10 Bitcoin Price Changing Factors

37

Here are 10 factors that can influence the price of Bitcoin:

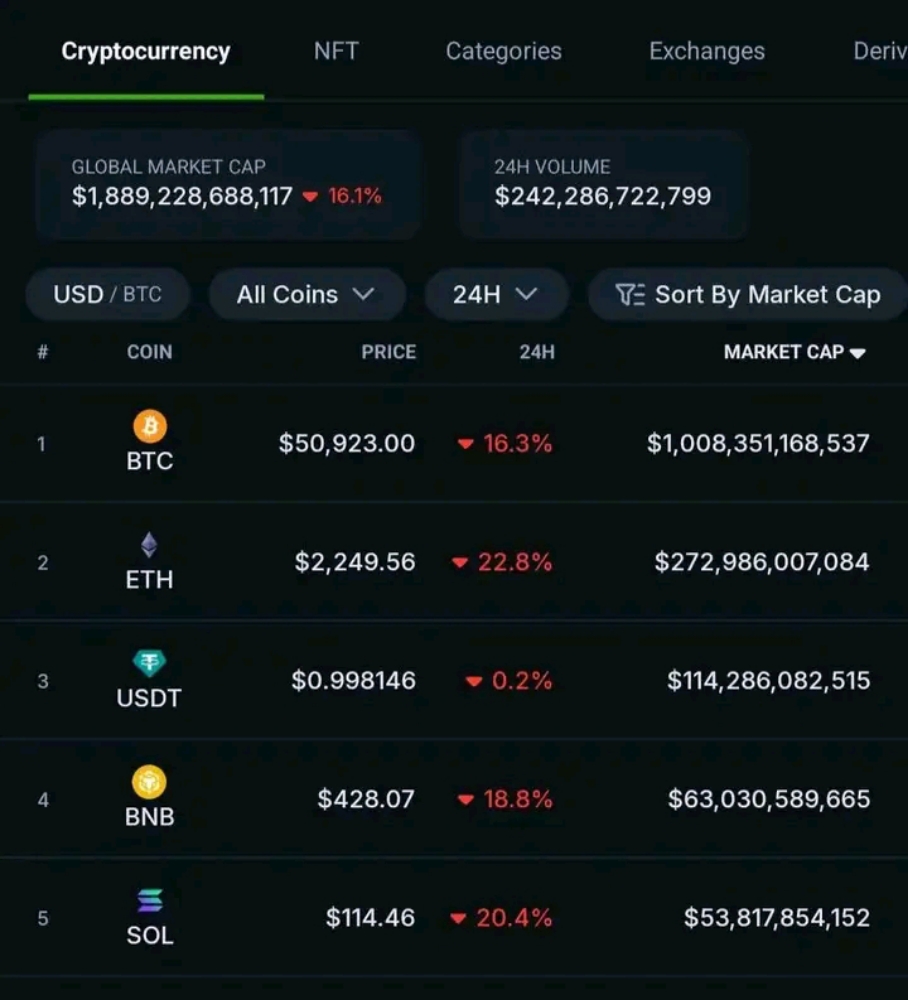

- Market Demand: The overall demand for Bitcoin plays a significant role in its price. If there is high demand from investors and users, the price tends to rise, and vice versa.

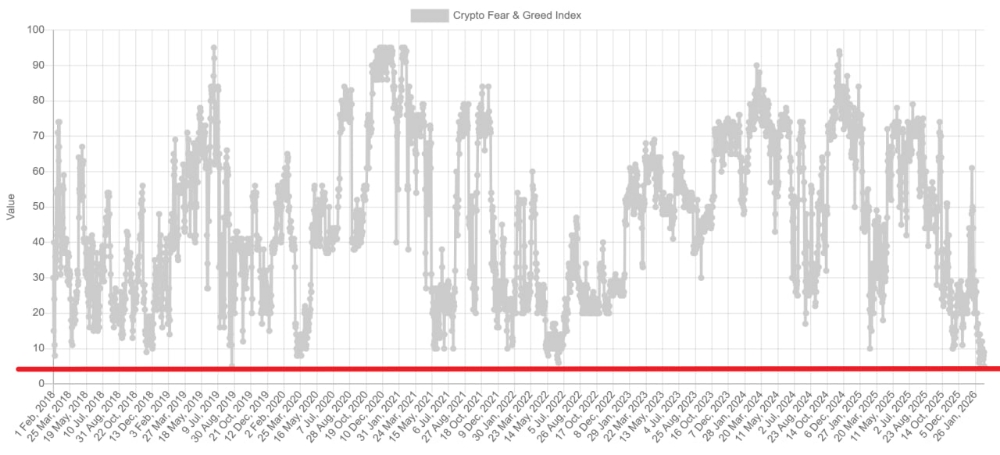

- Investor Sentiment: Investor sentiment and market psychology can impact the price of Bitcoin. Positive sentiment and optimism can drive up prices, while negative sentiment can lead to price drops.

- Regulatory Environment: Government regulations and policies can have a significant impact on Bitcoin's price. Favorable regulations can boost adoption and increase the price, while restrictive regulations can have the opposite effect.

- Economic Factors: Economic conditions, such as inflation rates, interest rates, and global economic stability, can affect the price of Bitcoin. In times of economic uncertainty, some investors turn to Bitcoin as a hedge against traditional markets, potentially driving up the price.

- Technological Developments: Advancements and innovations in blockchain technology, scalability solutions, and improvements in Bitcoin's network can impact its price. Positive developments can increase investor confidence and lead to price increases.

- Media Coverage: Media coverage, news events, and public perception can significantly influence Bitcoin's price. Positive coverage or endorsements from influential individuals or institutions can lead to increased demand and price appreciation.

- Security and Hacking Incidents: Bitcoin's price can be affected by security breaches or hacking incidents involving cryptocurrency exchanges or wallets. High-profile attacks can shake investor confidence and result in price declines.

- Market Manipulation: Due to its relatively small market size, Bitcoin can be susceptible to market manipulation by large traders or whales. Manipulation attempts can lead to price fluctuations and volatility.

- Global Adoption: The level of adoption and acceptance of Bitcoin as a mainstream payment method can impact its price. Increased adoption by businesses and individuals can drive up demand and positively influence the price.

- Halving Events: Bitcoin has a fixed supply, and every four years, the block reward given to miners is halved. These halving events, designed to control inflation, can impact supply and demand dynamics, potentially leading to price increases.