Cryptocurrency Trading: Spot vs. Perpetual Contracts

Cryptocurrency trading has become increasingly diverse, offering various instruments and methods to suit different trading strategies and risk appetites. Among these, spot trading and perpetual contracts are two popular options. Each has its unique features, benefits, and risks. In this blog post, we will delve into the intricacies of spot and perpetual contract trading to help you determine which might be better suited for your investment goals.

Understanding Spot Trading

Spot trading is the most traditional form of trading within financial markets, and this holds true within the realm of cryptocurrency as well. It involves the direct exchange of assets and is fundamental to the concept of buying low and selling high. Let's break down the components and characteristics of spot trading in the cryptocurrency market.

The Mechanics of Spot Trading

Immediate Transaction Settlement

In spot trading, transactions are settled "on the spot." This means that when a trade is executed, the exchange of the cryptocurrency for fiat currency or another cryptocurrency is completed immediately. The buyer gains ownership of the cryptocurrency, and the seller receives the agreed-upon payment.

Market Orders and Limit Orders

Spot trading typically involves two types of orders: market orders and limit orders. A market order is executed immediately at the best available current market price, while a limit order is set to execute at a specific price and may be filled when the market reaches that price.

Trading Pairs

Cryptocurrency spot trading is conducted in pairs, such as BTC/USD or ETH/BTC. The first currency in the pair is the base currency, which is being bought or sold against the quote currency, which is the currency used to pay for the trade.

Advantages of Spot Trading

Accessibility and Simplicity

Spot trading is relatively straightforward, making it accessible to newcomers in the cryptocurrency market. Most cryptocurrency exchanges offer an intuitive interface for spot trading, allowing users to buy and sell with ease.

Ownership and Control

When you purchase cryptocurrencies on the spot market, you gain full ownership of the assets. This means you have the freedom to hold them in your wallet, use them for transactions, or transfer them as you wish.

No Leverage-Related Risks

Spot trading does not involve leverage, which means there is no risk of liquidation associated with borrowing funds. This can be particularly appealing to those who prefer to avoid the additional risks that come with trading on margin.

Long-Term Investment Potential

Spot trading is well-suited for investors who believe in the long-term potential of cryptocurrencies. By owning the actual assets, investors can hold onto their investments through market fluctuations with the aim of long-term appreciation.

Risks and Considerations in Spot Trading

Market Volatility

The cryptocurrency market is known for its high volatility. Spot traders must be prepared for the possibility of sudden and significant price movements that can impact the value of their holdings.

Liquidity Concerns

While major cryptocurrencies typically have high liquidity on spot markets, some altcoins may have lower trading volumes, which can make it challenging to enter or exit positions without affecting the market price.

Security Risks

Owning and storing cryptocurrencies come with security risks. Traders must ensure the safety of their assets against theft or hacking by using secure wallets and practicing safe storage methods.

Market Risk

As with any investment, spot trading carries the risk of loss due to adverse market movements. Traders should conduct thorough research and consider diversifying their portfolios to manage this risk.

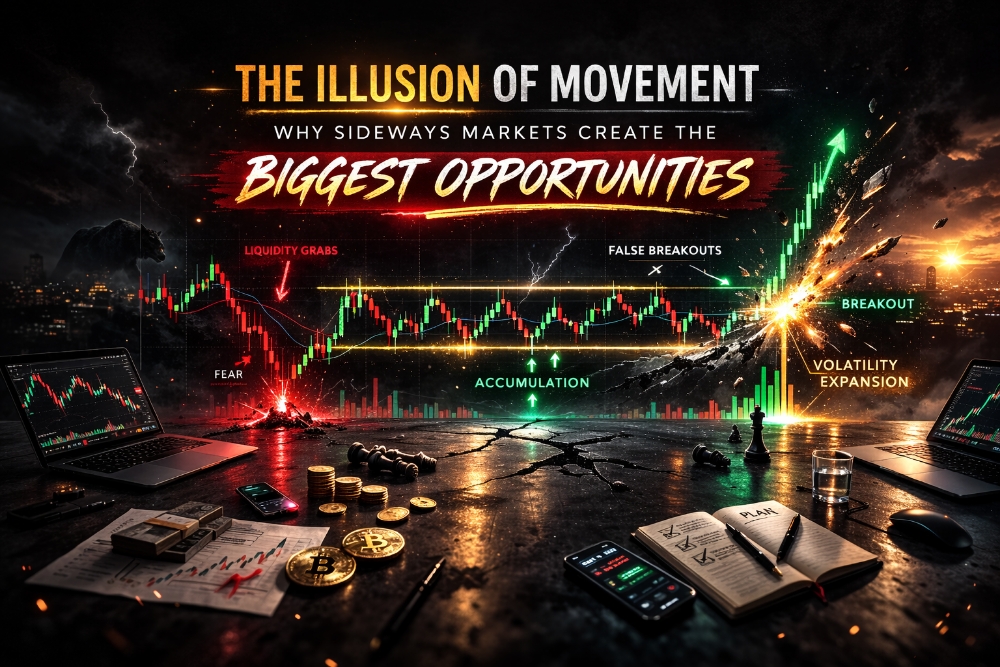

Exploring Perpetual Contracts

Perpetual contracts have become a staple in the cryptocurrency derivatives market, offering traders a way to speculate on price movements without owning the underlying asset. These financial instruments are similar to traditional futures contracts but with a significant twist: they have no expiration date. This feature allows traders to hold positions for as long as they wish, provided they can meet the ongoing margin requirements. Let's delve deeper into the world of perpetual contracts and what makes them a unique trading vehicle.

