Hot Wallets: What Are They?

What Are Hot Wallets?

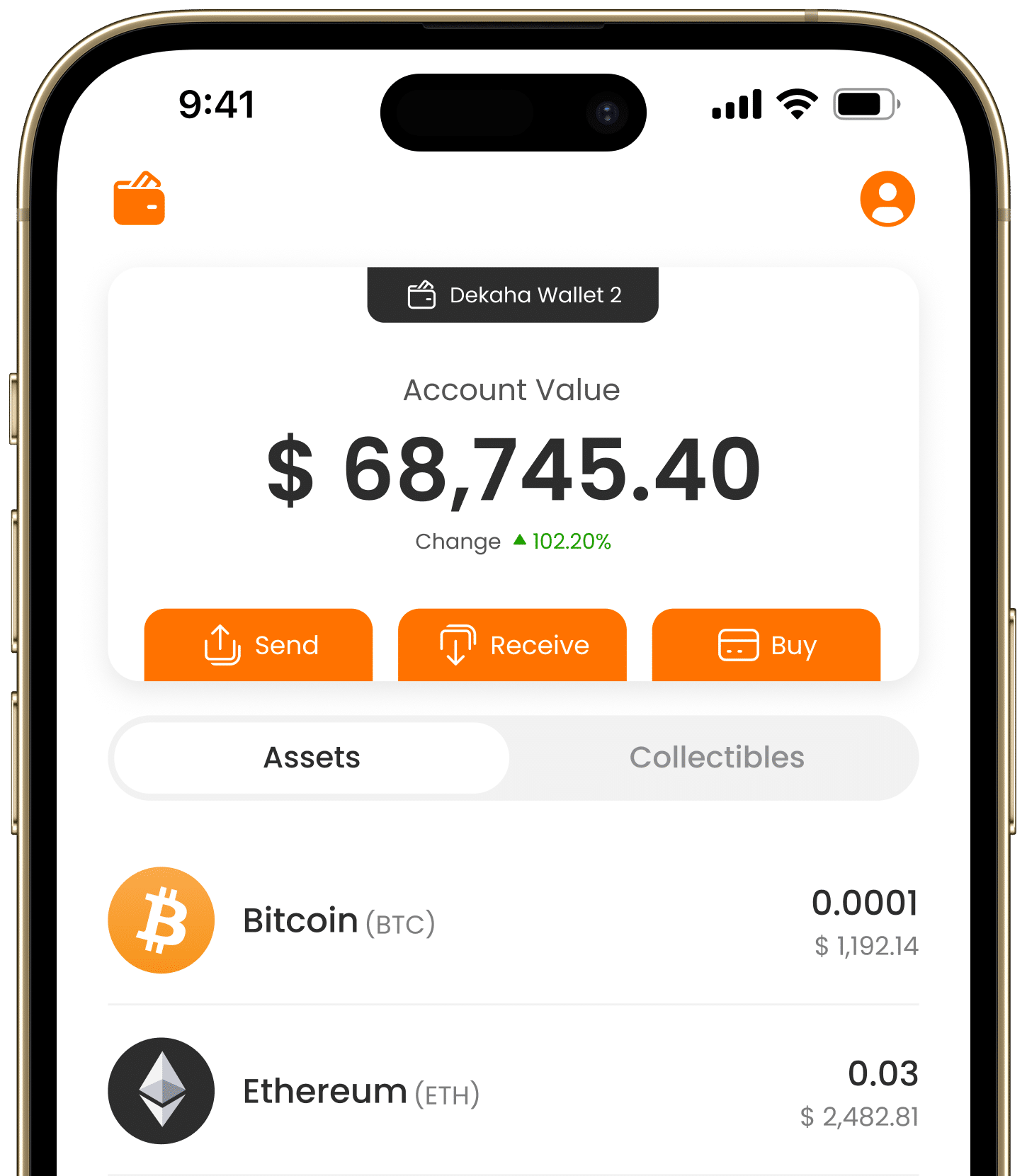

The term hot wallet refers to a digital asset storage solution that remains connected to the internet, enabling users to manage and conduct cryptocurrency transactions conveniently. “Hot” denotes that the wallet is online, giving users more freedom for sending, receiving, buying, selling, staking, and more.

They are the opposite of “cold” wallets, which keep your funds safe and disconnected from the world wide web. We’ll discuss other distinctions later in this article.

Despite their convenience, hot wallets come with an inherent security risk, as their internet connectivity exposes them to potential threats like hacking attempts and malware. Still, some of them are better than others at protecting their users, and we decided to describe the eight most secure hot wallets in this guide.

