Research: Introducing Berachain

Berachain is trying to achieve both technology and culture, and it is not enough just to describe it as a “Tendermint-based EVM-compatible layer-1 solution”.

Berachain adopted a novel “Proof of Liquidity” to resolve the liquidity issue that other L1s are experiencing and proposed a “Tri-token system” taking into account the disadvantages and advantages of the existing layer-1 tokenomics.

Berachain intends to create its own culture by partnering with unique protocols, accelerating bold chain-native projects, and through its maniac and engaging community.

Why Berachain?

Why introducing Berachain among countless layer-1 protocols?

1. Introduction

1.1 The misunderstanding

If Berachain is introduced as a “Tendermint-based EVM-compatible layer-1 solution”, it might leave many people wondering about the chain.

How can a chain be named “Berachain”?

If you are somewhat repelled by the name “Berachain”, you are not alone. It is absolutely not common to name a layer-1 solution as a Bear(Bera)-chain.

The naming comes from the team’s history of starting as an NFT project community Bong Bears. It is completely natural to raise questions about the authenticity of this project by just hearing the name only. Although the team wrapped themselves up in memes, that is not everything about this project.

Tendermint-based EVM layer-1? Isn’t it too boring?

Just the idea of another layer-1 solution alone can make you lose any interest. At best, there are already other Tendermint-based EVM layer-1 solutions like Evmos, Canto, Kava, etc. I cannot deny that I also get unconsciously critical of a new layer-1 solution thinking that what can be so different. Berachain is indeed a Tendermint-based EVM layer-1 solution, but it does not do justice to introduce it as just another L1 product. Berachain does have something extra.

1.2 Something extra

‘Something extra’ of Berachain is its technology and culture.

Apple is a prime example of a company that has technology and culture. It’s Apple’s unique and creative technology that attracts consumers but its culture and vibe is an equally attractive element in buying its products. Same for the Dyson. Of course, it has supreme motors and technology but it’s its brand and culture that makes us add Dyson’s vacuum cleaner to our wishlist.

It is the technology and culture that matters for crypto protocols, especially for layer-1 protocols. Types of consensus algorithm, transaction processing speed, token design and fee mechanism, block finality, and bridge solution are the technologies that belong to layer-1 and good technology can indeed be a competitive edge in layer-1. However, most blockchain technologies are open-source, and technological edge cannot be the only factor that can differentiate them from others.

Layer-1 can be likened to a country. People choose a country to reside in by considering various elements — the image of it, who lives there, what culture they have, and whatnot. The same goes for users when they look for a layer-1 they want to settle. The problem is, most layer-1 protocols do not have a unique culture. Many of the layer-1 chains provide the same features although with different names and it is hard to recall a distinctive color or vibe when we think about a specific chain.

1.3 And then, there goes Berachain.

Berachain is serious about the problem it is trying to solve and establishing a technological solution towards this goal. Also, it is good at forming communities through memes and is striving to form a unique ecosystem by selecting innovative protocols only for partnership. Berachain can be the layer-1 solution that can achieve both technology and culture.

2. Berachain Overview

Berachain is a Tendermint-based EVM-compatible layer-1 solution, but it differentiates from other chains as below:

2.1 Liquidity

Berachain introduced a novel “Proof of Liquidity” mechanism to the Tendermint to resolve the liquidity issue other alt layer-1 platforms, besides Ethereum, are experiencing. Users can get block rewards by staking other tokens than Berachain’s native tokens. The staked assets are used as the liquidity of the pool while contributing to the chain’s security.

2.2 Token design

Berachain designed a unique token design considering the issues and benefits of the existing layer-1 token designs. It has adopted a novel “Tri-token system” where BERA works as a native token, BGT as a governance token, and HONEY as a stablecoin.

2.3 Ecosystem

While using Crocswap as its AMM, Berachain is establishing an ecosystem by partnering with protocols that provide innovative features such as Abacus and Redacted Cartel. It is very encouraging that many projects are built on the chain thanks to its engaging and maniac community even before the mainnet is launched.

