Strategies for Success in the Crypto Market: Navigating Volatility and Capitalizing on Opportunities

Strategies for Success in the Crypto Market: Navigating Volatility and Capitalizing on Opportunities

Introduction:

The cryptocurrency market is a dynamic and ever-evolving ecosystem, offering both unprecedented opportunities for financial growth and inherent risks of volatility. As more individuals and institutions enter the space, navigating the crypto landscape requires a strategic approach and a deep understanding of market dynamics. In this comprehensive guide, we'll explore key strategies for success in the crypto market, from risk management techniques to long-term investment principles.

Understanding Market Dynamics:

Before diving into the crypto market, it's essential to have a solid grasp of its unique dynamics and drivers. Unlike traditional financial markets, cryptocurrencies are highly decentralized and operate 24/7, making them susceptible to rapid price fluctuations and market sentiment. Factors such as regulatory developments, technological advancements, and macroeconomic trends can all impact crypto prices, requiring investors to stay informed and adapt their strategies accordingly.

The Rise of Cryptocurrencies:

The emergence of Bitcoin in 2009 marked the beginning of a revolutionary new era in finance. Designed as a decentralized digital currency, Bitcoin introduced the concept of blockchain technology, a distributed ledger system that enables secure and transparent transactions without the need for intermediaries. Since then, thousands of cryptocurrencies have entered the market, each offering unique features and use cases, from decentralized finance (DeFi) platforms to non-fungible tokens (NFTs).

Risk Management Techniques:

Given the inherent volatility of the crypto market, risk management is paramount for preserving capital and mitigating potential losses. One fundamental principle of risk management is diversification, spreading investment across multiple assets to reduce exposure to any single asset's volatility. Additionally, setting clear risk thresholds and adhering to disciplined stop-loss orders can help limit downside risk and protect against market downturns.

Long-Term Investment Principles:

While short-term trading strategies can yield quick profits, long-term investing offers the potential for sustainable growth and wealth accumulation. Adopting a long-term investment mindset involves identifying high-quality projects with strong fundamentals and growth potential, then holding onto them through market fluctuations. By focusing on the underlying technology and utility of cryptocurrencies, rather than short-term price movements, investors can build a resilient portfolio poised for long-term success.

Staying Informed and Educated:

In the fast-paced world of cryptocurrency, staying informed and educated is key to making informed investment decisions. This involves conducting thorough research on individual projects, understanding their technology, team, and use cases. Additionally, keeping up with industry news, market trends, and expert analysis can provide valuable insights into market sentiment and emerging opportunities.

Technical Analysis and Chart Patterns:

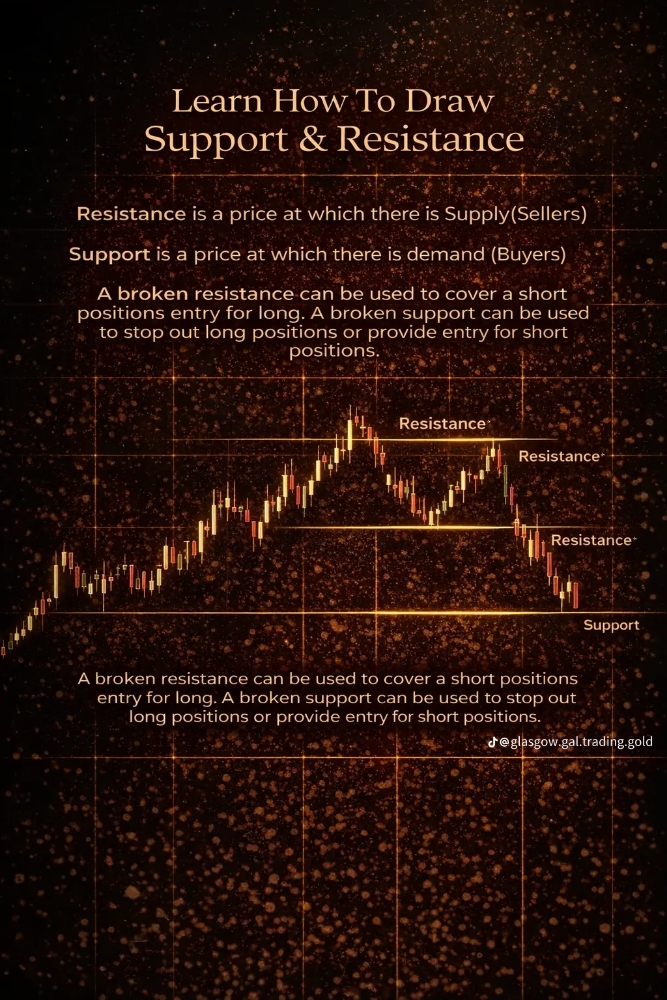

Technical analysis is a powerful tool for predicting future price movements based on historical market data and chart patterns. By analyzing price charts and identifying key support and resistance levels, traders can make informed decisions about when to buy or sell assets. Common chart patterns include head and shoulders, triangles, and double tops/bottoms, each signaling potential trend reversals or continuation patterns.

Embracing Volatility as an Opportunity:

While volatility can be daunting for some investors, seasoned traders view it as an opportunity to capitalize on market inefficiencies and price fluctuations. By adopting a contrarian mindset and buying the dip during market downturns, investors can acquire assets at discounted prices and position themselves for potential upside gains when the market rebounds. However, it's essential to exercise caution and avoid succumbing to emotional impulses, as impulsive trading decisions can lead to costly mistakes.

The Role of Fundamental Analysis:

In addition to technical analysis, fundamental analysis plays a crucial role in evaluating the long-term potential of cryptocurrencies. This involves assessing factors such as the project's technology, team, community, and use cases to determine its intrinsic value and growth prospects. Fundamental analysis can help investors identify undervalued assets with strong fundamentals and long-term growth potential, providing a solid foundation for building a successful investment portfolio.

The Importance of Risk Management:

Risk management is a fundamental aspect of successful trading and investing in the crypto market. This involves setting clear risk thresholds, diversifying investments across multiple assets, and adhering to disciplined trading strategies. By managing risk effectively, investors can protect their capital and minimize potential losses, allowing them to navigate the ups and downs of the market with confidence and resilience.

Conclusion:

The cryptocurrency market presents a wealth of opportunities for investors seeking to capitalize on the transformative potential of blockchain technology and digital assets. By understanding market dynamics, implementing risk management techniques, and adopting a long-term investment mindset, investors can navigate the crypto landscape with confidence and resilience. As the market continues to evolve and mature, staying informed, adaptable, and disciplined will be essential for success in this dynamic and rapidly-changing ecosystem.