How Do Hot Wallets Work?

Digital wallets known as “crypto hot wallets” allow instant access to and storage of cryptocurrencies. They work by using computer programs or internet distribution hubs that produce and store the private keys needed to access the assets.

As a result of these wallets’ internet connectivity, users may easily send, receive, and manage their cryptos in real-time. Hot wallets are more vulnerable to security threats than cold wallets since they are always connected to the web, thus it is crucial for users to have strong security measures in place and to be cautious about safeguarding their digital assets.

Before using a hot wallet, you may have to open an account. If the wallet is non-custodial, you’ll likely just get your public and private keys and complete the process, meaning there’s no need to provide sensitive data. For custodial wallets, which have custody of your private keys, you’ll probably have to go through the full registration process and provide information such as your email, password, and more.

In both cases, your private key, a secret cryptographic code, should remain hidden. Due to their connection to the internet, hot wallets can be vulnerable to malicious attacks. It is, therefore, important to take all necessary precautions to protect the private key and wallet from potential threats.

Since they’re connected to the web, hot wallets have many different functionalities, including swapping, access to various dApps, exchanges, and more. Nowadays, many wallets, hot and cold, feature staking functionalities.

Benefits of Using a Hot Crypto Wallet

There are arguments for both hot and cold wallets. Here’s a short overview of the most popular benefits of using a hot wallet.

- Easy access

- No additional cost

- Staking and swapping

- Easy access to dApps

- Recovery and backup

Let’s take a look at each of these aspects in more detail.

Easy Access

Hot wallets allow you to access and manage your crypto funds anytime, as long as you have a stable internet connection. The software helps users access their crypto from a range of devices. For example, a hot wallet can come in handy if you need to send money to someone or make a payment quickly. Many even feature QR codes and other functions that simplify transactions, so you don’t have to deal with tedious wallet addresses.

No Additional Cost

Cold or hardware wallets require you to have a dedicated piece of hardware where you’ll store your crypto wealth. You’ll need to purchase one of the Trezor or Ledger hardware options and spend up to several hundred dollars. The good news is that all hot crypto wallets are free of charge, meaning there are no upfront payments. These wallets usually make a profit by charging a small fee for your transactions.

Staking and Swapping

Staking has become increasingly popular in the crypto world, as it allows crypto owners to make passive income with their coins. Therefore, many wallets offer various staking options, although not all can be beneficial. As with crypto trading, staking does not guarantee a profit, so you have to be careful where you choose to invest your funds.

In addition to staking, many wallets have built-in exchanges or are part of bigger exchange platforms.

Quick Access to dApps

Many hot wallet crypto solutions feature access to exchanges where you can use various trading options. In addition, some wallets are compatible with a wide range of decentralized applications.

For instance, MetaMask can be easily connected to various Ethereum projects. If you go to CryptoKitties, one of the original NFT-based collectible games, and launch it, the MetaMask plugin in your browser will automatically pop up, and you can connect it to start playing.

Access to dApps is perhaps the biggest advantage that hot wallets have compared to their cold counterparts.

Recovery and Backup

Many hot crypto wallets offer all kinds of recovery and backup options should you lose or damage your device or in case of theft. The process often entails using your recovery phrase or mnemonic seed that you should remember at all costs. Following the backup procedures can help you successfully retrieve your funds, which is one of the main advantages of hot wallets.

Furthermore, in the ever-evolving landscape of hot wallets, new security features are being introduced to augment the backup and recovery process. Some cutting-edge hot wallets offer advanced mechanisms like biometric authentication, such as fingerprint or facial recognition, to enhance the security of wallet restoration.

By leveraging these state-of-the-art technologies, hot wallets provide an additional layer of protection, ensuring that only authorized individuals can access and recover the wallet. These forward-thinking security measures exemplify the continuous efforts of hot wallet developers to prioritize safeguarding users’ funds and personal information.

Cold Wallets vs. Hot Wallets

As stated, hot wallets are connected to the web, as opposed to cold storage wallets. A Bitcoin cold storage or cold wallet, on the other hand, is not on the web.

Which one should you pick, then? Well, that depends on how much money you intend to store. If you have millions in crypto, using a cold wallet is a must, as it will enhance your security.

Finally, you should take into account that the amount you own changes every day. According to Reuters, the price of BTC could go up to $100,000 by the end of 2024, so you should move some of your “digital gold” to a cold wallet when the time comes.