3. Liquidity

3.1 Liquidity of the existing layer-1 protocols

The foundation for any layer-1 DeFi protocols is ample liquidity. Lack of abundant liquidity can affect the slippage of the whole layer-1 when a certain amount of funds is withdrawn.

Assume that each layer-1 has $50M of lending. Ethereum, with the highest liquidity, will have a slippage of 9% while Phantom and Avalanche have a slippage of up to 30–40%. As such, maintaining abundant liquidity is the basic element for the security of a layer-1 chain.

However, the problem is that liquidity providers or LPs are always ready to move their funds somewhere else. LPs would immediately move their assets that used to provide liquidity in the current protocol whenever there’s a better opportunity (i.e. higher interest in other layer-1 protocols). This is why you can observe the liquidy rotation where a lump sum of liquidity is withdrawn all at once from one layer-1 to another at a specific point in time if you look at the TVL(Total Value Locked) of alt layer-1s except for Ethereum.

3.2 The Proof of Liquidity (PoL)

Berachain resolves the liquidity rotation through its novel Proof of Liquidity (PoL) mechanism by aligning the incentives of a layer-1 and the LPs in that chain.

PoL is similar in many ways to the delegated proof of stake systems (dPoS) consensus algorithm of existing Cosmos chains. In dPoS, users can receive block rewards by contributing to the security of the chain by staking their native tokens through validators. However, PoL has some differences from the dPoS.

It’s not necessarily the native token that can be used for staking.

