange.[101]

ATMs

Bitcoin ATM

Bitcoin ATM

Jordan Kelley, founder of Robocoin, launched the first Bitcoin ATM in the United States on 20 February 2014. The kiosk installed in Austin, Texas, is similar to bank ATMs but has scanners to read government-issued identification such as a driver's license or a passport to confirm users' identities.[102]

Initial coin offerings

An initial coin offering (ICO) is a controversial means of raising funds for a new cryptocurrency venture. An ICO may be used by startups with the intention of avoiding regulation. However, securities regulators in many jurisdictions, including in the U.S., and Canada, have indicated that if a coin or token is an "investment contract" (e.g., under the Howey test, i.e., an investment of money with a reasonable expectation of profit based significantly on the entrepreneurial or managerial efforts of others), it is a security and is subject to securities regulation. In an ICO campaign, a percentage of the cryptocurrency (usually in the form of "tokens") is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, often Bitcoin or Ether.[103][104][105]

According to PricewaterhouseCoopers, four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. The Swiss regulatory agency FINMA stated that it would take a "balanced approach" to ICO projects and would allow "legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system." In response to numerous requests by industry representatives, a legislative ICO working group began to issue legal guidelines in 2018, which are intended to remove uncertainty from cryptocurrency offerings and to establish sustainable business practices.[106]

Price trends

The market capitalization of a cryptocurrency is calculated by multiplying the price by the number of coins in circulation. The total cryptocurrency market cap has historically been dominated by Bitcoin accounting for at least 50% of the market cap value where altcoins have increased and decreased in market cap value in relation to Bitcoin. Bitcoin's value is largely determined by speculation among other technological limiting factors known as blockchain rewards coded into the architecture technology of Bitcoin itself. The cryptocurrency market cap follows a trend known as the "halving", which is when the block rewards received from Bitcoin are halved due to technological mandated limited factors instilled into Bitcoin which in turn limits the supply of Bitcoin. As the date reaches near of a halving (twice thus far historically) the cryptocurrency market cap increases, followed by a downtrend.[107]

By June 2021, cryptocurrency had begun to be offered by some wealth managers in the US for 401(k)s.[108][109][110]

Volatility

Cryptocurrency prices are much more volatile than established financial assets such as stocks. For example, over one week in May 2022, Bitcoin lost 20% of its value and Ethereum lost 26%, while Solana and Cardano lost 41% and 35% respectively. The falls were attributed to warnings about inflation. By comparison, in the same week, the Nasdaq tech stock index fell 7.6 per cent and the FTSE 100 was 3.6 per cent down.[111]

In the longer term, of the 10 leading cryptocurrencies identified by the total value of coins in circulation in January 2018, only four (Bitcoin, Ethereum, Cardano and Ripple (XRP)) were still in that position in early 2022.[112] The total value of all cryptocurrencies was $2 trillion at the end of 2021, but had halved nine months later.[113][114] The Wall Street Journal has commented that the crypto sector has become "intertwined" with the rest of the capital markets and "sensitive to the same forces that drive tech stocks and other risk assets", such as inflation forecasts.[115]

Databases

There are also centralized databases, outside of blockchains, that store crypto market data. Compared to the blockchain, databases perform fast as there is no verification process. Four of the most popular cryptocurrency market databases are CoinMarketCap, CoinGecko, BraveNewCoin, and Cryptocompare.[116]

Social and political aspects

According to Alan Feuer of The New York Times, libertarians and anarcho-capitalists were attracted to the philosophical idea behind Bitcoin. Early Bitcoin supporter Roger Ver said: "At first, almost everyone who got involved did so for philosophical reasons. We saw Bitcoin as a great idea, as a way to separate money from the state."[117] Economist Paul Krugman argues that cryptocurrencies like Bitcoin are "something of a cult" based in "paranoid fantasies" of government power.[118]

David Golumbia says that the ideas influencing Bitcoin advocates emerge from right-wing extremist movements such as the Liberty Lobby and the John Birch Society and their anti-Central Bank rhetoric, or, more recently, Ron Paul and Tea Party-style libertarianism.[119] Steve Bannon, who owns a "good stake" in Bitcoin, sees cryptocurrency as a form of disruptive populism, taking control back from central authorities.[120]

Bitcoin's founder, Satoshi Nakamoto, has supported the idea that cryptocurrencies go well with libertarianism. "It's very attractive to the libertarian viewpoint if we can explain it properly," Nakamoto said in 2008.[121]

According to the European Central Bank, the decentralization of money offered by Bitcoin has its theoretical roots in the Austrian school of economics, especially with Friedrich von Hayek in his book Denationalisation of Money: The Argument Refined,[122] in which Hayek advocates a complete free market in the production, distribution and management of money to end the monopoly of central banks.[123]

Increasing regulation

The rise in the popularity of cryptocurrencies and their adoption by financial institutions has led some governments to assess whether regulation is needed to protect users. The Financial Action Task Force (FATF) has defined cryptocurrency-related services as "virtual asset service providers" (VASPs) and recommended that they be regulated with the same money laundering (AML) and know your customer (KYC) requirements as financial institutions.[124]

In May 2020, the Joint Working Group on interVASP Messaging Standards published "IVMS 101", a universal common language for communication of required originator and beneficiary information between VASPs. The FATF and financial regulators were informed as the data model was developed.[125]

In June 2020, FATF updated its guidance to include the "Travel Rule" for cryptocurrencies, a measure which mandates that VASPs obtain, hold, and exchange information about the originators and beneficiaries of virtual asset transfers.[126] Subsequent standardized protocol specifications recommended using JSON for relaying data between VASPs and identity services. As of December 2020, the IVMS 101 data model has yet to be finalized and ratified by the three global standard setting bodies that created it.[127]

The European Commission published a digital finance strategy in September 2020. This included a draft regulation on Markets in Crypto-Assets (MiCA), which aimed to provide a comprehensive regulatory framework for digital assets in the EU.[128][129]

On 10 June 2021, the Basel Committee on Banking Supervision proposed that banks that held cryptocurrency assets must set aside capital to cover all potential losses. For instance, if a bank were to hold Bitcoin worth $2 billion, it would be required to set aside enough capital to cover the entire $2 billion. This is a more extreme standard than banks are usually held to when it comes to other assets. However, this is a proposal and not a regulation.

The IMF is seeking a coordinated, consistent and comprehensive approach to supervising cryptocurrencies. Tobias Adrian, the IMF's financial counsellor and head of its monetary and capital markets department said in a January 2022 interview that "Agreeing global regulations is never quick. But if we start now, we can achieve the goal of maintaining financial stability while also enjoying the benefits which the underlying technological innovations bring,"[130]