Which Cryptocurrencies Can You Store in a Hot Wallet?

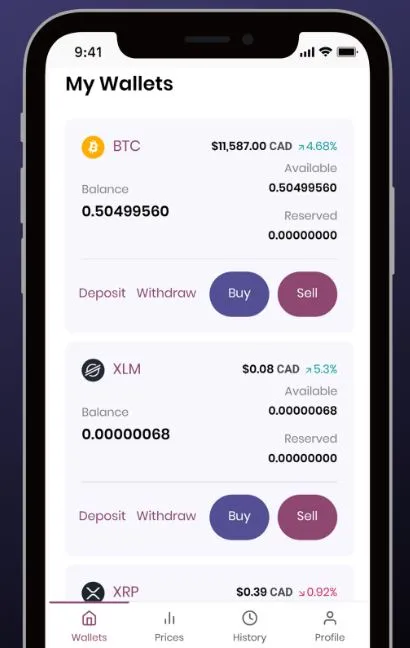

In most cases, you’ll be able to store Bitcoin, Ethereum, and other popular cryptos. Nonetheless, some wallets will only focus on one crypto or one blockchain. Why, you may wonder? Here’s the deal, hot wallets can be divided into single- and multi-blockchain wallets.

Single-blockchain wallets communicate with one chain. For instance, if it only communicates with the Bitcoin blockchain, you can only store one crypto: BTC. Some blockchains handle more than one crypto. If the wallet communicates with the Ethereum blockchain, it means you can store all ERC tokens in it.

These wallets are generally more secure since they are specialized for one blockchain. Additionally, they tend to have more features tailored specifically to the coin or blockchain they support. However, you’ll have to create several wallets if you want to store multiple cryptocurrencies. For example, if you want to store Bitcoin and Ethereum, you’ll need two different wallets.

Multi-blockchain wallets communicate with two or more chains. Users can manage their Bitcoin and Ethereum funds from the same wallet. Multi-blockchain wallets also enable users to exchange digital assets from different blockchains in a single transaction without moving funds from one wallet to another. This makes it much easier to diversify digital asset portfolios and access funds from different blockchains.

Multi-blockchain wallets provide an efficient and secure way to manage digital assets. However, there are also some potential downsides.

First, managing multiple digital asset wallets can be confusing for users unfamiliar with different blockchains. Second, those who lose access to their multi-blockchain wallet might not have access to any of their digital assets, as some millionaires experienced, according to the NY Times. Finally, multi-blockchain wallets could be less secure than single-blockchain wallets, as they provide more opportunities for hackers to access users’ digital assets.

How Many Cryptos Can You Store in a Hot Wallet?

Wallets usually don’t have any minimum and maximum limits on how much of a single crypto you can store. In other words, you can hold your entire crypto wealth in a crypto hot wallet. However, that’s not the best idea if you have a lot of money stored in digital currencies. At some point, switching to a cold wallet might be a good idea.

Finally, you should remember that the number of supported cryptos changes over time. Usually, they incorporate more cryptos — if a new ERC-20 token is added, you can store it via MetaMask.

However, there are also factors that could result in a negative impact. For instance, Coinbase trading volumes fell after tightening the regulations around the exchange in the US. This could also affect the Coinbase wallet in the near future, limiting what digital coins Americans can store in it.

That’s why it’s crucial to stay on top of the latest developments in the crypto sphere and understand how specific regulations or shifts in the industry could influence your crypto wealth and, ultimately, your crypto hot wallet.

Conclusion

To sum up, hot wallets provide the convenience of storing and using your cryptocurrencies. Many can be easily connected to various exchanges or used for accessing decentralized applications. Our top choice is Best Wallet, a multi-blockchain hot wallet with a DEX and NFT Integration within the platform. It also offers market insights and helps users spot promising tokens even before they hit exchanges.

References

- https://ethereum.org/en/developers/docs/intro-to-ethereum/

- https://www.reuters.com/technology/bitcoin-could-hit-100000-by-end-2024-standard-chartered-says-2023-04-24/

- https://www.ft.com/content/e904f8bd-0d4f-4d38-8d71-a199e7e9c131

- https://www.nytimes.com/2021/01/12/technology/bitcoin-passwords-wallets-fortunes.html

- https://www.bloomberg.com/quicktake/bitcoins#xj4y7vzkg

- https://electrum.org/

- https://metamask.io/

- https://trustwallet.com/

- https://www.coinbase.com/wallet

- https://www.exodus.com/

- https://www.okx.com/web3

- https://wallet.mycelium.com/