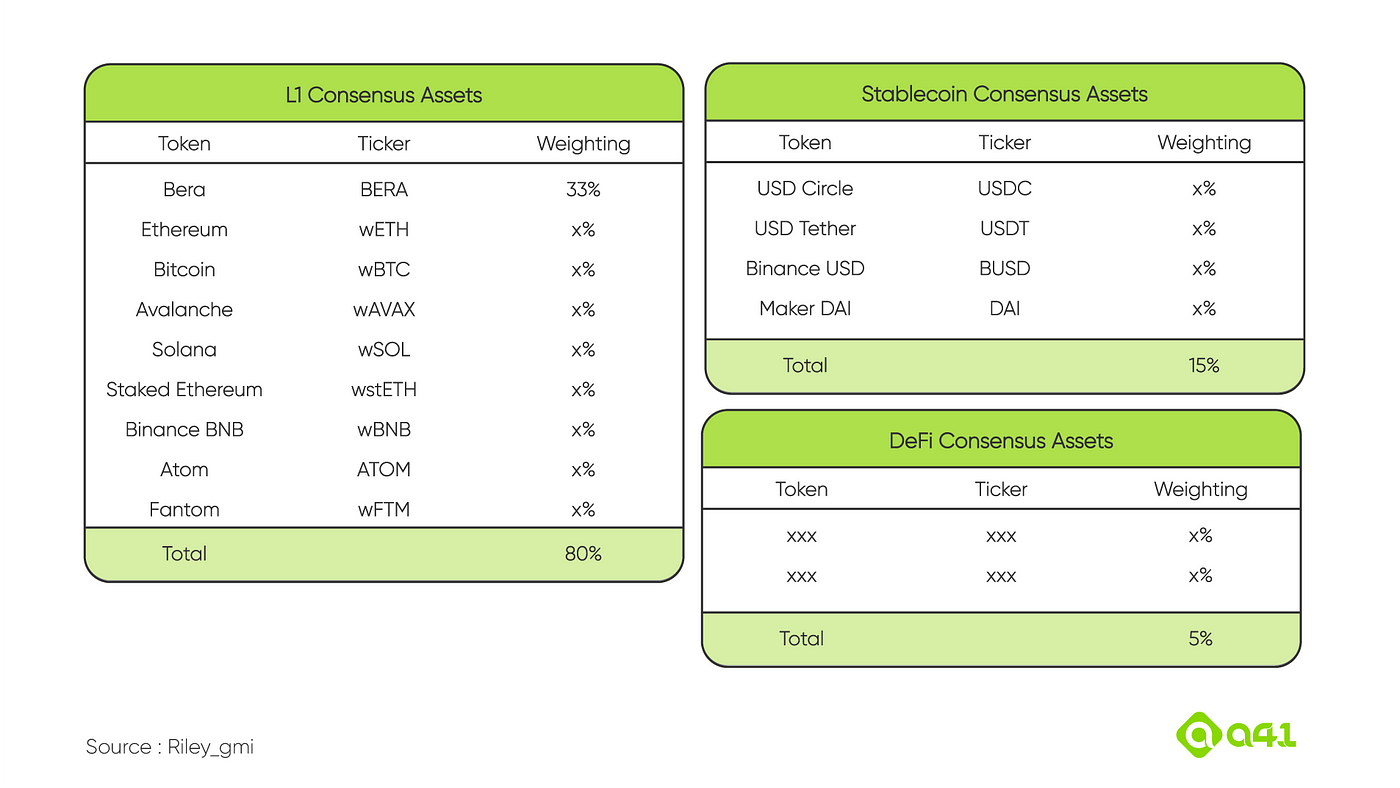

In the dPoS, only the native token of a chain can be used for staking. However, in the Proof of Liquidity, not only BERA, which is Berachain’s native token, but also the native tokens of other layer-1 chains (e.g. wETH, wSOL, wAVAX, etc.), wBTC, stable coins (e.g. USDC, USDT, etc.), and DeFi blue chip tokens (not released yet) can be used for staking and block rewards. However, since each token has different levels of contributions to the security of the chain depending on its price fluctuations and market share, they have different weightings and the block rewards for staking will be determined based on the weightings. According to currently published data, combined weighting for L1 native tokens is 80%, stablecoins have 15%, and DeFi blue chip tokens have 5%. The detailed weight of each token has not yet been released. The initial value of the weightings will be determined by the Berachain team, but as soon as the chain is up and running, the weights will be determined by governance.

According to currently published data, combined weighting for L1 native tokens is 80%, stablecoins have 15%, and DeFi blue chip tokens have 5%. The detailed weight of each token has not yet been released. The initial value of the weightings will be determined by the Berachain team, but as soon as the chain is up and running, the weights will be determined by governance.

Staked assets are used as liquidity for the chain.

As the name PoL suggests, various tokens staked by the users are used as the chain’s liquidity in addition to their contribution to the chain’s security. Once users stake their tokens, Berachain pairs these tokens with its stablecoin HONEY and uses them as the liquidity of the chain’s native DEX. This allows users to receive fees by providing liquidity through staking, in addition to getting block rewards. Also, users can mint HONEY based on the staked assets and use them freely in the Berachain ecosystem.

One disadvantage of the mechanism is that the assets staked by users are exposed to impermanent loss (IL) since they are used as liquidity. To cancel this IL, the chain takes on a leveraged long position in its native perp exchange.

3.3 Expected results of introducing the Proof of Liquidity

Can Resolve the Issue of the “Liquidity Rotation”

Since the users staking their assets in Berachain naturally becomes an LP, incentives of the LPs and the chain are aligned. Also, users can mint the chain’s stablecoin HONEY, and use them as they want in the Berachain ecosystem. This allows users to use their assets much more effectively and gives them more incentive to stay in the chain. This built-in function of the Berachain is very much similar to liquid staking which is receiving much attention in the Cosmos ecosystem.

Various Benefits of Using Native Tokens for Staking

Although Berachain has not finalized the list of DeFi blue chips that can be used for staking, the list likely includes the native tokens of Defi protocols that are deployed on the Berachain. DeFi protocols that launch on Berachain can have several benefits.

First of all, protocols can enjoy higher liquidity than their native tokens. As soon as users stake their tokens, they are paired with HONEY by the chain’s native AMM and used as liquidity. It is expected to be much easier and more effective to bootstrap the liquidity of the native tokens than doing it through liquidity providers in decentralized exchanges.

