The Evolution of Finance: Traditional vs. Decentralized Finance

Traditional finance, characterized by centralized institutions such as banks and regulatory bodies, has long been the cornerstone of the global economic system. However, the emergence of blockchain technology and smart contracts has paved the way for a decentralized alternative—DeFi.

Traditional Finance: A Pillar of Stability

Traditional finance has established itself as a robust and regulated system, providing stability and trust to millions worldwide. Banks, governments, and regulatory bodies play integral roles in maintaining financial order, ensuring security, and fostering economic growth. However, the traditional system is not without its shortcomings, including inefficiencies, high transaction costs, and limited accessibility.

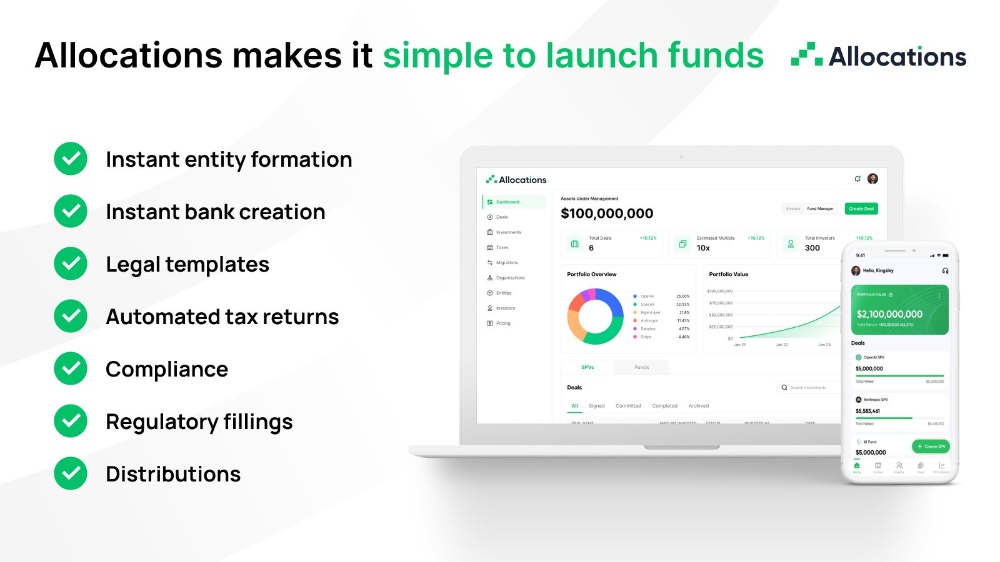

Decentralized Finance: The Disruptive Force

DeFi, on the other hand, leverages blockchain technology to create a decentralized ecosystem that operates without intermediaries. Smart contracts, self-executing pieces of code, facilitate various financial activities, such as lending, borrowing, and trading, within a transparent and automated framework. This decentralized approach promises lower costs, increased accessibility, and greater financial inclusivity.

The Battle for Dominance

While DeFi offers a tantalizing glimpse into a more accessible and efficient financial future, it faces hurdles on its path to widespread adoption. Regulatory challenges, security concerns, and scalability issues remain key obstacles. Traditional finance, with its established infrastructure and regulatory frameworks, holds its ground against the disruptive force of DeFi.

The Synergy of Coexistence

Rather than an outright replacement, a more plausible scenario is the coexistence and collaboration of traditional and decentralized finance. Hybrid models, combining the strengths of both systems, may emerge to address the shortcomings of each. Institutions may integrate blockchain technology to enhance efficiency, reduce costs, and offer new financial products without abandoning the regulatory safeguards of the traditional system.

Conclusion: A Harmonious Future?

The future of finance seems likely to be a synthesis of the old and the new. Traditional finance, with its stability and regulatory framework, will persist, while DeFi continues to evolve and carve its niche. The synergy between these two paradigms could redefine the financial landscape, providing a more inclusive, efficient, and resilient system for the benefit of all.

In the end, the question may not be about replacement but about adaptation and collaboration as the financial world charts its course into a decentralized future.

#Writing Competition