The Value Chain of Crypto/Forex in Nigeria

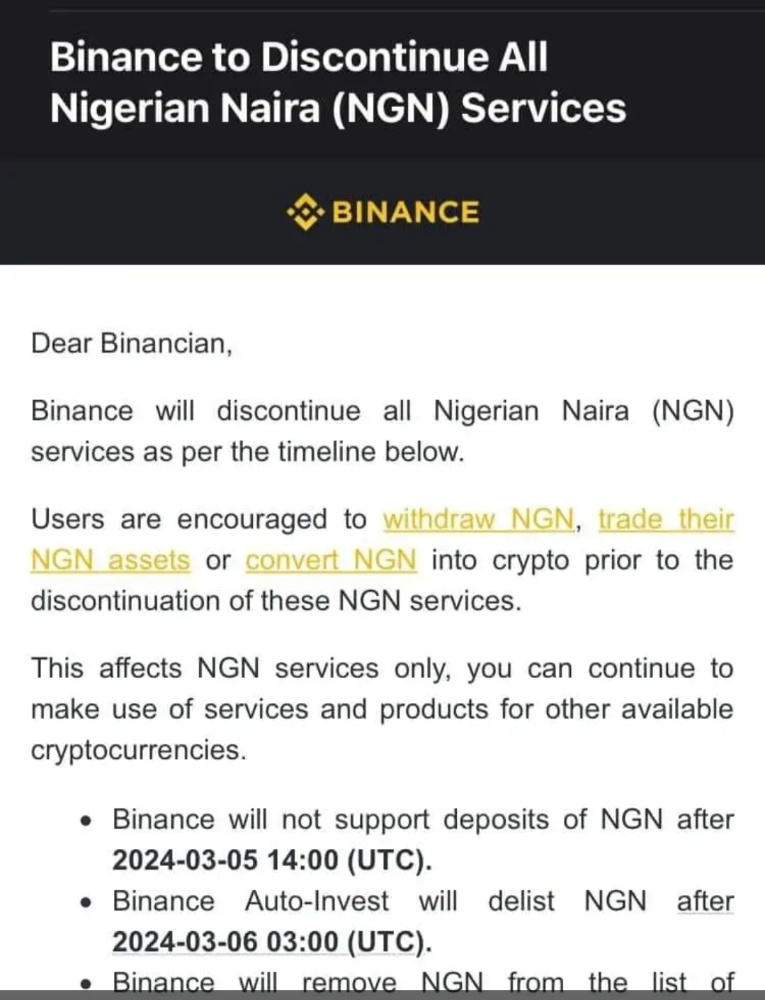

1. Exchanges: These are the platforms where users can buy, sell, and trade cryptocurrencies and forex. They provide a secure environment for transactions and offer features like order books, margin trading, and staking. Popular Nigerian exchanges include Binance (although their status is currently uncertain as the policies of the government are opposed to their operations), Luno, Quidax, and AEX Global.

3. Brokers: Forex brokers act as intermediaries between traders and the forex market. They offer leverage, trading platforms, and market analysis, allowing users to speculate on currency movements. Some Nigerian brokers also facilitate cryptocurrency trading.

4. Payment Processors: These companies handle the movement of funds between users' bank accounts and crypto/forex exchanges or P2P platforms. They ensure secure and efficient transactions, but their fees can impact overall costs. Popular payment processors in Nigeria include Paystack and Flutterwave.

5. Banks: While some Nigerian banks have been hesitant to embrace crypto, others are starting to see its potential. Banks may offer custodial services for digital assets or partner with crypto companies to facilitate transactions.

7. Technology Providers: Blockchain technology companies provide the infrastructure that underpins cryptocurrencies. Additionally, companies that offer Know Your Customer (KYC)/Anti-Money Laundering (AML) solutions are essential for ensuring compliance within the crypto/forex space.

8. Media and Educational Resources: A growing number of Nigerian media outlets and educational platforms are dedicated to informing the public about cryptocurrencies and forex trading. They play a vital role in promoting financial literacy and responsible investment practices.

Understanding the Value Chain

By understanding the different players in the Nigerian crypto/forex value chain, you can make informed decisions about where to buy, sell, and trade your assets. It's important to consider factors like security, regulation, fees, and the reputation of each service provider before engaging in any transactions.

The Future of Crypto/Forex in Nigeria

The Nigerian crypto/forex market is still evolving, and its future trajectory will depend on several factors, including:

Regulatory clarity from SEC and CBN.

Increased adoption and mainstream acceptance of cryptocurrencies.

Development of a robust and secure financial infrastructure.

Despite the challenges, Nigeria's young, tech-savvy population and growing internet penetration position it for continued growth in the crypto/forex space. By fostering a collaborative environment between regulators, businesses, and consumers, Nigeria can harness the potential of these markets for economic development and financial inclusion.

Disclaimer: This exposition is for informational purposes only and should not be considered financial advice. Always do your research before making any investment decisions.