Second, it provides an additional utility to the token holders. Token holders can have an additional utility of getting block rewards by staking their tokens in Berachain in addition to the existing utility of the tokens.

Third, alignment of the incentives. As native tokens of the protocol are used to increase the security of the chain, it naturally aligns with the incentives of the protocols and Berachain. In turn, this aligns the incentives of the three stakeholders of users, protocols, and the chain.

Can Form Bribe Markets

As was mentioned before, each token has its weight and the block rewards are determined according to the weighting. Since the weights will be determined by the governance in the future, it is possible that bribe markets can be formed at the governance stage. From the point of DeFi protocols, more block rewards directly affect the token’s competitiveness and prices. Therefore, it is likely that they increase the demand for their native tokens, and possibly see services like bribe.crv appear.

4. Token Design

4.1 Tokenomics of the existing L1s

Berachain adopted its unique Tri-token model after taking a comprehensive look at the tokenomics of the existing L1s. Below are some of the points to consider when we look at the tokenomics of the existing L1s.

The Paradox of Tokens

Most L1 tokens are used to pay gas fees while having the utility of governance. The problem with this mechanism is that as more gas fee is paid by using the chain, more tokens will be used, resulting in less governance power. The contradiction here is that heavy users who frequently use the L1 will have less power in governance.

Native Stablecoins

Despite Terra’s collapse, the growth of UST has certainly been noteworthy. It reminded many L1s of the importance of having a unique stablecoin, and it led to the launching of USN of NEAR and USDD of TRON. Aside from the success of the project, having a chain-native stablecoin has the following advantages:

- It prevents the value fragmentation.

- Having a chain-native stable coin can attribute the values that can be captured by the stablecoin without making them taken by third-party stablecoins such as USDT, USDC, FRAX, etc.

- It allows customization.

- Unlike third-party stablecoins, chain-native stablecoins can be customized at the design level in the direction each Layer 1 wants to go.

Transferability of Governance Tokens

Due to the issues arising from governance tokens being traded in the market and transferred between users led to an active discussion on making governance tokens non-transferrable.

Some problems arise as governance tokens are traded in the market and transferable between people, and accordingly, discussions about making governance tokens non-transferable have been quite active. Making the governance token non-transferable increases the cost of governance attacks through token acquisition, can induce specific actions for governance participation, and prevent governance from being dominated by capital.

4.2 The Tri-Token System; BERA, BGT, and HONEY

$BERA

BERA corresponds to a typical layer 1 native token. BERA is used to pay block rewards as well as gas fees. All BERA tokens used for gas fees are burned. From what is known so far, BERA is expected to be issued with an annual inflation rate of 10%.

What is notable among its utility is earning BGT by staking BERA, which is the only way to earn BGT. Therefore, to earn BGT, you can stake BERA from the first place or stake the BERA that you earned from staking other assets.

$BGT

BGT stands for the Bera Governance Token and is a governance token in the form of a non-transferable NFT. To resolve the aforementioned paradox of tokens, Berachain separated out the tokens of the Berachain into BERA, the gas token, and the governance token, BGT.

As a governance token, BGT is used to determine the block reward for each staking asset and which tokens can be added for staking. Therefore it is expected that the demand for BGT to increase with time.

Importantly, BGT holders can get part of the fees generated from the whole chain in HONEY. For example, part of the DEX swap fees, funding fees for perp trading, and interest on HONEY loans are distributed to the BGT holders. BGT cannot be traded in the secondary market since it can only be earned by staking BERA and is non-transferable. Users can earn more BGT by staking more BERA for longer and have to return BGT to unstake BERA.

$HONEY

HONEY is Berachain’s native stablecoin. Users can mint HONEY with assets staked on Berachain as collateral. HONEY is an over-collateralized stablecoin that requires at least 150% of the borrow as collateral. (For example, a minimum of the asset of $1.5 should be staked in Berachian if you want to mint $1 worth of HONEY).

