Trader psychology fundamentals for Futures market

39

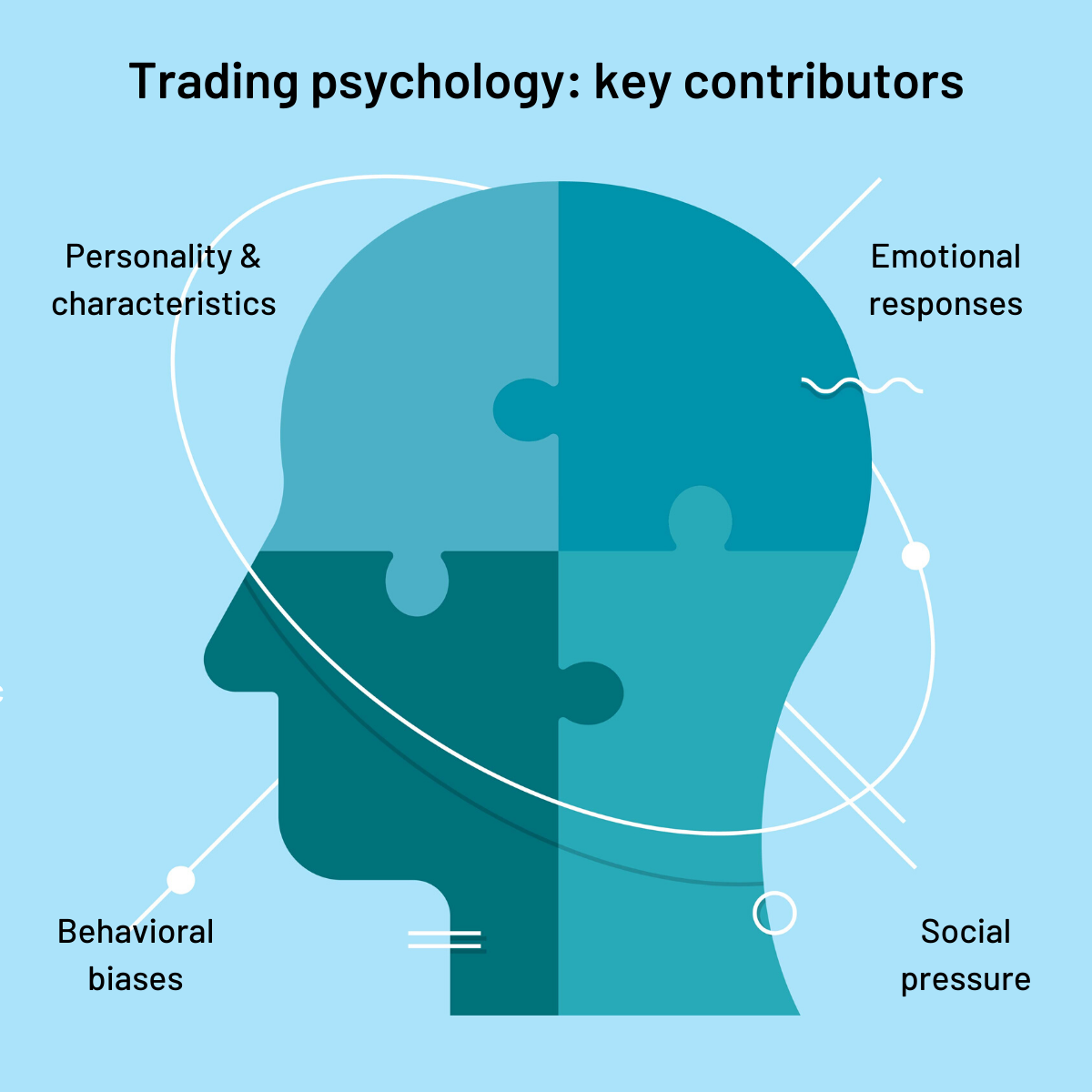

Trader psychology is a critical aspect of success in futures trading. It encompasses the emotional and cognitive factors that influence decision-making and behavior in the financial markets.

Understanding and managing trader psychology is essential for making rational and disciplined trading decisions. Here are some key fundamentals and points related to trader psychology in futures trading:

1- Risk Perception and Management:

- Leverage Magnification: Traders must understand that leverage magnifies both potential profits and losses. This magnification can significantly impact risk perception and management.

- Risk Tolerance: Assessing individual risk tolerance is crucial when selecting leverage levels. Traders should only use leverage that aligns with their risk appetite.

2- Fear and Greed:

- Fear of Loss: Traders often fear losses, leading to irrational decision-making, hesitation, or prematurely closing winning positions.

- Greed: The desire for more profits can lead to overtrading or ignoring risk management principles.

3- Loss Aversion:

- Loss Aversion Bias: Traders tend to feel the pain of losses more intensely than the pleasure of gains. This can lead to risk-averse behavior and reluctance to take necessary risks.

4- Overconfidence:

- Overtrading: Excessive confidence can lead to frequent trades, even in unfavorable conditions. Traders may overestimate their abilities and neglect careful analysis.

- Confirmation Bias: Traders may seek information that confirms their existing beliefs, potentially ignoring contrary evidence.

5- Patience and Impulsivity:

- Patience: Waiting for the right trading opportunities is crucial. Impulsive decisions, driven by the need for action, can lead to losses.

- Delayed Gratification: Successful traders understand that profits may take time and are willing to wait for their strategies to unfold.

6- Discipline:

- Stick to Trading Plan: Having a well-defined trading plan and the discipline to follow it helps avoid emotional decision-making.

- Consistency: Traders need to consistently apply their strategies and not deviate based on short-term market fluctuations.

7- Stress Management:

- Mindfulness Techniques: Practices such as meditation or deep breathing can help manage stress and maintain focus during volatile market conditions.

- Recognizing Burnout: Long hours and constant monitoring can lead to burnout, affecting decision-making. Taking breaks is important.

8- Adaptability:

- Adapting to Market Conditions: Markets can change rapidly. Traders need to adapt their strategies to evolving market conditions rather than sticking to a rigid approach.

- Learning from Mistakes: Embracing mistakes as learning opportunities rather than viewing them negatively is essential for growth.

9- Self-Awareness:

- Understanding Biases: Recognizing cognitive biases, such as anchoring or the disposition effect, helps traders make more objective decisions.

- Monitoring Emotions: Being aware of emotional states during trading allows for better control and decision-making.

10- Continuous Learning:

- Humble Approach: Acknowledging that the market is unpredictable and continuously learning from experiences and market dynamics is vital.