Guide for forex beginners.

Guide for beginners on navigating the Forex market.

At the core of Forex trading lies the concept of currency pairs. Currencies are always traded in pairs because when you buy one currency, you're simultaneously selling another. The most commonly traded pairs include the EUR/USD (Euro/US Dollar), GBP/USD (British Pound/US Dollar), and USD/JPY (US Dollar/Japanese Yen). Each currency pair has a base currency and a quote currency, and the exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency.

Central banks, commercial banks, hedge funds, multinational corporations, and individual traders all participate in the Forex market, each with different objectives and strategies. Central banks, for example, intervene in the market to stabilize their currencies or achieve specific economic goals, while hedge funds and individual traders seek to profit from fluctuations in exchange rates.

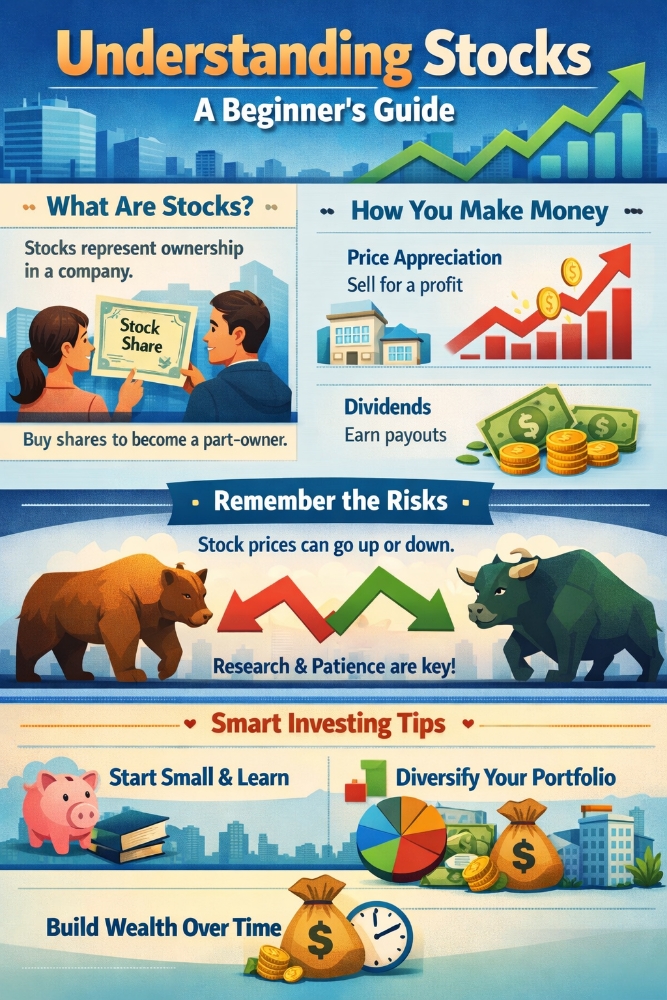

Leverage is a key feature of Forex trading that allows traders to control larger positions with a relatively small amount of capital. While leverage amplifies potential profits, it also magnifies losses, making risk management crucial. Stop-loss orders, which automatically close a trade at a predetermined price level, are commonly used to limit downside risk.

In conclusion, the Forex market is a complex yet accessible arena where currencies are bought and sold. Understanding its mechanics, including currency pairs, market participants, trading hours, leverage, and analysis techniques, is essential for anyone looking to navigate this dynamic and lucrative financial market. Whether you're a seasoned investor or a novice trader, continuously educating yourself and practicing disciplined risk management are key to success in Forex trading.