HONEY is used as a key currency in the Berachain ecosystem. Since the assets staked by users are always paired with HONEY and used as liquidity, all DEX transactions involve HONEY. It is also used to pay funding fees in the chain’s perp exchange.

Since we saw UST being de-pegged from its pair, people might wonder how HONEY can maintain its peg. As was mentioned above, since HONEY is an over-collateralized stablecoin, it is much more secure in terms of maintaining the peg. Besides, there are other measures to ensure it does not lose its peg:

- HONEY can be minted against staked assets as collateral, and the interest for minting can be adjusted in the process.

- Slippage and fees can be adjusted through HONEY’s Algorithmic Market Operation(AMO).

- Constant demand is expected since HONEY is used to pay funding fees in the perp exchange.

5. The Ecosystem

Berachain’s ecosystem consists largely of partnerships, chain-native projects, and communities. Unique projects and communities are combined to create Berachain’s own culture.

5.1 Partnerships

Crocswap

Crocswap is planning to create a native DEX in Berachain. It distinguishes itself from the traditional DEXs as below:

- Unlike the existing decentralized exchanges which have each liquidity pool as its smart contract, Crocswap is a single smart contract DEX where the entire DEX runs on a single smart contract. Each liquidity pool is represented in a lightweight data structure that allows gas fee reductions.

- Crocswap uses a dual liquidity model. It acts like a Constant Function Market Maker (CFMM) for small transactions like Uniswap v2, but LPs can also provide liquidity by specifying the scope as in Uniswap v3. This allows taking only the advantages of concentrated liquidity and ambient liquidity while complementing the disadvantages of the two.

- It supports permissioned pools where a permit oracle determines who can use the pool and which tokens can be used.

Crocswap is evaluated as the next-generation AMM since it provides other innovative functions in addition to what’s mentioned above. More information about Crocswap can be found in this article.

Synapse Protocol

Synapse Protocol will work as a cross-chain solution for Berachain. It is a popular bridge that connects 16 chains as of now with a bridge volume of approximately $11B.

Redacted Cartel

Redacted Cartel is expected to work as a bribe market for Berachain’s block reward weights. Hidden Hand, one of the Redacted Cartel’s services, already supports the bribe market of protocols such as Balancer, Floor DAO, and Frax Finance.

In addition, Abacus, an NFT valuation protocol, dAMM Finance, an institutional lending protocol, OlympusDAO, and Temple DAO, representatives of DeFi 2.0, and GumBall Protocol, an NFT liquidity solution, are expected to be launched on Berachain.

5.2 Chain-native Projects

In addition to the above-mentioned partnerships, the chain is preparing to roll out more unique native projects as below:

5.3 The Community

Last but not least, Berachain has a strong and maniac community. Berachain team and community members play games like Call of Duty and hold Poker tournaments awarding rewards as prizes from time to time. Supporters of the chain playfully tweet that Berachain does not exist and people retweet to make fun of it.

If an L1 chain only has a strong community without an innovative technology or solution, it cannot be only seen as positive. However, Berachain is worth receiving a good evaluation for its strong community that cannot be forked so easily, along with everything that’s mentioned above.

Community is one of few elements that cannot be forked in a crypto project, meaning that it can’t be imitated simply through capital or technology in a short period and in turn, shows high value. Also, projects with a strong community are much more likely to find the product market fit (PMF) through the participation of loyal users in the early stage.

6. Conclusion

Berachain is like a Trojan horse where it shows a strong community and memes on the outside and innovative technological attempts like the proof of liquidity, the tri-token model, and partnerships with distinctive projects on the inside.

Of course, since Berachain is approaching testnet and is still in the early stage aiming to launch in 3 to 4 months, it is impossible to know how much of their plans can be implemented or what new problems may arise after its rollout. Nevertheless, the team is constantly making new technological attempts based on the strong community, so let’s keep our eye on them.