The Nature of Perpetual Contracts

Definition and Structure

Perpetual contracts, often referred to as "perps," are types of derivatives that track the underlying asset's price. They are traded on margin, meaning traders can enter positions larger than their account balance, amplifying both potential profits and losses.

Funding Mechanism

To ensure the perpetual contract's price stays aligned with the spot price of the underlying asset, a funding rate mechanism is used. Traders holding positions may either pay or receive funding periodically, which is determined by the difference between the perpetual contract price and the spot price.

Leverage in Perpetual Contracts

One of the key features of perpetual contracts is the ability to use leverage. Leverage allows traders to multiply their exposure to price movements without committing the full capital upfront. While this can lead to significant profits, it also increases the risk of substantial losses, including the possibility of liquidation if the market moves against the position.

Advantages of Perpetual Contracts

High Liquidity

Perpetual contracts are known for their high liquidity, which is beneficial for traders looking to execute large trades without significantly impacting the market price. This liquidity also allows for tighter spreads and more efficient price discovery.

Short-Selling Capability

Unlike spot trading, where you typically need to own the asset to sell it, perpetual contracts allow traders to go short, betting on price declines. This feature is particularly useful for hedging existing positions or speculating on bearish market trends.

Hedging Opportunities

Traders can use perpetual contracts to hedge their spot market exposure. For example, if a trader owns Bitcoin and anticipates a short-term drop in price, they can open a short position with a perpetual contract to offset potential losses in their spot holdings.

No Expiry Date

The absence of an expiry date means traders can hold their positions indefinitely, without the need to roll over contracts as they would with traditional futures. This can be a significant advantage for those who wish to maintain a long-term view on the market.

Risks and Considerations of Perpetual Contracts

Complexity and Learning Curve

Perpetual contracts can be complex financial instruments that require a solid understanding of leverage, margin, and funding rates. New traders should approach these contracts with caution and take the time to learn how they operate before diving in.

Leverage-Related Risks

The use of leverage can amplify losses just as it can amplify gains. Traders must be aware of the risk of liquidation, which occurs when the market moves against a leveraged position and the trader's margin is insufficient to keep the position open.

Funding Rate Costs

The funding rate can add an extra cost or benefit to holding a perpetual contract position. If the funding rate is positive, long position holders will pay the funding rate to short position holders, and vice versa when the funding rate is negative. These payments can accumulate over time and impact the overall profitability of a trade.

Market Risk

As with any form of trading, perpetual contracts are subject to market risk. The volatile nature of cryptocurrency markets can lead to rapid and unpredictable price changes, which can be especially perilous when trading with leverage.

Spot vs. Perpetual: Which is Better?

The choice between spot and perpetual contract trading depends on several factors, including your trading style, risk tolerance, and investment horizon.

For the Long-Term Investor

If you're a long-term investor looking to accumulate and hold cryptocurrencies, spot trading is likely the better option. It allows you to own the actual assets and benefit from potential long-term appreciation without the complexities and risks associated with leverage and funding rates.

For the Active Trader

Active traders who prefer to enter and exit positions quickly to capitalize on market movements might find perpetual contracts more appealing. The ability to use leverage and short-sell enables traders to make significant profits, even from small price movements. However, this comes with increased risks, and such strategies should only be employed by those with a thorough understanding of the market and risk management.

Risk Management is Key

Regardless of the trading method you choose, risk management is crucial. This includes setting stop-loss orders, only investing what you can afford to lose, and diversifying your portfolio to mitigate potential losses.

Conclusion

Both spot and perpetual contract trading have their place in the cryptocurrency market. Spot trading offers simplicity and direct ownership, making it suitable for those with a long-term perspective. Perpetual contracts, on the other hand, provide flexibility and the potential for high returns on a short-term basis but require a good grasp of advanced trading concepts and risk management.

Ultimately, the better option depends on your individual goals, experience, and approach to trading. It's essential to conduct thorough research and possibly engage in paper trading or simulations before committing real capital to either method. As the cryptocurrency market continues to evolve, staying informed and adaptable will be key to successful trading.

Follow My Socials

Twitter - https://twitter.com/heysnti

Alpha Discord - https://discord.gg/hhNVVcp4jJ