Approval of Bitcoin ETFs will cause bearish trend

As the verdict on spot Bitcoin ETFs approaches between Jan. 8 and Jan. 10, market analysts, including K33 Senior Analyst Vetle Lunde, predict a sell-the-news scenario.

Lunde, citing trader exposure and derivatives’ massive premiums, suggests a 75% likelihood of this outcome, overshadowing the 20% chance of approval.

Despite signs of froth in the market, such as futures premiums reaching annualized levels of 50%, institutional players continue to build long exposure, reflecting expectations of approval. Open interest surged by over 50,000 BTC in the last three months, driven by anticipation of ETF approval.

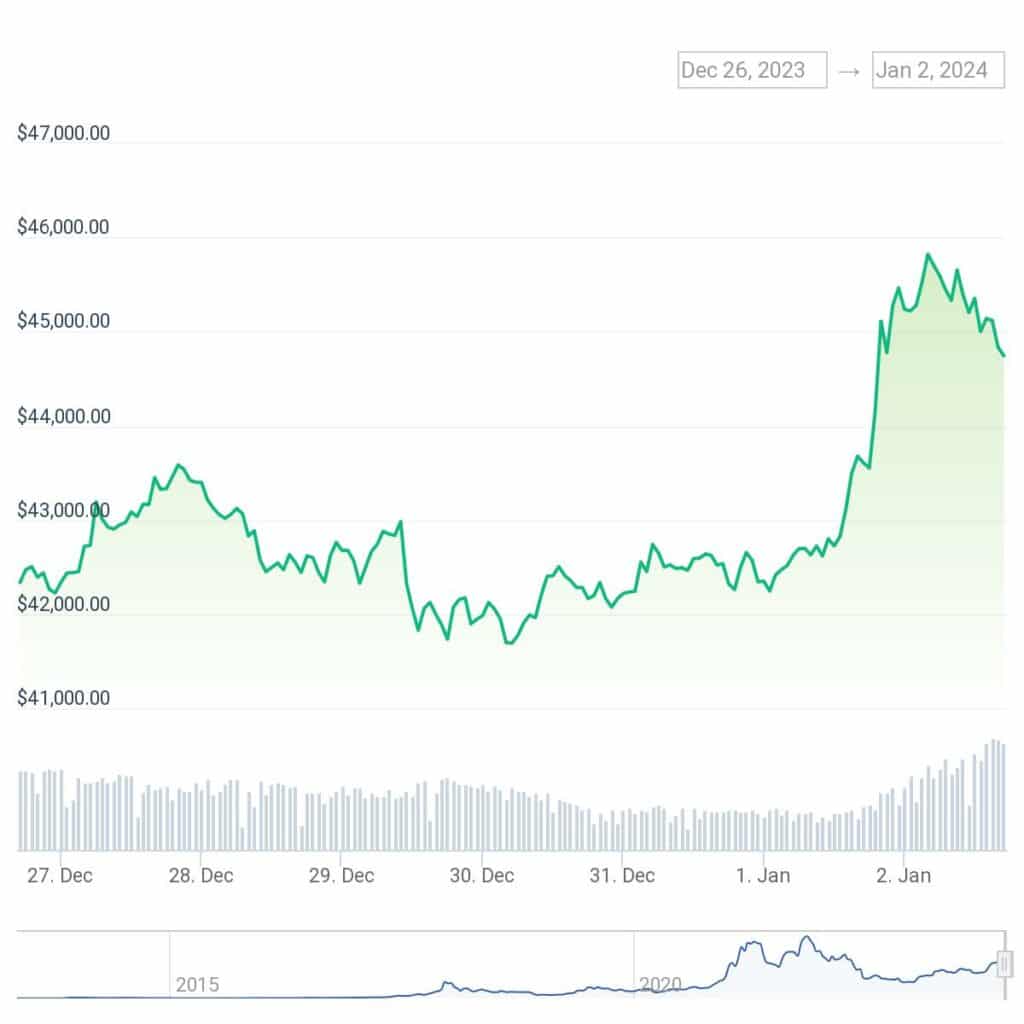

Seven-day chart of BTC | CoinGecko

You might also like: BlackRock designates JPMorgan, Jane Street as Bitcoin ETF authorized participants

On the retail side, funding rates on offshore exchanges hit an annualized high of 72%, indicating extreme anticipation. However, given the aggressive leverage from long positions, the impending ETF verdict may trigger long squeezes.

Bitcoin’s recent gains, surpassing $45,000, correlate with growing U.S. spot ETF approval anticipation. Analysts suggest a potential peak in the current rally on the verdict date due to profit-taking and unsustainable premiums.

Looking ahead, Lunde expects a net inflow of at least 50,000 BTC, equal to $2.3 billion in January, crucial for sustained market growth. While a sell-the-news event may lead to short-term fluctuations, the combination of potential spot ETFs and the Bitcoin halving event in April could contribute to a favorable market outlook as the year progresses.