Mastering the Single Candle Pullback Strategy in Trading

In the world of trading, where every flicker of a candlestick can indicate a potential shift in market sentiment, the single candle pullback strategy stands out as a powerful tool for traders seeking to capitalize on short-term price movements. This strategy relies on the analysis of individual candlesticks to identify temporary reversals within a broader trend, offering traders an opportunity to enter or exit positions with precision timing. In this article, we'll delve into the intricacies of the single candle pullback strategy, exploring its principles, implementation, and key considerations for success.

Understanding the Single Candle Pullback

At its core, the single candle pullback strategy revolves around the concept of price retracement within an ongoing trend. Unlike multi-candle patterns such as engulfing or harami, which require multiple candlesticks to form, the single candle pullback focuses on the behavior of a single candle relative to the preceding trend.

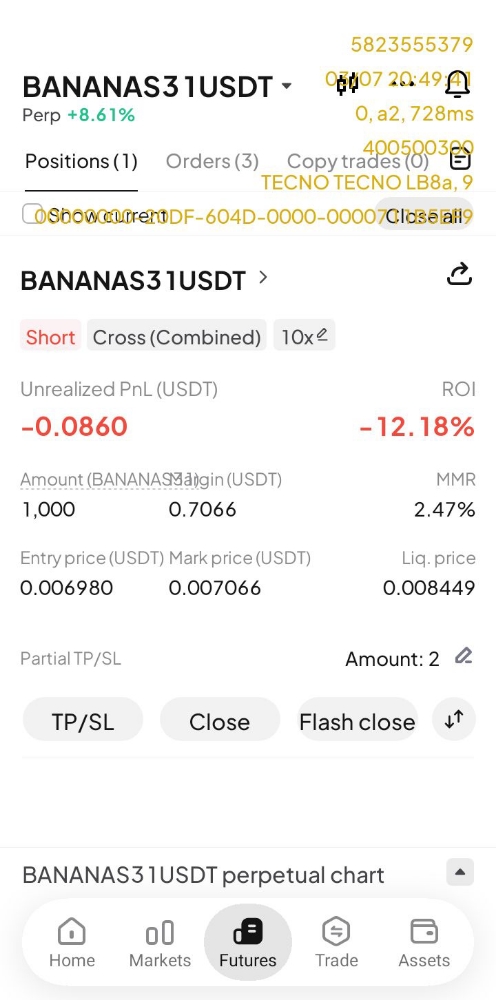

Typically, in an uptrend, a single candle pullback occurs when a bullish trend pauses momentarily, with a single bearish candle forming before the uptrend resumes. Conversely, in a downtrend, a single candle pullback manifests as a brief interruption in the bearish momentum, characterized by a single bullish candle appearing amidst a sea of red.

Identifying Key Components

To effectively implement the single candle pullback strategy, traders must familiarize themselves with the key components of a pullback candle. These include:

1. Length: The length of the pullback candle relative to preceding candles can offer insights into the strength of the pullback. A longer pullback candle suggests a more significant reversal in momentum compared to a shorter one.

2. Volume: Analyzing trading volume accompanying the pullback candle can provide confirmation of the reversal. Ideally, a decrease in volume during the pullback indicates weakening selling or buying pressure, depending on the direction of the trend.

3. Wicks and Body: The presence of long wicks and a small body in the pullback candle signifies indecision in the market, potentially signaling a reversal in the prevailing trend.

Implementing the Strategy

Implementing the single candle pullback strategy requires a combination of technical analysis skills and market intuition. Here's a step-by-step guide to executing this strategy effectively:

1. Identify the Trend: Begin by identifying the prevailing trend using technical indicators or price action analysis. Establish whether the market is in an uptrend or downtrend.

2. Spot the Pullback Candle: Look for a single candle that contradicts the prevailing trend, indicating a potential pullback. Pay close attention to the characteristics of the candle, including its length, volume, and wick formations.

3. Confirm the Reversal: Validate the pullback signal by analyzing additional factors such as support and resistance levels, Fibonacci retracements, or other technical indicators. Look for confluence to strengthen your conviction in the trade.

4. Enter the Trade: Once you've confirmed the reversal, consider entering a position in the direction opposite to the prevailing trend. Place appropriate stop-loss orders to manage risk and set profit targets based on key support or resistance levels.

5. Manage Risk: Continuously monitor the trade and adjust your stop-loss levels as the market progresses. Consider scaling out of the position as the trend resumes or exits if the pullback fails to materialize.

Key Considerations

While the single candle pullback strategy offers traders a concise and actionable approach to capitalizing on short-term price movements, it's essential to consider the following factors:

1. False Signals: Not all single candle pullbacks result in trend reversals. Be cautious of false signals and validate your analysis with additional confirmation indicators before entering a trade.

2. Market Conditions: Market volatility and liquidity can influence the effectiveness of the single candle pullback strategy. Exercise caution when implementing this strategy during periods of heightened volatility or low trading volumes.

3. Risk Management: Proper risk management is crucial when trading any strategy. Determine your risk tolerance and position size accordingly to avoid excessive losses.

4. Practice and Patience: Like any trading strategy, mastering the single candle pullback technique requires practice and patience. Continuously analyze past trades, refine your approach, and adapt to evolving market conditions.

In conclusion, the single candle pullback strategy represents a valuable tool in a trader's arsenal for identifying short-term trading opportunities within broader trends. By understanding the principles, implementing the strategy with precision, and considering key considerations, traders can enhance their chances of success in navigating dynamic market environments. As with any trading approach, discipline, and adaptability are essential for achieving consistent results over time.